Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by carboy

(Post 3137998)

Actually, smart money says "never take a loan on something which depreciates".

If you are worried about medical emergencies, get medical insurance.

Also if break the FD instead of taking a loan of 7.5 lakhs for 3 years at 12%, you are saving a monthly EMI of 25000. The Monthly EMI if put into a Recurring deposit at 9% for 3 years will be worth 10.3 Lakhs at the end of 3 years.

|

Smart Money also says take a loan on something that depreciates rather than put your life savings into it.

Medical emergencies is just an example, and for the record medical insurance will not insure your parents if they're above 65 or nearing it. Anyway there's a host of other things as I mentioned, like using the FD as a mortgage for your child's student loan, a personal loan, a loan to buy land. Emergencies could come in any form any day. Nobody in their right state of mind puts their entire life savings into buying a car. As somebody mentioned in this thread, it may be a good idea if you have 2-3 FDs. But not if you have a single pot of savings.

Keeping the FD of 7.5 lacs for 3 years will yield the same amount (10.3 L). But in return, in this scenario, you get the additional advantage of using your FD wherever you want. And of course the peace of mind that comes with having a huge savings deposit in your bank account.

As I said its a matter of opinion. To me it would seem penny wise pound foolish if I spend my entire life savings on a car and have nothing left in case I need the money on a rainy day which is what the savings are for in the first place. All of it just to save a mere 1500 per month on emi. (The difference between your FD cost and Loan Cost). Not to mention if you have a business, the interest paid on the car loan will be tax deductible. So it will negate the extra 1500 you spend on the car loan.

To most traditional Indians loans may seem like a bigger headache Inspite of many of the advantages they bring along.

Quote:

Originally Posted by Bluebeem

(Post 3138020)

Keeping the FD of 7.5 lacs for 3 years will yield the same amount (10.3 L).

|

No. It won't. It will yield 9.7 lakhs at 9% interest. You always pay higher interest for a loan than what you receive for a FD. So it will never ever yield the same amount unless mathematics is redefined.

Taking a loan against FD is also financially bad.

The math overall against loan vs FD is simple.

You pay x% for a loan.

Bank pays you y% for a FD.

y is always less than x.

So it loan will never come out financially ahead or even the same.

Anyway, this has been argued enough for this iteration. I'll be back for the next iteration later.

Quote:

Originally Posted by carboy

(Post 3138028)

No. It won't. It will yield 9.7 lakhs at 9% interest. You always pay higher interest for a loan than what you receive for a FD. So it will never ever yield the same amount unless mathematics is redefined.

Taking a loan against FD is also financially bad.

The math overall against loan vs FD is simple.

You pay x% for a loan.

Bank pays you y% for a FD.

y is always less than x.

So it loan will never come out financially ahead or even the same.

Anyway, this has been argued enough for this iteration. I'll be back for the next iteration later.

|

Do go check what rate car loans are being offered at. HDFC offers it at 9.5 fixed now.

The difference between your yield from the FD IS 50k.

And you get a break on your auto loan. To save a meager 50k you'd waste your life savings ?

Good luck

Loan against FD makes sense when there is a good differential between the FD loan rate and car loan.

SBI pays you 8.75% for FD for tenure of 1 yr+

You Pay 9.25% for Loan against FD

But if you want car loan, you have to pay 10.45% to SBI

if you take loan against FD, your savings are gone for the period your loan is outstanding.

Will be buying a new car costing 7.5L shortly. To finance this, I have the following options.

a) Go for a car loan from a pvt bank where I have a good relationship. Down payment will be around 2L.

b) Go for a cash purchase.

Returned 3 years back to India and started filing IT only last year so less chances of loan approval from other banks.

Cash purchase will not wipe out savings and pose no issues with cash flow.

If I go for car loan, will deposit the money into an FD. If going for cash purchase, will be taking up an RD and whatever EMI saved will go into this.

What are the pro and cons of these options ?. If going for cash purchase, will there be issues with IT ?. I have PAN number and all transactions will be via cheque.

