Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by Nikhs

(Post 4263748)

Have pre Booked Verna, the Invoice and Temp Registration have been done yesterday. As per the Kun United Hyundai dealer in AP, just getting the invoice won't help as the updated ex-showroom price will be sent to RTO and we end up paying life tax on updated price, so went ahead and got the TR done yesterday though I will be taking delivery on Aug 22nd.

|

Got to admire your patience - keeping the car at the showroom for > 15 days when it's literally waiting to be taken home. clap:

A quick question , if you guys don't mind.

I am planning to buy a new car in exchange for my 3 year old hatchback.

The old car is in the name of my pvt ltd company. The new car too will be bought in the company name.

The dealer from whom I am planning to buy the new car is asking me for a GST invoice which shows the total resale value (e.g. 350000) to be broken up into basic + gst . This works out to 271318 + 78682 (asuuming 28% GST + 1% cess)

This means I (my company) will be getting only 271318 in hand, as the GST component will flow to the government.

Now there is another dealer of the same car manufacturer who is willing to accept the old car, against a Credit note for Rs 350000 , which will be adjusted against the purchase value of the new car.

Questions:

1. Is the GST invoice necessary for exchange of the used car ?

2. If I go with the second dealer, then will the GST issue come up in the future to bite me , along with potentially interest thereon ?

3. Since I am told that this GST issue does not apply if

an individual is exchanging his/her car, does this mean that now I have to evaluate the depreciation benefit vis-a-vis the loss incurred through GST on future sale of the new car I purchase.

4. This is the part which I have been arguing with the dealer. If I agree to issue GST invoice for the old car, Since he is in the business of buying & selling cars, will he not be eligible for Input Tax Credit of the GST charged by me ? In that case, the GST on the old car is not an additional cost for him, as he will be able to claim set-off for the same when he sells that car ? He claims that government rules do not allow input tax credit on second hand cars (coming in through exchage). Is this true ?

Waiting for your views.

Quote:

If I agree to issue GST invoice for the old car, Since he is in the business of buying & selling cars, will he not be eligible for Input Tax Credit of the GST charged by me ? In that case, the GST on the old car is not an additional cost for him, as he will be able to claim set-off for the same when he sells that car ? He claims that government rules do not allow input tax credit on second hand cars (coming in through exchage). Is this true ?

|

Very valid points raised by you, unfortunately, no one has a correct answer yet. Most of the Dealerships are asking GST invoice whereas private dealers/ Brokers are ready to take the car without any GST. I think no one is actually aware on this and perhaps like ITC on lease rentals, this is a grey area yet and may become clear in some time. If Government needs GST on old cars, they must allow ITC on differential at least or like you suggested, the dealer should offset it with new sales.

Quote:

Originally Posted by AMKAM

(Post 4266490)

.

The dealer from whom I am planning to buy the new car is asking me for a GST invoice which shows the total resale value (e.g. 350000) to be broken up into basic + gst . This works out to 271318 + 78682 (asuuming 28% GST + 1% cess)

This means I (my company) will be getting only 271318 in hand, as the GST component will flow to the government.

|

Hi,

See if this link helps to clear your doubts -

http://economictimes.indiatimes.com/...w/59609713.cms

This link also specifies the sections of the GST where these amendments are written.

Also, I have read somewhere that the dealer when further sells your used car, he has to pay GST only on the profit margin that he has made in the deal and not on the entire value of the deal he has made. Unable to find the link for this update though.

Cheers,

naddy

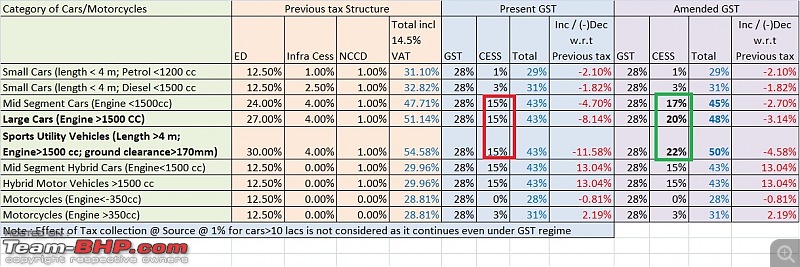

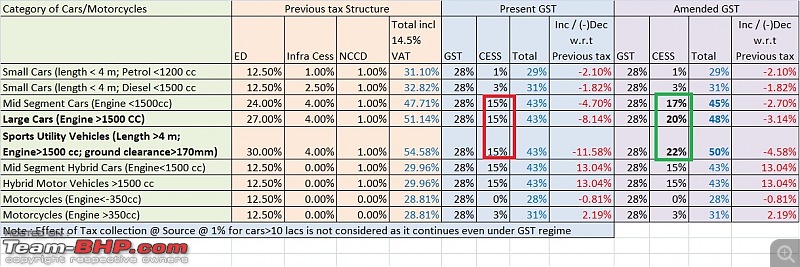

The government has decided to raise cess on mid- and large-sized cars and SUVs. It has decided to implement an increase in cess of 2 per cent for mid-segment cars, 5 per cent for large cars and 7 per cent for SUVs.

However, status quo has been maintained on small cars (petrol and diesel), 13-seater and hybrid vehicles.

Source: NDTV

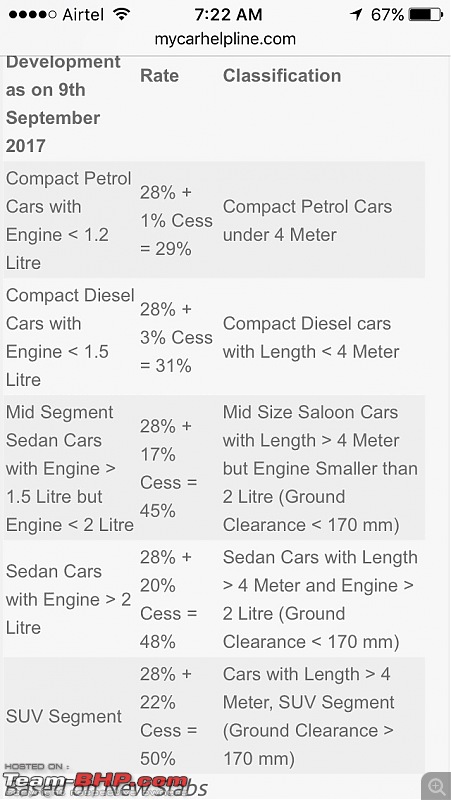

The updated comparison of GST rates after incorporating the today's changes in GST cess for mid size, Large cars and SUVs is posted below:

Hopefully, the Creta 1.4 CRDI, S-Cross and the Duster 1.5dCi will not be termed as SUVs, as their engine capacity does not exceed 1.5 Litre.

If they do have the ability to be reactive I'm disappointed they didn't also correct their stance on hybrids.

Big thanks to

Raman Bhadu for sharing this! Source: mycarhelpline.com

Quote:

Originally Posted by GTO

(Post 4267161)

|

This s the first time I seen the 2 litre engine make its debut on the GST charts.

Going by this the C class (2143 cc) will be taxed 3% more than the E 200 and E 220d (1991 cc) model?

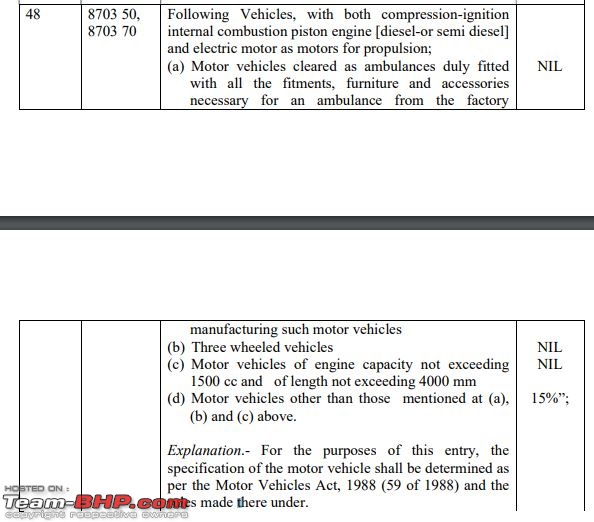

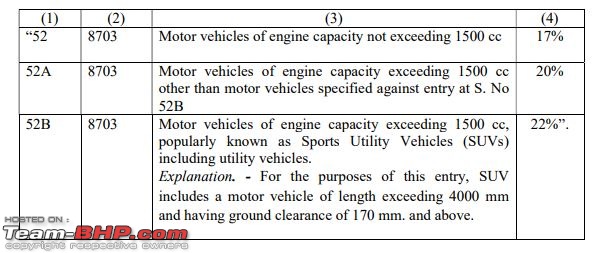

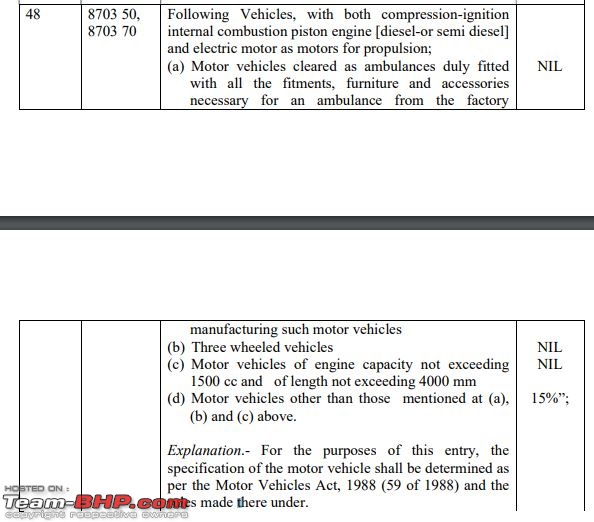

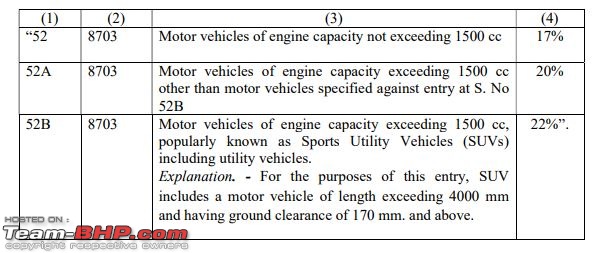

The GST Cess Notification from GoI has finally come in, laying rest to all these assumptions. Final GST Cess details are as below:

1. Vehicles less than 4m and 1500cc - NIL (Total 28% GST)

2. Vehicle more than 4m and less than 1500cc - 17% (Total 45% GST)

3. Vehicles more than 4m and 1500cc - 20% (Total 48% GST)

4. Vehicles more than 4m, 1500cc and 170mm GC - 22% (Total 50% GST)

Screenshots from the notification given below:

So the < 1.2 litre Petrol engine clause is dead. Now the classifications is 4 meters and 1500 CC.

Any thing slightly over the 4 meter mark is now minimum 17% costlier than a sub 4 meter car.

So in effect a sub 4 meter diesel which ducks under the 1500 cc mark is now 3% cheaper than before? Am reading this right ?

Quote:

Originally Posted by krishnadevjs

(Post 4268471)

The GST Cess Notification from GoI has finally come in, laying rest to all these assumptions.

|

When it's GoI, nobody can be certain about anything.

For example: there is no clarity on whether this applies to petrol and diesel engine alike?

Quote:

Originally Posted by AMKAM

(Post 4266490)

A quick question , if you guys don't mind.

I am planning to buy a new car in exchange for my 3 year old hatchback.

The old car is in the name of my pvt ltd company. The new car too will be bought in the company name.

Questions:

1. Is the GST invoice necessary for exchange of the used car ?

|

If your Pvt. Ltd company is registered under GST , I think there is no escape. You will have to raise a GST invoice with applicable GST rate based on the vehicle class. They say GST will not be applicable when individuals and unregistered persons sell used car either to another unregistered person or a registered dealer.

Since you are registered, tax audits and assessments will take place where they will scrutinize your balance sheet. Once they see sale of car, they will ask " where is the GST on this". In the earlier VAT regime 5% VAT was applicable on used car sale. I have always raised a VAT invoice for used car sale with 5% VAT. Sale price used to be always inclusive of VAT in such cases.

If these rules continue it makes no sense for a registered entity to sell a used car. Since 1) you don't get any input credit for the tax you have already paid and 2) if your selling price has to include 43% GST you are screwed. Better run the car to the ground and then sell it for peanuts. I hope some sense prevails and clarification and rational tax is levied for this category of transaction.

