My Analysis

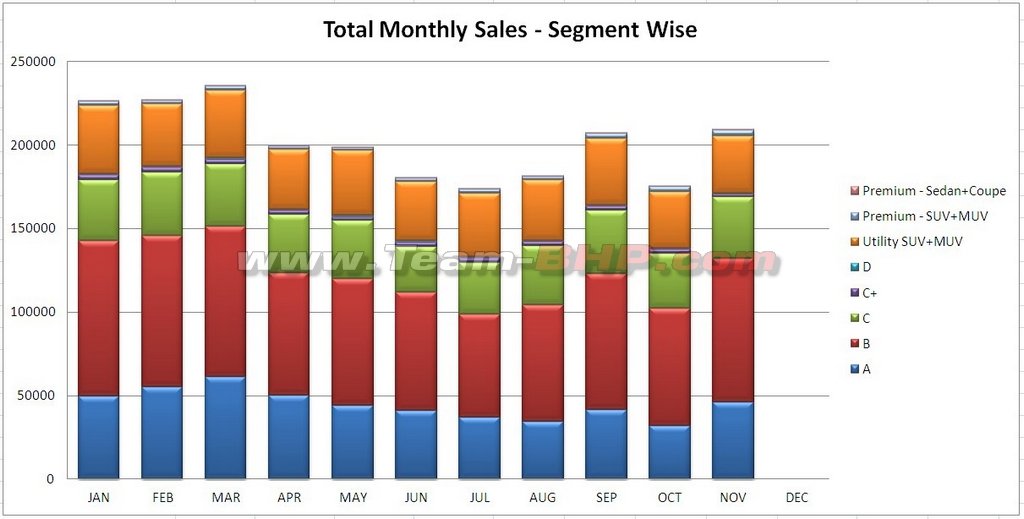

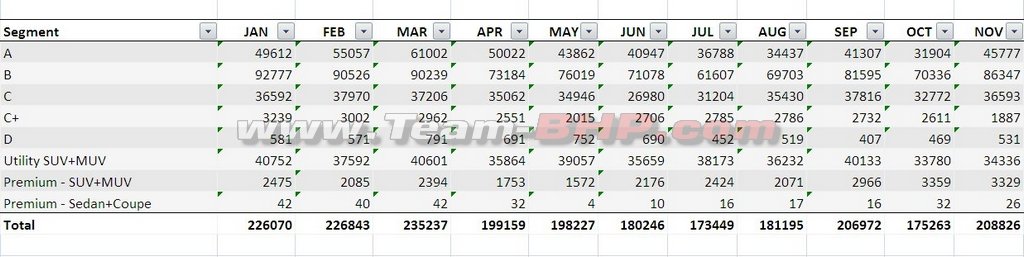

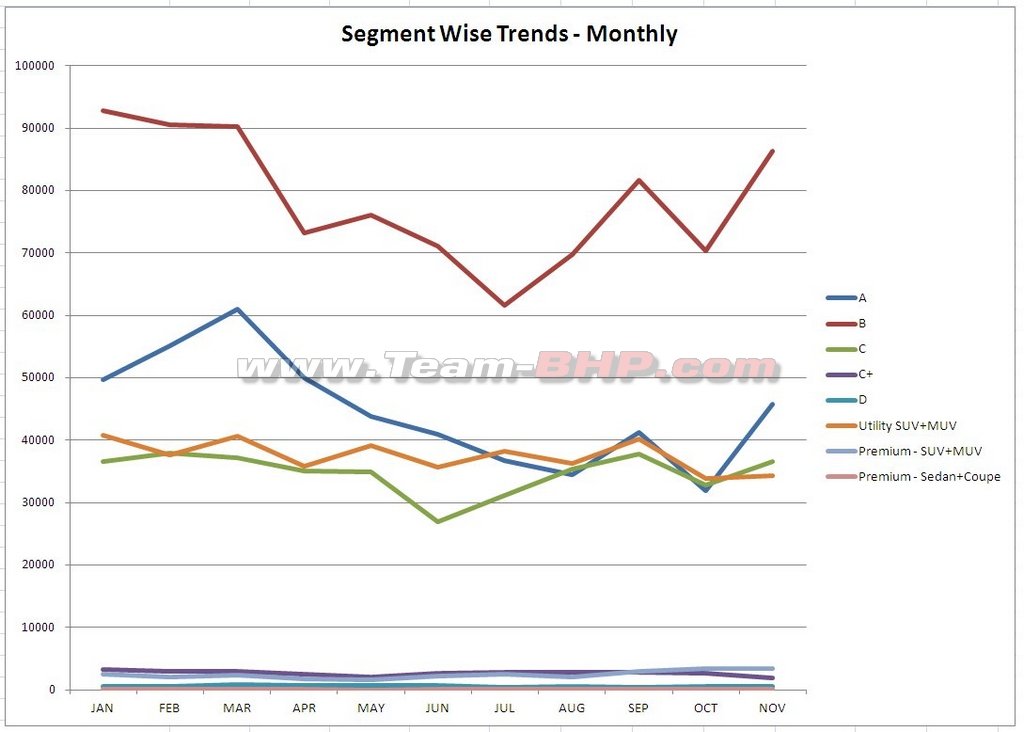

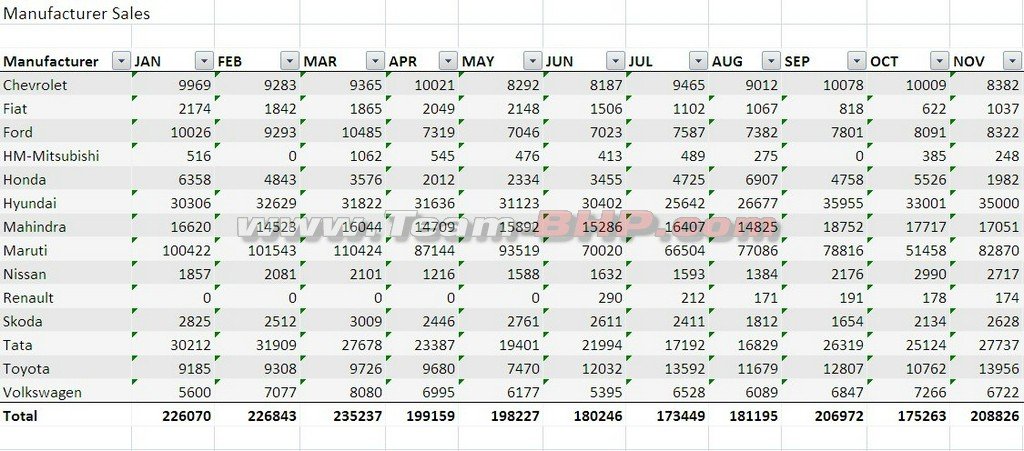

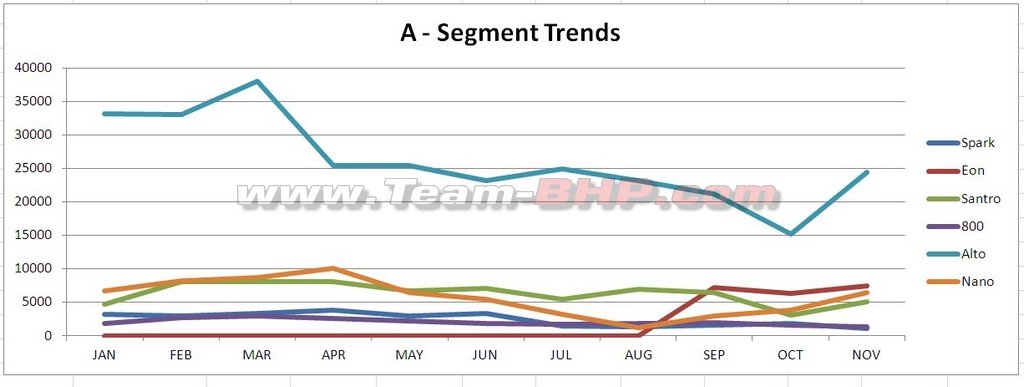

• There is indeed light at the end of the tunnel, at least for some car manufacturers in India. November 2011 has been the best month since March 2011 for the market overall. Those partying hard this weekend are Hyundai (November was the 2nd best month of the year), Mahindra, Tata & Toyota. Maruti is also pushing aggressively in recovery mode, with month-on-month sales up by nearly 30,000 cars. In fact, of the 33,000 units that the market gained month-on-month, 90% of that went Maruti’s way. Overall, the market has grown year-on-year, albeit in the single digits. Reasons are the same: expensive petrol, high interest rates and now, costlier cars (the weak rupee has shot up input costs). If the size of the pie doesn't grow much, and everyone's real hungry, I can assure you that it's going to be the survival of the fittest. Who wins? YOU, the customer. Better prices & better products are for real, while overpriced cars can take a hike. God bless competition

