| |||||||

|

| Search this Thread |  89,854 views |

| | #1 |

| Team-BHP Support  | |

| |  (55)

Thanks (55)

Thanks

|

| |

| | #2 |

| BHPian Join Date: Sep 2015 Location: Madras

Posts: 857

Thanked: 3,198 Times

| |

| |  (15)

Thanks (15)

Thanks

|

| | #3 |

| BHPian | |

| |  (9)

Thanks (9)

Thanks

|

| | #4 |

| Team-BHP Support  | |

| |  (38)

Thanks (38)

Thanks

|

| | #5 |

| BHPian Join Date: Jan 2005 Location: Coorg

Posts: 455

Thanked: 877 Times

| |

| |  (10)

Thanks (10)

Thanks

|

| | #6 |

| Team-BHP Support  | |

| |  (23)

Thanks (23)

Thanks

|

| | #7 |

| BHPian Join Date: Jan 2013 Location: Jaipur

Posts: 688

Thanked: 1,812 Times

| |

| |  (13)

Thanks (13)

Thanks

|

| | #8 |

| Team-BHP Support  | |

| |  (13)

Thanks (13)

Thanks

|

| | #9 |

| BHPian Join Date: Apr 2016 Location: Gurgaon

Posts: 72

Thanked: 132 Times

| |

| |  (5)

Thanks (5)

Thanks

|

| | #10 |

| BHPian Join Date: Nov 2013 Location: KL-7/ KL-8

Posts: 362

Thanked: 712 Times

| |

| |  (3)

Thanks (3)

Thanks

|

| | #11 |

| Team-BHP Support  | |

| |  (13)

Thanks (13)

Thanks

|

| |

| | #12 |

| BHPian Join Date: Dec 2014 Location: Jaipur, Noida

Posts: 318

Thanked: 1,123 Times

| |

| |  (13)

Thanks (13)

Thanks

|

| | #13 |

| Senior - BHPian Join Date: Jul 2016 Location: Hyderabad

Posts: 1,038

Thanked: 1,511 Times

| |

| |  (7)

Thanks (7)

Thanks

|

| | #14 |

| BHPian Join Date: Dec 2009 Location: Bangalore

Posts: 34

Thanked: 79 Times

| |

| |  (5)

Thanks (5)

Thanks

|

| | #15 |

| BHPian | |

| |  (14)

Thanks (14)

Thanks

|

|

Most Viewed

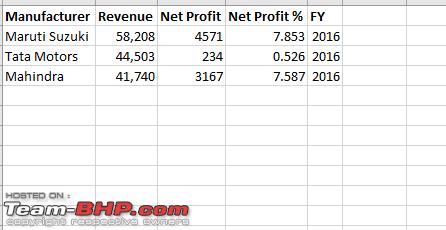

. I have always wondered how much the auto companies make and this gives a fairly clear picture.

. I have always wondered how much the auto companies make and this gives a fairly clear picture.

.

.  . Using the same cheap dashboard didn't do them too good.

. Using the same cheap dashboard didn't do them too good.