Quote:

Originally Posted by vivriti

(Post 3245511)

Will be buying a new car costing 7.5L shortly. To finance this, I have the following options.

a) Go for a car loan from a pvt bank where I have a good relationship. Down payment will be around 2L.

b) Go for a cash purchase.

|

If you are a salaried employee and do not have any black money issues, this is a no brainer - go for a cash purchase. On the other hand, if you want give some bank a part of your money (for whatever reasons - they gave you a free loan which helped you study and become what you are today and you want to pay them back, you met your wife while standing in the said bank's line and are hence eternally grateful to the bank etc), then take a loan and put your cash in a FD.

Buying a car or flat without a loan does raise a flag with the IT dept, but that would matter only if you are showing an annual taxable income of 2 Lakhs and buying a 7.5 lakh car. If all your money is white, then you need not bother about it.

Quote:

Originally Posted by vivriti

(Post 3245511)

Will be buying a new car costing 7.5L shortly. To finance this, I have the following options.

a) Go for a car loan from a pvt bank where I have a good relationship. Down payment will be around 2L.

b) Go for a cash purchase.

Returned 3 years back to India and started filing IT only last year so less chances of loan approval from other banks.

Cash purchase will not wipe out savings and pose no issues with cash flow.

If I go for car loan, will deposit the money into an FD. If going for cash purchase, will be taking up an RD and whatever EMI saved will go into this.

What are the pro and cons of these options ?. If going for cash purchase, will there be issues with IT ?. I have PAN number and all transactions will be via cheque.

|

Cash purchase depends on the Cash Balance factor in the Balance Sheet you filed with the Income tax department. In case you have no Business or Profession income and filing ITR returns like ITR 1, 2, 3 , you may not have prepared or filed balance sheet.

Ask your auditor with whom you have filed incometax returns to prepare cash flow statement and balance sheet and ascertain the cash balance you are getting on the year ending march 2013. If your cash balance and balance with bank Sb a/c is not enough to cover the price of the car , logically you cant make a cash pruchase. Your option is to go for finance only.

Other than the IT factor, you also need to think whether you are happy shelling out your cash savings for a depreciating asset.

Quote:

Originally Posted by undead

(Post 3255107)

Cash purchase depends on the Cash Balance factor in the Balance Sheet you filed with the Income tax department. In case you have no Business or Profession income and filing ITR returns like ITR 1, 2, 3 , you may not have prepared or filed balance sheet.

Ask your auditor with whom you have filed incometax returns to prepare cash flow statement and balance sheet and ascertain the cash balance you are getting on the year ending march 2013. If your cash balance and balance with bank Sb a/c is not enough to cover the price of the car , logically you cant make a cash pruchase. Your option is to go for finance only.

Other than the IT factor, you also need to think whether you are happy shelling out your cash savings for a depreciating asset.

|

Quote:

Originally Posted by vivriti

(Post 3245511)

Will be buying a new car costing 7.5L shortly. To finance this, I have the following options.

a) Go for a car loan from a pvt bank where I have a good relationship. Down payment will be around 2L.

b) Go for a cash purchase.

Returned 3 years back to India and started filing IT only last year so less chances of loan approval from other banks.

Cash purchase will not wipe out savings and pose no issues with cash flow.

If I go for car loan, will deposit the money into an FD. If going for cash purchase, will be taking up an RD and whatever EMI saved will go into this.

What are the pro and cons of these options ?. If going for cash purchase, will there be issues with IT ?. I have PAN number and all transactions will be via cheque.

|

+1 to Undead's View.

Buying a car fully with cash will always flag you on the IT Radar i.e if you're a business owner or have recently returned from another country. Even if your books are clean and there's no evasion, if they decide to audit your case, you have to go through the headache of dealing with the IT Dept, bribing low level officials to clear your absolutely clean files (as a private business owner in india its almost impossible not to have made some mistake in accounting). - Not to mention, the interest you pay on the car loan is tax deductible in your business.

However If you're a salaried employee, your company is bound to deduct taxes before they pay you hence you're fully covered. Keep in mind that all our savings must be justifiable by your income. In this case it doesn't matter whether you pay cash or take a loan.

