| | #76 | |

| Senior - BHPian Join Date: Apr 2008 Location: KL 7

Posts: 2,387

Thanked: 6,265 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group Quote:

Firstly since age has been bandied about a lot on this thread, Ratan Tata was much older than Mr.Mistry when he took over from JRD. He turned TELCO which was essentially a commercial vehicle maker into what Tata Motors is today. He initiated Tata to move into the passenger automotive space which started with two duds and then followed up with the successful Sumo. In 1998 launched India's first indigenous passenger car and to date is the only Indian passenger car maker! After the sales decline of the Indica his head was on the line and he offered to resign as well. It was his hands on approach that helped improve the car and made the V2 variant into a success. The JLR takeover was panned by almost every analyst at home and abroad. A company that never found success under multiple ownerships including giants BMW and Ford, today under Tata ownership has become the envy of the automotive world. Ian Callum himself admitted the F type would not have happened had it not been for Ratan Tata's insistence. They are reaping the rewards today of the heavy R&D expenditure they put in during the down time. Tata's commercial division saw growth with its first major international acquisition, Daewoo commercial - which was then turned into a success story. Even their portfolio was expanded rather than relying on antiquated models and moving into medium and light segments. No doubt there has been pitfalls. Model execution and marketing have always been Tata's pitfalls. Plenty of models that were great initiatives and launched at the right time but never really became the success they could have been. Safari, new Indica, Indigo, Aria etc That phase which has weighed heavily on the Tata brand saw the decline in sales and the company lose a lot of momentum. That said the company never gave up, the latest range of much improved models are based on the foundation laid by them and the lessons learnt from their failures. Even the positive outweigh the negatives by far. What Ratan Tata always showed was initiative and this was exactly what turned a loss-maker into a USD 40 billion dollar organisation, one that makes more money than Suzuki's entire global operations and M&M combined! I cannot claim to know what Cyrus Mistry has been planning for 4 years for Tata Motors going forward, but rest assured having Ratan Tata back even if temporary is not a bad thing for the company! | |

| |  (21)

Thanks (21)

Thanks

|

| The following 21 BHPians Thank shortbread for this useful post: | AbhisheKulkarni, desdemona, doxinboy, Gannu_1, GrammarNazi, GTO, hillsnrains, mh09ad5578, n.devdath, Nissan1180, Prowler, Puneet.S, rameshnanda, Ravindra M, Samurai, searchingheaven, stanjohn123, swiftnfurious, The Rationalist, TheARUN, vijit.gangwar |

| |

| | #77 |

| Senior - BHPian Join Date: Jul 2009 Location: Pune

Posts: 2,677

Thanked: 1,784 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group More reasons coming to light, and there isn't a whiff of any integrity issues. One alleged reason - one of many that led to this state of affairs, but one that TBHP can debate: "For example, Mistry signaled that the Nano -- developed by Ratan Tata after he saw a family of four on a scooter on a rainy evening -- should be scrapped as the project was consistently unprofitable and at its peak lost 10 billion rupees. "As there is no line of sight to profitability for the Nano, any turnaround strategy for the company requires to shut it down," Mistry wrote. "Emotional reasons alone have kept us away from this crucial decision.” Most of the differences in other areas/businesses run on similar lines. On this specific one, let the debates begin! |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank Sawyer for this useful post: | GTO, mh09ad5578, stanjohn123 |

| | #78 |

| Senior - BHPian Join Date: Dec 2008 Location: 144022

Posts: 1,233

Thanked: 3,119 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group Here is the link to Mr Mistry's actual email: http://im.rediff.com/money/2016/oct/...y-emailnew.pdf Hindsight is 6 by 6. In hindsight, I do think many of Mr. Ratan Tata's strategies or plans were faulty and over grandiose. I liked how the organization was moving under Mr. Mistry. Of the two Tata businesses I am tracking - coffee and chemicals - I think he did a good move by dis investing from fertilizers. Just connecting some dots backwards - and this may mean nothing actually. I found it rather curious when certain tweets were made from Mr. Tata's twitter account and later attributed to hacking. Then, only just some weeks back Economist - the stupid, but hallowed British fortnightly- published a critical article on the performance of Tata group. I do realize that Tata by way of its British acquisitions can be quite important to British, but still the timing seems uncanny. I for one am left thinking that somebody was stopped from doing good work. Last edited by rrsteer : 26th October 2016 at 20:32. |

| |  (7)

Thanks (7)

Thanks

|

| The following 7 BHPians Thank rrsteer for this useful post: | GrammarNazi, GTO, mh09ad5578, sairamboko, sanstorm, swiftnfurious, The Rationalist |

| | #79 | |

| Distinguished - BHPian  | re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group Too much speculation - if not Only speculation about the reasons for this. People shouting around and making comments are possibly upset about the happenings -- but for what ?

Quote:

1) What would a 80 year old bachelor gain by bringing down the CEO ? 2) SOmething as big as this most likely has the concurrence of the biggest share holders - i.e., the SP family. If the SP family is not involved With the change, then it can only mean a split in the Tata Sons group. | |

| |  ()

Thanks ()

Thanks

|

| | #80 |

| BHPian Join Date: Nov 2007 Location: Bangalore

Posts: 941

Thanked: 1,448 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group I don't even think this has anything to do with Tata motors. They are a global conglomerate. They don't focus on just one profit / loss making business and take a call. This is more to do with perception and succession planning. I am sure Ratan would've wondered what happens to Tata group once he's gone. It's always best to have some direct heritage into such companies as sooner or later, the founding family can find itself marginalized. I, for one, don't have a doubt that Ratan will do what needs to be done. When it's such a large group, one has also to think a bit more compassionately in terms of employees and grievances. Just running after profit with no social responsibility doesn't do a whole lot to the image of the conglomerate. He can bring this and Cyrus, in my personal opinion, didn't showcase himself as that. Remember our thread about values and why they are needed? This is one area where large companies have to follow values, even at a dent of profits, just to make sure they are respected in the global forum. |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank Mad Max for this useful post: | GTO, psankar, Puneet.S |

| | #81 |

| Senior - BHPian Join Date: Mar 2010 Location: Bangalore

Posts: 1,311

Thanked: 5,240 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group I am quite perplexed whe some are saying we should not speculate. But who is really forcing people to speculate? Why is no clarity coming from the board or the interim chairman? I am also quite surprised how people are blindly adoring Ratan Tata. He is just a businessman not a saint. Public memory is too short. We all heard him doing wheeling and dealing in Nira Radia tapes. He has done this board coups many times in the past if you examine history of this company. So why should one always whitewash TATA group citing their ethics and principles. I am tired of hearing Ratan Tata can't do anything wrong. We are talking here about a company of accumulated debt of around $26B, most of which happened during Mr Tata's tenure.I have not seen a single instance in the recent past where they showed their compassionate side be it Singur logjam or TCS headcount reduction. They are just like any other Indian business house with a great family overhang. One may soon see murky politics being played full force in this whole drama. Mistry meeting PM, all legal advisors of Tata group, ex Congress ministers. Lot of mystery in all this. Last edited by poloman : 26th October 2016 at 21:11. |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank poloman for this useful post: | comfortablynumb, cpbopanna, GrammarNazi, GTO, sanstorm, swiftdiesel |

| | #82 | |

| Senior - BHPian Join Date: Jul 2009 Location: Pune

Posts: 2,677

Thanked: 1,784 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group Quote:

The other Tata - Noel - isn't someone with much credibility which is why he wasn't considered earlier. On a different subject, the full text of the Mistry email - assuming it is genuine -raises many legitimate concerns that the new leadership is going to have their hands full explaining away, AND, more importantly, doing something to fix the issues raised. Brand TATA has taken a big hit in three days. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Sawyer for this useful post: | GTO |

| | #83 |

| Senior - BHPian | Tata Group could see $18 billion in writedowns : Cyrus Highlights •In an email, Cyrus Mistry has blamed Ratan Tata for constant interference. •Mistry said Tata Group companies face potential writedowns to the tune of close to $18 billion. •Tata is said to have become increasingly frustrated by Mistry's focus on divestments. "I cannot believe that I was removed on grounds of non-performance," Cyrus said going on to point to two directors, who voted for his removal, only recently lauding and commending his performance. Detailing out the problems he inherited in several Tata group firms, Mistry in his letter said the foreign acquisition strategy with the exceptions of JLR and Tetley, had left a large debt overhang. Cyrus alleged that it was Tata who forced the Group to foray into the aviation sector by making him a 'fait accompli' to joining hands with Air Asia and Singapore Airlines and making capital infusion higher than initial commitment. Also, "ethical concerns" had been raised over certain transactions and a "recent forensic investigation revealed fraudulent transactions of Rs 22 crore involving non-existent parties in India and Singapore. More Details |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank djay99 for this useful post: | GrammarNazi, GTO, Strella, The Rationalist |

| | #84 |

| BHPian Join Date: Sep 2015 Location: Madras

Posts: 857

Thanked: 3,198 Times

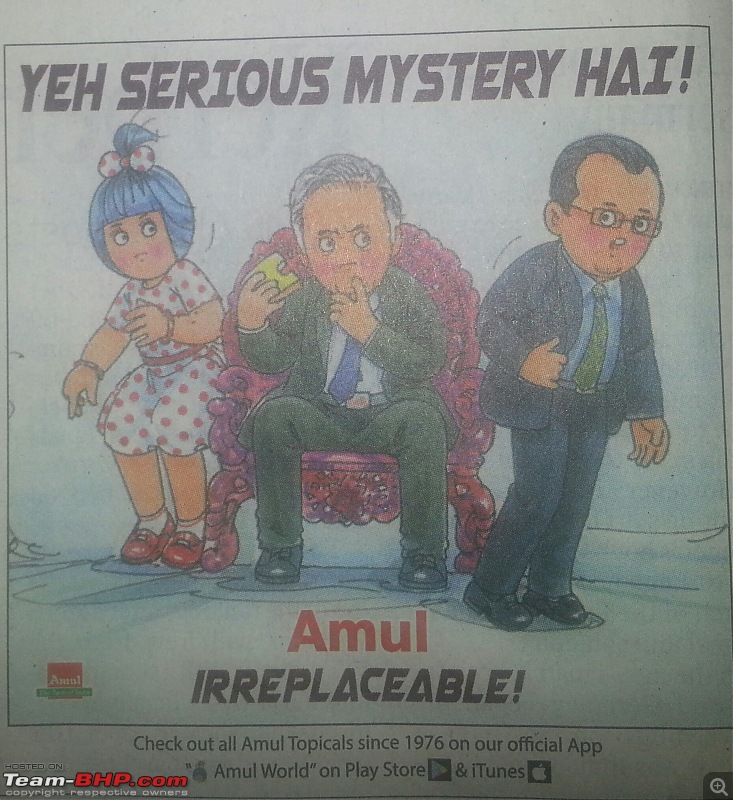

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group |

| |  (9)

Thanks (9)

Thanks

|

| The following 9 BHPians Thank Karthik Chandra for this useful post: | CrAzY dRiVeR, doxinboy, dZired, FlyingSpur, GTO, nishsingh, Strella, The Rationalist, wheelguy |

| | #85 | |

| Senior - BHPian Join Date: Jul 2009 Location: Pune

Posts: 2,677

Thanked: 1,784 Times

| Quote:

And on the lighter side, but not in jest: Mistry was sacked for telling the group companies what my three year old granddaughter sometimes hears from her mother: Your eyes are bigger than your stomach. Last edited by GTO : 27th October 2016 at 11:01. Reason: Merging back to back posts | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank Sawyer for this useful post: | cpbopanna, GTO |

| | #86 |

| BHPian Join Date: Aug 2008 Location: Delhi

Posts: 371

Thanked: 721 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group I for one believe that business cant always be about balance sheets. I think Mr Mistry was too focussed on balance sheets which I think is not the way the TATA group goes about doing things. Purely my opinion ! |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks coldice4u for this useful post: | GTO |

| |

| | #87 |

| Senior - BHPian Join Date: Jul 2009 Location: Pune

Posts: 2,677

Thanked: 1,784 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group I don't know all the truth of things - obviously - but perhaps he was forced to be so focussed because of how the balance sheet for the group looked like when it was handed over to him? Fundamentally, business is about profits, like it or not. And the Tata group cannot say we will not make profits because we are so good at all other things we claim to do better than others; profits pay for these activities after all. There is a very strange interview given to NDTV by a trustee of one of the Tata Trusts, a very strange person named VR Mehta. Supposedly given to justify the decision, he does exactly the opposite, when you read the Mistry email and combine it with what is said in the interview. In fact his biggest criticism of Mistry is that he was not delivering enough profits and dividends to the Trusts! More and more, the thing looks like Alice in Wonderland. Off with his head, said the Queen of hearts, when she did not like what someone said. Last edited by Sawyer : 27th October 2016 at 10:10. |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank Sawyer for this useful post: | cpbopanna, GTO, naveenroy, The Rationalist, the_skyliner, wheelguy |

| | #88 | |

| BHPian Join Date: Aug 2013 Location: Pune

Posts: 868

Thanked: 1,519 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group Quote:

True, Tatas believe in giving back to the society but how can they do that if they fail to acquire it (through profits) in the first place? Mr. Mistry's point about Nano's losses is very crucial. A company can not carry on with a huge burden of a loss making product (with no foreseeable future) to protect "pride". Moving on at the right time is a key to success nowadays. I am not sure if it is true but I heard this quote of RNT: "I do not believe in taking right decision, I take decision and make it right". Well, sorry Mr. Tata, that is just proving your decision to be correct at any cost. That's not good business. | |

| |  (8)

Thanks (8)

Thanks

|

| The following 8 BHPians Thank the_skyliner for this useful post: | BKN, GTO, rrsteer, sairamboko, Sawyer, swiftnfurious, The Rationalist, wheelguy |

| | #89 |

| Distinguished - BHPian  | re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group Tatas have always tried to give back to the society in some way or the other. Airlines, educational institutions, hospitals, telecom, chemicals and what not. Almost all the sectors in which they operate, they always have the cheapest/VFM but good quality offering along with premium products. I can give several examples such as: - Ginger vs. Taj - Nano/Indica vs. Aria - Tata Agni vs. Tata Tea Gold - Voltas low end AC vs. high end ones - Sonata vs. Edge/Raga and the likes - Tata Docomo, Tata Swacch, Amalgamated Plantations, Tata Salt, etc No doubt about it that many of these would be burning money while some others will be earning it. For a typical businessman, the businesses burning/not earning much, would be wastage of time and resources. I completely agree that it wouldn't make business sense. Profitability and eventual shareholder value creation are the prime metrics. For Tatas, they have always done business while taking care of all the stakeholders (not only shareholders) and from the profits reaped, they have tried to invest a portion of it for the society. It has been their commitment since ages and their metrics probably has been something like "impact on the society for each of their action". These difference in vision in the first and the second approach of doing business will always lead to conflicts. And that is what has happened. PS: I, for one, buy a product blindly if it has "A Tata Enterprise" written on it. I feel assured that this product won't harm me. I have never been disappointed. I have been an ex-TCS employee and have several relatives/acquaintances at various levels in Tata group of companies. I haven't heard any complaints from any of them except for being a bit slow and laid-back in certain cases. PPS: If anyone has seen the Dark Knight movie series, I can somehow relate the very last dialogue of DK to the Tatas. And also, the initial part of DKR where Bruce Wayne (Ratan Tata) asks Alfred as to why the donations dried up and Alfred (Cyrus) replies there is no profit generated to fund those activities. Also the part in Batman Begins, where Bruce buys all the company shares in open market to take back the rein of his company. Sorry for such a lengthy post which is so off topic. Last edited by ashis89 : 27th October 2016 at 11:07. |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank ashis89 for this useful post: | Latheesh, Prafful_Rathod |

| | #90 | |

| BHPian Join Date: Aug 2013 Location: Pune

Posts: 175

Thanked: 503 Times

| re: Cyrus Mistry Out : N Chandra In as Chairman of Tata Group The explosive letter from Mistry to Tata Sons board in full. Quote:

Last edited by catchjyoti : 27th October 2016 at 11:36. Reason: Added link to source news | |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank catchjyoti for this useful post: | Karthik Chandra, Maky, The Rationalist |

|