Team-BHP

(

https://www.team-bhp.com/forum/)

The insurance for my Ford Classic is due next month. Following are the details of the current policy :

Company - Royal Sundaram

Vehicle IDV - Rs.695,573

Total Premium (Nil Depreciation) - Rs.29,361

I'm a total rookie when it comes to car insurance and could use some help here.

1. Royal Sundaram Policy was arranged by the showroom guys at the time of purchasing, so will it be better if I continue with the same or should I ask for quotes from other providers?

2. I've never made a claim, so eligible for NCB. I can expect 20% reduction in premium amount because of that right? Any other discounts that I could/should push for? Like loyalty or something?

3. The current policy details include broker and intermediary details. Can I make any significant savings on premium if I approach the company directly this time?

Hope you guys will help me out here. Thanks in advance:)

Quote:

Originally Posted by RiGOD

(Post 3713479)

The insurance for my Ford Classic is due next month. Following are the details of the current policy :

Company - Royal Sundaram

Vehicle IDV - Rs.695,573

Total Premium (Nil Depreciation) - Rs.29,361

I'm a total rookie when it comes to car insurance and could use some help here.

Hope you guys will help me out here. Thanks in advance:)

|

The best practice is to check online for various vendors and go with the one who provides the best quote and the best service. Check with your regular service center about the insurance providers who they have a cash less tie up with.

www.policybaazar.com is a good place to start with.

You will get an NCB for no claims made, and there is no loyalty for sticking to the same provider, on the contrary for some of the providers, they actually charge more to the existing customers.

Hi,

I'm selling off my Hyundai iGen i20 (June-2012) which has zero dep insurance (currently 3rd year) from ICICI & it'll expire on June 17, 2015. No claims in this year till now.

I have a buyer ready & I'll be doing the transaction in the first week of July 2015.

Now, how do I deal about my insurance with the new buyer?

1> Insurance Ownership & Renewal - Should I do it or ask the buyer do it?

2> Transfer

3> NCB Benefit

I have gone through the HOW TO SELL YOUR CAR thread & still had above queries.

Note: I haven't initiated Ownership Transfer in RTO yet.

Quote:

Originally Posted by ILTDrive

(Post 3713480)

The best practice is to check online for various vendors and go with the one who provides the best quote and the best service. Check with your regular service center about the insurance providers who they have a cash less tie up with. www.policybaazar.com is a good place to start with. You will get an NCB for no claims made, and there is no loyalty for sticking to the same provider, on the contrary for some of the providers, they actually charge more to the existing customers.

|

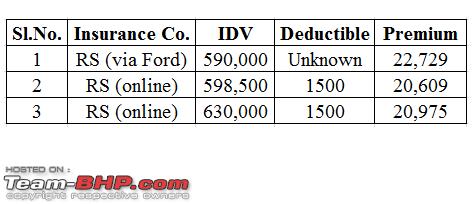

Contacted Kairali Ford, Trivandrum and they mentioned that Royal Sundaram and New India Assurance are the companies they're having cashless tie up with. Following are the quotes (both 0% depreciation) that I received :

Company - Royal Sundaram

Vehicle IDV - Rs.590,000

Premium - Rs.22,729

Company - New India Assurance

Vehicle IDV - Rs.590,000

Premium - Rs.20,189

Planning to go with the latter for obvious reasons (low premium). Any final suggestions mate?

Received this message a couple of days back "Dear Cust, Revision in Service tax from 12% to 14% will be effective from 1st June 2015. Please renew your car insurance before 28 May 2015."

Quote:

Originally Posted by RiGOD

(Post 3713479)

1. Royal Sundaram Policy was arranged by the showroom guys at the time of purchasing, so will it be better if I continue with the same or should I ask for quotes from other providers?

2. I've never made a claim, so eligible for NCB. I can expect 20% reduction in premium amount because of that right? Any other discounts that I could/should push for? Like loyalty or something?

3. The current policy details include broker and intermediary details. Can I make any significant savings on premium if I approach the company directly this time?

|

Answering your queries serially:

1) If RS has provided competitive quotes, then stick to them or else move to someone who gives a better service.

2) During the first renewal, in case of no claim previous year you are entitled to 20% NCB. You could get Antitheft device & ARAI membership discounts if you are eligible. But these are pittance in comparison with NCB discount.

3) It is always beneficial if you buy Insurance online as you can save money.

I saw your subsequent post where you are thinking of opting for New India, I would suggest stick to RS. Reason being RS is the official Insurance partner of Ford, hence they would be having the correct part costs in case of claims. Refusal of claims by RS in a ford workshop would be rare. However NIA can refuse the claim or play spoilsport when it comes to spares cost as they wouldn't be having the latest updated price list. Hence would not agree with the workshop charges in case of claims. Just my personal line of thought (although I have got this info from an Insurance friend)

Quote:

Originally Posted by DevendraG

(Post 3713683)

1> Insurance Ownership & Renewal - Should I do it or ask the buyer do it?