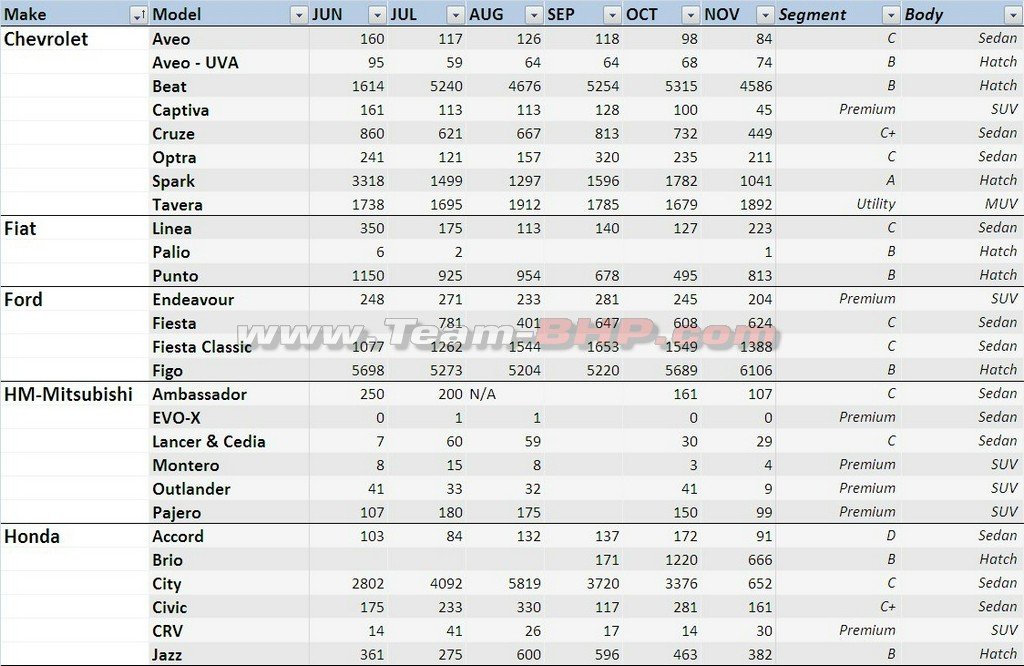

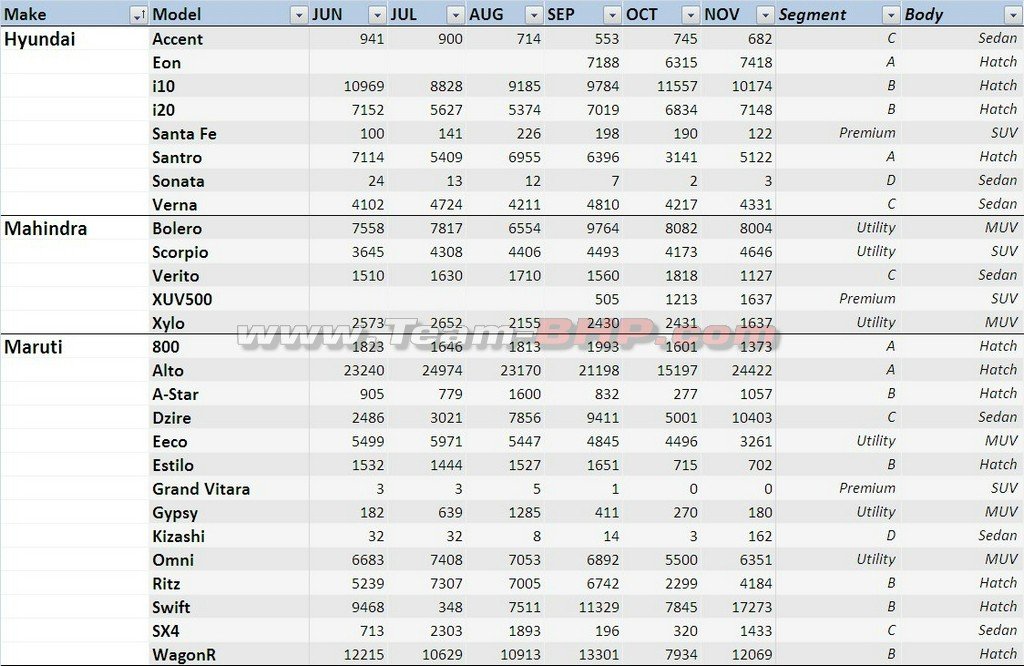

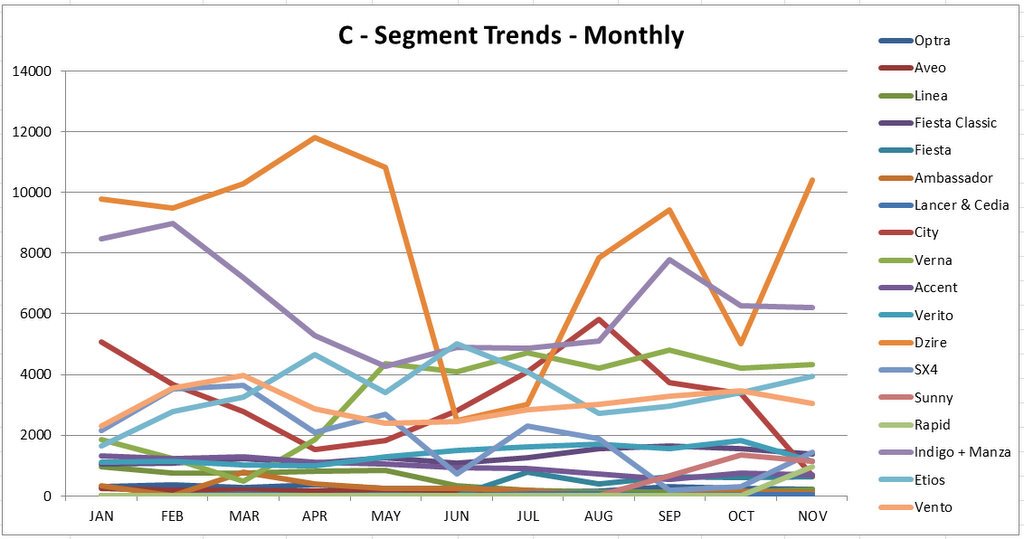

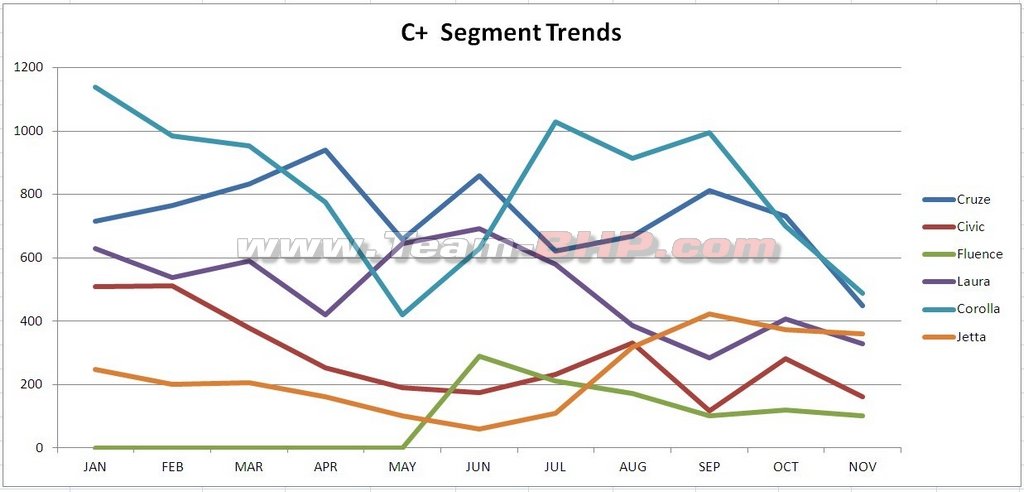

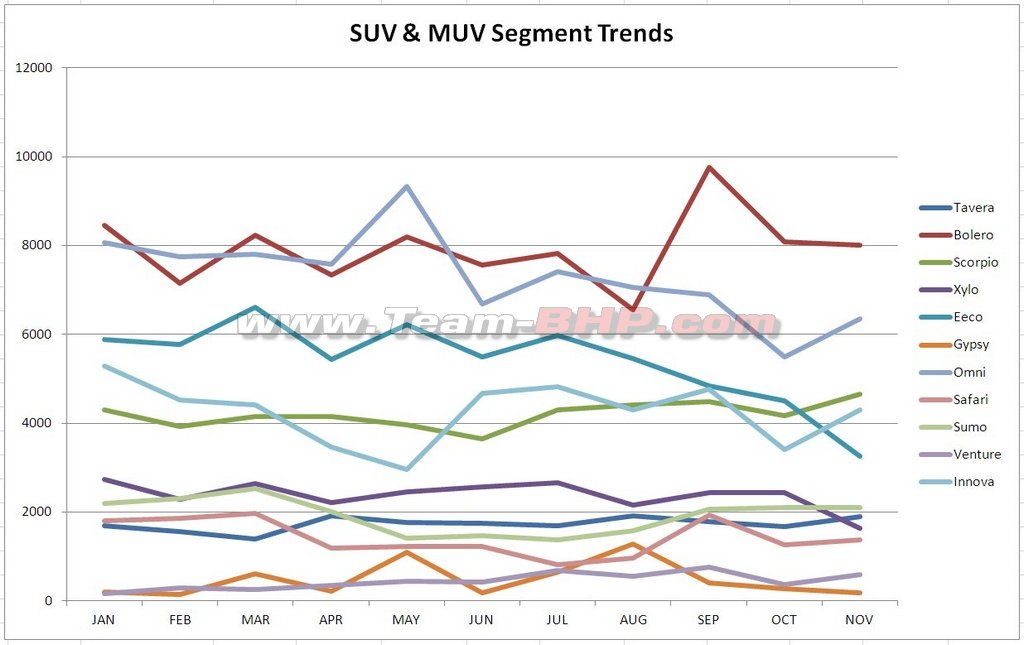

• Interestingly, November was a rare month where sales of C segment sedans overtook that of MUVs & SUVs. No doubt, the plethora of launches & options has made the C sedan segment an exciting category to watch. In fact, if the Honda City had another 4000 unit month, C segment volumes would’ve been within an arm’s length of the entry-level A segment. Skoda was the most recent entrant with the Rapid, a car that’s identical to the Vento, yet priced noticeably lower. Clearly, buyers are looking at value-for-money purchases in the C segment, rather than spending 50% more money in the C+ segment. Just look at how the C+ segment (Corolla, Cruze, Civic etc.) has shrunk down to a mere 1,887 cars….it’s worst performance this year. A sedan like the Hyundai Verna (class-topper in its segment by a significant margin) offer all the tech, equipment, power & style that buyers were looking for in the C+ segment. Why spend more?

