| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  55,029 views |

| | #1 |

| Team-BHP Support  | Dear Manufacturers, this is where opportunities lie PURPOSE OF THIS THREAD: To see if manufacturers have an opportunity to introduce a new car - * of a particular body shape (hatch, sedan, SUV, MPV) * and size (length / width) * at a particular price point * and chassis features (FWD/RWD/AWD, body-on-frame/monocoque) and achieve reasonably high probability of success (assuming the product is decent enough). As an extension of above, to see if us customers are facing a dearth of options in certain pockets - despite having 15 manufacturers and 100 models to choose from. CAVEATS: Just because a sub-segment has very few competitors, it does not guarantee success if a new model is introduced. Conversely, even if a sub-segment has 15 competitors, a newly introduced model can still take away share from others or even expand the size of the sub-segment (market). Anyway, Based on the above parameters, vehicles under each body shape have been categorised under 4 or 5 sub-segments -   Last edited by SmartCat : 10th April 2017 at 17:12. |

| |  (72)

Thanks (72)

Thanks

|

| The following 72 BHPians Thank SmartCat for this useful post: | 400notout, 9thsphinx, ACFT, AGwagon, amitjha086, anshumandun, aviat18, Avikbrio, BlackPearl, CarguyNish, cbatrody, Crazy_cars_guy, DevendraG, Dusk Tiger, dZired, Enobarbus, fuel_addict, Grand Drive, GTO, highway_star, hiren.mistry, IN07KL0484, InControl, IshaanIan, ishankpatel, jetsetgo08, johannskaria, Karthik Chandra, kat, Kiterunner, KPS, Latheesh, Lij, mayank0782, NPV, Ponbaarathi, prashanthyr, procrj, PVS, R2D2, Rajeevraj, RavenAvi, Rehaan, RICK004, RoadSurfer, roby_dk, rshanker, rsquared, RSR, S.MJet, sahibrain, samm, sbkumar, shanoj, Sheel, Simhi, sooraj.naik, spanner777, sri2012, subbu567, swiftnfurious, Teesh@BHP, theexperthand, thewhiteknight, timuseravan, Torino, turbospooler, V.Narayan, vb-saan, Vik0728, volkman10, wilful |

