Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by null

(Post 5612610)

Extending the question, when we renew the insurance for 2nd year, how do we buy insurance for just OD (since TP is already present for 3 years)? My understanding was, when you buy a comprehensive insurance, it has both components - own damage and damage to others - baked in. So, will we end up paying TP part again unnecessarily during 2nd year renewal? (esp. so when you want to switch providers).

|

It's simple. You can just renew OD insurance in second and third year (same company or you can switch to another insurer). Just remember to provide your TP details to the new insurer so that it can be endorsed in the OD policy document.

Quote:

Originally Posted by null

(Post 5612610)

... when we renew the insurance for 2nd year, how do we buy insurance for just OD (since TP is already present for 3 years)? My understanding was, when you buy a comprehensive insurance, it has both components - own damage and damage to others - baked in. So, will we end up paying TP part again unnecessarily during 2nd year renewal? (esp. so when you want to switch providers).

|

You can opt for only OD insurance when you are renewing the policy in the second year. This is possible with the same insurance company or another provider of your choice as well.

Hi,

I've booked the new Kia Seltos 2023 which is expected to be allotted in a month or two. Meantime I'm trying to understand how car insurance works. When I bought my first car, I blindly went by what the dealer quoted and this was way back in 2009. This time, I'm looking to do better!

For the Seltos GTX+ DCT, the dealer is quoting Rs 75,748 as the insurance. On Kia's portal, it mentions the insurance partner as GODIGIT.

Just now, I was checking out Insurancedekho and see quotes from companies with premium as low as Rs 28,922 (National) and as high as Rs 78,898 (Bajaj Allianz). GoDigit is quoting ~76k. All of these for IDC value of 20L and includes Zero Dep.

How can the difference be so massive? Comparing the Plan Details as mentioned on InsuranceDekho, I can't figure out much for the reason of this massive difference. How should one decide which insurance to go with? Will I be missing out on anything important if I go with, say, National? (other than cashless claim, maybe)

Quote:

Originally Posted by Sufficient_shop

(Post 5613697)

This time, I'm looking to do better!

For the Seltos GTX+ DCT, the dealer is quoting Rs 75,748 as the insurance. On Kia's portal, it mentions the insurance partner as GODIGIT.

|

Its always beneficial to get the new car insurance from outside rather than from dealer as its much cheaper.

The Insurance premium for your Seltos will be in the range of 50-60K for the new car as there will be a 3 yr TPL premium of min 24K and rest OD will be in the range of 25-30K based on the IDV proposed. So you can expect a premium closer to 60K.

You can check with the workshop with which Insurance cos do they have a cashless tie up and get quotes for the insurance co on their website and comparator websites. Review the T&Cs of the add ons and take an informed call.

Quote:

Originally Posted by Sufficient_shop

(Post 5613697)

Hi,

I've booked the new Kia Seltos 2023 which is expected to be allotted in a month or two. Meantime I'm trying to understand how car insurance works. When I bought my first car, I blindly went by what the dealer quoted and this was way back in 2009. This time, I'm looking to do better!

For the Seltos GTX+ DCT, the dealer is quoting Rs 75,748 as the insurance. On Kia's portal, it mentions the insurance partner as GODIGIT.

Just now, I was checking out Insurancedekho and see quotes from companies with premium as low as Rs 28,922 (National) and as high as Rs 78,898 (Bajaj Allianz). GoDigit is quoting ~76k. All of these for IDC value of 20L and includes Zero Dep.

How can the difference be so massive? Comparing the Plan Details as mentioned on InsuranceDekho, I can't figure out much for the reason of this massive difference. How should one decide which insurance to go with? Will I be missing out on anything important if I go with, say, National? (other than cashless claim, maybe)

|

How do we determine an IDC value for a new car? Will it be the OTR price as it is quoted by dealer?

Quote:

Originally Posted by itzvicky201

(Post 5616227)

How do we determine an IDC value for a new car? Will it be the OTR price as it is quoted by dealer?

|

We can choose the IDC value. It can be anything between the ex showroom price and on road price.

