| | #3931 |

| Senior - BHPian | |

| |  (2)

Thanks (2)

Thanks

|

| |

| | #3932 |

| BHPian | |

| |  (1)

Thanks (1)

Thanks

|

| | #3933 |

| BHPian Join Date: May 2013 Location: shimla

Posts: 280

Thanked: 322 Times

| |

| |

| | #3934 |

| Senior - BHPian | |

| |  (2)

Thanks (2)

Thanks

|

| | #3935 |

| Distinguished - BHPian  Join Date: Sep 2009 Location: Chennai

Posts: 7,201

Thanked: 9,650 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #3936 |

| BHPian Join Date: Aug 2016 Location: Garhwal, Pune

Posts: 190

Thanked: 549 Times

| |

| |

| | #3937 |

| BHPian Join Date: Sep 2013 Location: Canada / B'lore

Posts: 801

Thanked: 2,818 Times

| |

| |

| | #3938 |

| BHPian Join Date: Jun 2008 Location: BLR/EWR

Posts: 778

Thanked: 368 Times

| |

| |

| | #3939 |

| Senior - BHPian Join Date: Jul 2006 Location: bangalore

Posts: 2,387

Thanked: 6,628 Times

| |

| |

| | #3940 |

| BHPian | |

| |  (1)

Thanks (1)

Thanks

|

| | #3941 |

| Senior - BHPian | |

| |

| |

| | #3942 |

| Senior - BHPian | |

| |  (1)

Thanks (1)

Thanks

|

| | #3943 |

| BHPian Join Date: Aug 2016 Location: Garhwal, Pune

Posts: 190

Thanked: 549 Times

| |

| |

| | #3944 |

| BHPian Join Date: Jun 2008 Location: BLR/EWR

Posts: 778

Thanked: 368 Times

| |

| |

| | #3945 |

| BHPian Join Date: Dec 2006 Location: Kolkata

Posts: 896

Thanked: 617 Times

| |

| |

|

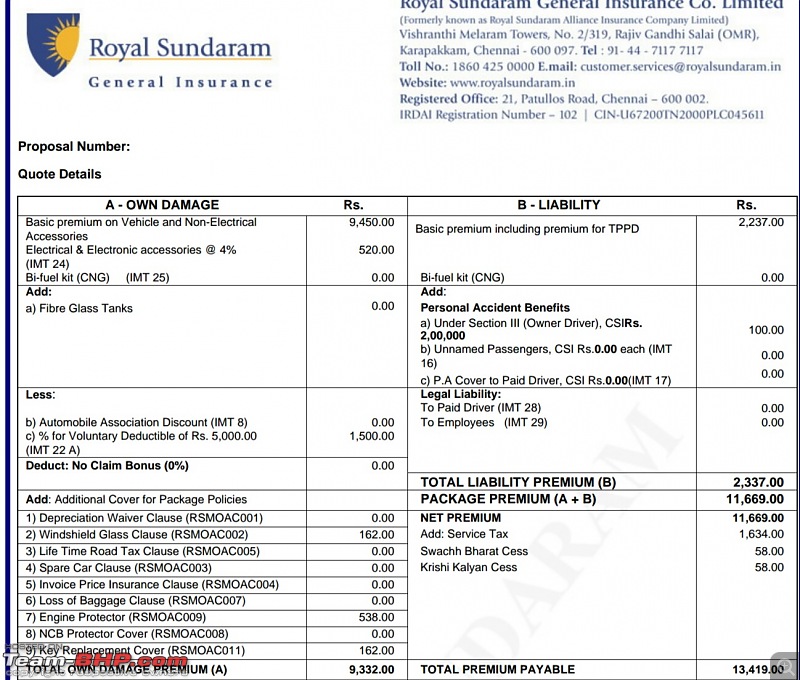

some catch here ?

some catch here ?