Besides all of the above factors IMHO, There's no bigger asset than hard cash and i would spend it very wisely. As a pvt business owner, i always go for a comfortable 2-3 year loan, just to stay off the radar. Even if that means ending up paying few pennies extra as interest.

Agree with your views carboy, undead and bluebeem. We have decided to buy the car using a loan instead of cash. Am a former NRI and building a company. Therefore I haven't much salary or business income to show except some retainership and rentals.

We have also decided to make some investments and keep aside funds for kids education. Therefore it doesn't make sense to put money into a car !.

:thumbs up

Hello all,

Please help me understand this.

Lets say I want to buy a car that costs 5 Lacs and I have sufficient balance in my bank account.

Now I have the following options:

1. I pay the entire amount upfront and get the car Ė nothing gained nothing lost.

2. I get an FD made with some nationalized bank and take a loan against FD at 1% higher rate of interest annually. So in this case Iím at a loss of 1% annually.

3. I get an FD made of 5 lacs with some nationalized bank and at the end of 3 years my money would be 677791-(at an interest rate of 8.5% p.a.) and get the car financed by some bank, lets say ICICI. The latest EMI that is being offered as of today is around 3250 per lac. So my total payout at the end of 3 years would be 3250(emi) x 5lacs x 36(months) = 585000. Total savings 677791 Ė 585000 = 92791.

So isnít option 3 the best here.

I would have 5 lacs stored as FD that can be used at a time of emergency and I will also be able to claim tax deductions on interest paid on car finance.

Please let me know if Iím missing on something.

Quote:

Originally Posted by NamoJain

(Post 3434734)

Hello all,

Please help me understand this.

Lets say I want to buy a car that costs 5 Lacs and I have sufficient balance in my bank account.

Now I have the following options:

1. I pay the entire amount upfront and get the car – nothing gained nothing lost.

2. I get an FD made with some nationalized bank and take a loan against FD at 1% higher rate of interest annually. So in this case I’m at a loss of 1% annually.

3. I get an FD made of 5 lacs with some nationalized bank and at the end of 3 years my money would be 677791-(at an interest rate of 8.5% p.a.) and get the car financed by some bank, lets say ICICI. The latest EMI that is being offered as of today is around 3250 per lac. So my total payout at the end of 3 years would be 3250(emi) x 5lacs x 36(months) = 585000. Total savings 677791 – 585000 = 92791.

So isn’t option 3 the best here.

I would have 5 lacs stored as FD that can be used at a time of emergency and I will also be able to claim tax deductions on interest paid on car finance.

Please let me know if I’m missing on something.

|

1. Not recommended. Dont lose your savings on a depreciating asset.

2. Recommeded , not much benefit out of it.

3. Get the Emi chart. 8.5% on diminishing? I am not sure. Usually they charge on flat rate . Compare the EMI with a nationalised bank. I think the effective rate would be around 10.5% to 11% . Private banks charge higher. I suggest a nationalised bank like IOB , SBI etc.

My advice is keep the FD in bank. Get a EMI for 5 yrs on diminishing balance. Interest on car loan can be claimed as an expenditure .

Wouldn't it be a better idea to invest in (for example) corporate bonds at 13-14 % and get a loan using them as collateral?

I'm thinking of hdfc corporate bonds instead of an fd in hdfcbank.

Or am I missing something?

Quote:

Originally Posted by NamoJain

(Post 3434734)

Hello all,

Please help me understand this.

.

.

.

Please let me know if Iím missing on something.

|

1. Unless there is some more contextual information (like expected cash flow in near future) this is the best option financially speaking.

2. If you intend to service the loan for entire tenure of FD then this is a no go because you will pay the bank an extra 1% on your own money. This option might be worthwhile if you expect cash flow in near future and would prefer to pre-pay the auto loan within a short tenure and continue your FD. A typical auto loan will charge you for pre-payment whereas pre-paying loan on your own FD wont.

