Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by rki2007

(Post 3078159)

People i have a query. I claimed a body repair insurance claim during sept 2012. I renewed the insurance for this year during Jan 2013 with 0% NCB due to claim. Now i have sold of my car a week back. Is there any possibility for me to get the NCB claim when the insurance is renewed the next time and offcourse by the transferee.I personally see no chances for the same but one of my friend was pretty sure that the NCB of 20% is attributable to me.

People your ideas please?

|

There is no way you will get the NCB for the insurance of the car sold already and the transferee being endorsed on the new insurance. It belongs to the new owner now completely, forget about it.

Quote:

Originally Posted by RajeswaranK7

(Post 3078217)

Somebody banged my fiesta in the rear, i can only guess where it could have happened. I was on the way from Ramanathapuram to Chennai via Madurai. I had stopped for breakfast @ Ramanathapuram ( i had parked the car on the other side of the road some distance away from the hotel) and noticed the damage only when i stopped at Madurai at my inlaws place, so didn't file a complaint :Frustrati. The boot and rear bumper are damaged, the boot it not locking properly. I need to force it as the floor has rises a bit due to the impact. I have a zero depreciation policy from Bajai Allianz. If the need raises to replace the boot and the bumper, will everything including painting be covered under insurance?? This is the first time i am making an insurance claim.

OT: I showed the damage to a FNG and he said that when the boot and bumper are replaced, they will not be of the same quality (especially, finishing on the inner edges in case of boot). Is this true??

|

You only need to pay the standard deduction for your claim and nothing more, everything else is 100% covered in the 0-dep policy without worry.

Don't know why your FNG is advocating so. But be practical, there is no way you will get the factory finish with even the company's own ASC workshop paint-booths. It really depends upon how meticulously the ASC workshop paint-booths follow processes, and do the work upto the last dot. Even Toyota's own ASCs are not able to get factory finish so why blame the others? However, if any issues are found, they (ASC) are liable to cover any and all anomalies in completeness for a certain duration without fail, which is called Warranty duration of the work.

