Team-BHP

(

https://www.team-bhp.com/forum/)

Another hike in 3rd Party Insurance in the offing. :deadhorse

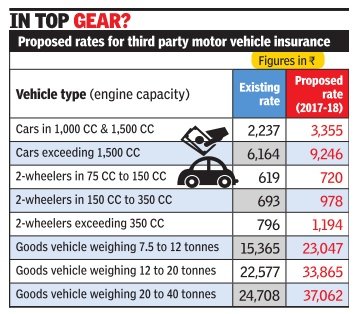

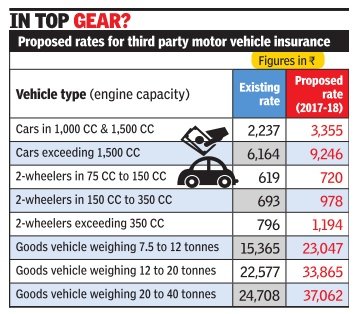

IRDA has proposed a 50% hike in 3rd party insurance premiums across the categories.

This is a third such hike in as many years. This will surely pinch the pockets more.

Unlike comprehensive insurance, 3rd party premium is fixed and leaves with no scope negotiation or discounts.

3rd-party-car-insurance-to-cost-more

Premiums for cars above 1500CC will touch almost 10K an year. :Frustrati

Quote:

Originally Posted by speedmiester

(Post 4157545)

Another hike in 3rd Party Insurance in the offing. :deadhorse

IRDA has proposed a 50% hike in 3rd party insurance premiums across the categories.

|

This has become now a regular feature. Hike the TPL premium rates which is in the hands of the government. What is the logic of leaving the hike for the engine < 1000cc. I thinks that's where the bulk of the selling is. Now there will be an hue and cry in the public and by the end of the month, the actal hike will be trimmed to the 20-30% levels.

Instead of bringing reforms to quickly address the TPL claims, the government is busy in hiking the premium rates.

The above figures are only third party premium. Add to that own damage, driver something, cess, tax and I am seeing a figure of 12K for my 16 year old Ikon.

Very soon premium will be more than the residual value of the car.

What I hear is that third party claims are very much in excess of the receipts, so Comprehensive is used to cross subsidize. Now let us see the comprehensive premia decrease. Then there will be some sense.

Quote:

Originally Posted by fordday

(Post 4157765)

Very soon premium will be more than the residual value of the car.

|

As the product costs decrease and cost of labour at service centres increases along with inflation of associated costs, this is inevitable. A friend bought a 2005 Alto in the UK. the car cost him 700 GBP, and the insurance was 2200 :D

Attached is the revised Third Party premium rates as per IRDA circular.

Private cars:

Not exceeding 1000 cc: 2055 No change.

Exceeding 1000cc but not exceeding 1500cc: 3132. 40% change since last year.

Exceeding 1500 cc: 8630. 40% change since last year

2 Wheelers:

Not exceeding 75 cc: 569

Exceeding 75 but not exceeding 150cc: 720 16% change since last year.

Exceeding 150 but not exceeding 350cc: 970. 40% change since last year.

Exceeding 350 cc: 1114. 40% change since last year.

Mods: Request you to change the thread title to suitable.

I got my two wheeler and Car's insurance renewed this week. Both are expiring in the coming month. For what its worth, saved a few bucks this year at least.

Quote:

Originally Posted by vinit.merchant

(Post 3941613)

What is the point of increasing the TPL premium so steeply each year?

There are hardly any claims made against the TPL, at least in the passenger vehicle segment. Most of us do not go for this due to the lethargic procedures involved.

In spite of not much claims arising out of TPL, the rise in premiums is surprising.

There is a large % of vehicles running uninsured on Indian roads and with this move, the number will only increase.

PS: Now the TPL premium for my Palio gtx will be 1/8 the resale value of the car. What an irony.

|

The claims made for TP are huge, even in the passenger vehicle segment sir. This rise is direct result of the claims made.

Secondly the resale value of your Palio has very little to do with the premiums as, even if it is a brand new car and hypothetically, by accident if it damages the opp person or his property the damages are going to be huge irrespective to your cars value. In such an event the insurance will save you from shelling out the claims made on you.

Quote:

Originally Posted by hrman

(Post 4172193)

I got my two wheeler and Car's insurance renewed this week. Both are expiring in the coming month. For what its worth, saved a few bucks this year at least.

|

My brother just renewed his car's insurance today as well, even though the due date was the 28th of April. He reckons he saved about 1,400 bucks by renewing it before the April 1st deadline.

Quote:

Originally Posted by ghodlur

(Post 4172114)

Exceeding 1500 cc: 8630. 40% change since last year

|

Frankly, this is getting ridiculous. That means, for basic 3rd party coverage on my 20 year old Jeep with a

book value of 0, I'll be paying close to 10 grand. I pay a lesser amount for my 5 year old Sunny with a book value of 5 lakhs (IIRC) and full coverage (including theft & accidents).

With such pricing, many of the less-informed will be tempted to skip insurance altogether. This will especially be the case with Mahindra / Tata / other UVs, all of whom have engines larger than 1.5L.

It is frustrating! Every year it seems like we are paying more than the previous year. There is no concession for driving history. Everybody has to pay for the inefficiencies of the insurance industry. Why can't the insurance be linked to driver instead of the car like in some countries like US? It will be an incentive for responsible driving.

Quote:

Originally Posted by The Great

(Post 4172561)

The claims made for TP are huge, even in the passenger vehicle segment sir. This rise is direct result of the claims made..

|

Nope. Third party claims for passenger cars are miniscule. however, for commercial vehicles they are very big. But commercial vehicles have a powerful lobby, so your premium will subsidize them.

Quote:

Originally Posted by altius

(Post 4174437)

There is no concession for driving history.

|

Seriously! Imagine this: My Sunny's insurance which has had two accident claims & which the insurance company will have to pay for in the future (if & when)

is cheaper than my Jeep which has never met with an accident in 20 years; even if it does, the insurance company doesn't have to pay.

Quote:

Originally Posted by tsk1979

(Post 4174467)

however, for commercial vehicles they are very big. But commercial vehicles have a powerful lobby, so your premium will subsidize them.

|

Great point, thanks! Explains why the premium is so high for cars with big engines.

Seems like a good time to buy a turbo petrol instead of naturally aspirated. like the ecoboost instead of the 1.5

Most happy would be the owners of the 1.4 TSI. At least it got something right

Quote:

Originally Posted by GTO

(Post 4174416)

Frankly, this is getting ridiculous.

|

It is not only the increase in amount which is ridiculous but the categorisation too is. What is the logic of the having it based on Engine capacity?

For example my Vento 1.6 TDI has to pay around 8600 as 3rd party premium but the Vento 1.5 TDI with the same power, torque, length, height and of the same vintage has a premium of only around 3100 (a difference of about 5500). It is high time that 3rd party premium is also de-regularised and charged based on your history and risk profile

| All times are GMT +5.5. The time now is 07:03. | |