| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  64,373 views |

| | #1 |

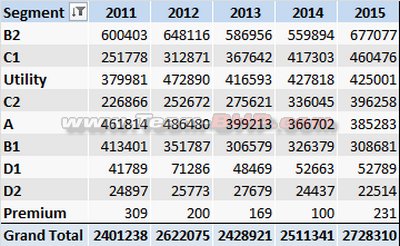

| Team-BHP Support  | The 2015 Report Card - Annual Indian Car Sales & Analysis! 27 lakh cars! Even better than the adrenaline-packed 2012!  Gainers cut-off has been placed at 50,000 cars   Thanks to Aditya for preparing these beautiful charts!   NOTE: The tragic Chennai floods affected some manufacturers, but not all. |

| |  (56)

Thanks (56)

Thanks

|

| The following 56 BHPians Thank GTO for this useful post: | 9thsphinx, @Chaand, Aceman82, aeroamit, AJ-got-BHP, Amartya, Aragorn, aravindkumarp, deetjohn, Dhruba_Nazira, dkaile, drivebyfire, gearedup, gschandra, Hrishi_111, iVento, Jakku, JoseVijay, jpcoolguy, Karthik Chandra, kevintomin, KPS, libranof1987, MaheshY1, mallumowgli, Mevtec, mi2n, mrbaddy, myavu, Myth_sx, nihilanth, nkghai, PointZero, prashanthyr, PSOPS, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samaspire, Sherlocked, sidhu_hs, Simhi, sri2012, swiftnfurious, Teesh@BHP, tharian, The Observer, theexperthand, tifosikrishna, timuseravan, vb-saan, vibbs, yosbert |

| |

| | #2 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis!    |

| |  (41)

Thanks (41)

Thanks

|

| The following 41 BHPians Thank GTO for this useful post: | 9thsphinx, adimicra, AJ-got-BHP, deetjohn, Dhruba_Nazira, drivebyfire, Grand Drive, gschandra, Hrishi_111, hybridpetrol, InControl, JoseVijay, Karthik Chandra, libranof1987, lloydofcochin, MaheshY1, maximus., Mevtec, mi2n, myavu, Myth_sx, n:CorE, nihilanth, Nilay, nkghai, prashanthyr, PSOPS, Rajeevraj, RavenAvi, Rehaan, rshanker, RSR, Senna4Ever, sidhu_hs, Simhi, SS-Traveller, The Observer, theexperthand, vb-saan, vibbs, yosbert |

| | #3 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis!    |

| |  (31)

Thanks (31)

Thanks

|

| The following 31 BHPians Thank GTO for this useful post: | 9thsphinx, AJ-got-BHP, auto_enthusiast, drivebyfire, gschandra, IcarusMan, InControl, JoseVijay, Karthik Chandra, libranof1987, MaheshY1, Mevtec, myavu, n:CorE, nihilanth, nkghai, PointZero, prashanthyr, PSOPS, Rajeevraj, RavenAvi, Rehaan, rshanker, RSR, sidhu_hs, Simhi, sri2012, swiftnfurious, theexperthand, vb-saan, yosbert |

| | #4 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Maruti-Suzuki Maruti is the 3rd oldest car manufacturer in India. But make no mistake, it's fitter, faster & fiercer than the younger group. In its relentless pursuit of market share, Maruti increased its annual sales from 11.52 lakhs in 2014 to 12.89 lakhs in 2015. That's an additional 1.37 lakh cars! To put things in perspective, Maruti's increase is about equal to the total sales of Toyota India. The company performs well on all parameters and shows no real signs of weakness or vulnerability. Product development efforts have strengthened, its sales & marketing function is powerful, the dealer & service network is the best and Maruti closely guards its 'cant-go-wrong-with-me' reputation. The best sellers remain the 'dependable four' - that is, the Alto (2.72 lakh sales), followed by the Dzire (2.36 lakh), Swift (2.06 lakh) and WagonR (1.70 lakh). All of these have recorded marginal YOY growth, with the only exception being the Dzire which has climbed up by a whopping 12%! That number is particularly impressive since the base was high (Dzire was already a best-seller). In 2015, the high point for this compact sedan was October where it moved a staggering 24,502 copies!! For the practical WagonR, the second half of 2015 provided a major boost - its sales have consistently hovered near the 15,000 level from July to December. Interestingly, nearly all Marutis on sale have recorded YOY increases. It's only the Ritz which has failed the class with a red mark on its report card - Ritz sales dropped down to nearly half of the 2014 numbers (19.8k versus 35.6k). Maruti mercilessly killed its slow-sellers in 2013-2014 and it's now time to lay the Ritz to rest too. The 7-seater Ertiga doesn't record any growth. It's the 2nd Maruti to see a fall in sales, although the decline is very small (60.2k vs 61.1k) and can be entirely attributed to a production shift to the facelift (see Aug-Sept numbers). The Celerio is a pleasant surprise, having increased its sales by 23% to 83,000 cars. I say pleasant because, if it weren't for the AMT & that crude 2-cylinder diesel, the indistinguishable Celerio would've sank without a trace in the crowded marketplace. Maruti's marketing machinery pushed the Celerio to an unbelievable 8000 - 9000 car range for 3 months of 2015! The Ciaz's sales success has finally given Maruti a piece of the action in the C2 sedan segment, something the SX4 & Baleno sedan could never do. About 54,000 Ciaz' rolled out in 2015 and the sedan is now a strong no.2 in the segment, even though the Honda City is miles ahead. When the Ciaz has a good month, it sells over 5,000 copies. That's respectable. Gypsy sales are as reliable as its 4x4 capability - about 5,000 in both the years, a chunk of which goes to India's defence forces. December was a standout month - this mountain goat sold nearly 1,200 copies! The commercial sector has performed satisfactorily with the Omni & Eeco both recording higher sales. The Eeco had an especially strong year with a 23% increase to 62,000 dispatches! From the new launches, it's a bitter-sweet scenario for Maruti. On the one hand, it got the Baleno absolutely spot on in terms of price & packaging. The hatchback is surprisingly competent. In just 3 months, 24,000 Balenos were sold, with December alone seeing over 10,000 shipments. What's also clear is that the Baleno is taking a couple of thousand sales away from the Swift (refer to monthly sales threads). On the other hand, the flagship S-Cross has gone into a tail-spin. From its first month of full production (August), the S-Cross has slipped into a state of continuous decline, closing the year with merely 2,000 sales in December. Its 1.6L engine, build & road manners are strong. However, the car looks ugly and Maruti completely botched up the pricing of the 1.6L variants. Hardly surprising when someone bragged about getting a 4 lakh discount on this car. Last week, Maruti slashed its prices by up to 2 lakh! If only the S-Cross was priced right from day one. Last edited by GTO : 21st January 2016 at 15:42. |

