| Re: December 2011 : Indian Car Sales & Analysis

December is usually known as the “stock clearance” month. No dealer (or manufacturer) wants to hold on to 2011-build models entering into the New Year, and they do everything they can to liquidate inventory. Then, there are 3rd quarter targets to be met by the marketing & sales functions. Many customers wait for January-built cars as that will fetch them better resale down the road. These are the main reasons why the market usually sees heavy discounting at the end of the year. Fact is, even some of the newly launched cars (e.g. Eon) have discount offers. Another stimulus was the announcement of an impending price hike in Jan 2012 by nearly all manufacturers.

The final month of 2011 saw its fair share of performers & laggards. Details:

Maruti sales were down nearly 15%! As was predicted, it’s not going to be easy for Maruti to regain the market share it lost during the quarter with troublesome labour issues. It’s status quo for the Alto that maintains its monthly average (of the current financial year) and remains India’s best selling car. Other star performers from the Maruti stable are the Swift (still chewing through the 100,000 booking backlog), Dzire (November & December have been exceptionally good) and the WagonR. The Ritz can do better, but it’s production has been diverted in favour of the Swift. On the flip side, Maruti’s list of duds is fast expanding. The back benchers list includes the A-Star (a relatively modern car), Estilo, Kizashi & Grand Vitara. Even the SX4 is fast losing favour in the C segment, despite getting a diesel variant last year. The Eeco & Omni continue to suffer from the lack of a diesel engine option; remember, a good number of buyers for these two UVs are from the commercial segment.

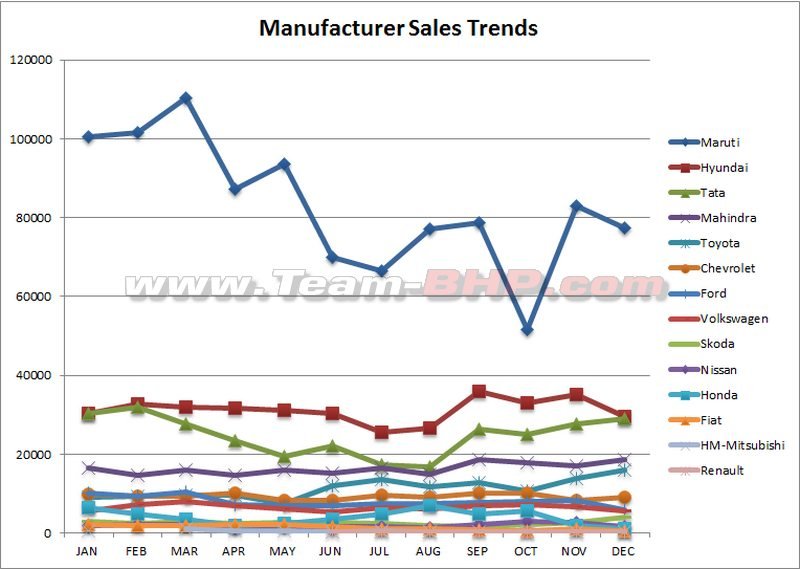

Hyundai’s cumulative sales are up 13% year on year (29,516 over 26,168 for December 2010), but all of its models have dipped month-on-month nevertheless. While sales have improved YOY, keep in mind that the Eon was added to the portfolio only this year. The i10 remains a strong performer at 8,000 units, yet December marked the lowest point for this hatchback (monthly average is 11,500 cars). It’s never quite gone back to the pre-petrol price hike days. The Verna continues its dominating run and closes 2011 as the best selling sedan from the upper-C segment. The Eon has a reasonable month, albeit not outstanding if you consider its positioning as an Alto competitor. It is important to note that Tata is breathing down Hyundai’s neck (refer to the manufacturer trends chart) in cumulative monthly sales.

The Indica & Vista sisters are on a roll, averaging 10,000+ units for the last 4 months. The Indigo + Manza also have a respectable innings with nearly 7,000 sedan despatches. December was the best month for the Sumo in 2011 and way above its monthly average of 1,900 units. Note that the Sumo tops the monthly movers chart (among those selling over 500 units a month). Nano is still performing below expectation if you consider the price bracket it has a presence in. Even a 1.6 lakh discount does nothing for the Aria’s fortunes. The pressure must be on at Tata’s headquarters to price the new Safari / Merlin properly.

The Bolero continues with its magic over the UV segment, celebrating the new year in style. An astounding 9,000+ copies shipped! The Scorpio also has a good month with a score of 4,387, while the XUV500 is slowly working its way through the order backlog with 2,253 factory despatches. On the other hand, the Xylo & Verito continue their downward spiral. If you ask me, the Xylo is a better, more spacious & modern UV compared to the Scorpio. But well, who can argue with looks & image at the end of the day (more so with the Xylo's ugly face). The Xylo also appears to be suffering from step-motherly treatment at the moment. Extremely poor performance by what was touted as a game-changing UV at one point in time.

Toyota had an exceptionally good month. This time, it’s the Etios & the Innova both crossing the 5,000 point. Toyota must be pleased with a passenger car overtaking its UV for the second month in a row; remember, the Japanese giant’s best selling Indian cars have so far been utility vehicles (Innova currently, and the Qualis earlier). The Liva also brings the volumes home, helping Toyota record its best-ever Indian month (cumulative sales = 15,948 for December). The Corolla has an inexplicably fall which I can only guesstimate to part supply issues from Thailand. Toyota’s Fortuner is seeing a 10 - 12% correction on its monthly averages; XUV500 effect?

To understand what a well-priced diesel can do to your portfolio, just look at the Beat. It’s sales have more than doubled since the 3-cylinder oil burner was introduced, and it’s consistently clocking ~5,000 units a month. The Spark, on the other hand, has become a marginal player since the Beat diesel’s launch; surprisingly small numbers for a well-priced car that’s pretty darn competitive in the entry segment. The dip started since July, about the time that petrol shot to over 70 bucks a pop. The Cruze has a mediocre month in terms of outright sales, the only saving grace is that everyone else from the segment did too (Altis, Laura, Jetta, Civic). Heavy discounting has helped the Tavera sell above its monthly average. Chevy badly needs the facelifted Captiva (launch is just around the corner), and at a more value-for-money price. Why the brand even bothers with duds like the Optra, Aveo & UVA is beyond me.

The VFM Figo continues to be Ford’s star performer, but there’s little else to cheer about in Chennai. The 2011 Fiesta’s disastrous pricing has led to, well, disastrous sales. Surprisingly, the previous generation Fiesta Classic’s sales have fallen 30% month on month to <1,000 cars. Stock adjustment at the dealer’s end, I suppose. December was the lowest performing month for the Endeavour as well. Reason? Two words = Mahindra XUV500. Don’t want to sound like a broken record here, but Ford’s going to need to reposition the new Fiesta sooner rather than later. Also, it’s got quite the opportunity with the upcoming EcoSport SUV if it manages to price it well.

An ordinary month for Volkswagen with nothing to write home about. The all-rounded Vento can surely do better than the 2,400 tally. In fact, it should be outselling the Polo, compared to which it is a far superior product (primarily down to that awesome 1.6L diesel). The Passat isn’t able to keep pace with the Skoda Superb’s awesome run. I’m surprised with a dip in the Jetta’s sales though. It’s one heck of a car, and quite a looker too. The 40% month-on-month dip is surprising.

Good month for Skoda, with most of the portfolio ending the year on a positive note. The Superb has a special month, nearly touching 500 units, and the year’s best performance. It even outsold all its competitors combined. Keep in mind though that November saw supply issues (a mere 119 units), and the November + December numbers combined are about on par with the luxo-barge’s average for the year. The Yeti records its best month of 2011 with 326 shipments which is good for the funny-looking SUV. Cheaper 4x2 variant is undoubtedly at work here. The Rapid is still to gain traction at the production level, and I have no doubt that it will be Skoda’s best selling product (more than the sub-par Fabia hatchback for sure).

Little to cheer about at Nissan, despite the launch of two extremely relevant products in recent time. The Sunny falls to a completely unexpected 500 cars, while the Micra has a poor 1,000 unit run (B2 segment has also fallen BTW). The Sunny is extremely well-priced, has class-leading legroom and now a super diesel engine; Nissan’s marketing function will need to get more aggressive. Many find the Sunny diesel to be over-priced. I think it’s a fantastic deal if you consider that workhorse Logan diesel engine, space & the overall quality. I’m not a fan of the sluggish petrol Sunny though.

Honda must be glad 2011 is behind it. The year brought one disaster after another for the Japanese marque, the most recent being the Thailand floods. Take the case of the Brio; it’s well-priced, extremely competent, has ready customers but absolutely no supplies. It’s a similar tune for the Honda City & Jazz as well. Cumulative sales for December were a mere 1,000 odd units, the lowest in a long, long time. Honda must have its fingers crossed as the midnight bell welcomed 2012. Deliveries of the facelift City will start soon.

Tragic month for Fiat with the Punto falling to a mere 269 cars. No sunlight for its sedan sibling, the Linea, either. Fiat probably has the highest engines + variants / sales ratio in the country. The Italians have launched facelifts today, but I’m afraid they will do little other than provide a momentary boost (unless drastic price cuts follow). Fiat is also unveiling its exclusive brand Cafe in Delhi soon.

The 6 decade old Ambassador is the sole model to somehow report 3-digits sales...something that the more modern Mitsubishis couldn’t quite manage. Still, I think the Pajero did reasonably well if you take into account the vintage of this SUV, and HM-Mitsubishi’s ever-shrinking dealer network. On the other hand, the petrol-only Outlander completely tanks. Don’t forget that this SUV used to do a 100 odd units in some months. The only real good news for me is that 4 new EVO’s have been added to Indian roads.

The over-priced Renaults fail to make a mark on the market. The brand will suffer from zero recall until it brings more relevant products to the Indian space. Lets see how the good-looking Pulse (and a xerox of the Micra) is positioned though.

Last edited by GTO : 3rd January 2012 at 16:49.

|

(15)

Thanks

(15)

Thanks

(29)

Thanks

(29)

Thanks

(20)

Thanks

(20)

Thanks

(9)

Thanks

(9)

Thanks

(21)

Thanks

(21)

Thanks

(1)

Thanks

(1)

Thanks

(4)

Thanks

(4)

Thanks

. As usual, laggards list lead by Mitsubishi & FIAT. Depite having good cars, when will they learn the tricks of the trade? Is it that difficult? For some, it seems so, else there shouldn't be reason for not selling such good products. For FIAT, all action seems to be getting product/ pricing right with least care in the world for actual buyer. 'Forget once sold' seems to be their mantra

. As usual, laggards list lead by Mitsubishi & FIAT. Depite having good cars, when will they learn the tricks of the trade? Is it that difficult? For some, it seems so, else there shouldn't be reason for not selling such good products. For FIAT, all action seems to be getting product/ pricing right with least care in the world for actual buyer. 'Forget once sold' seems to be their mantra  . About HM-Mitsibishi, less said, the better.

. About HM-Mitsibishi, less said, the better.