Team-BHP

(

https://www.team-bhp.com/forum/)

clap: I am glad that one politician has bitten the bullet since i am sure this be done by other states just before election to get attention. After all if one monkey throws his cap down, i am sure the other monkeys will follow soon.

Coming from a state where our voters have got TV, Fan & Mixie in the last 2 elections as goodies (of course that we dont have electricity to use them is another matter), i am hoping the VAT on petrol is removed to garner some votes soon.

being a petrol head, i am praying to demolish the Petrol Vs Diesel divide which is ever increasing

All of you are missing one point, this is not a news, just a calculation done by a media house, similar to if Uncle was a lady, we call him auntylol:.

Yes, Goa Govt. has done it, but they had this in their election manifasto. But Goa is a small state and does not require the funds to run the state, like TN/KA/MH needs. If they reduce the vat on petrol, some other tax will go up some place. Still its at a calculation stage, and we have not seen anything comming out of Govt's mouth, other than reducing Diesel price by some 45 paise from 1st April in KA(yes, its true, its there in State budget). So wait and watch.

Although it makes me immensely happy to know that such a thing has been speculated by someone, I'm not sure if removing VAT off petrol is a good idea.

The Karnataka Govt. needs money for various spendings such as temple donations, land for CM's families etc. and some peanuts for development; if they don't earn it off VAT on petrol (which itself should be unimaginably humongous), they'll increase tax somewhere else.

A slight reduction would be wonderful though :)

All talking about Petrol VAT. Just DREAM if VAT is removed on Diesel :D

Quote:

Originally Posted by asdon

(Post 2731252)

But Goa is a small state and does not require the funds to run the state, like TN/KA/MH needs.

|

Smaller states may need lesser funds, but one cannot say that Goa

does not require the funds.

Smaller states generate lesser funds and their expenditure is proportionately smaller than larger states. But all states, large or small, are always reluctant to let go of easy income, such as VAT on petrol prices.

You may have missed the importance of Goa's decision to reduce petrol prices. Consider the following:

* Goa has done what (perhaps) no other state government has done before: Virtually abolish VAT on petrol.

* Goa need not have done so, specially since all other states also have a high VAT on petrol.

* At a time when oil companies are itching to raise petrol prices every other day, Goa has effectively displaced this urge by virtually removing VAT prices.

* Goa may have lost considerable (small in proportion to larger states) revenue in this process and will, hopefully, find some other way to mobilise funds, but it has driven home the point that reducing petrol prices IS possible.

What Goa has shown is that State governments CAN reduce the price of petrol, if they have the WILL to do so and the WAY to generate alternate revenue to make up for the losses.

My eyes lit up when I saw the thread title. I had to recheck to make sure I was not imagining things. Reduction in petrol price is definitely welcome (more so since we have 4 petrol cars in the family) .

But as many said its wishful thinking in Karnataka at least. What Goa has done is commendable. But Goa is a small state and tourism is the major industry there. So the logic of the Goa Govt. to reduce fuel prices is justifiable. The same logic will not hold good in Karnataka whose capital is already choking with four wheeler traffic. The car buying class don't need any incentive to buy cars here. Notwithstanding the high road tax, a staggering amount of cars are being registered everyday in Bangalore.

This is very unlikely to happen in KA. As per

Petrol at Rs58/l if Karnataka follows Goa - Bangalore - DNA :

Chief minister DV Sadananda Gowda, who presented his maiden budget on March 21, has already ruled out any cut in tax on petrol as he is faced with the task of mobilising additional resources to ensure the implementation of his Rs1 lakh crore budget

Quote:

Originally Posted by asdon

(Post 2731252)

But Goa is a small state and does not require the funds to run the state, like TN/KA/MH needs. If they reduce the vat on petrol, some other tax will go up some place.

|

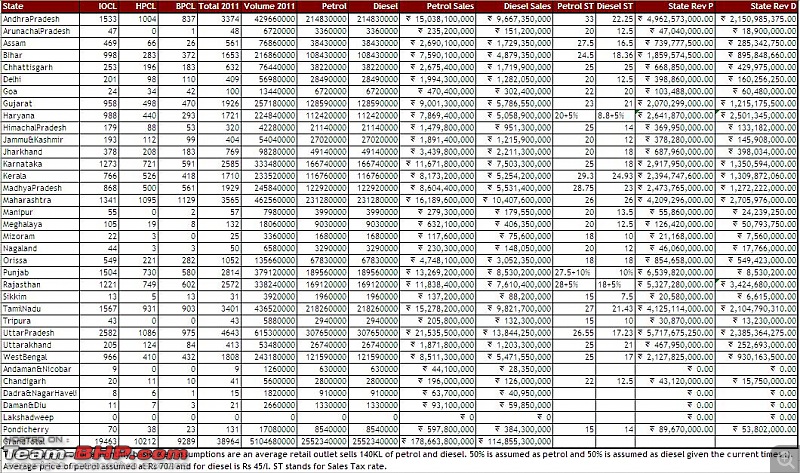

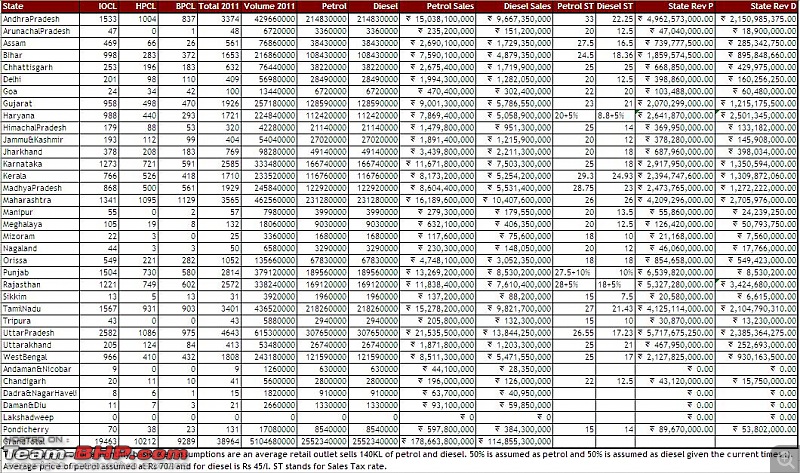

You might be right on this point. I did a very back of the envelope calculation of how much states might be earning on sales tax revenues on petrol and diesel. This is based on the data I collected over an hour's research of available documents in the public domain. I started out with the no. of retail outlets per state and UT selling petrol and diesel and then went forward from there. I assumed 140 KL per month as average sale per outlet (This is as per an MD of a refinery in his recent 2011 AGM speech).

Some key assumptions are listed here.

The most important one is that this is a monthly view on an average. Some experts with contacts in the industry can correct me if I am wrong somewhere. Looks like Goa indeed has only 10.34 crores in sales tax revenue from petrol compared to the biggies. States like Uttar Pradesh, Punjab, Tamil Nadu, Maharashtra, etc. will never ever think of such a suicidal policy of letting go VAT on petrol, sorry to say :Frustrati.

Since I did it in a jiffy, I hope I got my mathematics right stupid:, so uploading the actual calculation sheet for others to verify the simple formulas and the approach.

revenuebreakup.xls

35:65 ratio sounds reasonable than 50:50 ,to me, for the petrol to diesel volume. But great work !

Some more news on this subject.

The Union Minister of State for Parliamentary Affairs Rajiv Shukla yesterday welcomed the Goa government's proposal to reduce petrol prices by Rs 11 and said the other states, especially the BJP ruled ones, should emulate the step to ease the burden on the common man. "As far as petrol and diesel are concerned, states get more tax than the Centre from petroleum products. They impose more tax and get more. If states abolish taxes, then it will ease the burden on the common man," Shukla said. "Central government had already reduced the custom duty...the share of the state government is far bigger as far as money generated from petroleum products is concerned. State government should think over this (emulating Goa)," he said.

Source :

Bihar not to slash vat on petrol, IBN Live News

If it happens then I would like to see other state govt's (AP) to follow suit. It would really help all of us.

Diesel makes so much sense now. But unable to take the decision of parting with my petrol car for a Diesel just for the price factor.

[quote=BheemBoy;2731636]If it happens then I would like to see other state govt's (AP) to follow suit. It would really help all of us.

quote]

AP politicians are the greediest lot. Only infighting among themselves and they do not care a hoot for public welfare. Does the opposition, like TDP, have guts to announce that they will sell petrol at Rs.50, like Goa. Trust me, if they do this, they will wipe out ruling Congress. Every poor / low income guy uses a 100 cc bike which runs on petrol. When will our politicians realise this?

The government can very well reduce the VAT on petrol and heftily increase the prices of liquor/Cigars/Cigarette/Bidis/Pan Masalas. This will fill the government kitty. A drunkard will consume liquor, no matter what is the price. Similarily a smoker will definitely keep on smoking even if the prices are doubled. IMHO, this will definitely be helpful. Everyone will be happy including the government.