| |

| | #2 |

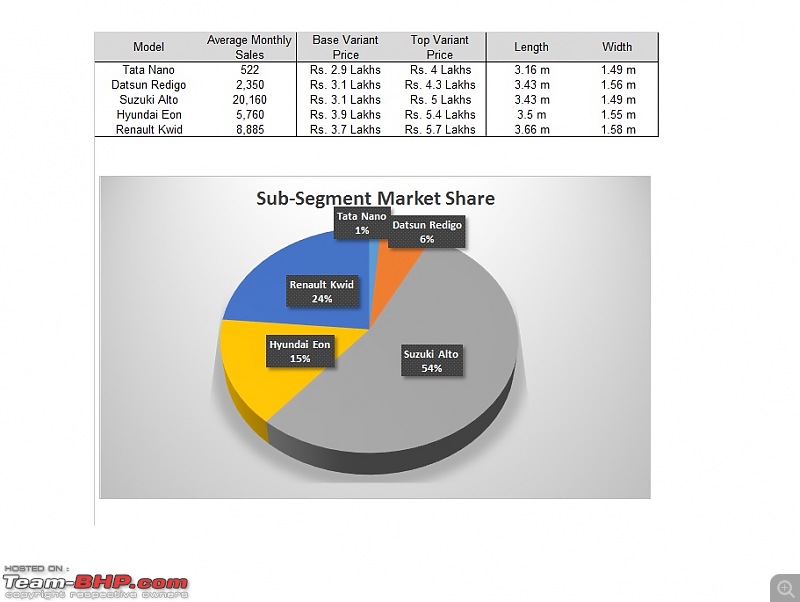

| Team-BHP Support  | re: Dear Manufacturers, this is where opportunities lie SUB-SEGMENT 1 (HATCHES):  Comments: 1) Average monthly sales for each model is sum of last 6 month sales divided by 6. Prices are on-road Mumbai. 2) The segment clocks an average of 38,000 units per month, with just 5 competitors. If a newly introduced model manages to clock even 6,000 per month, it is quite a big deal. If we assume Rs. 2.5 Lacs as the average ex-factory price (before all taxes), we are looking at topline of 6000 units x Rs. 2.5 Lakhs x 12 months = Rs. 1,800 cr per year. 3) Margins are likely to be extremely low though. Also, any model introduced in this segment needs to be developed from a clean sheet of paper. 4) Still, seems like a great opportunity, but remember that there is an elephant in the room - ALTO. The name is a brand in itself with 54% market share. If a manufacturer intends to bring a dull cheap car with the intention of TAKING AWAY market share from the Alto, that is not going to happen. Note that even as the number of contenders are increasing at slow pace, Alto has managed to increase the number of units sold over time. 5) This means any newly introduced model is likely to expand the segment, as long as it has an USP. Success of Eon and Kwid proves that you really don't have to price the car at Alto levels. Eon scores with its sharp looks and great interiors, while Kwid has that desirability factor (SUV looks) 6) The reason for failure of Tata Nano is apparent when you look at its base variant price, and compare it with others in the segment - especially Alto and RediGo. In EMI terms, Rs. 20,000 is not much. What you get with Alto and Redigo (when compared to Nano) is a more complete car (speed not limited to just 100 kmph, large boot, powerful engine, large fuel tank) 7) Good opportunity for Nano 2.0, with all its flaws fixed. It would probably involve ditching the engine in order to compete with others. For other manufacturers, there is scope for introducing new cars between price points Rs. 3.1 Lakhs (RediGo/Alto/Nano) and Rs. 3.8 Lakhs (Kwid/Eon) Last edited by SmartCat : 10th April 2017 at 12:30. |

| |  (45)

Thanks (45)

Thanks

|

| The following 45 BHPians Thank SmartCat for this useful post: | AGwagon, amitjha086, Avikbrio, avinash_clt, BlackPearl, CarguyNish, Crazy_cars_guy, DevendraG, Enobarbus, fuel_addict, GTO, hiren.mistry, IshaanIan, ishankpatel, johannskaria, Karthik Chandra, Keynote, KPS, Lij, mayank0782, NPV, procrj, Rajeevraj, RavenAvi, Ravi Parwan, Rehaan, RICK004, romeomidhun, rshanker, rsquared, RSR, S.MJet, Sheel, Simhi, sooraj.naik, spanner777, sri2012, subbu567, swiftnfurious, Teesh@BHP, theexperthand, Torino, V.Narayan, v12, vb-saan |