| |  (43)

Thanks (43)

Thanks

|

| The following 43 BHPians Thank GTO for this useful post: | 9thsphinx, Aficionados, aravindkumarp, Contrapunto, Dhruba_Nazira, drivebyfire, gostel, Hrishi_111, hybridpetrol, JoseVijay, jpcoolguy, libranof1987, MaheshY1, Mevtec, myavu, n:CorE, nihilanth, pankaj09, prashanthyr, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, S2!!!, samabhi, shobhit.shri, shreyak_ss, sidhu_hs, Simhi, sri2012, sukhoi, swiftnfurious, Teesh@BHP, tharian, The Rationalist, theexperthand, Tushar, vb-saan, vibbs, Viju, yosbert |

| | #5 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Hyundai Riding on a wave of well-positioned new launches (Grand i10, Elite i20, Creta), Hyundai sees a 16% sales increase to 4.76 lakh units. It's only a matter of time before the Korean giant crosses the magical 5 lakh cars / year mark. Everyone thought that the new MNCs will weaken the position of the industry stalwarts. Well, the exact opposite happened. Maruti & Hyundai became more powerful, while the newbies were left shaking their heads in disbelief. The all-rounded Elite i20 is Hyundai's best-selling car in India. And what a hatchback it is! Except for January, the i20 has sold over 10,000 every month of the year. Next up is the Grand i10 which increased its deliveries by 20% to 1.24 lakhs. These two hatchbacks account for over 50% of Hyundai's total sales in India - that's how important they are. Must mention, the Grand i10 has been on a resurgence in the second half of 2015, consistently delivering 5 digit sales numbers. It was earlier an 8,000 - 9,000 performer. The best month? October with 14,000 sales. Other than these two cars though, every other Hyundai has suffered a sales decline. The Eon & previous-gen i10 majorly disappoint (especially the former). The Eon never really lived up to Hyundai's expectations, and loses 8,526 sales to close the year at 72,000. Not quite the Alto beater it was meant to be, eh? The ol' i10 is fast becoming a marginal player (2015 = 33,000) - we can see it struggling to maintain even 2,000 sales / month since September. Guess Hyundai still has to learn from Maruti on how to concurrently sell two generations of a car...successfully. I won't be surprised if the i10 retires from the market in 2016. Not much of good news with Korean sedans either. The Xcent can't hold a candle to the Dzire and has seen a flat year, with a sales figure that is nearly identical to 2014. Forget the Dzire, even the Honda Amaze knocked it out in a straight fight. While 51,000 dispatches is still respectable, we'll all agree that the Xcent should be doing more volumes with Hyundai's backing. In the C2 segment, the Verna is now too old and is getting royally slaughtered by the City & Ciaz month after month. Once the star of the segment, the Verna has to contend with merely 1,000 odd sales each month. Annual loss is in the region of 40%. The next-generation Verna couldn't be coming a moment too soon. As if to match the Verna, the Elantra also loses ~40% sales on the YOY charts. From 3,426 cars in 2014, the Elantra slipped to 1,985 in 2015. The Elantra is being outsold by more expensive cars like the Skoda Octavia! Hyundai's flagship product in India - the premium Santa Fe - hasn't fared any better. Annual numbers are down by 28% to a paltry 1,280 shipments. The Fortuner can do that in a single month!! The last 5 months have been awful for this SUV with sales in the mere double digits. The air is only going to get thinner with the arrival of the next-generation Endeavour & Fortuner. After two long paragraphs of bad news, Hyundai has something to smile about - the Creta. With an eye on profitability, Hyundai took the risk and priced it a lakh higher than it should've been. The gamble paid off, with customers lining up in droves outside Hyundai showrooms! The Creta has already sold over 40,000 copies and is the first million+ rupee vehicle to enjoy such high volumes. Waiting lists are running long and the order book is getting heavier by the day. No surprise, the Creta is the only 'cant-go-wrong' all-rounded SUV in the segment. The XUV500 has the typical Mahindra weaknesses, the Duster is too old & cheaply built, the EcoSport is too small and the Scorpio / Safari are too crude. No contest. No competition. Last edited by GTO : 21st January 2016 at 15:45. |

| |  (40)

Thanks (40)