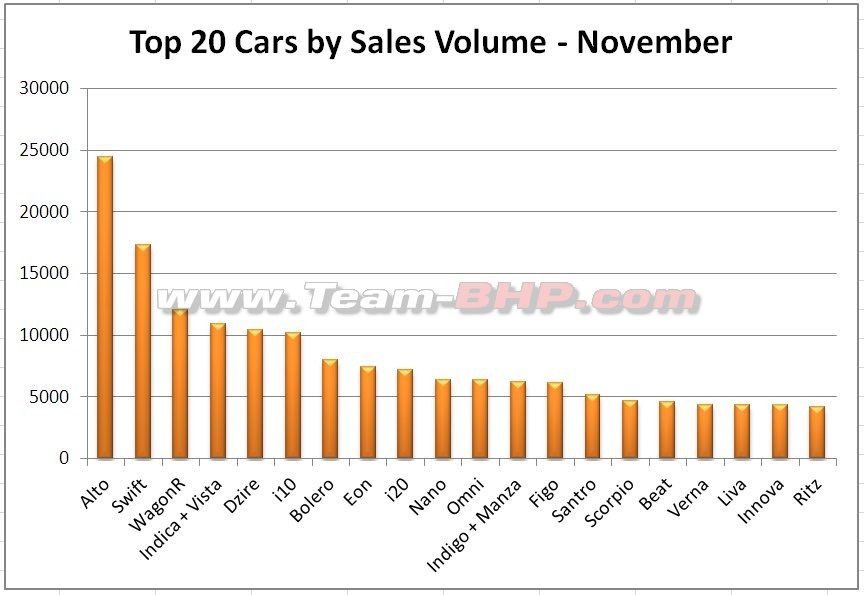

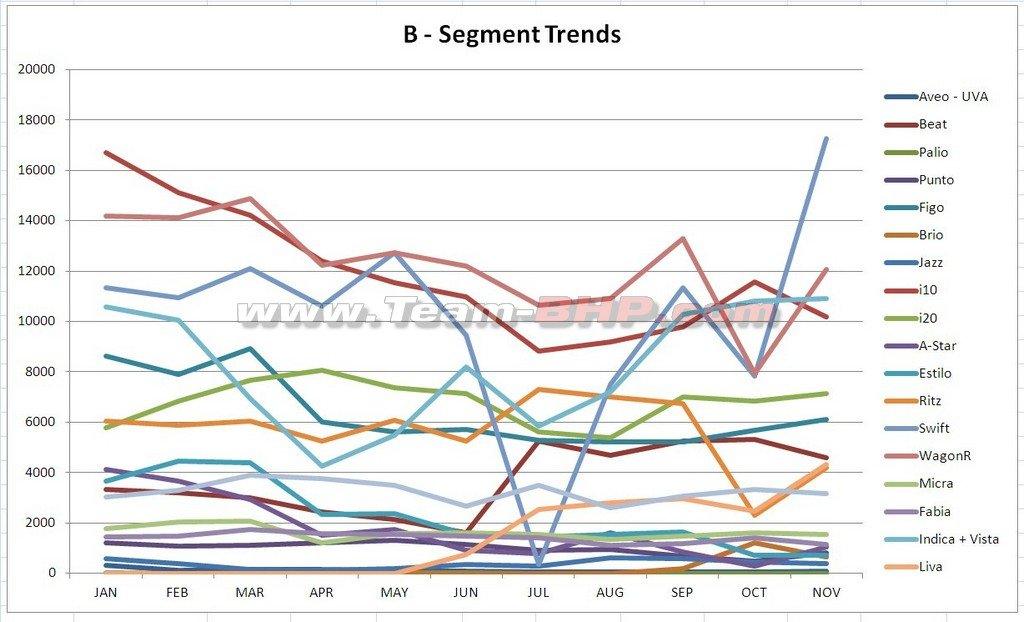

• There’s a fair share of hits & misses for Maruti in November. If this were a Formula 1 race, you would see only Maruti drivers on the entire podium. The No.1, No.2 and No.3 positions are all occupied by the popular Suzukis. The Swift, in particular, has had its best month in history with over 17,000 shipments. The Alto & WagonR also climb back to their usual 25K & 12K levels. The Dzire clocks a stellar month with over 10,000 cars reaching customers. Conversely, it’s a

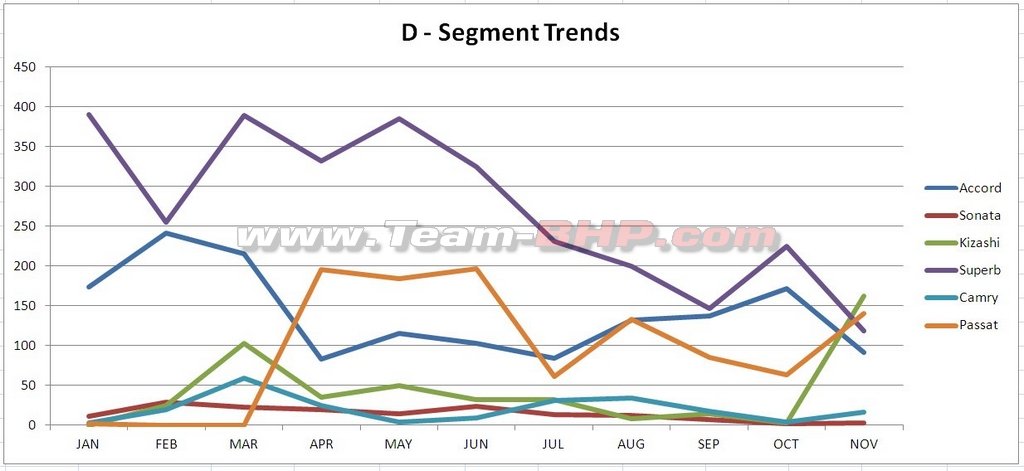

desert dry spell for the Ritz (production diverted to the Swift), Eeco, A-Star & Estilo. The Omni & SX4 are recovering, while Kizashi imports shoot up like nobody’s business. Get this, the Kizashi tops the 20 lakh sedan segment. Is it sustainable? Nope. Lastly, the less said about the Grand Vitara, the better.

