Team-BHP

(

https://www.team-bhp.com/forum/)

NOTES:

1: Only cars that sell 500+ units (and thus, the relevant models) have been included in the gainers & losers chart.

2.

A big shout-out to parrys for preparing these beautiful charts & graphs!

Movers & Shakers

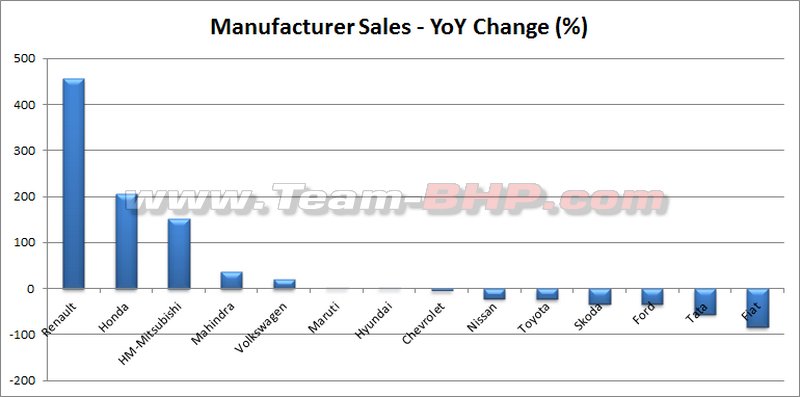

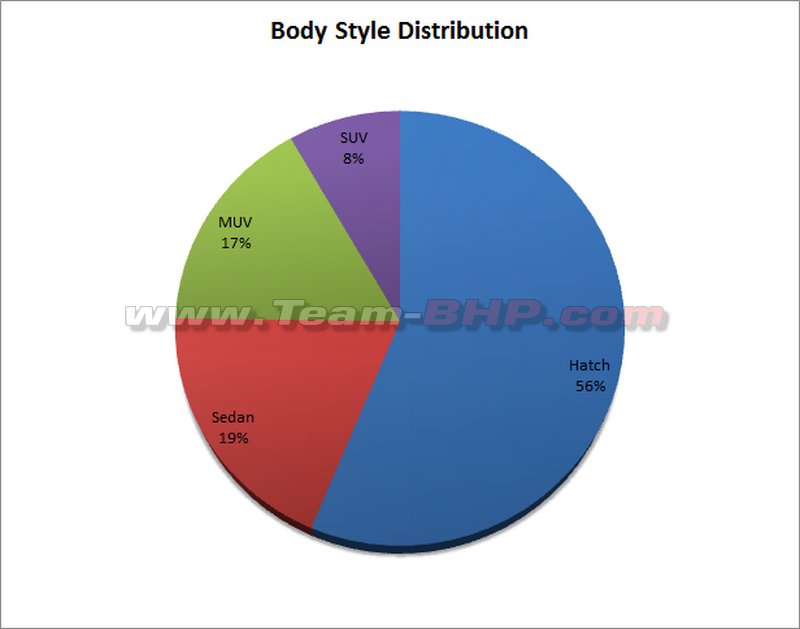

A good start to 2013, as is usually the case with the first month of the year. After all, it’s easier to sell a Jan 2013 build car even in May 2013, than it is to move a Dec 2012 car in Feb 2013. Customers demand a build date of the current year, and rightly so!

With a cumulative figure of 2.3 lakh cars, Jan 2013 was the 2nd best month of this financial year (

after October 2012). Importantly, the bump in sales is 20% over the previous month. Overall year-on-year sales are off by 5%; that’s actually good news when you consider the current state of the market and compare it to the buoyant times of early 2012.

The RBI announced a marginal cut in the repo rate (0.25) and cash reserve ratio (to 4%). On the flip side, the deregulation of diesel pricing means the fuel will see slow & steady price increases over the coming year.

Maruti’s domestic numbers actually grew 2% over the corresponding period of 2012, while the month-on-month tally rises by 25%. January was also the first month of the current financial year where Maruti enjoyed 6-digit volumes. However, exports dived noticeably by about 22%. Maruti’s domination, even after all of the world’s brands have arrived in India, is commendable. The Alto, WagonR, Swift & Dzire scale new heights, with three of them recording their highest sales performance in 6 months. The company's latest UV – the Ertiga – also has a good run, even if it’s slipped off the previously held 7k level. The facelift, variant shuffling & AT gearbox don’t seem to be doing much for the Ritz. Fact is, the car is getting old in design terms, and a full generation behind the Swift. The SX4 experiences growth, but 1,000 units isn’t saying too much for a Maruti sedan. Probably dealers stocking up the marginally updated version? The lack of a diesel option has stalled the resurgence of the Eeco (aka Versa).

Hyundai also records a marginal Y-O-Y growth and quite an impressive M-O-M jump. Petrol cars continue to crawl back slowly & steadily. The entry-level Eon moves past the 8,000 mark, but the i20 – Hyundai’s most expensive hatchback – outsells all of its (cheaper) siblings! The Fluidic Verna & Elantra remain the sedans to beat in the C2 & D1 segment (respectively). These two have given the market exactly what it wanted. On the flip side, the Sonata brings back D2 segment nightmares for Hyundai. Some things, I guess, will never change.

Mahindra’s got its foot on the accelerator and there’s no letting back. Get this: For the entire of year 2011, Mahindra sold about ˝ as much as no.2 car maker Hyundai. The home boys appear to be firmly ensconced at the 25,000 average now. That’s only 8,000 units shy of the Koreans. Primary reason? One blockbuster UV launch after another. The Bolero goes from strength to strength, yes. But the shortened Xylo (i.e. Quanto) adds another 3,000 to the kitty. The Scorpio & XUV500 are habitual 4,000 / month scorers. Their latest SUV, the premium’ish Rexton, has a good month at 457 sales and has outsold every SUV in its class, save for the mighty Fortuner. For a niche product, the Thar is a decent runner @ 600+ copies.

Breaking the trend set by the top 3 is Tata Motors. Y-O-Y sales are less than 50% of the Jan 2012 levels, while the M-O-M climb is slimmer than the others too. A dismal 15,000 shipments makes Jan the second-worst month in a year for Tata (

after the equally poor December 2012). This is the net result of poor reliability & quality levels and an ageing product line (for the most part). The Indica + Vista and Safari + Storme are the only products to have earned their lunch. Everything else – from the Nano to the Aria – has under-performed. It’s shocking to see the Indigo + Manza at a low 2,367 units. If it weren’t for its commercial vehicle division & Jaguar-Land Rover, Tata would have been in the red. The passenger car division remains Tata’s weakest (albeit most visible).

Toyota reports a small increase from December, but 13K is well off the 17K of last January. There’s a clear reason for that: While the Innova & Fortuner (1,500 pieces!!!) keep the cash registers ringing, the big T is going to have to bring contemporary hatchbacks & sedans (like the Swift, i20 etc.) to the Indian market. The old-school Liva & Etios can’t cut the mustard. The unbreakable Corolla Altis has its share of fans in the market; 384 is a fair number by current D1 standards.

Chevrolet has new additions to its portfolio, and three MUCH REQUIRED deletions (Optra, Aveo, Aveo UVA). Status quo for the Beat diesel which is Chevrolet’s star performer, followed by the dependable Tavera. Not much to write home about otherwise, not even from the Cruze which was a champion at one time. Obviously a facelift strategy gone wrong. The Sail UVA fails to make any sort of mark in the fiercely competitive B2 hatchback segment. Competent yes, though buyers are clearly not giving the dated design & interiors a second look. We’ll be keenly watching the market performance of the well-priced Sail sedan.

The Polo revvs up and how! 4,600 units is a great month for VW’s hatchback. I consider the Vento as an under-performer in the market though, as it is still the best diesel C2 sedan, although the lukewarm numbers simply don’t show it. 233 isn’t bad for the Jetta, considering its pricey tag…it has outsold sister Laura for the 2nd month in a row. Overall, VW records notable Y-O-Y and M-O-M gains, primarily due to the Polo. There’s still a lot of work left to do.

The Figo is Ford’s “everything” at the moment. The Endeavour & Fiesta Classic suffer a sharp nosedive from their usual levels. New Fiesta hits new lows. A poor start to 2013 for the American company, whichever way you look at it.

2,900 cars makes a respectable month for the City, considering its petrol-only offering. The Brio is the other car keeping the Honda dispatchers busy, yet 2,300 is a poor show for a Rs. 5 lakh hatchback. All other Hondas are in the two-digit range, including the Jazz! At 61 pieces, the Jazz is the worst selling hatchback in India, outsold by other flops like the Fabia & Punto. The otherwise brilliant machine simply never recovered from its initial pricing debacle. The 30 units you see of the CRV are of the next-generation car. It’s also locally assembled (not CBU), so perhaps, the pricing might be more realistic. You can expect an official review later in February.

There’s no real setback in demand for the Duster, thus we can nail down the fall to 3,500 units as supply limitations. The Scala appears to be settling at the 800 level. Sister concern Nissan sees the Sunny stepping up to 2,500 shipments, while the Micra also has a spike in its (normally dismal) performance. The Evalia – touted as an Innova competitor – seems to be a complete write-off. Period.

Can’t figure out what Skoda is up to. We keep hearing of big changes & management reshuffling, but the market numbers don’t show any signs of improvement. The Rapid’s love with the 1.5K point is inexplicable for such a well-priced competent car. The luxo-barge Superb, though still in the lead, isn’t dominating the D2 segment as it did earlier. The Passat & Accord aren’t that far behind anymore. Only 2,000 cars keeps Skoda ahead of just the permanent back-benchers, HM & Fiat.

For having the support of a nearly defunct manufacturer, the Pajero Sport is a splendid performer @ 230 copies. That is ~50 crore rupees in gross for HM. And the vintage Ambassador does outsell some other modern sedans (including the Linea). Fiat is down 85% from last Jan, which wasn’t a strong position to start with. In my opinion, Fiat should reposition itself as a niche manufacturer targeting segments where competition doesn't exist (e.g. how Renault got the Duster). As Bud Fox once said "If your enemy is superior, evade him".

Folks, we have one interesting year ahead of us!

The Diesel : Petrol Story

Chevrolet

Beat 2599 : 436

Sail UVA 721 : 355

Sail Sedan 638 : 198

Hyundai

Elantra 347 : 141

i20 4998 : 3657

Verna 3895 : 1171

Nissan

Micra 963 : 373

Sunny 1749 : 707

Renault

Duster 3467 : 87

Fluence 1 : 107

Pulse 126 : 277

Scala 754 : 58

Skoda

Fabia 185 : 44

Laura 169 : 1

Rapid 1146 : 312

Superb 59 : 54

Tata

Indica 7308 : 13

Indigo 2332 : 35

Toyota

Corolla 252 : 132

Etios 2469 : 431

Liva 2247 : 180

VW

Jetta 206 : 27

Polo 3503 : 1076

Vento 1711 : 313

Glad to see the increase in Polo numbers. I always believed that this car had a monthly potential of close to 5000 units. Looks like, massive trolling on forums like this about the poor service experience has woken VW up from deep slumber. In Bangalore where the rot was neck deep, lot of customers are coming up with favorable expreriences about the SCs now a days.

Bring in a good 4 cyl engine and see the Polo sales zoom past i20.

This month held many surprises, Tata Safari Storme, in Top Gaingers Month over Month, and Toyota Fortuner touching 1500 levels from ~1200 levels all through the year, and Innova dropping. Also the red hot offering from Renault the Duster falls to about half the usual numbers? Were there some supply side issues, or its just the initial euphoria has died down a bit looking at Renault's delivery and service capabilities.

Glad to see SX4 and City doing well and BTW City outsells Brio and Jazz. I thought Brio was doing much better than this.

Outlander at 0 isnt a surprise, but fail to understand when would Mitsubishi take serious note of its offings and pricing in India.

Nice to see these figures .

Sad to see Skoda sharing the bottom spots with the permanent backbenchers. Competent strong and well rounded cars. I think their service reputation and perception about cost of spare parts is killing them in the market. Immediate need to have a revamp and work more on improving their image on the service front. Not having a Cross over ala Duster or ertiga is also not helping.

Also interesting to note the ratio of i20 diesels to petrol. I guess cost difference of close to 1.5 lakhs makes the petrol sibling more VFM compared to diesel. With the diesel prices set to rise by at least 6-7Rs. in another year, we may see the market movement and euphoria towards diesel burners dying down.

Hyundai just cant get it wrong with the Verna and I20, i10s. Great performance in the market and second only to Maruti.

Whats happening with Tata? Mr. Cyrus has his task cut out. Serious steps need to be taken.

Many thanks for this eagerly awaited thread, GTO and parrys! You guys rock, as usual!

The top 3 manufacturers seem to be steadily consolidating their positions, doing what comes best to them, in a market that remains stagnant and will continue to do so for some more time.

Tata's cup of woes just seem to get bigger with each passing month. Had Toyota done justice to the Etios twins by upgrading the interiors and including essential bits left out in the inexplicable cost-cutting exercise, they would be the undisputed no.4 by now. I guess they may still get into that position, but it will be more due to Tata's rapid slide as Toyota themselves seem to have hit a wall. Only all-new products can propel them forward, but there aren't indications of any in the pipeline.

