| Re: Diesel Cars: Down, down, down! Market share = 34%

Car makers plying in the Indian market are re-adjusting their strategies, production plans and their component supply chains as they struggle to come to grip with the ever-changing environment regarding demand from their car customers, as petrol power is rapidly becoming the more preferred option over oil burners.

But even the best of re-aligned strategies can take a minimum of three to four months for implementation - a period which can be really tough to negotiate, as companies struggle to meet petrol-car demands even as they sit on huge piles of unsold diesel-car inventories.

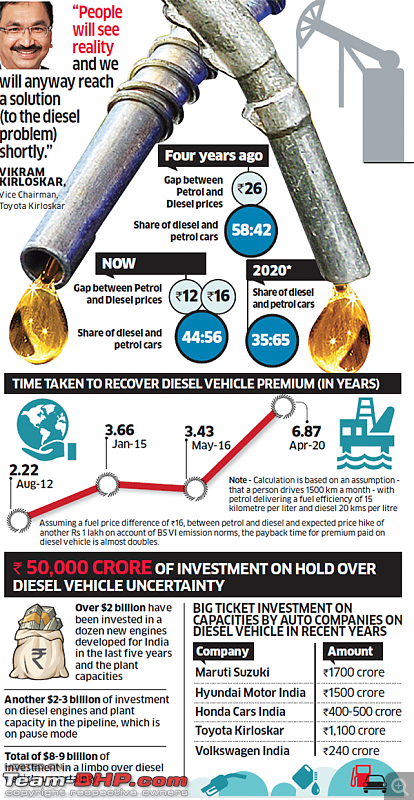

When the new BS-VI emission norms were advanced in January 2016 by the Government to be implemented by April 2020 (skipping BS-V norms altogether), car manufacturers now had to revamp their earlier product development plans and plan to achieve their fiscal targets in a much smaller time frame.

Now, with the Delhi-NCR ban on registration of 2,000cc+ diesels followed by the Kerala-ban for the same coming within months of each other, car companies have been hit hard and are struggling badly to adjust to this rapidly changing behaviour of the Indian auto sector.

More than the bans themselves, it's the apprehension of the Indian customer regarding diesel cars in general which has affected the demand-supply chain of most car companies in the Indian market.

Moreover, with the Supreme Court mentioning that it's considering a 30% cess on diesel cars above 2,000cc, diesel car sales could tumble down to really low levels in the days to come. Quote:

Take the case of Honda. It has seen a drastic shift in the petrol/diesel mix for the City in the last quarter as compared to Q4 of 2015. While four of every ten buyers opted for the diesel variant in Q4 of last calendar year, it came down to less than three of ten new purchases in January-March. Sale of the City has declined as a result.

"On the one hand you have petrol vehicle buyers waiting and on the other, you sit on unsold diesel vehicles. We have seen a swing of 15 per cent to petrol variants (from diesel) in the case of (the) City during the first quarter of 2016. The situation is uncertain," Jnaneswar Sen, senior vice-president (marketing and sales) at Honda Cars India, said recently.

Even though many companies, including Honda, have the flexibility to switch between diesel and petrol models, adjusting the production and component supply chain to meet this change takes a minimum of three to four months. Abrupt changes in demand pattern upset their production planning and results in sales loss. The challenge is not just limited to car makers - the component industry is also coming under stress, having to adjust to frequent changes in production plans by manufacturers.

Experts say the uncertain atmosphere has made India less attractive as an investment destination. "Sudden decisions create instability and question the validity of India as far as major investment decisions are concerned. This is not in the interest of India's citizens. Also, to fight air pollution and the problems that it causes for citizens, we need to look at the problem holistically," says Wilfried Aulbur, the managing partner of consulting firm Roland Berger, India. Aulbur, who used to head Mercedes in India, says the automotive industry has to do its part but one also needs to look at other factors contributing to air pollution.

"We consider a 30 per cent cess the same as a diesel ban. Considering the limited financial benefit that you get due to the price differential between the two fuels, some of the cars need to run for 10 years to recover the extra investment. If you add another 30 per cent to the price, why would anyone in the world buy (a) diesel (vehicle) anymore?" says Roland Folder, managing director and chief executive officer of Mercedes Benz India.

Toyota, which currently imports diesel engines for its India-made cars, is considering investments of Rs 1,100 crore to set up a diesel engine plant. N Raja, senior vice-president (sales and marketing) of the company, says the decision "demonstrates our strong belief that diesel is a good fuel when used with the latest technology. Diesel engine technology will continue to be an integral part of every automobile maker, considering the stringent fuel efficiency norms being introduced in year 2017."

| Business Standard

Last edited by RavenAvi : 29th May 2016 at 19:30.

|  (2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

)

)