2> Transfer

3> NCB Benefit

Note: I haven't initiated Ownership Transfer in RTO yet.

|

Devendar,

Thumb rule - when applying for ownership transfer at RTO, apply for Insurance transfer too. This will save time and future hassles. Same set of documents as required for Ownership transfer also apply for Insurance transfer. Answering your queries serially:

1) Its a mutual agreement. Generally the buyer opts for Insurance renewal and seller initiates the Insurance transfer.

2) Could not understand this query

3) NCB letter can be obtained from present Insurer. When applying for Insurance transfer, you can apply for NCB certificate too.

Nowadays, it is very difficult to get a third party insurance, especially converting a comprehensive insurance policy to a third-party-liability-only-insurance at the time of renewal. I learnt this in a hard way a few weeks back, when the comprehensive insurance policy of my Thunderbird 500 was about to expire. First, I tried to renew the then-valid comprehensive insurance as a third party insurance online, but in vain. Then, I tried taking a new third party insurance policy by contacting the insurance companies. Some said they don't do third party insurance and others gave some vague response. After getting fed up, I called the agent who did the comprehensive insurance policy for my Thunderbird 500 and requested him to renew it as a third party one. Initially, he too hesitated. But, I was firm. At the end, he agreed to my request. Now, my Thunderbird 500 is enjoying the third party insurance costing less than half of the comprehensive insurance premium. I managed to get a certificate from the insurer at the time of renewal stating that my no-claim bonus will be transferred to a new comprehensive insurance policy, if I buy a new two-wheeler within 3 years from the date of certificate. :)

Quote:

Originally Posted by J.Ravi

(Post 3714674)

Nowadays, it is very difficult to get a third party insurance, especially converting a comprehensive insurance policy to a third-party-liability-only-insurance at the time of renewal.

|

Ravi Sir,

Whats the advantage of having only the TPL on 2 wheeler? How much did you save by opting for TPL only?

Came across a rather disturbing news on the TOI.

http://timesofindia.indiatimes.com/i...w/47392161.cms

Quote:

Originally Posted by ghodlur

(Post 3714717)

Whats the advantage of having only the TPL on 2 wheeler?

|

I usually convert from comprehensive to third party after 2 years on my two-wheelers as my running is very less and my claim history is almost nil - only one claim on my erstwhile Suzuki Fiero so far - in my 40 years of riding. So, with the third party, atleast I can save on the premia! :)

Quote:

How much did you save by opting for TPL only?

|

For the expired comprensive policy, I paid ₹ 2 k+ with 10% NCB. Now, I paid ₹ 1,049 only for the TPL.

Quote:

Came across a rather disturbing news on the TOI.

|

During my long rides in 2 years, cops checked my bike's documents only once at Chittoor, Andhra Pradesh at midnight. Even, they did not bother about the insurance. When I voluntarily showed the insurance certificate, they did not even bother to look at it! :)

Quote:

Originally Posted by ghodlur

(Post 3714662)

I saw your subsequent post where you are thinking of opting for New India, I would suggest stick to RS. Reason being RS is the official Insurance partner of Ford, hence they would be having the correct part costs in case of claims. Refusal of claims by RS in a ford workshop would be rare. However NIA can refuse the claim or play spoilsport when it comes to spares cost as they wouldn't be having the latest updated price list. Hence would not agree with the workshop charges in case of claims. Just my personal line of thought (although I have got this info from an Insurance friend)

|

I decided to proceed with RS and while trying to renew the policy online, I was constantly getting an error saying that this particular policy cannot be renewed online. So I called the RS CC and the executive mentioned that my policy is linked to the Ford dealer and I can only renew the same via them. On mentioning about the higher premium charged by them for a lower IDV, he told that in that case I need to visit the nearest RS office in person and renew it so that I'll be able to continue renewing the same online the next time onward.

Then I called the RS branch office and they asked for the policy number and remaining details and told me that they'll call me back with the quote. 15 minutes later I get a call from the Ford insurance guy (yeah, RS office diverting me again to Ford!) saying that the quote is the same as he mentioned the other day and I won't be able to find any difference even if I approach the office directly. Seems like the local RS and Ford guys are playing the drama together so that I'll finally end up paying the extra premium (including their broker commission) to Ford which I'm not intending to do!

Finally I made a call to RS CC and mentioned the situation and they finally agreed to provide assistance by tomorrow afternoon to renew it online. Keeping my fingers crossed! Attached is a comparison table of the rates provided by Ford and RS (online).

Planning to purchase the 3rd option (if I ever can!). So did you ever face such issues while renewing online?:Frustrati

Quote:

Originally Posted by RiGOD

(Post 3716074)

Planning to purchase the 3rd option (if I ever can!). So did you ever face such issues while renewing online?:Frustrati

|

Never had these issues. I have had insurance with Tata AIG and Bajaj Allianz for my old car and National insurance and Bharathi Axa for the current one.

Just tell the FORD guys you will get it done from outside from a different agency of RS without revealing the name of the agency and see how they react.

I would go with National Insurance, as they were upfront in quoting the appropriate cost. In the event of a claim, all I need to pay is the compulsory deductible and the remaining is the insurance companies headache as I have a 0 Dep policy. isn't that what the policy is supposed to mean?

