Team-BHP

(

https://www.team-bhp.com/forum/)

Hello, has anybody used this portal for insurance renewal -

https://icai.newindia.co.in/Account/Home

This is exclusive to chartered accountants and the insurer gives some discount apparently. Is it legit or has some hidden t&c restricting claims?

Quote:

Originally Posted by Nonstop-driver

(Post 4558961)

Hello, has anybody used this portal for insurance renewal - https://icai.newindia.co.in/Account/Home

This is exclusive to chartered accountants and the insurer gives some discount apparently. Is it legit or has some hidden t&c restricting claims?

|

It appears to be a corporate discount sort of deal that ICAI worked out with New India Assurance as a benefit for its members. Just the same insurance as you'd get from New India as someone who isn't an ICAI member, but you pay slightly less premium, have a dedicated service contact with an SLA etc I guess.

As I see they have office insurance as well as professional indemnity (which insures you against a lawsuit from or related to a client).

Quote:

Originally Posted by hserus

(Post 4558971)

It appears to be a corporate discount sort of deal that ICAI worked out with New India Assurance as a benefit for its members. Just the same insurance as you'd get from New India as someone who isn't an ICAI member, but you pay slightly less premium, have a dedicated service contact with an SLA etc I guess.

|

I assumed that's how it would work but I don't see how their offer is better than what I'm getting on policy bazaar. 2017 registered Creta with 11.50L as IDV is at 29,000 with GST on both sites.

Quote:

Originally Posted by Nonstop-driver

(Post 4558999)

I assumed that's how it would work but I don't see how their offer is better than what I'm getting on policy bazaar. 2017 registered Creta with 11.50L as IDV is at 29,000 with GST on both sites.

|

If you go through policybazaar your personal data is sprayed out to a large number of insurance brokers around your city and you will get many calls about switching your insurance even five years after you sold your old car.

Quote:

Originally Posted by hserus

(Post 4559024)

If you go through policybazaar your personal data is sprayed out to a large number of insurance brokers around your city and you will get many calls about switching your insurance even five years after you sold your old car.

|

I always enter my deactivated number and they seem to accept it somehow :D

Anything specific to keep in mind when buying insurance from a new car online (e.g. Coverfox, Policy Bazaar etc), other than :

1. Engine number and chassis number to be provided when filling in the details.

2. 1 year own damage + 3 years third party insurance is mandatory

3. Addition of the zero depreciation option.

If these three things are taken care of, it will be equivalent to what the car dealer insurance providers would be providing, correct? Is there anything else to be taken care of when purchasing the new car insurance?

Quote:

Originally Posted by arindambasu13

(Post 4559045)

Anything specific to keep in mind when buying insurance from a new car online (e.g. Coverfox, Policy Bazaar etc), other than :

1. Engine number and chassis number to be provided when filling in the details.

2. 1 year own damage + 3 years third party insurance is mandatory

3. Addition of the zero depreciation option.

If these three things are taken care of, it will be equivalent to what the car dealer insurance providers would be providing, correct? Is there anything else to be taken care of when purchasing the new car insurance?

|

4. Any electrical accessories added?

5. If possible try to get the Return To Invoice add on too.

Quote:

Originally Posted by hserus

(Post 4559024)

If you go through policybazaar your personal data is sprayed out to a large number of insurance brokers around your city and you will get many calls about switching your insurance even five years after you sold your old car.

|

Hello sir! Long time, no interactions with you...

I am very surprised if one's personal contact info is shared with sundry brokers by web aggregators like Policybazaar. At work, I've been studying the regulatory framework laid out by the IRDA for functioning of licensed web aggregators such as policybazaar. They are only authorized to allow the user to choose 4 or 5 possible insurers' products, compare them and to finally choose one of them.

Once the customer buys one of them, policybazaar is actually mandated by the IRDA to share the lead information with all 4 or 5 of the insurers. They only get paid by the insurer whose product got purchased though. They don't get paid to share the leads with the other 4 insurers.

If there's a breach in the way policybazaar sells our info, their license can be summarily cancelled by the IRDA. IRDA's ombudsmen are reachable; the only thing is, how do we know if a broker received our info illegally?

To give them the benefit of the doubt - the insurers who legally receive lead information from policybazaar might well be sharing it with brokers out there...

The rules did change to tighten things a bit around 2014 but lead generation is rather an unethical field in India. Even if the portals don't leak your data out the brokers will surely do it.

That's why you buy your policy direct from the insurer either online or through an official of the insurance company at their own office itself.

https://www.medianama.com/2014/01/22...ndia-response/

Got a renewal notice from Maruti Insurance brokers for my 13 year old Swift ZXI with IDV of 1.08L at Rs 5002. Checked Coverfox and found Reliance to be cheaper at Rs 4534 for 2.21 IDV with free road side assistance included. Made the payment and received the policy in 15 mins.