Quote:

Originally Posted by itzvicky201

(Post 5616227)

How do we determine an IDC value for a new car? Will it be the OTR price as it is quoted by dealer?

|

Quote:

Originally Posted by Sufficient_shop

(Post 5616303)

We can choose the IDC value. It can be anything between the ex showroom price and on road price.

|

If you guys are referring to IDV, then it's 95% of ex-showroom price for a brand new car.

Quote:

Originally Posted by self_driven

(Post 5616331)

If you guys are referring to IDV, then it's 95% of ex-showroom price for a brand new car.

|

Every Insurance provider has options - lowest, best and custom. What I mentioned about is the custom IDV that one can choose.

Check this thread for more details -

https://www.team-bhp.com/news/cleari...nce-claims-idv

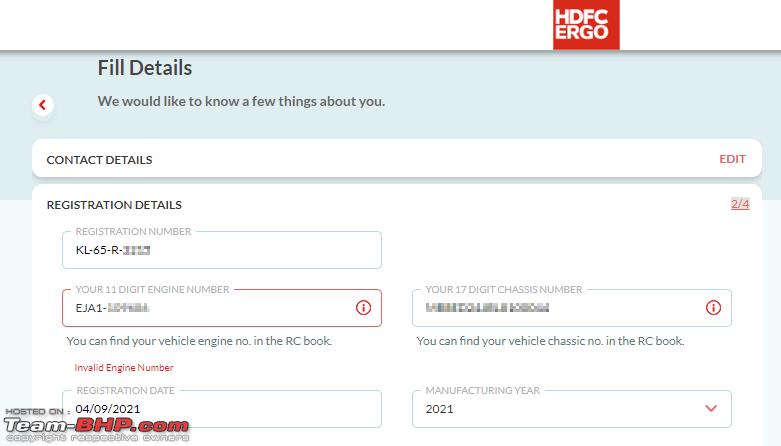

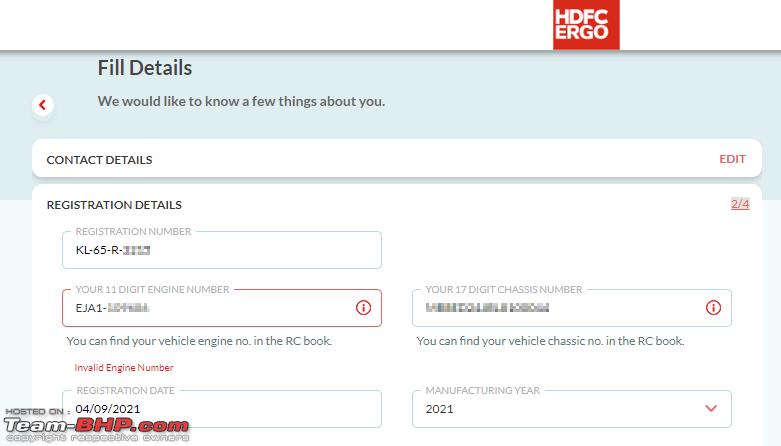

I'm having this frustrating error while trying to buy an own damage policy from HDFC ERGO for my two wheeler. Their website won't let me type in the engine number in the format that's shown in the RC and previous policy as well. This is exactly how the number is stamped on my crank case as well :Frustrati

If I remove the hyphen after EJA1 the error goes away. But that means the engine number is not the same as printed on the RC book anymore. How can I get around this?

Quote:

Originally Posted by Sufficient_shop

(Post 5616334)

|

Hi bud, I get that but no insurer would allow you to choose "anything between ex-showroom and on-road price" like you said in the earlier post.

IDV has to be lower than ex-showroom price and 5% lower for a brand new vehicle is standard practice. There is a complete chart for calculating IDV followed by most insurers for vehicles upto 5 years of age. Post 5 years, it is mutually decided with general rule of 10% annual depreciation. Some leeway is given to customers to increase or decrease the IDV but ultimately it is the insurer that decides total loss payouts irrespective of overinflated IDVs.

