Team-BHP

(

https://www.team-bhp.com/forum/)

General insurance companies are reducing their ‘Own Damage’ (OD) premiums by 5%-20% for all customers of private and commercial vehicles for the year 2018, as the new IRDAI circular has led to a cut in the commission offered by insurance companies to auto-dealers. The premium reduction is due to the IRDAI’s MISP (Motor Insurance Service Provider) circular which reduced the commission to auto-dealers. In addition automation of certain process by the Insurance co has brought down the costs considerably and it is a welcome move to pass on the benefits to the customers

http://www.livemint.com/Money/xkAn9K...-premiums.html Quote:

There have been other cost savings too. ICICI Lombard, for instance, now generates 87.5% of all its policies digitally and over 90% of its OD motor surveys are also done through video streaming, said Sanjeev Mantri, executive director, ICICI Lombard. “This also saves a big cost for us,” he said.

The introduction of Goods and Services Tax has also benefited. “Previously, we would end up paying VAT (Value-added Tax) on the spare parts (for vehicles), which was booked as an expense. With GST, we get input credit for what we spend on spare parts. That has come as a significant saving as we were paying around 12% VAT,” Mantri said.

|

As of now major Insurance co such as ICICI Lombard, Bajaj Allianz, HDFC Ergo, Universal Sompo have already reduced the OD premium for car insurance and this reduction is made available to both new as well as existing customers. The Car owners were already reeling with the hike in the TPL premiums last year and with the introduction of 18% GST on car insurance premiums, this reduction in the OD premiums will come as a fresh breath of air.

http://www.moneycontrol.com/news/bus...5-2467285.html http://www.business-standard.com/art...0500806_1.html

The only spoiler in this happiness would be a hike in the Third party Liability premiums (again) for this year or would the Insurance co surprise us further with a reduction of the TPL premium too.:)

Anyone bought new Insurance/renewed their existing policy can confirm this reduction?

Thanks for sharing. Is it applicable on purchase of online insurance coverage (direct) too or just offline/ dealer quotes (as the former does not include dealer commissions).

Thanks!

Quote:

Originally Posted by saket77

(Post 4355426)

Thanks for sharing. Is it applicable on purchase of online insurance coverage (direct) too or just offline/ dealer quotes (as the former does not include dealer commissions).

|

I presume the reduction will be applicable for online insurance purchases too, although nowhere it is explicitly mentioned. If BHPians who have renewed their Insurance or bought new in 2018 can confirm, it will make things clear.

Quote:

Originally Posted by ghodlur

(Post 4355460)

I presume the reduction will be applicable for online insurance purchases too, although nowhere it is explicitly mentioned. If BHPians who have renewed their Insurance or bought new in 2018 can confirm, it will make things clear.

|

I just renewed my car's insurance last week and didn't see any lowering of premiums. The cheapest online quote I got was for United India from Coverfox. Even with 50% NCB the gross premium was higher than last year's. And online quotes were cheaper than the agents I called.

So I just calculated from the two policy documents -

a) Basic OD is 16% lower than last year, but wouldn't this decrease each year anyhow - with lower vehicle value?

b) Third Party is 28% higher.

c) The net effective tax rate is up from roughly 15% to 18%.

@mn2363; I was being claimed for ages that Comprehensive policy holders were cross subsidizing the Act / TPFT policy holders. This is what you are witnessing. Good news for careful motorists.