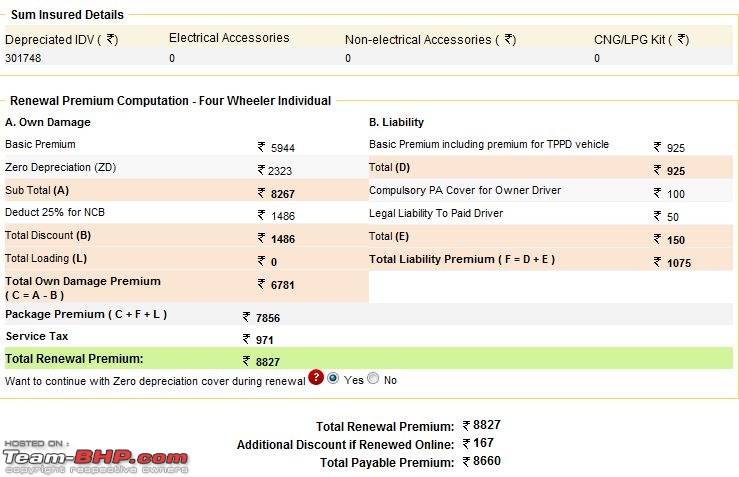

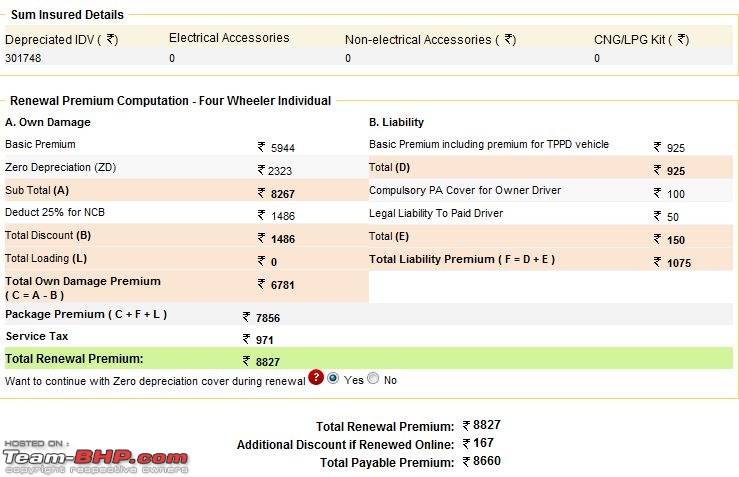

Hello Guys,

I am getting the Insurance renewed tonight. This is what I am getting for my 2011 March Beat LT Petrol (2 Years old).

Wanted your advice on the Zero Depreciation (ZD) value part. Should I opt for this ? It costs me an additional 2323 INR. What is the advantage of taking this option ?

Quote:

Originally Posted by mayankjha1806

(Post 3074513)

Got an email from Bajaj Allianz to renew it before April 01 as third party insurance cover is going to be increased? Is that true?

|

As posted by F50 the new rates for the TP liability are announced, suggest to renew immediately. IMO you should go for the comprehensive cover.

Quote:

Originally Posted by rki2007

(Post 3078159)

.I personally see no chances for the same but one of my friend was pretty sure that the NCB of 20% is attributable to me.

|

NCB of 20% would have been applicable if you had an Insurance cover for one complete year. In you case it will be 0% only.

Quote:

Originally Posted by F50

(Post 3079049)

The new TP rates released by IRDA

|

Isnt this different from what was proposed? On what basis is this calculated is best known to the IRDA guys only. The <1000cc was expected to have the higher increase but it seems they got the lowest increase.

Quote:

Originally Posted by Soumyajit9

(Post 3081338)

Hello Guys,

Wanted your advice on the Zero Depreciation (ZD) value part. Should I opt for this ? It costs me an additional 2323 INR. What is the advantage of taking this option ?

|

Since you car is only 2 year old, you can opt for the zero dep as it saves from shelling out anything in case of any claims (apart from the std deduction).

Quote:

Originally Posted by aka_iitd

(Post 3077242)

No they are just fooling you to earn quick bucks

Each service center has some list of insurers for cash less so please check with them. Infact you can check with other Hyundai service centers for such list.

|

Ok. Got a written reply from dealer today.

Respected Sir,

Please note that cashless facility is an arrangement between the workshop and insurance companies. Hyundai Insurance program is applicable only where the policy is renewed through Hyundai dealer. So,the dealer workshop may deny cashless facility if the policy is not renewed through them.

For any further clarification please feel free to call us.

Thanks and regards,

Mukesh Hyundai

Insurance Department

Quote:

Originally Posted by sbiswas

(Post 3082357)

Ok. Got a written reply from dealer today.

Please note that cashless facility is an arrangement between the workshop and insurance companies. Hyundai Insurance program is applicable only where the policy is renewed through Hyundai dealer.

|

As per the above they are taking about Hyundai Insurance program not about other insurance policy like from Bajaj/TATA etc. Cashless is applicable to other insurance provider at Hyundai workshop

A quick query: Guys the insurance for my Nissan Sunny is due for renewal. Earlier I had got the 0% depreciation cover from Royal Sundaram which costed me approx 16k Rs last time. Recently had to take a claim on the sunny due to some damage on the left side of the car. Now the renewal premium is being quoted at Rs 26k by Royal sundaram. The Nissan dealer itself advised me dad to go with Liberty Videocon general insurance copmany this time and there premium is coming to rs. 21k for the 0% dep cover.

So how is this company? Should I continue with the Royal Sundaram policy or shift to this new one? Have asked the dealer to mail me the details of the same.

Quote:

Originally Posted by drmohitg

(Post 3086280)

A quick query: Guys the insurance for my Nissan Sunny is due for renewal. Earlier I had got the 0% depreciation cover from Royal Sundaram which costed me approx 16k Rs last time. Recently had to take a claim on the sunny due to some damage on the left side of the car. Now the renewal premium is being quoted at Rs 26k by Royal sundaram. The Nissan dealer itself advised me dad to go with Liberty Videocon general insurance copmany this time and there premium is coming to rs. 21k for the 0% dep cover.

So how is this company? Should I continue with the Royal Sundaram policy or shift to this new one? Have asked the dealer to mail me the details of the same.

|

Liberty Videocon is a relatively new insurance co, I doubt whether they provide Zero dep add on (atleast not mentioned on their website). Also their garage list on the website does not have many Nissan dealerships tie ups.

Havent you tried apart from RS other Insurance co for quotes, I am sure you can get a better deal. The higher premium may also be due to the recent hike in the TP rates.

Quote:

Originally Posted by ghodlur

(Post 3086438)

Liberty Videocon is a relatively new insurance co, I doubt whether they provide Zero dep add on (atleast not mentioned on their website). Also their garage list on the website does not have many Nissan dealerships tie ups.

Havent you tried apart from RS other Insurance co for quotes, I am sure you can get a better deal. The higher premium may also be due to the recent hike in the TP rates.

|

Well this is what the Nissan dealer was recommending my Dad. The fact that its a new company might be the reason why there premium quote is relatively new. Also he clearly mentioned it is the 0% dep policy only.

One more query: How much should be the IDV value for a car in its second year? AFAIK the ex-showroom value for Nissan Sunny at the time of purchase was approx 8.2L. The IDV beind set now is 6.5L according to the dealer. Thats close to 20%. Is it too low or 20% depreciation is justified?

Quote:

Originally Posted by drmohitg

(Post 3086601)

One more query: How much should be the IDV value for a car in its second year? AFAIK the ex-showroom value for Nissan Sunny at the time of purchase was approx 8.2L. The IDV beind set now is 6.5L according to the dealer. Thats close to 20%. Is it too low or 20% depreciation is justified?

|

Ideally the IDV should be depreciated by 15% or 7L approximately. Maybe thats the reason for the low premium from Liberty. Try asking them the premium for 7L and you might find it at par with RS. How much did Royal Sundaram quote the IDV for a premium of 26K?

RS also offers a no NCB loss add on which will prevent the NCB loss in case of claims if you are interested.

If the IDV is reduced, isn't it saying that it is not zero depreciation? If it were, what does not depreciate? Or what constitutes zero depreciation?

Quote:

Originally Posted by krishnaraja

(Post 3086680)

If the IDV is reduced, isn't it saying that it is not zero depreciation? If it were, what does not depreciate? Or what constitutes zero depreciation?

|

As far as I know zero % depreciation means at time of claim there is no depreciation counted on various parts changed during a claim. Can someone elaborate?

^^^^^

To answer your query, Zero Dep means if there is any claim involving plastic/ fiber parts, the company will pay the claim in full. In a regular policy, Plastic and fiber parts are depreciated by 50%. So if there is a damage to the headlight, tail-light, bumper, mirror or any plastic part, the company is liable to pay only 50% of the cost of replacement of that plastic part. Zero dep policies are available at an additional premium and usually only for new cars upto three years.

I had a query. My Skoda Rapid Ambition's insurance is up for renewal this month. I currently have a Zero Dep policy with ICICI Lombard. My first years premium was 25k with IDV of 8.27L.

The renewal quote from ICICI Lombard pegs IDV at 6.97L and premium of Rs.22k approx.

I have no claims so can get 20% NCB. I have some quotes ranging from 17k(regular non-zero dep policies) to 25K(zero dep) from Future, Bharti Axa and Tata AIG. The peculiar thing is some providers/ agents are quoting the above premiums for IDVs ranging from 6.9L to 8L. How is it possible to have an IDV of 8L for the 2nd year on a vehicle whose ex-showroom price was 8.7L? Am I missing something?