• Hyundai had an exceptionally good month with exactly 35,000 factory -> dealer shipments. This, in a generally damp period for the industry. The bump up was majorly driven by the Eon that closed November at the ~7.5K mark. That said, the Eon hardly matches on expectations (Hyundai's own projection was 12K a month). The i10, i20 and Verna all delivered strong performances, the latter two topping their respective categories. The Santro, on the other hand, is slowly getting overshadowed by its more modern sibling.

• The Indicas (old & the new Vista) have their 3rd straight month with over 10,000 units shipped, while the Indigo + Manza also do respectively well at the 6,000 level. You will remember that November 2010 was a devastating month for the Nano, with a mere 500 copies leaving factory premises. The 2012 Nano (6,400 shipments) has a lot riding on it, what with a host of improvements being incorporated (Team-BHP review coming up soon). The Aria has completely tanked to an embarrassing mid-100 level…cheaper 4x2 variant notwithstanding. Meanwhile, the Safari trundles along at its monthly average.

• The Bolero & Scorpio remain Mahindra’s star performers, together bringing in nearly 13,000 high-profit sales. Remember, the margins on UVs are t-h-i-c-k. The XUV500 is sold out for a couple of months (what a well-priced product can do, even if it costs over a million bucks!!!) and is slowly chewing through the waiting list. It matches Xylo shipments, down to the last digit. The Verito sinks in November, recording its worst month in 7. Perhaps, Mahindra’s attention was only on the XUV500’s launch. But with a slew of modern cars around it, will the Verito be able to bounce back? Only with the cheaper sub-4 meter version, I reckon.