Thanks

|

| The following 40 BHPians Thank GTO for this useful post: | 9thsphinx, aeroamit, aravindkumarp, BNM, drivebyfire, Grand Drive, Hrishi_111, JoseVijay, jpcoolguy, Karthik Chandra, libranof1987, MaheshY1, Mevtec, myavu, n:CorE, nihilanth, nkghai, pankaj09, PearlJam, prashanthyr, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samabhi, sathya.bhat, shreyak_ss, sidhu_hs, Simhi, sri2012, swiftnfurious, The Rationalist, theexperthand, Tushar, vb-saan, vibbs, Viju, yosbert |

| | #6 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Mahindra It's been a close battle for the final podium slot; Mahindra beat Honda to the No.3 position by the slimmest of margins (~2,700 cars). In the F1 world, that would be like crossing the finish line half a second ahead of someone hot on your tail. 2015 was a flat year for Mahindra with no growth shown. Total sales were identical to 2014, both years at about 2.05 lakh units. The company must be worried that their best-selling UV - the Bolero - lost 14% in sales, settling at an annual tally of 88,000 (2014 = 1.02 lakh). The weak monsoons hurt the rural economy for sure. You can see its effect on Bolero numbers which got weaker in the 2nd half of the year. This is a matter of concern as the Bolero accounts for over 40% of Mahindra's total volumes. Still, whatever the Bolero lost, the TUV300 brought in (more on that later). Mahindra moved 51,000 Scorpios off the assembly line in 2015. That's the same as what it managed in the year before. While there's been no growth, let's not forget that the Scorpio is a 15 year old model, new hydroformed chassis notwithstanding. The updates that the model got in 2014 have contributed to maintaining its sales momentum. An average of 4,300 monthly sales is very good, especially when you consider how the Scorpio's price has shot up too. Mahindra's profit margins on this SUV will be f-a-t. That said, the second half of the year saw a weaker performance from the Scorpio, although the hit wasn't as severe as with the Bolero. For a big 15-20 lakh SUV backed by a non-premium brand, the XUV500's sales have never failed to amaze. Well, in 2015, this all-rounded SUV actually increased its numbers from 35k to 37k. The facelift brought with it a lot of improvements, and the recently launched Automatic variant will only widen its appeal. A monthly average of 3,000 sales is quite a feat for an expensive SUV that is over 4 years old. It says a lot about the product, yes, but it also shows the lack of competition in the 15 - 20 lakh SUV space. The ugly Xylo & Quanto slip from poor market positions to even more miserable ones. Both the flops bring YOY loses, with the Quanto showing an eye-watering 80% dip. Forget life support, even the ventilator can't save these two. Lost causes Mahindra, time for their funeral procession. Don't waste your time & management bandwidth when you have more important products (including the KUV100). Same goes for the other flop sisters, the Verito & Vibe. Although the two actually increased their sales by 767 cars, they are still duds which together manage a pitiful 200 - 300 cars each month. @ Mahindra, be sure to include their names in the obituary. Also grappling for life is the Rexton. Admittedly, I've been perplexed whenever I saw the Rexton move over a 100 pieces in a month. It is such an old, ordinary, unsorted, lacklustre SUV that costs an eye-popping 25 lakhs on the road. I'm glad that the market has put it in its place. From August onward, it's barely sold a dozen each month. Annual sales loss = 67%. The TUV300 starts off on a strong note and has already sold over 16,000 pieces. Will be interesting to see what sales level it settles down to. It's got unique styling, a VFM price tag, a nice cabin & lots of features. That small 3-cylinder engine & bouncy ride are its two major weaknesses. Honestly, if you give the TUV300 the 2.2L mHawk diesel, it'll take away half of the Scorpio's sales. A small engine with 1 missing cylinder was a planned move to differentiate it from the more expensive siblings. Last edited by GTO : 23rd January 2016 at 08:36. |

| |  (33)

Thanks (33)

Thanks

|

| The following 33 BHPians Thank GTO for this useful post: | 9thsphinx, aeroamit, aravindkumarp, drivebyfire, Hrishi_111, InControl, JoseVijay, Karthik Chandra, libranof1987, MaheshY1, Mevtec, myavu, n:CorE, nihilanth, pankaj09, prashanthyr, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samabhi, shobhit.shri, sidhu_hs, Simhi, spikester, swiftnfurious, theexperthand, Tushar, vb-saan, vibbs, yosbert |

| | #7 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Honda 2015 marks the best ever year for Honda India, with sales crossing the 200,000 mark for the first time. The annual sales increase was 12.6% (2015 = 202390, 2014 = 179783). This performance is largely driven by the City & Amaze, both of which account for over 70% of Honda's volumes. Honda played it safe with the new City and made it evolutionary in nature (over the previous generation). Lots of kit was added and the all-too-important diesel variant was introduced too. Even though its quality is not perfect like the 3rd-gen, the City has been a resounding sales success. YOY volumes improved from 77k to 83k and it has sold over 7,000 pieces in 6 different months of the year! The Amaze ended 2015 with 63,831 sales; however, it wasn't on a high note as the compact sedan's 2014 sales were marginally higher @ 65.5k. Sales in the 3rd & 4th quarters dropped about 20% compared to the first two quarters. Still, the Amaze did outsell the Xcent and that's an achievement in itself. None of the other mass-market Hondas have any shine left. The poorly positioned (read = overpriced with a cheap build) Mobilio fell flat on its face with a sales loss of 37% YOY. It's sold in the paltry 3-digits since July and has been in a continuous sales decline. Officially a flop now. Chief competitor - the Ertiga - outsold the Mobilio by over FOUR times! Same story with the li'l Brio which went from 13k sales in 2014 to 10.6k in 2015. The Swift & Grand i10 sell more in a single month! The petrol-only CR-V has carved out its own niche & has a loyal fan following. This is demonstrated by its sales which are identical for the first & second halves of 2015, irrespective of market swings. While its sales increased to 913 cars, the CR-V is only a marginal player in the SUV segment. Honda launched the all-new Jazz in July 2015 and thought it'll apply some of the City formula (diesel, equipment, cheaper production techniques) to the hatchback. Didn't work, nope. Primary reason being the formidable competition (i20, Baleno etc.) in a fiercer segment. The Jazz has sold nearly 30,000 copies since launch, but its sales have been in an unstoppable decline since the month of launch. From a high of 6.6k, they dropped to 3.3k in November and 2.6k in December. Honda must be extremely concerned about the market's tepid response as it was counting on the Jazz to build some more market-share. Few cars ever recover from a weak launch. |

| |  (31)