If someone wishes to have more coverage, there is RTI add-on which covers the on-road cost of the car in case of total loss. Even in that case, although it is irrelevant, one has to declare IDV less than ex-showroom price.

So one can insure a brand new car for less than the ex-showroom price with a standard policy or the on-road price with RTI add-on. There is no in-between option to be had.

Quote:

Originally Posted by b16h22

(Post 5616469)

If I remove the

hyphen after EJA1 the error goes away. But that means the engine number is not the same as printed on the RC book anymore. How can I get around this?

|

Write a mail to

care@hdfcergo.com with a photo of your bike's RC and ask them to generate a quote for you. Their team is quite active from what I've seen.

I am helping my BIL buy the new car insurance for his Tata Safari from ICICI Lombard, however strangely the new Safari variants aren't listed on the website of ICICI Lombard and still shows the Storme and the Dicor variants. Number of calls, messages to ICICI have gone unanswered. Any known Insurance agent in Pune who can help get the Insurance.

PS: ICICI Lombard is one of the lowest quotes for the new Safari, the other lowest is United India Assurance which didn't even bother to provide a quote courtesy the public sector image.

The images of Safari used on most comparator websites are still of Storme.:Frustrati

I have a question, my brother's S-Cross is due for insurance renewal. I want to know whether Zero Depreciation includes engine cover also ? Issue is that if we want zero dep, we don't see any company offering engine protect in that. And when we select engine protect, there are a few companies with poor solvency ratio without zero dep coverage. So will zero dep cover any engine issues?

Quote:

Originally Posted by BoneCollector

(Post 5620476)

I have a question, my brother's S-Cross is due for insurance renewal. I want to know whether Zero Depreciation includes engine cover also ? Issue is that if we want zero dep, we don't see any company offering engine protect in that. And when we select engine protect, there are a few companies with poor solvency ratio without zero dep coverage. So will zero dep cover any engine issues?

|

Engine protect is a separate cover, independent of zero dep. you will need to purchase engine cover separately. A zero dep cover will not cover engine damages like hydrostatic lock (water damage to engine) etc

Met an accident on 21st September in Bangalore. Front bonnet and bumper got damaged along with rear bumper. I totally forgot to lodge the complaint but took photo of both vehicles involved in accident.

Now surveyor is asking for police complaint acknowledgement.

I have 2 options as per him:

1. Police acknowledgement copy: rear and front both will be covered in insurance. As it goes above 50k amount

2. Self declaration on 100 rupees stamp paper. I will get only front covered which is the major portion.

My vehicle is Hyundai i20. Insurance was taken from dealer only (trident Hyundai).

Insurance provider is New India Assurance.

Question: this is my first time doing this process:

1. I guess I need to go to normal police station rather than traffic police station?

2. Do I need to go to accident area specific police station or anywhere can be done?

3. After these many days, will police entertain?

Quote:

Originally Posted by Nicky

(Post 5632473)

Met an accident on 21st September in Bangalore. Front bonnet and bumper got damaged along with rear bumper. I totally forgot to lodge the complaint but took photo of both vehicles involved in accident.

Now surveyor is asking for police complaint acknowledgement.

I have 2 options as per him:

1. Police acknowledgement copy: rear and front both will be covered in insurance. As it goes above 50k amount

2. Self declaration on 100 rupees stamp paper. I will get only front covered which is the major portion.

My vehicle is Hyundai i20. Insurance was taken from dealer only (trident Hyundai).

Insurance provider is New India Assurance.

Question: this is my first time doing this process:

1. I guess I need to go to normal police station rather than traffic police station?

2. Do I need to go to accident area specific police station or anywhere can be done?

3. After these many days, will police entertain?

|

AFAIK, police report is not needed/sought if no life or property is damaged. What is the Trident Hyundai SA suggesting? Generally they have good rapport with the surveyor and try to expedite. The whole point of going with Hyundai Assurance Insurance is to have a seamless experience during claim, specially when no life or property damage occur. I'm surpised that they are making you jump the hoop :unhappy

| All times are GMT +5.5. The time now is 00:47. | |