Chevrolet are taking full advantage of their wide product range, though they don't have any blockbuster. I predict the Sail and Enjoy will continue this trend. The U-VA may find it tough to crack the super competitive supermini segment, but the well-priced and well-rounded Sail should find it easier to become one of the top 3 sellers among entry-level sedans. If GM can get the Enjoy right, they should be able to see 5-digit volumes a month, which is a credible achievement.

While the top 6 seem to hold on to their positions, there is a lot of jostling for position among the next 6 manufacturers - will have to wait and see who emerges best, given the promising products some of them have lined up, such as the EcoSport and Amaze.

As for the two established back markers, one can only hope they find ways to remain in business, sooner rather than later.

Edit: Nice to see more companies sharing the diesel-petrol split. By the way, is there a reason for Renault's odd Fluence and Pulse ratios, or should they be the other way round?

Quote:

Originally Posted by GTO

(Post 3031245)

The Diesel : Petrol Story Renault

Duster 3467 : 87 Fluence 1 : 107

Pulse 126 : 277

Scala 754 : 58

|

Great Work GTO and parrys!!

:Shockked: Now this is unbelievable!! The Petrol outselling the Diesel Fluence comprehensively!! Is there a mistake from Renault in giving these numbers? Or did they do that on purpose to get our attention on the Fluence!! lol:

Thanks GTO as always. I just noticed one figure which stood out. The i20 Diesel : Petrol ratio. Always thought the i20 petrol outsells the diesel by a fair margin but now the Diesel outsells the Petrol. This could be because of the newly launched Era CRDI variant ?

Apart from that the Jazz numbers I think are low because Honda is not showing interest to sell it ( apparently they dont make money in this car ).

Amazed by the Scorpio numbers ! a product that's almost at the end of its life cycle still outsells by more than twice the STORE + SAFARI + SUMO combination ! I recall TML dismissing the Scorpio as a model competing with the Sumo when it was launched trying to protect the Safari. And now it even outsells the Duster!

TML ends the year where M&M started and vice versa. Dont think 2013 will be any different for the Indian manufacturers but Toyota might soon overtake TML for sure.

Quote:

Originally Posted by GTO

(Post 3031238)

Mahindra’s got its foot on the accelerator and there’s no letting back. Get this: For the entire of year 2011, Mahindra sold about ˝ as much as no.2 car maker Hyundai. The home boys appear to be firmly ensconced at the 25,000 average now. That’s only 8,000 units shy of the Koreans. Primary reason? One blockbuster UV launch after another. The Bolero goes from strength to strength, yes. But the shortened Xylo (i.e. Quanto) adds another 3,000 to the kitty. The Scorpio & XUV500 are habitual 4,000 / month scorers. Their latest SUV, the premium’ish Rexton, has a good month at 457 sales and has outsold every SUV in its class, save for the mighty Fortuner. For a niche product, the Thar is a decent runner @ 600+ copies.

|

Just doing the math, at the start of 2012, Mahindra was lagging the number 2 spot by 42%. At the beginning of 2013, they're lagging by 22%.

In the month of December 2012, they were 14% behind Hyundai.

They've halved the gap as of now.

It may just take one more block-buster launch for them to come into the number 2 position. Probably a B2 segment hatch, well priced which can eat into the i20's pie ?

The i20 and i10 combined together do around 17k units a month.

A well designed and a 'priced to sell' hatch from Mahindra should be able to manage 7k units, no ?

Can Mahindra strip Hyundai of the number 2 position ? What is your thought ?

What just happened there? Polo! How? This really is interesting. Can anybody throw some light on this please? What clicked here?

Is Petrol really fighting back? If one has to go by the diesel petrol ratio of i20 and Polo.

And when will Tata wake up? I mean, there's really nothing positive to talk about - no new models and nothing exciting. Can they not do something to at least the Vista D90, which is such a capable product inside with all the right ingredients. All it needed was an equally exciting exterior which is such a let down. Tata needs a new design philosophy big time. Looks are subjective I know, but, where are the looks?

When my bro went to get our Liva serviced last month, he was told that they are coming up with entirely new interiors for the Liva pretty soon. I guess that would be some sort of a boost for this highly potential but under-performing car.

Such a thing of beauty - Skoda Rapid. Victim of bad A.S.S. Period.

And thank you GTO. This report is one thing which I wait for every single month and it is always a pleasure to go through it. Nice and crisp.

| All times are GMT +5.5. The time now is 05:19. | |