Thanks (31)

Thanks

|

| The following 31 BHPians Thank GTO for this useful post: | 9thsphinx, aeroamit, aravindkumarp, drivebyfire, Hrishi_111, JoseVijay, libranof1987, MaheshY1, Mevtec, myavu, n:CorE, nihilanth, nkghai, pankaj09, prashanthyr, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, RSR, samabhi, shreyak_ss, sidhu_hs, Simhi, swiftnfurious, theexperthand, Tushar, vb-saan, vibbs, Vitalstatistiks, yosbert |

| | #8 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Toyota The battle for 5th place has been equally tight with Toyota taking the spot by only 1,572 cars ahead of Tata. YOY, Toyota increased its sales by 5% to 1.4 lakh cars. The Japanese giant is a slow yet steady mover - this is evidenced by the fact that nearly all of its cars (except for the Fortuner) recorded YOY growth. Innova sales climbed by a minuscule 2%, but considering the market conditions, its 10 year old vintage and steep pricing, moving 5,000 cars on an average each month just goes to show the customer's trust in this MUV. Heck, even emperor Bolero lost volumes in 2015! On the flip side, the Fortuner is slipping. While its YOY numbers have fallen by 6%, sales in the second half of 2015 are telling; they dropped a massive 28% (compared to Jan-June). I think this is due to a combination of factors - limited supply of CKD kits (as the next-gen has been released in Thailand?), competition (Endeavour effect, improved XUV500) and of course, its age & high pricing. Hold back your scoffs though - 16,000 sales for a 30 lakh vehicle is still an outstanding performance. Though, I predict that the current-gen Fortuner has crossed its peak and will become weaker in 2016. The outdated Etios shocked everyone by grinning & flashing a score card with a 21% YOY increase! This was probably driven by the taxi market, in particular the Ubers & Olas of the world. Toyota has given it a push in the second half of the year where the Etios managed an average monthly tally of 2,827. Not bad for what is such an old model. In comparison, the Liva / Cross had a flat year (YOY increase of only 185 cars). Competition in the hatchback segment is very brutal and I'm honestly surprised that the Liva hasn't sunk further down. Still, it's a flop model whatever way you look at it. An average of 1,800 cars / month is perhaps 1/3rd of the sales projections Toyota originally had in mind. A good year for premium Toyotas. Let's start with the most premium of them all, the mighty Land Cruiser. Sales nearly tripled to 120 units. Simply 'wow' for an overpriced SUV costing 1.5 crores! In comparison, the cheaper (but still frightfully expensive) Prado sold only 57 cars, of which 48 were in February alone. Must be a bulk order (e.g. hotel group) or bulk import. It's otherwise not going anywhere and has had many months with zilch sales. Nice times for Toyota's premium sedans too. The Toyota Corolla outsells all of its competitors combined at 7,574 cars. That said, the D1 sedan segment is getting royally whupped by same-price SUVs. In the latter half of 2015, Corolla sales settled at a monthly average of 500 cars - a far cry from levels maintained in previous years. The Camry brought home a 35% increase in YOY sales to 979 cars (within an arm's length of segment leader, the Superb). The hybrid variant is gaining in popularity, and there's no direct competition in the segment either (Accord, Teana, Passat have all been discontinued), although customers are flocking to smaller Audis / BMWs / Mercedes in the same price band. Additionally, Toyota must be worried about the all-new Superb which has the potential to become a game-changer. Last edited by GTO : 21st January 2016 at 17:20. |

| |  (35)

Thanks (35)

Thanks

|

| The following 35 BHPians Thank GTO for this useful post: | 9thsphinx, aeroamit, Aficionados, aravindkumarp, Contrapunto, drivebyfire, Gannu_1, Hrishi_111, Insearch, JoseVijay, Karthik Chandra, libranof1987, MaheshY1, Mevtec, myavu, n:CorE, nihilanth, pankaj09, prashanthyr, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samabhi, sidhu_hs, Simhi, swiftnfurious, The Rationalist, theexperthand, Tushar, vb-saan, vibbs, yosbert |

| | #9 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Tata Motors Right behind Toyota is Tata Motors with 1.38 lakh sales. A 9% increase in YOY numbers, but that's only half the story. Other than the new launches & the Nano, every Tata model has suffered a sales loss. The ol' Indica sisters lost 5% volume, still managing a monthly average of 2,900 cars. This is Tata's bread & butter car, largely driven by the cab segment & budget shoppers. The Indica still gives Tata most of its sales. Next up is the ol' Indigo CS with a 13% YOY decline at 24k cars. The original compact sedan of India caters to a similar market as its hatchback sibling. Not once has it sold over 2,000 cars in the June-December period though. Taxi drivers now have many options in the segment (even the Xcent is coming in a base variant for cab drivers). The updates that the Nano received keep the model alive with average monthly sales of 1,900 cars. Sad fate for what is an incredibly smart car. The Nano has remained a loss-making project for Tata. Tata's UVs are all going downhill at full throttle. The Aria has been shipping in the single digits since September and dealers are sitting on unsold stock. YOY loss is a staggering 83%, down to a paltry 231 units. Let's hope that the Hexa is priced right from day one itself. The Safari Storme received some nice updates in 2015, albeit they aren't enough to spruce up the old girl. It needs a fresh body & trimming of its many versions! YOY sales are down 15% to 8,000 cars (chief competitor, Scorpio, does that in 2 months). Safari & Storme numbers have largely been in the 3 digits all year long. The Sumo is Tata's best selling UV with 10,621 cars, but that's hardly saying anything when the Bolero does comparable numbers in a month! The ageing Sumo also loses 30% compared to 2014, with sales again settling in the 3 digit range. The Venture? It's a total write-off. From Tata's new cars, the Zest brings home about 25,000 orders. It's holding onto its monthly average of ~2,000 sales. That's nothing compared to the other compact sedans, but at least Tata has a chance to showcase its improved quality & engineering to some customers. Much unlike the Bolt which is a complete flop due to poor pricing & marketing by Tata. In the current financial year (April 2015 onward), the Bolt has maintained a depressing average of 700 cars / month. It's a competent hatchback, no doubt, but this market segment has stronger players and Tata doesn't have enough of a differentiator to draw customers. It's also a damaged brand in the eyes of potential shoppers. Tata better work some magic on the Zica which is quite a hatchback (apart from the 3-cylinder engines). |

| |  (32)

Thanks (32)

Thanks

|

| The following 32 BHPians Thank GTO for this useful post: | 9thsphinx, aeroamit, Aragorn, drivebyfire, Gannu_1, Hrishi_111, Insearch, JoseVijay, jpcoolguy, Karthik Chandra, MaheshY1, Mevtec, myavu, n:CorE, nihilanth, nkghai, pankaj09, prashanthyr, RavenAvi, Rehaan, rshanker, RSR, samabhi, sidhu_hs, sri2012, swiftnfurious, theexperthand, Tushar, vb-saan, vibbs, Viju, yosbert |

| | #10 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Ford Ford had a fully flat year. 2014 & 2015, both, brought sales of ~77,000 cars (each). At any given point in its Indian history, Ford has managed to sell one model only - that is, one car brings it an overwhelming majority of volumes. We hope that will change with the new launches. In 2015, 55% of its volumes came from the EcoSport. All isn't well with this talented compact SUV though. YOY numbers have fallen 17% to 42,000 sales (2014 = 51k). Except for Jan & Feb, it's not once crossed the 4,000 mark. What's more, the EcoSport's sales average for the second half of the year (excluding flood-hit December) was 3,440 units / month. The EcoSport still makes a compelling case for itself and I hope that it doesn't suffer because Ford's attention is diverted to newer launches. The EcoSport is going to need marketing support as there are more compact SUVs coming our way. The sweet new Endeavour is an important product for Ford. Personally, I'm glad that the company killed the laggards (Fiesta, Classic) so that the management doesn't waste time on products that aren't selling anyway. Always look forward, not backward. The new Figo & Aspire are well-priced and have a lot of attributes tuned to mass market tastes (including a light build & steering!). They offer good styling, a powerful diesel, comfortable ride quality, space, features & safety kit. Just wish Ford had spread their launches apart as they might have ended up with too much on their hands. I reiterate, Ford India hasn't demonstrated that they can sell multiple cars in high volume. Initial numbers for the Figo siblings aren't encouraging. The Aspire slid from a high of 5,176 (August) to 2,366 (November). The Figo hatchback lost 21% volume in only its second month of full production (November) to 2,790 cars. These aren't healthy signs for mass market cars. Ford must be terrified - they need to stop the fall as mass market cars never recover if the early months show weak numbers. Ford is going to have to burn the midnight oil. The engineers have done their job; now, it's up to the sales & marketing functions to push hard if they want to increase market share in 2016. Ford surely has the cars to cross the magical 100,000 mark, but.....will it? |

| |  (33)

Thanks (33)

Thanks

|

| The following 33 BHPians Thank GTO for this useful post: | 9thsphinx, Aragorn, drivebyfire, Gannu_1, Hrishi_111, Insearch, JoseVijay, jpcoolguy, Karthik Chandra, MaheshY1, Mevtec, mi2n, myavu, n:CorE, nihilanth, pankaj09, prashanthyr, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samabhi, Senna4Ever, shreyak_ss, sidhu_hs, Simhi, swiftnfurious, The Rationalist, theexperthand, Tushar, vibbs, yosbert |

| | #11 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Renault With the new kid in town, Renault is on a roll. YOY growth is about 20% to 53,000 units, and the Kwid is only getting started. Renault designed, built, kitted & priced the Kwid just right. It's one of the rare new launches to see a continuous month on month growth since launch. Waiting periods are running longer than 6 months, production is being ramped up and new variants (1.0L, AMT) are coming. The French better not goof this one up - they've gotten a HUGE opportunity. The Kwid alone has the potential to double Renault's sales & market share in 2016. This is also the Team-BHP Car of the Year, 2015  ! !It's a depressing sight otherwise, no matter where you look in a Renault showroom. Every other Renault car is a flop. Let's start with the Duster which had a strong market position. In 2014, the Duster sold 40,000 copies! 2015? Shrunk to 24,000. From April onward, its monthly sales average has been merely 1,588 cars! The Hyundai Creta has given it a mind-numbing body blow, while the S-Cross, improved XUV500 & 2014 Scorpio facelift took even more sales away. December saw heavy discounts on the Duster. Will the upcoming facelift & AMT variant improve its fortunes? Only time will tell. But one thing is for sure - it's long lost the first mover advantage & the product itself is old (it felt old even at the time of launch). Renault priced the Duster higher than expected and got away with it because of the lack of competition. There's no way it's moving at the current price level anymore. The Lodgy's failure shows just how finicky the MUV segment is. It's a great people mover & showed promise, but has fallen flat on its face, with pitiful triple-digit sales in the second half of 2015. Unless Renault does something magical, it's going the way of the Evalia. All the other flops (Fluence, Koleos, Pulse & Scala) are not even worth talking about. They're sitting idle, gathering dust. |

| |  (30)

Thanks (30)

Thanks

|

| The following 30 BHPians Thank GTO for this useful post: | 9thsphinx, drivebyfire, Gannu_1, Hrishi_111, Insearch, JoseVijay, Karthik Chandra, MaheshY1, Mevtec, myavu, n:CorE, nihilanth, pankaj09, prashanthyr, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samabhi, sidhu_hs, Simhi, sri2012, swiftnfurious, The Rationalist, theexperthand, Tushar, vb-saan, vibbs, yosbert |

| |

| | #12 |

| Team-BHP Support  | Volkswagen The bad news just doesn't stop for Volkswagen. Emission scandals, no new investments for India (from its German parent), no new models to offer, arrogant dealerships, reliability issues...the list goes on. Keeping that in mind, I'm stunned that VW is able to hold onto its volumes YOY. 2015 = 43,156 cars (2014 = 44,210). I'm even more flabbergasted that the Polo sold 28,000 copies in 2015 (2014 was around the same number). Remember, it's priced on the higher side and customers don't generally like old, expensive products. She's an 8 year old model for heaven's sake! Says a lot about the pull of VW (as a brand) and the Polo (as a car). VW keeps giving it updates too (so many new engines & transmissions). That said, the Polo's market position has started to weaken and there's no light at the end of this tunnel. Only saviour is the all-new 6th generation Polo that is making its international debut later in 2016. The frequently facelifted & updated Vento chugs along calmly, moving 12,550 cars in 2015 (annual sales loss of 4%). C2 segment customers simply don't like old models and it's only the City & Ciaz managing respectable volumes here. Still, if you combine Vento + Rapid numbers (same car, same production line, different badge), that's 24,000 cars a year. Makes them take the No. 3 spot in the segment, ahead of the Verna! That's saying something about these old girls, wot? The Jetta loses ~9% volumes YOY, closing the year at 2,010 cars. That's about the same as the Hyundai Elantra, but the Skoda Octavia is way ahead in the market (700 cars more). Looking at production numbers of the final quarter, I think there is inventory buildup at the factory / dealer level. However, VW is trying to maintain the high price with discounts being limited to free insurance & a 20K loyalty / exchange bonus. Like the Polo & Vento, the 5-year old Jetta is also growing white hair, although it's aged gracefully. The next generation is still sometime away. The cute Beetle was recently launched at Rs. 29 lakhs, and there is talk of the all-new Passat coming our way soon. VW is going to display the Passat at the Auto Expo next month. Also, not to forget, the Polo-based compact sedan / hack job / eyesore / sign of desperation will also be frightening visitors at the motor show. General Motors - a Top 3 manufacturer at the global level - is behaving like a clueless chicken in India. It may be a leader globally, but in India, it's sitting at the back of the class with other losers. Chevrolet has sold NINE different models in 2015, and ALL of them (except for the new Trailblazer) have posted YOY losses. This report card is filled with 'Fs' - there isn't even a single 'D' here. From selling 58,000 cars in 2014, the General crashes to 37,000 cars in 2015 - a sales loss of 21,000! That's a miserable 37% YOY decline. So many models on sale, but terrifying incompetence in selling even one of them. Like a restaurant serving North Indian, South Indian, Chinese, Mexican, Italian & Mexican cuisine...with tables that remain empty all day long. If Chevrolet has to improve its innings in India, it's going to need a complete overhaul. I'm talking brand, product, marketing, sales, after-sales...EVERYTHING. Imagine, in the financial capital of India, the company doesn't have a service center in South or Central Mumbai!! And they need focus too - Chevrolet sells cars from 4 different nationalities in India. Korean (Beat, Cruze etc.), Chinese (Sail twins, Enjoy), Japanese (Tavera) & a mixed breed (Trailblazer is based on a USA pickup chassis). What's the point of such a diverse product range if you can't sell any of them? Get this - EACH of its cars is now selling in the double or triple digits only and is a flop in its respective segment. After spending 20 years in the country, GM still hasn't figured out how to make money here. In 2014-15, it lost Rs. 1,000 crores. I think General Motors USA will give it another shot or two. If it works out, fine. If not, it'll either scale down operations in the country and become a small niche manufacturer, or withdraw from the market altogether (like it took out Chevrolet from Europe). I don't know whether Arvind Saxena resigned from GM, or the company fired him. But seeing how things are, it's easy to see why whoever took the decision did so. Last edited by GTO : 21st January 2016 at 16:21. |

| |  (32)

Thanks (32)

Thanks

|

| The following 32 BHPians Thank GTO for this useful post: | 9thsphinx, ambivalent_98, drivebyfire, Gannu_1, Insearch, JoseVijay, Karthik Chandra, libranof1987, MaheshY1, Mevtec, msdivy, myavu, n:CorE, nihilanth, nkghai, pankaj09, prashanthyr, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samabhi, sidhu_hs, swiftnfurious, The Rationalist, theexperthand, Tushar, vb-saan, vibbs, yosbert |