Quote:

Originally Posted by diyguy

(Post 4560430)

Got a renewal notice from Maruti Insurance brokers for my 13 year old Swift ZXI with IDV of 1.08L at Rs 5002. Checked Coverfox and found Reliance to be cheaper at Rs 4534 for 2.21 IDV with free road side assistance included. Made the payment and received the policy in 15 mins.

|

Would they NOT refuse cashless claims in Maruti ASC, if you buy the insurance outside? This is what has been told to us at Mandovi, JP Nagar.

Quote:

Originally Posted by JMaruru

(Post 4560437)

Would they NOT refuse cashless claims in Maruti ASC, if you buy the insurance outside.

|

sorry missed mentioning that reliance has cashless tie up with all major service centers in Chennai. I just did a complete under chassis overhaul personally this past week and don't intend going to any garages henceforth but this is supported if needed.

Dear members,

I drive an Elite i20 (Petrol). We purchased the car in April 2016, and its insurance renewal is due next month (shortly). Since the time I started working last year, I decided to take care of i20, since it is only me who drives it (my father drives a Ciaz).

The car is in immaculate condition, as it is used only by me and by the grace of god, we have never claimed insurance in past 3 years of ownership.

Of late, I have been browsing various websites (Policybazaar, Acko, CoverFox etc) and have requested various quotes. The only problem I have faced so far is, which provider to opt for. If the premium is low, the IDV offered is very low, and with respectable IDV quotes, the Premium amount is too high. I seek your experience and help to help me in this situation.

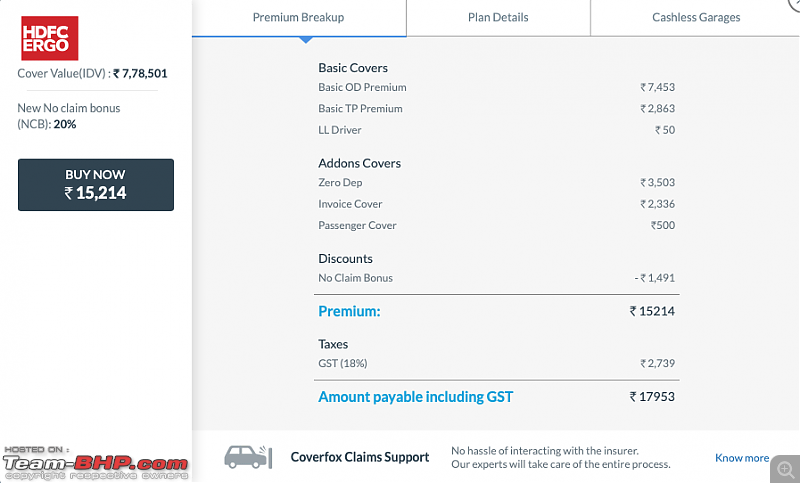

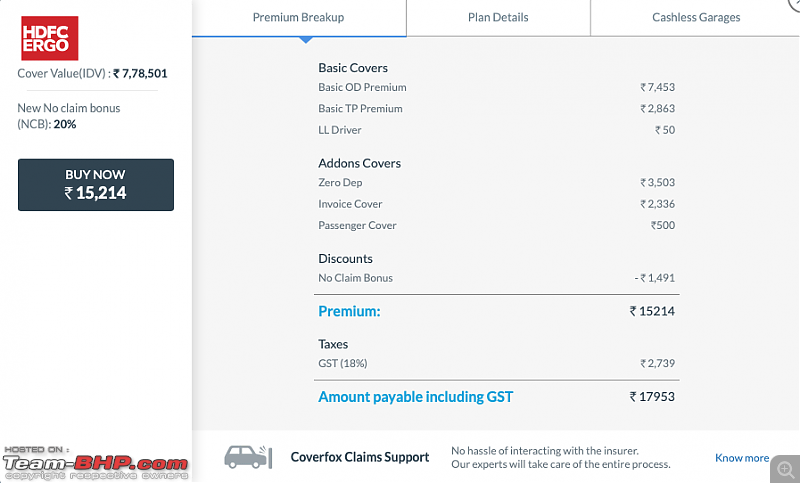

My Abarth is due renewal in May 2019. Current policy is HDFC Ergo with Zero dep and Invoice protection covers. Paid ~27k for IDV of 7.22L. The car will be 3 years old in 2019.

Got a quote for ~17k with both these covers included and a higher IDV of 7.78L. I also checked policy wordings on the HDFC website and there was no 3 year limit. My question is, is the proper? AFAIK, RTI and other covers are available only for first 3 years.

Quote:

Originally Posted by blackwasp

(Post 4561975)

I also checked policy wordings on the HDFC website and there was no 3 year limit. My question is, is the proper? AFAIK, RTI and other covers are available only for first 3 years.

|

It is OK. The RTI and other add on covers vary between insurance cos. Some offer RTI cover for 3 yrs some for even 6 yrs like Cholamandalam. The T&C of the add on cover needs to be read to understand the fine print.

| All times are GMT +5.5. The time now is 22:48. | |