| | #3 |

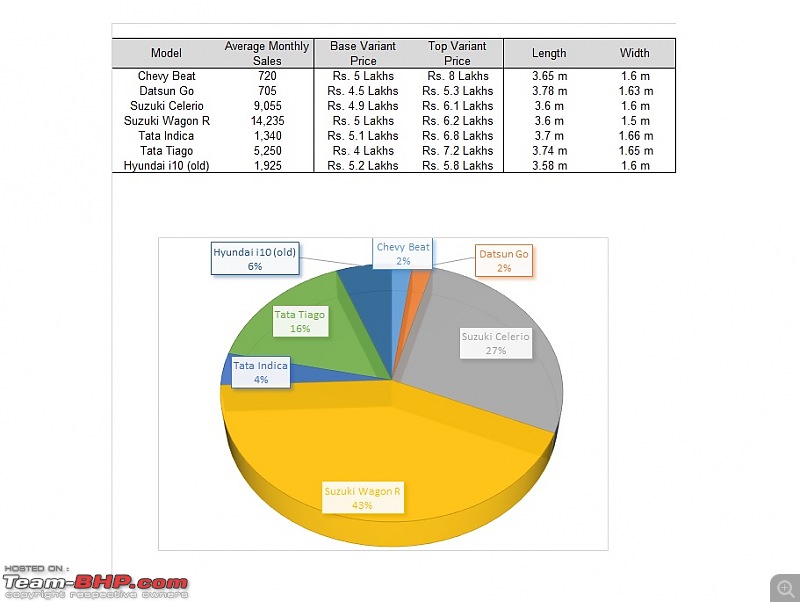

| Team-BHP Support  | re: Dear Manufacturers, this is where opportunities lie SUB-SEGMENT 2 (HATCHES)  Comments: 1) A segment in between Alto and Swift, with combined volumes of 33,000 units per month. Seems quite busy with 7 options to choose from. 2) But here is the deal. The old i10 production and sales have stopped. It is rumored that old gal Indica's production will be stopped soon. And it is rumoured that GM India is exiting idea, so out goes Chevy Beat too. So in this important segment, we as customers have only 4 models to choose from. Four! 3) The segment seems to be a duopoly between Wagon R and Celerio. But these models don't have the strong brand pull of Alto. These two models were originally selling 10,000 units and 5,000 units per month for a long time, before creeping up slowly. Very likely due to lack of decent alternatives from other brands. If manufacturers want to take away market share from Maruti, this is a segment they should closely look at. 4) Tata Tiago's success in this segment is a good sign (for customers). Hyundai is planning to reintroduce the Santro brand (new model) to take on Wagon R (Year 2003 redux). Datsun Go's low sales when compared to RediGo's 2500 units implies that Datsun has decent customer walk-ins, but they are not picking up Datsun Go. It might help if more premium variants are introduced (with ABS, touchscreen, power mirrors, alloys etc). Renault could also further take the Kwid upmarket. 5) It's best to introduce petrol only models in this segment. Or perhaps petrol + LPG or petrol + CNG. If a diesel is introduced, it has to be cheap to manufacture (2 or 3 cylinder) because this is a price sensitive segment. One cannot have a Rs. 1 Lakh premium over the petrol variant. But low cost diesel engines will have NVH issues, driving customers away. Both Wagon R and Celerio are petrol only cars now. Tiago too is reported to have a 75:25 petrol:diesel mix. Last edited by SmartCat : 10th April 2017 at 12:42. |

| |  (41)

Thanks (41)

Thanks

|

| The following 41 BHPians Thank SmartCat for this useful post: | AGwagon, Avikbrio, avinash_clt, CarguyNish, Crazy_cars_guy, Enobarbus, fuel_addict, GTO, hiren.mistry, IshaanIan, ishankpatel, johannskaria, Karthik Chandra, Lij, mayank0782, mrbaddy, NPV, procrj, RavenAvi, Ravi Parwan, redcruiser, Rehaan, romeomidhun, rsquared, RSR, S.MJet, Sheel, Simhi, sindabad, sooraj.naik, sri2012, subbu567, swiftnfurious, Teesh@BHP, theexperthand, Torino, V.Narayan, v12, vb-saan, Vik0728, vsrivatsa |

| | #4 |

| Team-BHP Support  | re: Dear Manufacturers, this is where opportunities lie SUB-SEGMENT 3 (HATCHES)  Comments: 1) The ever popular 'Swift' sub-segment cars is clocking an impressive 38,000 units per month (same as the 'Alto' segment). Not exactly a red hot growth segment these days, but it is not stagnating either - the sub-segment is seeing 8 to 10 percent an year growth, same as the industry. 2) But wow, it is quite a crowded segment. Customers have lots of options to choose from. 3) Interestingly, this is how the sub-segment looked 2 years back -  Then, although the Swift had a dominant 50% plus share, models like Liva/Brio/Bolt were doing quite well. Hyundai Grand i10 has seen a 50% increase in avg monthly sales while Swift is down 20% (avg monthly sales). However, the imminent launch of new Swift should take its share back over 50%. 4) Decent sales of Ignis/KUV100 implies that there is demand for hatchbacks that "look like SUVs". Manufacturers, take note. But to succeed, there needs to be a new "top-hat", not just black plastic cladding. Last edited by SmartCat : 11th April 2017 at 01:30. |

| |  (43)

Thanks (43)