Quote:

Originally Posted by RiGOD

(Post 3716074)

Planning to purchase the 3rd option (if I ever can!). So did you ever face such issues while renewing online?:Frustrati

|

Your guess is correct, the dealer and the RS branch guys are hand in glove. You did the right thing by contacting RS regarding the issue. But why did you opt for deductible? By deductible, I assume its voluntary deductible.

Believe me I am facing an issue with RS as of now. My Punto's insurance expires on 16th June, hence decided to renew it (to take the advantage of lesser service tax which is going to be increased from June 1 to 14% from 12.3%). The quote on RS website was humorous, they under quoted the IDV and over quoted the premium. I tried buying 1) as a new buyer & 2) as a buyer from different insurance co. Both the times the quote was 1/2 the amount quoted for me as an existing user. Have called RS to respond back, unfortunately my mobile is playing a truant. :Frustrati:Frustrati

Quote:

Originally Posted by ghodlur

(Post 3716382)

But why did you opt for deductible? By deductible, I assume its voluntary deductible.

|

Yes, voluntary. There was an option to choose an amount for voluntary deductible inorder to save the premium and I chose Rs.1500. If it's left as zero the premium hovers somewhere around 21.5k. Will it be better if I leave it as zero?

Quote:

Originally Posted by ghodlur

(Post 3716382)

Believe me I am facing an issue with RS as of now. Have called RS to respond back, unfortunately my mobile is playing a truant. :Frustrati:Frustrati

|

I was actually totally inclined towards RS but their current attitude is making me think again. Kairal Ford (Trivandrum) confirmed their they have cashless tie up with both RS and New India Assurance (NIA). But the cons of NIA you mentioned in an earlier post sounds scary. Is that particular scenario valid even if they have direct association with the Ford Service Centre?

Quote:

Originally Posted by RiGOD

(Post 3716395)

Will it be better if I leave it as zero?

|

If you opt for it, you will pay 1.5K + 1K during any claim. I normally do not opt for voluntary deductibles, take an informed decision

Quote:

Is that particular scenario valid even if they have direct association with the Ford Service Centre?

|

Although an Insurer has a cashless tie up with the service workshop, they still outsource the Surveying part of third party and depend on their judgement for making the claim valid. Now if the Surveyor doesn't have a clue about the spares cost, he will rely on the old data available with the Insurer and pass the claim accordingly. The difference in the spares cost will have to be borne by the customer. Ideally the Insurance co should have an updated list but this rarely happens.

Just look at your car's ex showroom cost on any Insurer's website, is it the latest one? Not possible.

Quote:

Originally Posted by ILTDrive

(Post 3716226)

Never had these issues. I have had insurance with Tata AIG and Bajaj Allianz for my old car and National insurance and Bharathi Axa for the current one.

|

Quote:

Originally Posted by ghodlur

(Post 3716399)

Although an Insurer has a cashless tie up with the service workshop, they still outsource the Surveying part of third party and depend on their judgement for making the claim valid. Now if the Surveyor doesn't have a clue about the spares cost, he will rely on the old data available with the Insurer and pass the claim accordingly. The difference in the spares cost will have to be borne by the customer. Ideally the Insurance co should have an updated list but this rarely happens.

|

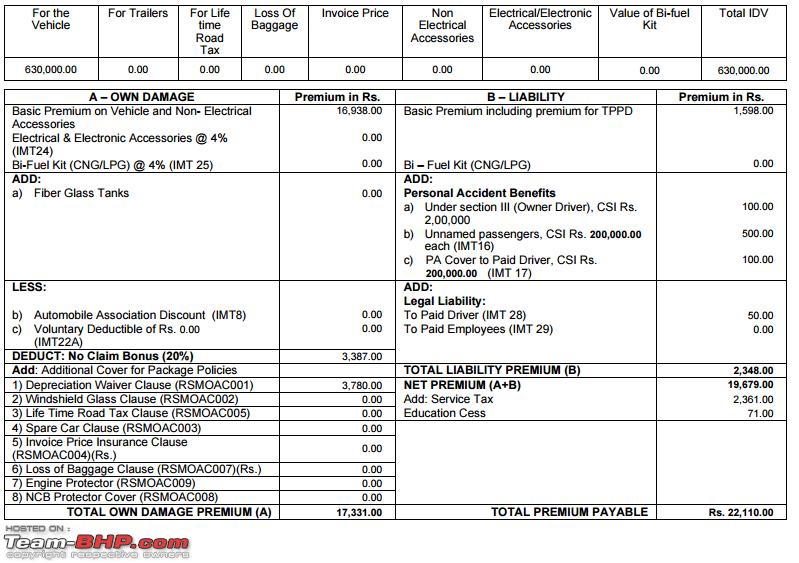

Got a callback from the RS executive and he helped me to renew the policy online. Attached is the detailed breakdown of the payment made. Any suggestions or opinions so that I can rectify mistakes made, during the next renewal. Thanks again for the help guys:)

| All times are GMT +5.5. The time now is 20:18. | |