Quote:

Originally Posted by Turbanator

(Post 4266537)

Very valid points raised by you, unfortunately, no one has a correct answer yet. Most of the Dealerships are asking GST invoice whereas private dealers/ Brokers are ready to take the car without any GST. I think no one is actually aware on this and perhaps like ITC on lease rentals, this is a grey area yet and may become clear in some time. If Government needs GST on old cars, they must allow ITC on differential at least or like you suggested, the dealer should offset it with new sales.

|

If a GST registered entity is selling a car, I don't think GST is avoidable unless clear notifications and clarifications are issued.

Quote:

Originally Posted by naddy

(Post 4266553)

Hi,

Also, I have read somewhere that the dealer when further sells your used car, he has to pay GST only on the profit margin that he has made in the deal and not on the entire value of the deal he has made. Unable to find the link for this update though.

Cheers,

naddy

|

This will be applicable only when a used car dealer buys a car from an individual and then resells it. FOr example A (an unregistred individual) sells a used car for Rs. 3.00 lakhs to ABC & Sons (a used car dealer). Since A is an individual, GST is not applicable on this transaction. ABC & Sons then wants to sell this car for Rs. 3.50 lakhs to C, GST will be applicable on the margin of Rs. 50,000 @ applicable rate for vehicle class and not on the entire sale value of Rs. 3.50 lakhs. Or atleast that is what I think they mean.

Quote:

Originally Posted by Arjun Reddy

(Post 4268506)

So the < 1.2 litre Petrol engine clause is dead. Now the classifications is 4 meters and 1500 CC.

|

Hey, just rechecked. The <1.2L Petrol classification still exists.

It's in Sl. No 47 of the notification (

Motor vehicles of engine capacity not exceeding 1200cc and of length not exceeding 4000 mm).

Hence, I stand corrected.

1. Petrol vehicles less than 4m & 1200 cc - 1% (Total 29% GST) - Alto,i20, Swift, Kwid, Amaze etc.

2. Diesel Vehicles less than 4m & 1500cc - 3% (Total 31% GST) - Alto,i20, Swift, Kwid, Amaze etc.

3. Petrol Vehicle less than 4m & 1200cc - 1500cc - 15% (Total 43% GST) - Ford Ecosport 1.5, Fiat Punto Abarth etc.

4. All vehicles more than 4m and less than 1500cc - 17% (Total 45% GST) - City, Verna, Vento

5. All vehicles more than 4m and more than 1500cc - 20% (Total 48% GST) - Octavia, BMW, Merc, Audi

6. All vehicles more than 4m, 1500cc & 170mm GC - 22% (Total 50% GST) - All SUVs

I guess this should be accurate.

Quote:

Originally Posted by Arjun Reddy

(Post 4268506)

Any thing slightly over the 4 meter mark is now minimum 17% costlier than a sub 4 meter car.

So in effect a sub 4 meter diesel which ducks under the 1500 cc mark is now 3% cheaper than before? Am reading this right ?

|

The sub 4m diesel under 1500cc mark was always at 3% Cess (after GST implementation). This continues. Hence, I guess there's no change in price.

Quote:

Originally Posted by DriveOnceMore

(Post 4268514)

When it's GoI, nobody can be certain about anything.

For example: there is no clarity on whether this applies to petrol and diesel engine alike?

|

I believe this applies to both petrol and diesel as mentioned above. The reason I say so is that all petrol & diesel cars above 4m & 1500CC had 15% Cess from July till now. This means they were all classified under Sl. no 52 in the Notification.

Now, the Govt. has split 52 into 52, 52A and 52B as per my previous post. This is only to add 2%, 5% and 7% additional cess.

Attaching the notification for your reference.

notification05-compensation-cess-rate.pdf

Quote:

Originally Posted by krishnadevjs

(Post 4268570)

4. All vehicles more than 4m and less than 1500cc - 17% (Total 45% GST) - City, Verna, Vento

5. All vehicles more than 4m and more than 1500cc - 20% (Total 48% GST) - Octavia, BMW, Merc, Audi

|

I think you made a small mistake about which car falls in which category. Based on point 5 "All vehicles more than 4m and more than 1500cc", Verna will fall in this category where as "Caiz,Vento,Rapid,City" will fall in category mentioned in point 4 "All vehicles more than 4m and less than 1500cc"

| All times are GMT +5.5. The time now is 08:36. | |