| | #166 |

| BHPian | |

| |  (2)

Thanks (2)

Thanks

|

| |

| | #167 |

| BHPian Join Date: Jul 2016 Location: New Delhi

Posts: 62

Thanked: 267 Times

| |

| |

| | #168 |

| Distinguished - BHPian  | |

| |  (1)

Thanks (1)

Thanks

|

| | #169 |

| BHPian Join Date: Jul 2016 Location: New Delhi

Posts: 62

Thanked: 267 Times

| |

| |

| | #170 |

| BHPian Join Date: Aug 2010 Location: Panchkula

Posts: 554

Thanked: 649 Times

| |

| |  (2)

Thanks (2)

Thanks

|

| | #171 |

| Team-BHP Support  Join Date: Mar 2011 Location: Gurgaon

Posts: 6,703

Thanked: 28,286 Times

| |

| |

| | #172 |

| Senior - BHPian | |

| |

| | #173 |

| BHPian | |

| |  (1)

Thanks (1)

Thanks

|

| | #174 |

| Distinguished - BHPian  | |

| |  (3)

Thanks (3)

Thanks

|

| | #175 |

| BANNED Join Date: Nov 2007 Location: Chennai

Posts: 3,282

Thanked: 4,876 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #176 |

| BHPian Join Date: Sep 2011 Location: Chennai

Posts: 277

Thanked: 185 Times

| |

| |

| |

| | #177 |

| Distinguished - BHPian  | |

| |  (3)

Thanks (3)

Thanks

|

| | #178 |

| BHPian Join Date: Nov 2015 Location: Chennai

Posts: 188

Thanked: 395 Times

| |

| |  (1)

Thanks (1)

Thanks

|

| | #179 |

| BHPian Join Date: Sep 2011 Location: Chennai

Posts: 277

Thanked: 185 Times

| |

| |

| | #180 |

| BHPian Join Date: Apr 2007 Location: Bangalore

Posts: 160

Thanked: 122 Times

| |

| |

|

Most Viewed

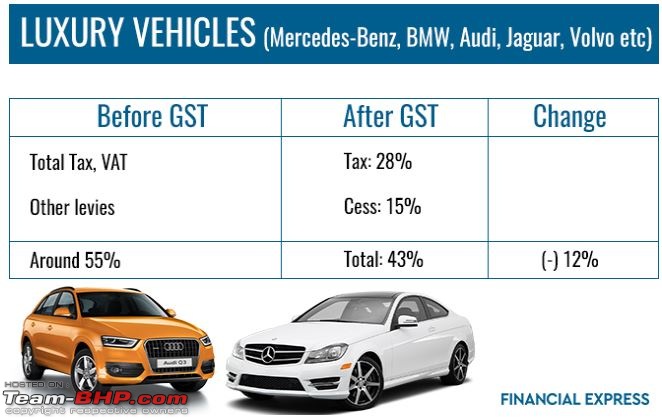

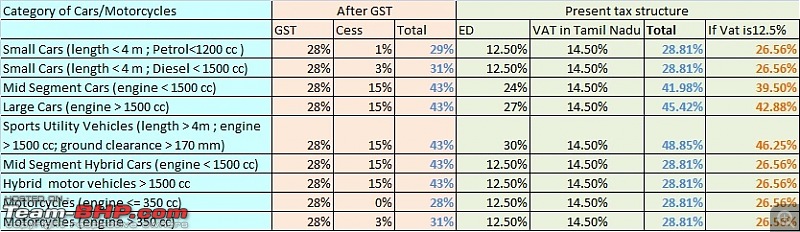

28%+15%. I see a computation at this link:

28%+15%. I see a computation at this link: