| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  40,324 views |

| | #16 | |

| BHPian Join Date: Jan 2013 Location: Cochin

Posts: 237

Thanked: 393 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Quote:

All I meant was that Mahindra could always get a bit more expertise and know how to go and make a really world class product that would be accepted anywhere in the world as a top shelf product. With all due respect, I think they are yet to build themselves and international reputation beyond their usual strengths of Value for Money and Robustness. If I am misinformed regarding Mahindra's international reputation, my apologies at the outset. | |

| |  ()

Thanks ()

Thanks

|

| |

| | #17 |

| BHPian Join Date: Sep 2015 Location: Cochin

Posts: 115

Thanked: 152 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Good thread. Mitsubishi is almost down and out in the Indian market. But in the past they created industry benchmarks. Lancer's old diesel mill is the absolute benchmark in terms of reliability. Introduced in the late 90s this car is still going and has earned people's trust. It was the most reliable diesel and even today cars with 3 lakhs Kilometres can be found. The quality of the engine took the game to a new level. In Kerala it's a very trusted engine along with Toyota's engines. Pajero is the best SUV in it's segment if luxury and off roading ability are considered together. Having said that later updated like Cedia, outlander failed to click. Mitsubishi is quite strong in it's engineering. If it brings relevant models to the Indian market then they can turn the tables. The logo of three diamonds is still trusted by Indians. I think sooner or later they will improve their market share by bringing better models. |

| |  ()

Thanks ()

Thanks

|

| | #18 | ||||||

| Senior - BHPian Join Date: Apr 2008 Location: KL 7

Posts: 2,394

Thanked: 6,310 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Quote:

I am not talking about taking over Mitsubishi because its a very strong car maker, but I am saying so because it has a LOT of potential. The same way Skoda was to VW or Chrysler to Fiat. 1) Mitsubishi is a global brand and has an established service and sales network. It will take Tata and Mahindra decades to reach the same stature and reach. 2) Tata needs a mid priced brand to compliment its existing line up and Mahindra needs a global brand period, SsangYong is simply too weak. Imagine the potential of a Xenon that is well built and competitively priced when badged a Mitsubishi, it is HUGE!! Even selling 20k of the same globally can change the fortunes of either company. The same product at the same price will never sell as much when called a Tata or Mahindra, and with nowhere near the same profit margins. eg. Great Wall sells a good quality, very competitively priced pick up called the Steed in the UK. I think they have been doing it for 5 odd years now. Common sense would mean its a better buy than a low spec'd L200 or Navara. But no one really wants them, simply because they do not know the Brand. 3) Mitsubishi might have a poor line up but they have very strong brands. Lancer, Galant, Colt, Pajero, Evo.....they are all strong brands simply lacking a good product. The moment the two combine they will sell. Imagine what simply an Evo brand can be turned into....Sports saloons, coupes, lifestyle SUVs etc...etc.. Quote:

I sat in the Mitsubishi hatchback Mirage recently. Its such a plain and overpriced car. Imagine if a well spec'd Bolt or Tiago that cost 15-20% cheaper than the Mirage!! They would sell well in almost all markets Mitsubishi were present in. The cost in marketing the models in Western markets and creating the sales/service network under their own brands will be huge for Tata and Mahindra. Break even would not happen in the near future and the financial risks are big. Even before all this understanding the regulations, tax/duty structure, homogolating their cars for each markets, all these are very challenging for new entrants. Quote:

How expensive will it be for Tata or Mahindra to develop their own mainstream electric or hybrid car (please not the E20, its not classified as a car in many markets let alone mainstream). Once they spend all this money how will they recover it. How many Indians will buy a 20+ lakh Hybrid XUV500, that Mahindra would have spent millions to develop. Quote:

My point is can they sell it?! Especially in developed markets under their own brand. It took VW a decade to turn Skoda into a considerable global carmaker. With all the financial resources, readily available platforms, cost savings, market reach, a DECADE!! Quote:

Mahindra tried very hard to enter the market with the Scorpio pick up. Years they were at it, to no avail. I have no idea at the money they threw into that attempt. Mitsubishi's struggles are because of a poor model line up, This can be fixed with investments. Money is where Mitsubishi struggles. Tata and Mahindra struggle with local expertise and poor brand recall. The chances of an American buying a Mitsubishi might be low, but the chances of him buying a Tata or Mahindra is almost zilch. Quote:

If the Outlander Sport (smaller variant) which is more expensive and nowhere near as great value as a XUV500 sold nearly 40k cars in America alone. Now if the Mahindra XUV500 sold cheaper than the Outlander Sport, how many will Mahindra sell. 30k, 20k even 10k?! Now imagine if it was rebranded Mitsubishi Outlander Plus or something, sold at an attractive price, as I mentioned before the potential is HUGE!! Mitsubishi is not an instant money maker for Tata or Mahindra, but it can be turned into one. Far easier and potentially at a much lower cost than turning their own brands into globally relevant car manufacturers. | ||||||

| |  (15)

Thanks (15)

Thanks

|

| The following 15 BHPians Thank shortbread for this useful post: | Captain Haddock, cbatrody, forester, InControl, iTNerd, Latheesh, m.shekhar, mallumowgli, n.devdath, RavenAvi, RoadSurfer, S2!!!, SnS_12, speed_edge, suyr |

| | #19 | |

| BHPian Join Date: Sep 2015 Location: Cochin

Posts: 115

Thanked: 152 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Quote:

Brilliant market analysis. It is true that TATA and Mahindra can benefit from owning the Mitsubishi brand in terms of marketing their products overseas. Brilliant market analysis. It is true that TATA and Mahindra can benefit from owning the Mitsubishi brand in terms of marketing their products overseas. But the engineering superiority enjoyed by Mitsubishi cannot be ignored. Mahindra and Tata are on a learning curve. They cannot design, built high end cars on their own from scratch. Tata's estate was heavily inspired by Benz's estate, Mahindra created Scorpio after heavy out sourcing. Tata owning Jaguar & LandRover only gives them access to high end technology but it takes time for them to assimilate that into Tata motors, till then they will remain separate entities. XUV is a great product but can Mahindra's production lines ensure the same consistency as that of Mitsubishi's ? Mitsubishi when it manufactured lower end cars like Lancer and Cedia, they had far better quality control than Tata & Mahindra. Mitsubishi's experience in manufacturing high end cars is absolutely several notches above Tata & M&M's. I think if Mitsubishi is bought, which is hypothetical then the engineering part would be the ace up the sleeve rather than just rebadging. Last edited by Captain Haddock : 27th April 2016 at 23:23. Reason: syntax check | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Captain Haddock for this useful post: | cbatrody |

| | #20 |

| Distinguished - BHPian  | re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Yes, its true that Mitsubishi is sinking and acquisition by cash rich companies on the prowl cannot be ruled out. Corporate predators with gameplans may already be flexing their muscles around the world. Like Late Mr R.P. Goenka, the patriarch of the RPG empire, hardly built any industry from the land and foundation upwards. The RPG Group always bought sick and ailing companies with brand equity, nursed them, revived them and made their fortunes. HMV was sinking due to piracy of recorded music with companies like T series and illegal music cassettes having a field day and the RPG group bought HMV, revived it and has made a fortune. Dunlop India was bought by RPG from its British management as an ailing company that was well revived, but later predator and liquor king Mr Manu Chabbria spoiled the RPG gameplan having bought a majority stake, mismanaging the company, leading it into losses and then abandoning it soon after. Purchase of Japanese company shares/ equity stakes are guided by their protective domestic corporate laws, but not so tough to acquire. Renault has bought into Nissan Motors, when the latter was making losses. GM has shares of Suzuki Motor Corporation that helped it get our "Esteem's" Japanese hatch and market it as the Geo Metro in the US. I am not able to comment as to whether Mahindra or Tata will make moves to acquire stakes in Mitsubishi Motors as their priorities are very focused and wherever there is a vacuum in any sphere of their business they make predatory moves. Mahindra acquiring a majority stake in Pininfarina, Italy was to get a stronghold in their own hitherto weak design faculties. Their acquisition of a majority stake in Peugeot's two wheeler business was to strengthen their own two wheeler company, that's going nowhere despite the "O's" in the Gusto, Mojo, Rodeo, Duro and so on. About Tata, there are doubts as they are already under fire with their once very profit making, British steel business. Licking their major wounds, they may not venture so quickly into another acquisition. With JLR doing so well under their umbrella, they are much better off and hardly may bother to bring in a weak global brand into their fold. Last edited by anjan_c2007 : 27th April 2016 at 23:43. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks anjan_c2007 for this useful post: | S2!!! |

| | #21 | |

| Senior - BHPian | re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Quote:

That said, like other members have pointed out, buying controlling stake in a Japanese company is extremely far-fetched. Heck even the giant VW could not hold on to a 20% stake in a relatively small family-run Japanese company; Suzuki. So I'd say the chances of Mahindra or Tata getting their hands on majority shares in Mitsubishi, are non-existent. Last edited by IshaanIan : 28th April 2016 at 00:42. | |

| |  ()

Thanks ()

Thanks

|

| | #22 |

| BHPian Join Date: Mar 2006 Location: Bangalore

Posts: 329

Thanked: 532 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Cyrus Mistry is very clear that the growth lies in India, irrespective of how JLR has delivered. Hence, a lot of his decisions (including but not restricted to Corus sell off) are to shed foreign assets and focus inwards on India business. The uncertainty around steel prices makes it even more tough to manage a global production base. I think Tata will like to hunker down and consolidate gains on the current TM launches before it looks to expand it's brand portfolio. |

| |  ()

Thanks ()

Thanks

|

| | #23 | |

| BHPian Join Date: May 2014 Location: in Transit

Posts: 165

Thanked: 683 Times

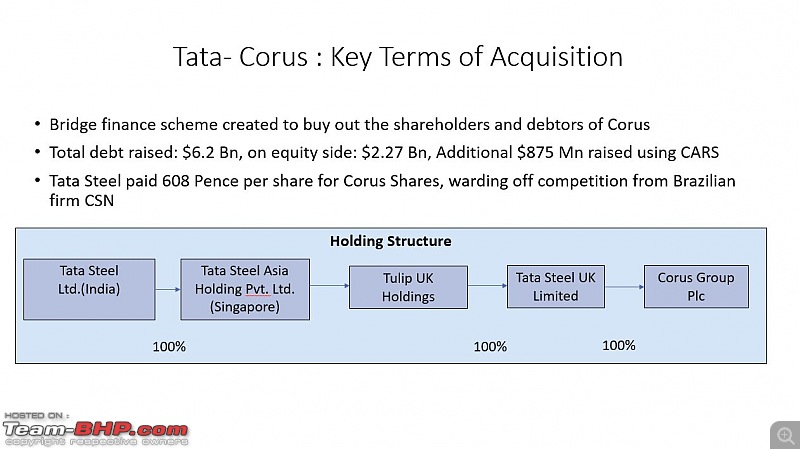

| Re: Mitsubishi: a prime takeover target for Tata/M&M ? Off topic:  Quote:

So in essence, Tata Corus Deal debt has nothing to do with any acquisitions that Tata Motors may do in future. Also, if I'm not wrong, the various entities are listed separately on stock exchanges and would have their own credit ratings. This shows their debt capacity would be independent of each other's fortunes and solely dependent on their own organization. Additionally, Tata Corus deal was structured in such a way that a different company holds Corus Steel Plc.  Here's a slide from the presentation I made, on the holding structure. So the debt Tata's took for taking over Corus, is essentially on books of Corus, guaranteed by the assets and collateral from Corus, which is held by a different firm. Now, Tata just has to sell of Corus to get rid of the debt. and this process has already initiated. It was a very interesting deal, wherein Tata took over a firm which was a lot larger than Tata itself, and only few such deals have happened in Merger & Acquisition history. I'll be more than happy to explain further if people are interested. | |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank LordSharan for this useful post: | a*ed, InControl, Kool_Kid, m.shekhar |

| | #24 | |

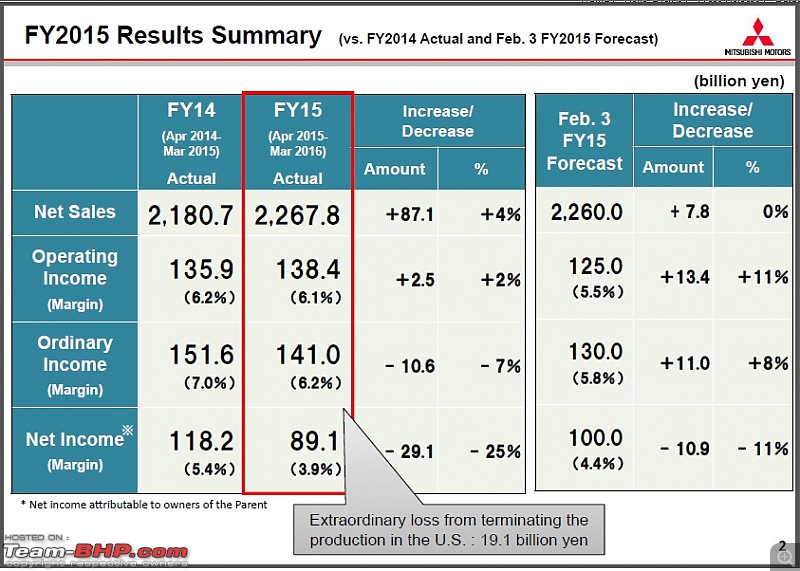

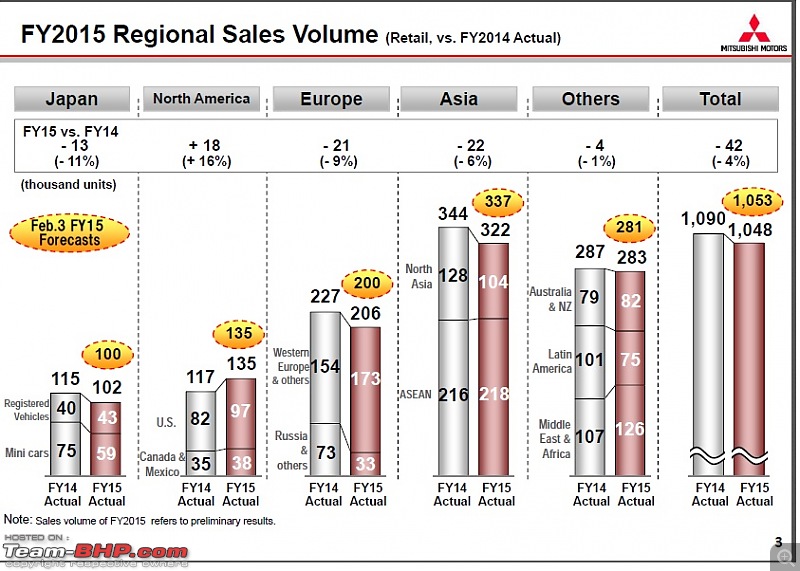

| BHPian | re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! It doesn’t look like they are doing badly if you look at their “Full Year Fiscal 2015 Operating Results”, announced on the 27th of April for the year ending 31st Mar 2016. There seems to be an extraordinary loss in its non-consolidated financial results due to terminating the production in the US. Also, they have kept the “full-year FY2016 (April 1, 2016 through March 31, 2017)” forecast on hold as they are in the process of assessing the ‘Mileage Scandal’ impact on their sales.

Press Release: Quote:

Source: http://www.mitsubishi-motors.com/pub...etail1002.html | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks cbatrody for this useful post: | ankan.m.blr |

| | #25 |

| Senior - BHPian Join Date: Dec 2008 Location: 144022

Posts: 1,235

Thanked: 3,130 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! This would be a marriage made in hell, if ever Tata or a Mahindra did manage to circumvent all the crossholdings to pick up a majority stake in Mitsubishi Motors. Cultural fit is a very big challenge in M&As. Companies operating in same countries, in same industries will have vastly different cultures. Think -IBM vs Google. And here we are imagining an integration between a Japanese auto maker and an Indian auto maker. Even if there are many technical synergies present, the day I hear M&M is even pursuing such a transaction I will offload all my M&M shares. Even before I look at any other aspect, I feel the cultural challenges will be insurmountable. This is not to generalize that M&As can't happen between Indian and Japanese companies. But specific to this case where a traditional Japanese corporation with its own history of producing cars/SUVs is being suggested to be brought over by relatively novice Indian auto makers. I can't harp more on the word 'traditional' and 'own history' especially in the context of Japan. |

| |  ()

Thanks ()

Thanks

|

| | #26 | |

| BHPian Join Date: Jan 2015 Location: Gurgaon

Posts: 185

Thanked: 241 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Quote:

By the way, the price of Mitsubishi Motors stock has jumped up today at Tokyo Exchange, perhaps on inspiration from this post  Mitsubishi is certainty not Honda, but still a formidable and respected auto-mobile brand globally. If I am right, the market can of Mitsubishi Motors is less than one tenth of Honda and a strategic investor may see value. | |

| |  ()

Thanks ()

Thanks

|

| |

| | #27 |

| BHPian Join Date: Aug 2009 Location: Bangalore

Posts: 583

Thanked: 698 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Does Tata or Mahindra really need to buy Mitsubishi? I dont think so. The costs (both money and otherwise) of buying a company like Mitsu would far outweigh the benefits that M&M or Tata would derive out of the acquisition. In the case of M&M, they both know how to build good SUVs and Electric Cars. In the case of Tata, they have the JLR to ask if they need expertise in making good cars. Hence I dont think both have a real need to buy a failing company like Mitsubishi. BTW, good luck with the buying if they ever choose to that! As I see on the internet, Mitsubishi motors is part of a conglomerate of about 40 companies who all hold a stake in Mitsubishi motors and in each other, and none of them hold a controlling stake! So I guess Tata and M&M will need the go-ahead of these 40 guys to be able to lay their hands on Mitsu. |

| |  ()

Thanks ()

Thanks

|

| | #28 |

| BHPian Join Date: Dec 2015 Location: Udupi, M'lore

Posts: 55

Thanked: 42 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! You have got a point. Hypothetically speaking, the brand Mitsubishi suits M&M more than TATA. Mitsubishi is known for their off-roaders which is also Mahindra's forte. TATA already have their hands full with JLR. If they can turn JLR around, then that would be great. Global economy isn't really favorable now for luxury car makers. Mitsubishi could be one fish too many for them to bite. |

| |  ()

Thanks ()

Thanks

|

| | #29 | |

| BHPian Join Date: Oct 2014 Location: NCR/Turin

Posts: 639

Thanked: 1,534 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Quote:

While we may throw bricks at Tata, the fact remains that they managed to do something which the brits,BMW and ford couldn't have dreamt of, made JLR profitable and back in game. I am confident that Jag just might overtake one of the German trio in the future judging by the direction they're heading. Last edited by Doge : 28th April 2016 at 23:19. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Doge for this useful post: | Captain Haddock |

| | #30 | |

| BHPian Join Date: Sep 2015 Location: Cochin

Posts: 115

Thanked: 152 Times

| re: Mitsubishi: A prime takeover target for Tata or Mahindra? EDIT: Nope it's Nissan! Quote:

M&Ms current flagship the XUV would be an entry level MUV in the west(Well below US spec Outlander sport). Even if they manage to design and manufacture a car similar to a pajero it would be from a virtually unknown brand (Tata is better off as far as global brand perception is concerned, because of the enormous size of the conglomerate and the fact that the Nano and JLR acquisition created a lot of buzz). Mitsubishi is reeling under financial crisis but is leagues ahead of brands like M&M as far as engineering and brand perception is concerned. They are pretty resilient and have survived atom bombs and world wars. It would be nearly impossible to rip Mitsubishi motors off from the larger consortium, but if a firm like M&M can do that, then it would give them a big push in engineering and global brand perception. Based on my limited knowledge I cannot agree to the view that M&M's engineering and global presence is so advanced that acquiring a firm like Mitsubishi would be just a liability. | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank Captain Haddock for this useful post: | cbatrody, nmenon |

|