Team-BHP

(

https://www.team-bhp.com/forum/)

Are lease plans open to individuals now? I am a lawyer with a law firm, on a retainer basis. Wondering if I can get a car on lease?

As I see the Lease and the specifics of how it is executed is different either by leasing company or the agreement between the employer and the leasing company.

In my company its finance leases and works very similar to a loan. (except, for the tenure of the lease the vehicle will be in the name of my company)

The leasing company has little or no involvement in the running and maintenance of the car, unless you are doing a modification that will change the configuration of the car. Which I did in my case by retro fitting LPG kit, they had to issue a NOC (even insurance company had to) for RTO to endorse it on the RC book (now card), except for that I had no interaction with leasing company for the entire tenure.

I suppose the ones where leasing company is managing the fleet the terms of service and the exit policy and buyback option of the vehicle is different...

Interestingly in my company, this policy is not extended to employees in MH, not sure the reason though.

I see two disadvantages with lease:

1. major one being, if you leave the company during the tenure of the lease, you end up doing a pre-closure and may have to pay some penalty.

(dont know if the new company also has a lease policy and tied up with same leasing company are there any benefits)

2. there is no part payment option where you could save on the overall outflow, however two options available are to do a down payment upfront or complete (pre-)colsure when ever you want.

I just completed a lease and planning a new one. The completed Lease was on my Santro AT: (all figures rounded to nearest thousand)

Lease Amount: 4,36,000

Interest: 12%

Total Rental Paid: 4,67,000 over three years with monthly rent/emi of 13,000

RV + VAT Paid: 89,000 (RV amount is fixed at 20% of lease amount + VAT at the beginning of the leases)

So total outflow: 5,57,000

There is a fringe benefit tax of 9% on the rent/emi (that do not reflect on the payslip so not I-T tax) amount so you dont exactly save 30% on tax. Also usually interest on leases is 1% more than the loan.

So you lose say 10% of 30% tax benefit. So the 20% of the rentals paid is: 93,000

Now pushing the savings a bit further, the opportunity cost of not paying the down payment in the case of lease (typically 15% in loans): 65,000.

There are other high return investment tools and perhaps businessmen are able to do better, but choose a FD at a simple interest of 7% (the least I have seen) you gain: (P*T*R/100) 13,000.

So over all you save: 1,07,000

So my actual outflow towards my Santro AT: 4,50,000 (which was the onroad price quoted by the dealer when I bought it)

If I had gone for a loan I would have paid around 5,30,000 + the tax + loss on down payment. Which would have been at least 1.5 lacs more than what I have paid now.

Now, I am at the door holding the knob for the next lease :) -- Scorpio AT + 4x4 + Air bags:

Lease Amount: 14,57,000

Interest: 13%

Total Rentals, I would pay at the end of 3 years (rent/emi of 43,000):15,97,000

RV (20%) + VAT: 2,98,000

Total Out Flow: 18,95,000

Savings on TAX at 20%: 3,11,000

Savings on the Opportunity Cost of down payment 7% simple interest: 45,000

Total Savings: 3,57,000

Actual Outflow towards new car: 15,37,000

If I do the same with a loan I will end up paying around 19 lacs (total emi + tax for the emi + possible savings on the down payment)

Here again only catch being - "what if" I change my job in between. Otherwise Lease works great!

Quote:

Originally Posted by ajitkumarlb As I see the Lease and the specifics of how it is executed is different either by leasing company or the agreement between the employer and the leasing company.

In my company its finance leases and works very similar to a loan. (except, for the tenure of the lease the vehicle will be in the name of my company)

|

Hi Ajit,

Is Orix the leasing company? who pays the road tax and will interest rate change if the tenure is for 5 years?

Quote:

Originally Posted by prabhuferrari

(Post 2402090)

Hi Ajit,

Is Orix the leasing company? who pays the road tax and will interest rate change if the tenure is for 5 years?

|

GE Capital was for the first lease.

For the new one, yes its ORIX.

We have two options 3 & 4 years. 5 years option is listed in the policy as an exception and I did not enquire further as I was looking for 3 years.

The interest rate for 3 & 4 years is 13%.

This is the quote I received from the dealers (not much difference between the three)

Ex SR Price: 1225323

Road Tax: 231218

Insurance: 47340

(these three are optional)

Incidental/handling (RTO): 6000

STD Fitment: 14700

Warranty: 9999

On Road: 1524581

ORIX is funding:

Ex SR Price: 1225323

Road Tax: 231218

Catch: have to take 1st year insurance from Orix only. That is 33k.