Data shown by web aggregators,

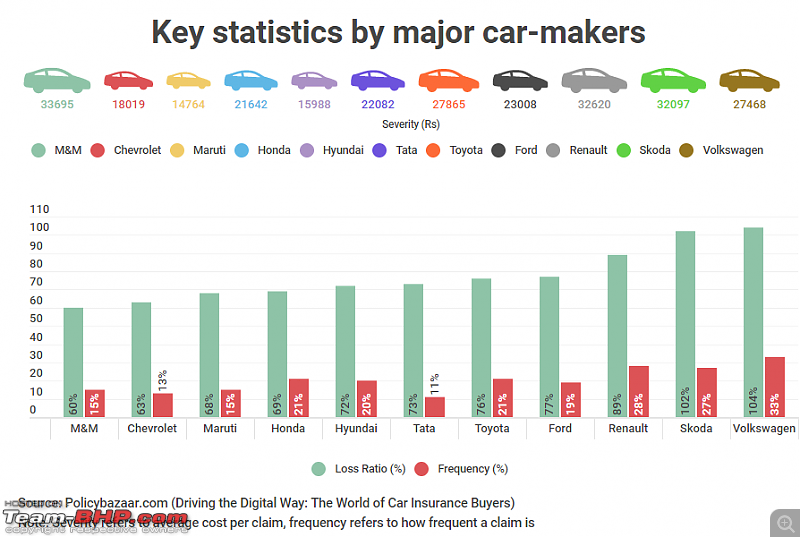

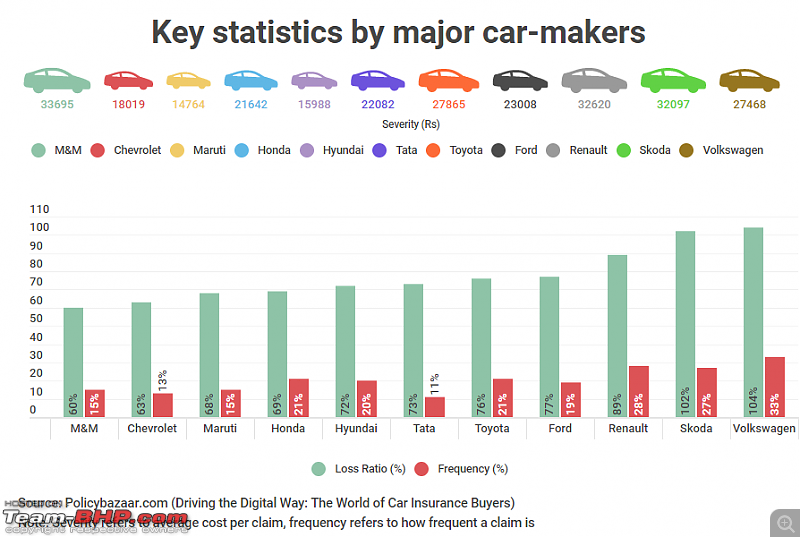

Volkswagen car could incur a higher rate of own damage premium versus a Mahindra & Mahindra (M&M), Chevrolet or Maruti Suzuki car!

Own damage portion covers the individual’s and any insurance for their own vehicle and will pay for any internal or external damage to it.

Quote:

while the loss ratios of Volkswagen exceed other car-makers across several states, the average cost per claim stood at Rs 27,468.

|

Quote:

Volkswagen had a loss ratio of 104 percent, that is for every Rs 100 paid as premium, Rs 104 was paid as claim. On the other hand, M&M had loss ratios of only 60 percent, while Chevrolet had 63 percent and Maruti Suzuki had 68 percent.

|

In terms of earned proportion, or market share, Maruti Suzuki stood on top with 24 percent followed closely by Hyundai with 22 percent.

Quote:

Similarly, by fuel type. diesel cars had a higher loss ratio of 87 percent while CNG had 84 percent and petrol had 64 percent

|

Quote:

SUVs/mini SUVs had a lower loss ratio across all models, whereas hatchbacks had a much higher loss ratio.

|

Hyundai Creta was at 32 percent loss ratio whereas a Toyota Etios Liva had a loss ratio of 110 percent.

Haryana fared the worst (84 percent) when it came to loss ratios, while

Karnataka and Andhra Pradesh fared the best with 59 percent loss ratios.

Link

Link

Own damage motor insurance can now be bought separately.

Come 1st September car owners can buy Own Damage cover separately i.e the TPL cover and the OD cover can be from two different Insurance cos. This will be applicable for old and new vehicles (4 wheelers & 2 wheelers).

Quote:

vehicle owners will be allowed more flexibility on two counts: Firstly, one could choose to buy an OD cover at a later date although it is not advisable, and second, they could buy this cover from a different insurer.

|

Benefits to customer:

1) Greater flexibility to choose

2) Reduced premiums due to competitive pricing by Insurance cos

3) For new cars OD can be bought only for a year instead of present 3 years along with TPL

More details in the link.

https://www.livemint.com/insurance/n...478090951.html

Logically this should follow if the cross subsidy is done away with. However, I am sceptical.

Why was the policy of reducing NCB to zero brought back, why the peak NCB is now capped at 50% (65% is only for cars on that). Are we encouraging or discouraging safe driving?

Quote:

Originally Posted by ghodlur

(Post 4615860)

For new cars OD can be bought only for a year instead of present 3 years along with TPL

|

What is new here? My new car (Jan 2019 purchase) insurance policy has TPL part that's valid for 3 years and OD part that's valid for 1 year.

Quote:

Originally Posted by anandpadhye

(Post 4615940)

What is new here? My new car (Jan 2019 purchase) insurance policy has TPL part that's valid for 3 years and OD part that's valid for 1 year.

|

I assume the insurance for OD & TPL will be from the same Insurance cos. Now you can buy OD & TPL insurance from different Insurers. That way you get the advantage of competitive premium pricing.

| All times are GMT +5.5. The time now is 11:46. | |