| | #31 |

| Senior - BHPian Join Date: Jan 2008 Location: Bombay

Posts: 1,466

Thanked: 1,021 Times

| |

| |

| |

| | #32 |

| BHPian | |

| |

| | #33 |

| Senior - BHPian | |

| |

| | #34 |

| Team-BHP Support  | |

| |

| | #35 |

| BHPian Join Date: Oct 2008 Location: Mumbai

Posts: 78

Thanked: 4 Times

| |

| |

| | #36 |

| Senior - BHPian Join Date: Dec 2007 Location: Bangalore

Posts: 4,106

Thanked: 537 Times

| |

| |

| | #37 |

| BHPian Join Date: Sep 2008 Location: Bavaria Germany

Posts: 190

Thanked: 8 Times

| |

| |

| | #38 |

| BHPian | |

| |

| | #39 |

| Senior - BHPian Join Date: Feb 2004 Location: DL XX XX XXXX

Posts: 1,634

Thanked: 1,011 Times

| |

| |

| | #40 |

| Senior - BHPian | |

| |

| | #41 |

| BHPian Join Date: Oct 2007 Location: Dubai

Posts: 53

Thanked: 2 Times

| |

| |

| |

| | #42 |

| Senior - BHPian Join Date: Feb 2004 Location: DL XX XX XXXX

Posts: 1,634

Thanked: 1,011 Times

| |

| |

| | #43 |

| Senior - BHPian | |

| |

| | #44 |

| Senior - BHPian Join Date: Feb 2007 Location: Delhi

Posts: 1,356

Thanked: 24 Times

| |

| |

| | #45 |

| BHPian Join Date: Oct 2008 Location: Mumbai

Posts: 78

Thanked: 4 Times

| |

| |

|

Most Viewed

but still would like to know. I just recieved a call from a Guy in Kotak mahindra and regarding the car loan i inquired about for Swift Vdi. he said the waiting period is 3 months but he can ge me that for a premium in a week. I was surprised and asked how come.

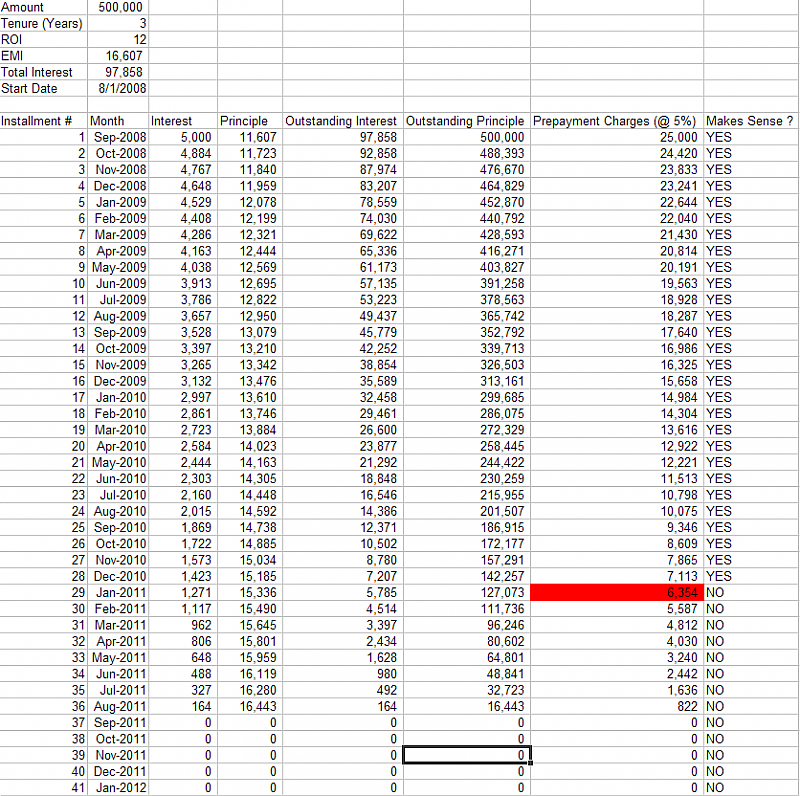

but still would like to know. I just recieved a call from a Guy in Kotak mahindra and regarding the car loan i inquired about for Swift Vdi. he said the waiting period is 3 months but he can ge me that for a premium in a week. I was surprised and asked how come.  yes you read that right. If you close the loan with your own funds(meaning, not from another loan), there are no foreclosure charges. My love hate relationship with SBI continues. It is a case of losing a bit of self esteem and gaining in blood pressure to save some money !

yes you read that right. If you close the loan with your own funds(meaning, not from another loan), there are no foreclosure charges. My love hate relationship with SBI continues. It is a case of losing a bit of self esteem and gaining in blood pressure to save some money !