3. The problem with your math here is you are not considering the cash flow problem. You may keep 5 lakhs in a bank FD but remember that your EMI is a monthly payment. Lets say your FD earns 9% and EMI is 3250/lakh on a loan of 5 lakhs. At the end of first month your FD's value will be 5 lakhs * (1 + 9%/12) = 5,03,750. Now your EMI will be 3250 * 5 = 16,250. If you pay the EMI payment from your FD's value, your FD amount will become 4,87,500. Since your FD principal has reduced from 5 lakhs to 4.875 lakhs, interest component that the bank will pay next month will be lower too. But EMI will remain the same. If you do the math, you will find that at a point in payment schedule your FD value will become 0 but you will have outstanding EMI. This is obvious because ROI of auto loan > ROI on bank FD. I would strongly advise staying away from this idea unless you want to make the bank rich.

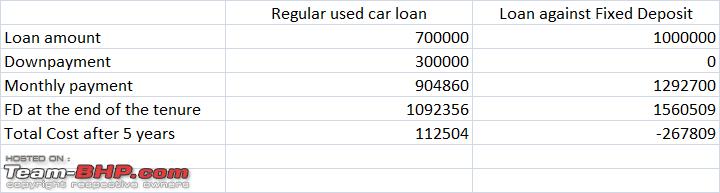

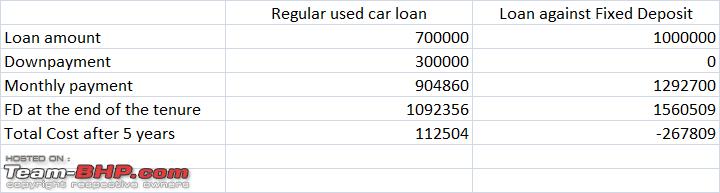

Namojain brought up an interesting calculation (point #3 in his post).

Assumptions for the below excel sheet:

- I have 10 lakhs liquid on hand

- On an FD, I get 9%

- Private banks charge +2% on the FD rate they give you (though +1% isn't too hard to find...any ways, worst case scenario).

Take a look at the calculation below. Am I missing on something here? For the columns on the LHS, I've put 3 lakhs down, taken a loan of 7 and the 7 lakhs (cash that I had on hand) into an FD.

On the RHS, I've created an FD of the entire 10 lakhs, and taken a loan of 10 lakhs at +2%. How is it that the RHS option is working out significantly cheaper? Am I missing out on something or is Namojain spot on? Is the reason behind this gain 'quarterly compounding' as practised by banks whereby the interest starts earning interest?

As a businessman, I can write off the interest expenses (thus getting 30% tax benefits). Sure, the FD gains are also taxable, but there are business cycles where you can reduce the taxable amount on the FD's profits. Haven't included this in the sheet, it is yet another advantage.

Also attaching the excel sheet in case someone wants to play with it.

I have an Overdraft facility against the Fixed Deposits of bank . Its almost always charged at 1 % over the FD rates with Nationalised banks . The Fds can be in any of the family members names as long as they are joint holders on your bank account.

I have almost purchased all cars in the past 5 years using this bank overdraft .Trust me with the non prepayment penalty you will almost always close the loan or reduce the overdraft usage much much quicker than what you will do for a car loan . And this is a good thing .

If i were to pay a car loan and hypothetically would be paying say an EMI of 20K a month , my mind would be set and get comfortable with this outflow every month . As against this if there is a bank overdraft which has say a Negative 5 lac balance i will try to close this as soon as i can . Whatever additional saving over and above the regulars will always go to pay the same.

Interest paid is deductible against Interest earned . So tax benefit is also there.

I think everyone should have an Overdraft against FD facility . Its a good safety net even for unscheduled expenses if they arise . A decade ago i would use Overdraft against Shares ( LAS ) facility , however nowadays the interest on that kinda loan is close to 15 % Per annum, and is an expensive loan .

Lets not even get into the thing that Car is an Asset . It is not , Assets do not depreciate . Its an expenditure . The Stingy Gujju in me does not permit me to take loan for expenditure.

| All times are GMT +5.5. The time now is 05:01. | |