| | #13 |

| Team-BHP Support  | Nissan How do you go from a bad position to one that's worse? Just ask Nissan. YOY volumes have tanked 40% to a paltry 21,547 cars (2014 = 36,575). Sometimes, I wonder what the hundreds of managers & executives at these companies keep themselves busy with? You'd think, if they can't sell new cars, they'd go out of their way to take care of the few customers paying them lakhs of rupees. Nope, ask me, I'm a Nissan Sunny owner. Every Nissan product on sale has recorded a YOY loss. Ironically, Nissan's best-selling car is also its most expensive, the Terrano, which brings the brand half of its sales. Compared to 2014, the Terrano lost 50% of new customers and has closed the year at 10,670. From July onward, it's never once crossed the 1,000 level. Not that Nissan should get any credit for this SUV - it's done nothing other than slapping its badge on the radiator grille. Nissan's own cars - the Micra & Sunny - lose 16% & 48% sales YOY. Not once did the two flops bring in 4 digit numbers. Meanwhile, the Evalia sold all of 244 copies (YOY loss = 51%). I'm willing to bet that a good number of that was by Nissan itself to transport its employees!!! Worryingly, Nissan doesn't have any important launches on the anvil either. Expect a lot of their office bandwidth to be used up by Facebook this year. Datsun increases its YOY sales by 45% to 19,378 cars, but before you get excited, it's largely driven by the new Go+ which has already begun floundering. The Go+ sold between 1,000 - 1,500 units from March to May, and has since dropped to the 700 - 800 level. It's not expected to recover or make any significant impact. The Go hatchback is now officially a flop. For a car whose price starts at merely Rs. 3 lakh, it's sold a depressing 709 units / month on average. The YOY sales loss is 35%. I've said this before and will say it again - resurrecting the 'Datsun' brand itself was a big mistake by Nissan. In India, they thought that Datsun will be the economy brand, Nissan will be somewhere in the middle and Renault at the top. But then, Renault goes ahead and launches the Kwid at a significantly lower starting price than the Datsun Go! How is Datsun the cheap brand, and Renault the higher-end nameplate then? What a mess. From the marketing POV, the Datsun brand stands for nothing. Renault-Nissan should just kill it - they're throwing good money after bad. There's also the matter of unnecessary distractions. Renault & Nissan are still not major players (independently) in India. Why not invest the resources you have to strengthen these two brands? Why bring in a 3rd that overlaps with your existing product range and chews away management time & finances? Nissan has already been admitted to the ICU. Do they need another critical patient? Last edited by GTO : 21st January 2016 at 16:28. |

| |  (29)

Thanks (29)

Thanks

|

| The following 29 BHPians Thank GTO for this useful post: | 9thsphinx, drivebyfire, Gannu_1, Insearch, JoseVijay, MaheshY1, Mevtec, mrbaddy, myavu, n:CorE, nihilanth, pankaj09, prashanthyr, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samabhi, shreyak_ss, sidhu_hs, swiftnfurious, The Rationalist, theexperthand, Tushar, vb-saan, vibbs, yosbert |

| | #14 |

| Team-BHP Support  | Another confused & under-performing brand is Skoda. One year, they decide they want to be part of the sub-10 lakh space for volumes. Then, we hear of the bossman saying he only wants to target the premium segment. They had better decide soon as this dilly-dallying isn't working out for them. After spending 15 years in India, Skoda doesn't even have a measly 1% market-share. Despite so many customer complaints, they are still unable to fix problems with their dealer network (link to a recent thread). Also take a look at Manas' predicament at this link. Skoda had a flat year, selling the same 15,000 odd cars that it did in 2014. The Octavia revved up a ~47% YOY increase to 2,722 cars! Speaks volumes (pun intended) about the Octavia's competence. It even outsold the VW Jetta & Hyundai Elantra! I wouldn't be surprised if the car maintains this pace in 2016 as well. There's been no real weakening in the latter half of 2015, while the segment isn't going to see any serious new launches this year. The Rapid has a small 3% YOY decline and sells 11.6k cars in 2015, which isn't too far from the VW Vento (12.6k cars). In Q4 2015, the Rapid actually outsold the Vento. The diesel + DSG combination has given these cars a shot in the arm. After all, there's a dearth of diesel automatic sedans in the C2 segment. Heavy discounting is bringing in sales from the Uber & Ola drivers too. Meanwhile, the Yeti remains the flop it always was. For 6 months out of the 12, this quirky looking SUV sold in the single digits! The new Superb's launch is just around the corner and - like its predecessor - the car has the potential to become a game-changer. @ Skoda, don't get carried away, price it competitively. Further, make sure you have enough supplies at launch. The way Octavia deliveries were handled in the early months was embarrassing. This year, Skoda's premium SUV will also be unveiled internationally. It'll probably hit India in 2017. The 30 lakh SUV segment is filled with unwieldy body-on-frames built for Asian markets. This new SUV has the potential to change the segment rules. Let's just hope that Skoda and its dealers don't botch things up. Why am I talking about a premium SUV here? Answer is in the next paragraph. VW won't agree with me, but I think VW should become the mass-market brand in India, and Skoda the premium. After all, the only car VW is able to sell is the Polo (cheapest car in the VAG India family). On the other hand, Skoda has more success in the 20 - 30 lakh space, as seen by the Octavia & Superb. The VW Passat suffered such poor numbers that it had to be discontinued, and VW dealers were still sitting on 2-year-old unsold Passats! The all-new Superb is much more anticipated than the new Passat for sure, and I haven't heard of any 30 lakh 7-seater VW SUV under development either. The writing is on the wall. Will VW & Skoda wake up? Occupying the last bench of the classroom are the usual suspects. Fiat loses another 30% of sales, ending 2015 at an awfully low note. Total sales = 8,620 cars (2014 = 12,397). Their cars are awfully old & outdated, and there's no important Fiat cars launching this year either. The Linea sells a measly 100 odd copies each month, yet has over 10 variants (including the old Linea Classic) on sale!! How confusing. Nothing is going to help - these cars are too old & long in the tooth now. The flopped Punto sold merely 564 cars / month on an average in 2015. It already has 3 different versions (Evo, Avventura, Abarth) and there's rumours of the pre-facelift model being launched again. What a dimwit decision - Fiat must be the only manufacturer to bring back a discontinued pre-facelift version in India. Not like it's going to have any positive impact on sales. Well, at least Fiat managers can go down and take a spin in the 145 BHP Abarth Punto whenever the monthly reports come in to depress them. Medical studies have proven it's the ultimate mood elevator  . .As things stand today, Fiat India is an engine supplier first, then a car manufacturer (related link). Less than 20% of their turnover is from cars. That said, Fiat can't indefinitely bank on the 1.3L MJD to keep paying the bills. Its biggest customer - Maruti - has started developing its own diesel engines. Maruti is known for inherent stinginess and isn't going to pay royalties to Fiat forever. In a couple of years, Marutis will be powered by diesels developed in-house. What will Fiat do then? What's the plan? Fiat is showcasing Jeeps at next month's Auto Expo. The premium segment can be an incredibly tricky one to crack. Volumes from the expensive SUV range will be too small to make any difference to Fiat India's balance sheet. The P-A-J-E-R-O brand has an unbelievable fan following in India! It's built a reputation as a tough abuse-friendly SUV that outlasts its owner. The actual sales figure will be more than the 1,746 cars listed in the sheet as we don't have data for two months (June & September)! Incredible. What helped? Without doubt, the launch of the Automatic variant. The Pajero Sport costs 30 lakh rupees on the road and is backed by two useless brands - one is bankrupt (HM), the other has no skin in the game (Mitsubishi). The sales network is small with only 48 dealers. Despite that, the Pajero Sport is the segment no.2, even outselling the Santa Fe (backed by Hyundai's power & might) & Rexton (backed by Mahindra's reach). Last edited by GTO : 21st January 2016 at 16:48. |