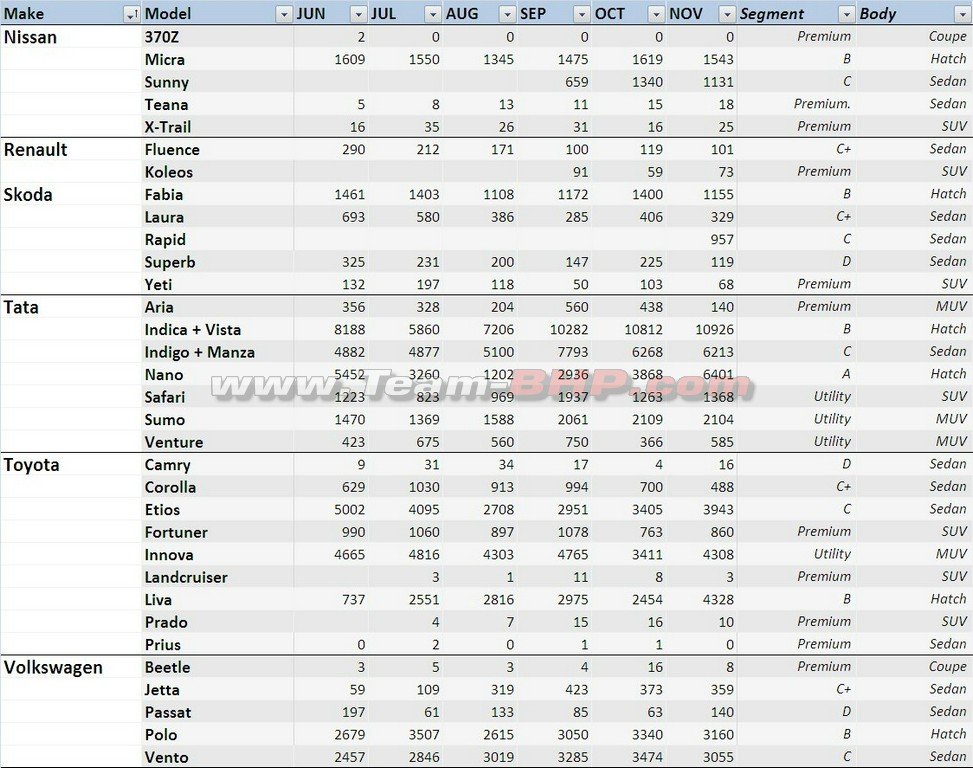

• Toyota has its best month of the year; perhaps the party’s going to run late into the night at a Bidadi club! After a long, long time, another Toyota overtakes the Innova as the brand’s best seller. Yup, it’s the Liva with over 4,300 cars sold. The Etios has a good month too, with 4,000 units moved. Thanks in no small part to the fresh diesels under the hood. Status quo for the Innova & Fortuner, though the Corolla appears to be hit by supply issues from Thailand, recording a forgettable month.

• Save for the Beat’s excellent performance (riding high on the 3-cylinder diesel), there’s not much happening over at Chevrolet. Things are looking gloomy for the Spark (5th month in a row) and the Cruze hasn’t lit up the tarmac either. Sure, there’s the Tavera which did ~1,800 units as usual. But there are too many duds in the portfolio, including the Aveo, UVA and Optra. The Captiva is also fast losing favor with the market. Chevrolet needs to get its act together and quick.

• Ford has its best month since March, the spike driven completely by the Figo. The well-priced old Fiesta continues to outperform the over-priced new Fiesta. I can’t think of too many other cars where the older generation consistently outsells the newer gen. Bite the bullet, Ford! Reposition the 2011 Fiesta before it’s too late.

• Volkswagen has a reasonably good month; the Polo & Vento put in their usual 3,000 tally. But what VW must feel good about is that, November was the first month that the Passat outsold the Superb. Even the Jetta outsold the Laura BTW. Watch this space for the Rapid versus Vento fight. Will VW *allow* the Rapid to outsell its identical sibling?

• Nissan isn’t able to capitalize on the Sunny’s super pricing. Anyone seen the stupid C-A-A-A-R ad? The spacious sedan deserved a better marketing strategy, as well as a DIESEL engine. Hopefully, the diesel Sunny is launched soon (@ the Auto Expo). Business as usual for the Micra @ 1,500.

• Skoda’s well-priced Rapid makes its debut. My prediction : The Rapid will go on to become the best selling Skoda, and give the brand previously unseen volumes. Volumes that the over-priced Fabia could never deliver upon. I’m extremely surprised by the Superb’s fall at 119 units; this has to be an issue with the logistics without doubt. The Laura has a rather mediocre month, while the Yeti continues with its flop-show.

• Tough times just don’t seem to end for Honda. First, it was the Japanese tragedy in the first half of the year that hit supplies. Then, the petrol-only manufacturer saw petrol prices rise stratospherically to over the Rs. 70 mark. Now, the Thailand floods have severely impacted part supplies. Honda has a tragic month with less than 2,000 cars sold. This, despite just launching a superbly priced, amazing hatchback (the Brio). Things will get better; it’s only a matter of time before the factory is working at full capacity again.

• Fiat’s strategy needs a major overhaul if its cars are to sell. Only problem is, no one knows what the real problem is. No, it’s not the after-sales, else Tata wouldn’t manage to do well with the exact same network. The Punto & Linea have yet another sub-par month. Together, and with all of 3 engine options

each, the two only just cross the 1,000 level.

• Got a HM-Mitsubishi showroom close by? Go, take a picture. It’s soon going to be history. Except for the Pajero, the Mitsubishis put in tear-inducing performances. The Ambassador, which used to bring in some cash to pay the bills, is also tanking. Babus apparently prefer modern steeds to take them to work (whenever that is

).

• The over-priced Fluence and the over-priced Koleos fill up the rear of the grid. Things will only look up for Renault once the (IMHO) great looking Renault Pulse is launched. Hopefully, that car is priced well & marks a positive change in the brand’s strategy.

(24)

Thanks

(24)

Thanks

(23)

Thanks

(23)

Thanks

(26)

Thanks

(26)

Thanks

(36)

Thanks

(36)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(5)

Thanks

(5)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

I thought both MUL (no Ads) and people have forgotten this car. I think massive discount or some bulk order is behind these numbers.

I thought both MUL (no Ads) and people have forgotten this car. I think massive discount or some bulk order is behind these numbers.