Quote:

Originally Posted by su1978

(Post 2731821)

A drunkard will consume liquor, no matter what is the price. Similarily a smoker will definitely keep on smoking even if the prices are doubled.

|

Unfortunately this is the same logic the government uses with regards to taxation for petrol and diesel. We really do not have a choice except to fill up our vehicles and keep driving.

That is why they raised the tax on cars in the new budget.

However, I do agree with you, raise taxes on other things and reduce tax on petrol and diesel. Will make life easier for everybody.

Quote:

Originally Posted by insipid.insane

(Post 2731623)

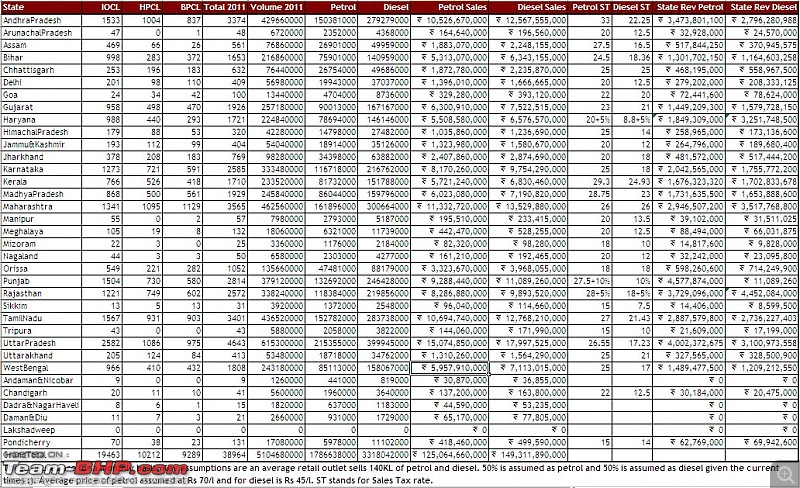

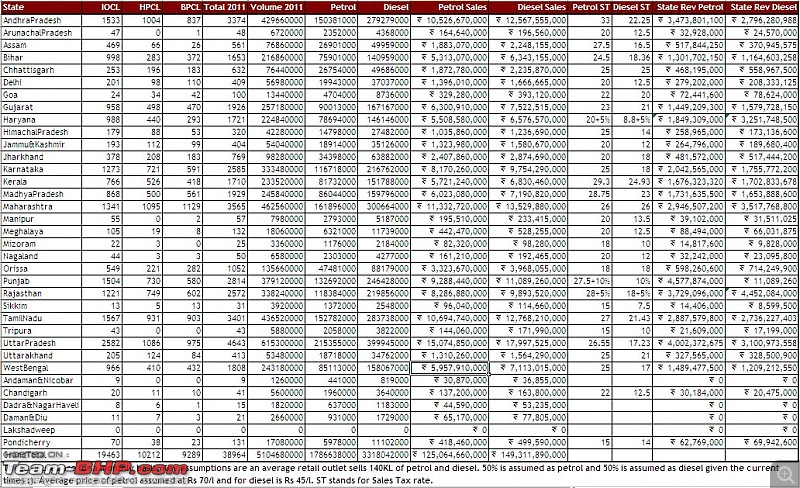

35:65 ratio sounds reasonable than 50:50 ,to me, for the petrol to diesel volume. But great work !

|

Thanks much. Yes I think you are right. I had seen somewhere about this ratio of sales figures but don't know why I ignored that stupid:. Here is a revised view of the same.

Note the revenue from petrol sales go even lower for Goa which is around 85 crores annually. Still remains in the thousands of crores for larger states. Some figures that stand out is for Punjab the difference between petrol and diesel looks atrocious. While they earn close to 5000 crores annually from petrol, the diesel earnings are only about 12-13 crores? Can someone please confirm if the figures assumed with respect to sales tax in Punjab are correct?

Updated the calculation sheet too.

revenuebreakupV3.xls Quote:

Originally Posted by mayankjha1806

(Post 2731630)

Some more news on this subject.

[i]The Union Minister of State for Parliamentary Affairs Rajiv Shukla yesterday welcomed the Goa government's proposal to reduce petrol prices by Rs 11 and said the other states, especially the BJP ruled ones, should emulate the step to ease the burden on the common man.

|

So as per Rajiv Shukla the common man doesn't live in the non-BJP ruled states :uncontrol. Seems like a case of only preaching and asking others to practice. Anyway its all about mathematics and finances. For example in West Bengal where I live it comes to around 1800 crores whereas the total revenue collection in the state is around 25000 crores. The ratio is significant to let go of it. I am sure this would be the case with even other big states, BJP ruled or not.

| All times are GMT +5.5. The time now is 19:51. | |