Another thing. Yesterday, when I approached Vinayak Skoda for buying an extended warranty on my car, (I didn't buy it during purchase since their premium was way too high) they said if I want extended warranty, I need to renew the insurance with Bajaj Allianz and they will provide a separate quote for it. Is this allowed? Any Bangalore buyers with Vinayak facing similar problems or bought Extended warranty before the end of one year?

Quote:

Originally Posted by krishnaraja

(Post 3086680)

Or what constitutes zero depreciation?

|

Quote:

Originally Posted by drmohitg

(Post 3086686)

As far as I know zero % depreciation means at time of claim there is no depreciation counted on various parts changed during a claim.

|

Zero depreciation is an add on cover along with the basic Insurance package by the Insurance companies. Below is the most detailed explanation of the add on, courtsey Royal Sundaram. Hope this helps.

Quote:

This means when you make a claim, you will get the full claim amount without any deduction for depreciation on the value of parts being replaced.

For example, normally when you have to replace some part and make a claim towards this replacement, you will not get the full cost of the part but only the depreciated cost depending on how old your vehicle is. Older the vehicle lower the value, however you can protect yourself against depreciation with this cover. If you take this cover, you will be paid full value of the parts without deduction of any amount towards depreciation. This means you do not have to pay out of your pocket towards the replacement of the parts.

What is Covered? - All plastic parts without applying depreciation in case of a claim.

- All metal parts without applying depreciation in case of a claim.

- You need not bear any portion of any depreciable parts. The cost of all parts necessitating replacement will be allowed in full.

What is not Covered? - The amount of total deductible mentioned in the policy schedule.

- Damage caused by an uninsured peril including mechanical breakdown.

- Damage to uninsured items including accessories and bi-fuel/gas kit.

- Claims made for theft of parts and/or accessories.

- Claims made under Self Authorisation Mode.

|

Quote:

Originally Posted by hrman

(Post 3086694)

The peculiar thing is some providers/ agents are quoting the above premiums for IDVs ranging from 6.9L to 8L. How is it possible to have an IDV of 8L for the 2nd year on a vehicle whose ex-showroom price was 8.7L? Am I missing something?

Another thing. Yesterday, when I approached Vinayak Skoda for buying an extended warranty on my car, (I didn't buy it during purchase since their premium was way too high) they said if I want extended warranty, I need to renew the insurance with Bajaj Allianz and they will provide a separate quote for it.

|

Ideally your IDV should be approx 7.4L or 10% depreciated from last year. Insurance co normally tend to give a range coz they want to vehicle owners either to buy insurance having low premiums or higher IDV's. Most of the Insurance buyers dont read the fine print of the policy. Higher IDV is just a way of trying to grab business.

Regarding the extended warranty, I guess the dealer is arm twisting you. Ext warranty and Insurance are un related. You need to contact Skoda and brief them about the dealer's attitude. Alternatively try other Skoda dealers for ext warranty.

Quote:

Originally Posted by ghodlur

(Post 3086696)

Zero depreciation is an add on cover along with the basic Insurance package by the Insurance companies. Below is the most detailed explanation of the add on, courtsey Royal Sundaram.

|

Just received the final premium amount from the Nissan dealer for my Sunny.

1. Royal Sundaram ( which I currently have and took a claim too which went quite smoothly): Rs. 23000

2. Liberty Videocon: Rs. 20200.

Both are 0% dep policies and due to the claim I lost my NCB and hence the slightly higher premiums. The IDV in both cases is same too and pegged at 6.5L ( 20% below the ex-showroom price).

Just read in a post some pages back that Liberty Videocon along with Bajaj and Bharti are the only companies that offer 0% dep for 5 years currently. So keeping that in mind should I opt to change to Liberty Videocon then? It gives me added cover for 2 more years and the premium is less too by a cool 3k.

| All times are GMT +5.5. The time now is 12:27. | |