| |  (34)

Thanks (34)

Thanks

|

| The following 34 BHPians Thank GTO for this useful post: | 9thsphinx, Abhi_abarth, Dhruba_Nazira, drivebyfire, Gannu_1, IcarusMan, Karthik Chandra, libranof1987, Mahesh Prasad, MaheshY1, mazda4life, Mevtec, myavu, n:CorE, nihilanth, pankaj09, pdma, prashanthyr, Rajeevraj, RavenAvi, Rehaan, RoadSurfer, rshanker, RSR, samabhi, Senna4Ever, sidhu_hs, supertinu, The Rationalist, theexperthand, Tushar, vb-saan, WorkingGuru, yosbert |

| | #15 |

| Team-BHP Support  | Re: The 2015 Report Card - Annual Indian Car Sales & Analysis! Among the big 3 German luxury marques, Mercedes races to the no.1 position with 13,502 cars sold! Audi moved 11,192 cars for 2nd place and BMW - once a loud bragger of its sales - refuses to share any stats at all. Period. Looking at BMW's numbers for the handful of months that we have data on, it can be safely assumed that they are w-a-y behind in the whereabouts of <7,000 cars. With absolutely stunning designs (vs the boring Mercs of yesteryear), a wider product range, aggressive marketing & strong dealer network, Mercedes returns to the top spot after years. To put things in perspective, 5 years back in 2010, Mercedes sold merely 5,819 cars. Just imagine the growth! We have model-specific data only for a couple of months. Based on that, the MFA-platform cars (CLA, GLA, A) and C-Class appear to be the sales leaders, closely followed by the evergreen E-Class (a favourite of corporates), and then the big SUVs (GLE & GL). The new S-Class is the benchmark amongst uber luxury sedans and India's elite just can't get enough of them. In December, Mercedes sold 50 copies of the Rs. 1.5 crore S-Class - that's quite a feat. Audi's sales are majorly driven by the A3 & A4 (heavily discounted), followed by the timeless A6. The Q SUVs together bring in about 300 sales a month. The cheapest Q3 obviously leads, no surprise there, but what is surprising is the Q7 (old & new) outselling the cheaper Q5 (a 'neither here nor there' SUV). Till mid-2012, BMW was the no.1 luxury car maker in India. Now, it's a distant 3rd. Ask BMW why its sales are so low and pat comes the reply "we are focussing on profitability, not volumes at the cost of discounting". Which is ridiculous because the 3 & 5-Series always have schemes running with 5 - 10 lakhs off the MRP  ! BMW under the leadership of Philipp von Sahr is doing a very poor job. He simply doesn't have the aggression or push of previous MD, Andreas Schaaf. BMW isn't able to sell the 3-Series, despite a competent product & heavy discounting (December = only 149 3-Series sold). Incredibly shoddy performance. Looking at the limited data we have, the 5-Series (sedan & GT) seem to be the sales leaders, followed by the 3-Series & X1. The X3 sold 70 units in December which is pretty good, but the more expensive X5 is unable to move in respectable numbers (only 20 in December). ! BMW under the leadership of Philipp von Sahr is doing a very poor job. He simply doesn't have the aggression or push of previous MD, Andreas Schaaf. BMW isn't able to sell the 3-Series, despite a competent product & heavy discounting (December = only 149 3-Series sold). Incredibly shoddy performance. Looking at the limited data we have, the 5-Series (sedan & GT) seem to be the sales leaders, followed by the 3-Series & X1. The X3 sold 70 units in December which is pretty good, but the more expensive X5 is unable to move in respectable numbers (only 20 in December). It's interesting to see how the average age of a luxury car buyer is coming down. Earlier, it was the mid-40s...think 45-46. Today, it's more like 38 - 39. India rocks! Last edited by GTO : 21st January 2016 at 17:42. |

| |  (64)

Thanks (64)

Thanks

|

| The following 64 BHPians Thank GTO for this useful post: | 9thsphinx, ambivalent_98, amitpunjani, Aragorn, arjithin, Contrapunto, CrAzY dRiVeR, Debashis_1, drivebyfire, driving_smartly, Gannu_1, GetLife, iVento, Jakku, jayakumarkp, jpcoolguy, karan561, Karthik Chandra, kevintomin, Lalvaz, libranof1987, MadAbtCars, madhav14, Mahesh Prasad, MaheshY1, mazda4life, Mevtec, Mission_PGPX, mrbaddy, mustang_shelby, myavu, n:CorE, nihilanth, NirmalK, nkghai, nmenon, pankaj09, prashanthyr, psankar, PSOPS, quickdraw, Rahul Bhalgat, Rajeevraj, RavenAvi, ravradha, Rehaan, RoadSurfer, RSR, Sahil, samabhi, shreyak_ss, sidhu_hs, supertinu, The Observer, The Rationalist, theexperthand, Tsixty1, Tushar, v12, vb-saan, veyron_head, Vitalstatistiks, WorkingGuru, xs2mayank |

|