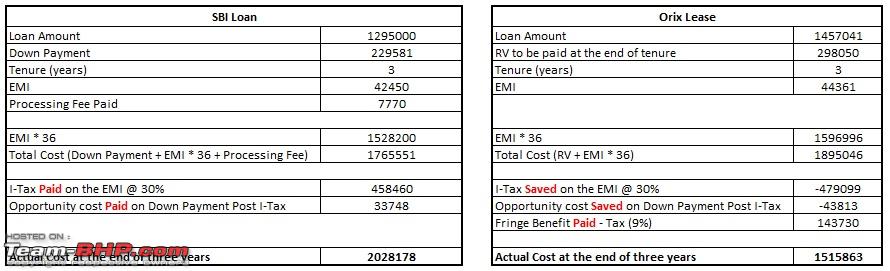

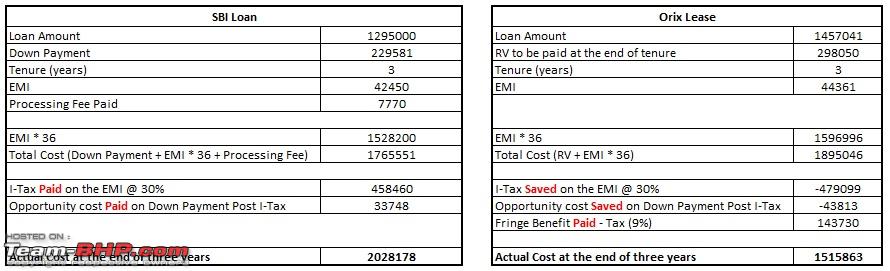

I got quote from both Orix & SBI and here is how it compares.

Note: Interest rate on Lease is at 18% not 13% as I had mentioned above.

Even then Lease makes sense!

Hi Bhpians:

A quick question on co. lease.. I can take a car on co. lease either from Delhi or Gurgaon (as our co. has offices in both these cities). But my residential address is in Gurgaon. I would like to know if I can buy a car from a Delhi dealer (very limited options in Gurgaon as there are very few dealers). Would there be any issues when the car gets transferred to my name after 3 years?

If there would be too many issues then I'd just take it from Gurgaon.. Also what happens if one gets transferred within the same co. to a different city before the 3 years is up ?

Thanks much

@Nimz, usually company leases vehicles are registered in the name of the co. so check with the dealers in Delhi if they can register it in Gurgaon.

OR do all the selection in Delhi and place the order for that specific model and specs with the Gurgaon dealer...

And internal transfer with in the same company should not be an issue, but I think that question could be answered by your HR/Payroll...

Can individuals take lease option ?

Quote:

Originally Posted by ajitkumarlb

(Post 2508583)

@Nimz, usually company leases vehicles are registered in the name of the co. so check with the dealers in Delhi if they can register it in Gurgaon.

OR do all the selection in Delhi and place the order for that specific model and specs with the Gurgaon dealer...

And internal transfer with in the same company should not be an issue, but I think that question could be answered by your HR/Payroll...

|

Thanks Ajitkumarlb.

The reason am looking at Delhi is that there are very few dealers in Gurgaon and often they are the only ones for a particular brand and service is pathetic. I have to run behind them to get a quote. Delhi dealer I checked with said he can get it registered in Gurgaon but the co. admin said something to the effect that the billing and registration has to be in the same city for a lease. So I guess this is not true from what you say.

But then I guess there would be a problem to transfer registration to Gurgaon if I get the co. registration done in Delhi. I understand that one would have to get an NOC and all that to do the transfer of registration. Would that be all done by the leasing co. are would it fall on me?

Thank you!

Hi All ,

Happy New Year

Need clarification on some queries

1. I am working for ABC company , leasing is provided by XYZ bank. In who's name the car will be registered.

2. I have heard the tax rates vary for Individual Owner and Company owned cars. Is this applicable for this scenario also? What is the tax rates for Chennai. As per the RTO website it is 10% . Does not specify for Individual or Corporate.

State Transport Authority

3. If Car is registered in name of XYZ bank, then at the end of the lease term when transferring the car to my name, can the NCB be also transferred ? As far as I know the NCB can be transferred from Employer to Employee. Will this hold good in this case?

4. The lease plan given by my company interest is around 13.50% for 4 year term and the Residual Value (RV) to be paid at the end of the term is 20% . Is this a fair amount or quite higher ?

5. I read earlier GTO comments on tax need to be paid on RV ? Can you please clarify?

Rgds

Quote:

Originally Posted by Marlon

(Post 2629080)

Hi All...

|

hope this helps, my replies with ">>"

1. I am working for ABC company , leasing is provided by XYZ bank. In who's name the car will be registered.

>> ABC Company

2. I have heard the tax rates vary for Individual Owner and Company owned cars. Is this applicable for this scenario also? What is the tax rates for Chennai. As per the RTO website it is 10% . Does not specify for Individual or Corporate.

State Transport Authority

>> Vehicle tax is usually based on the vehicle size & capacity. Need someone else to comment here.

3. If Car is registered in name of XYZ bank, then at the end of the lease term when transferring the car to my name, can the NCB be also transferred ? As far as I know the NCB can be transferred from Employer to Employee. Will this hold good in this case?

>> As its in the company name and the vehicle will be transferred to your name, NCB should not be an issue.

However one thing to note will be the first year insurance the financier usually insist on taking it from them or their tie-ups

4. The lease plan given by my company interest is around 13.50% for 4 year term and the Residual Value (RV) to be paid at the end of the term is 20% . Is this a fair amount or quite higher ?

>> that's the amount I am paying as well. Suggest reading recent posts on this thread as well.

5. I read earlier GTO comments on tax need to be paid on RV ? Can you please clarify?

>> RV usually attracts VAT (true in my case). Also RV amount is not deducted from salary, but a cheque/dd/online payment needs to be made and hence will end up paying I-T tax on this amount.

Hi Ajit,

I'm comparing two options here.

CompanyLease:

Looks to be very high on interest rates. I will be paying Rs 2170 per lac for 5 yrs (this is one of the options we have been given, the other options are out of my reach it seems) and with the RV as 5% at the end of the lease period along with the vat I guess. I understand that this will also attract 2800.00 of FBT (for cars at 1.6L or under that will be 1800.00 I guess). However, I'm yet to ask about the FBT and any hidden charges that I may find as a surprise later..

Against that, if I go with the SBI Car loan, they seem to be charging around 12.5% interest (reducing rate!).

You're opinions on these options available, let me know which one could be a useful option. I'm planning to take loan on ex-showroom and pay road tax+ other components from my pocket for now. In case if I leave the co, I will have two options, either transfer it to another employee willing to take it (I may be at loss of whatever money I spent from my pocket or less than that, depending on what kind of transfer deal I get) or prepay the loan to leasing co with the RV + VAT as on date and get it on my name (this may be a lossy option too).

hopefully it makes some sense if I stay for the entire tenure (considering fuel+Insurance+service charges are going to get tax benefits).

Your opinions are welcome.

Thanks.

Quote:

Originally Posted by Ketan

(Post 2647012)

Hi Ajit,

I'm comparing two options here.

CompanyLease:

Looks to be very high on interest rates....

|

At the core:

The benefit of lease is when the EMI amount is not showing up on your salary slip and hence no Income Tax (30%) being paid for that amount. V/S. Paying tax for the EMI amount in case of a loan.

And

If you look at RV amount v/s Down payment of a loan, you have savings there as well as RV amount would stay with you till end of the tenure, which you could perhaps gain some interest.

Unless you are in the fag end of the lease tenure, pre-closing a lease and moving to a loan in the earlier phase of the tenure, one could incur lose/end up paying a bit more if one had initially gone with only Loan option.

Considering these, a higher interest rate on the leases would be neutralized by the I-Tax savings. Your RV is quite less (5%), its 20% for me and yet I stand to gain from lease.

The math is quite simple, see this chart:

Why do you want to pay the tax by your self what is the advantage you see? You could use that amount else where a simple FD would fetch you 7 to 9% today for the tenure...

Folks - a question.

we are considering getting a Scorpio under a lease from my wife's company.

The plan is with Orix. Can you please let me know what happens if the vehicle gets stolen? what happens under the lease then?

IMO we would stop paying and loose all that we had paid till then?

I "suppose" the loss is settled by the insurance Co. to the financing Co. and the EMI's would end. Need to confirm though, will check what's the process at our office.

But make sure you check wit Orix/Company you'r wife is working with as the policies are not uniform across.

| All times are GMT +5.5. The time now is 06:53. | |