Thanks

|

| The following 43 BHPians Thank SmartCat for this useful post: | AGwagon, amitjha086, arnabchak, Avikbrio, avinash_clt, BlackPearl, CarguyNish, Crazy_cars_guy, Enobarbus, fuel_addict, GTO, hiren.mistry, IshaanIan, ishankpatel, johannskaria, Karthik Chandra, Keynote, KPS, Lij, mayank0782, NPV, procrj, R2D2, RavenAvi, Ravi Parwan, romeomidhun, rsquared, RSR, S.MJet, sahibrain, Sheel, Simhi, sooraj.naik, sri2012, subbu567, swiftnfurious, Teesh@BHP, theexperthand, Torino, turbospooler, v12, vb-saan, Vik0728 |

| | #5 |

| Team-BHP Support  | re: Dear Manufacturers, this is where opportunities lie SUB-SEGMENT 4 (HATCHES)  Comments: 1) The premium hatchback segment clocks 26,000 units per month on an average. That's a huge number for expensive large hatchbacks. What's more amazing is that each new launch has EXPANDED the sub-segment. If we look at the last 5 years data, the sub-segment sales growth in percentage terms is unbelievable! (OK believable, because of low base effect  ). ).2) With just 4 serious contenders and an expanding market, this looks like an incredible growth opportunity for companies like Toyota/Renault/Skoda/Ford and the home boys. However, do note that Jazz and Polo are slowly losing ground and customers are gravitating towards Baleno and i20. SUMMING IT UP (HATCHES)  Comments: 1) Small car specialist Suzuki has 6 hatchbacks on sale right now. Each of these models have around 8 variants. So what Suzuki has is models straddling different sub-segments, available at various price points. There is probably one Suzuki model/variant at every Rs. 15,000 intervals - from Rs. 3 Lakhs to Rs. 11 Lakhs. Hyundai now has 3 models, but each model has at least 10 variants. Something to ponder about, eh? 2) But yeah, this alone is not enough. Remember, Tata too has 4 models (and decent number of variants per model) like Hyundai. Anyway, both Tata & Mahindra have tasted success with Tiago and KUV100, and are likely to introduce new hatchbacks over the next few years. 3) Honda & Toyota are unlikely to give the hatchback segment much attention. Ford/VW too is unlikely to spend on R&D for India specific products. 4) Suzuki/Hyundai needs to keep an eye on one manufacturer only - the Renault Group. If you consider Renault/Datsun/Nissan as a single entity, it means they already have 10% share in this segment, in an incredibly short period of time. Carlos Ghosn has tasted blood, and is likely to spend significant R&D money to develop new models and grab a bigger share of the hatchback pie (1.6 million per year). Last edited by SmartCat : 11th April 2017 at 02:10. |

| |  (41)

Thanks (41)

Thanks

|

| The following 41 BHPians Thank SmartCat for this useful post: | aabhimanyu04, aargee, Avikbrio, avinash_clt, BlackPearl, CarguyNish, Crazy_cars_guy, Enobarbus, fuel_addict, GTO, hiren.mistry, IshaanIan, ishankpatel, johannskaria, Karthik Chandra, Keynote, KPS, Lij, mayank0782, NPV, procrj, R2D2, RavenAvi, Ravi Parwan, romeomidhun, rsquared, RSR, S.MJet, samaspire, Sheel, Simhi, sooraj.naik, subbu567, swiftnfurious, Teesh@BHP, theexperthand, Tojo_GotBhp, v12, vb-saan, Vik0728, vivee90 |

| | #6 |

| Team-BHP Support  | re: Dear Manufacturers, this is where opportunities lie SEDANS SUB-SEGMENT 1  1) The sub-4m sedan segment has booted variant of humble Tiago rubbing shoulders with the booted variant of premium Polo. Clocks an average of 34,000 units a month. Suzuki, as usual, has lion's share of the pie - although it is quite possible that it includes DZire Tour sales too. The pioneer of this segment Tata currently has 3 models in this segment, with a combined 20% share. 2) From the customer's point of view, this segment of cars is more practical than hatchbacks because of 400+ litres boot space. From the manufacturer's point of view, what's unique about this segment is that there are no 'flop' cars. Each and every model clocks at least 2,000 units per month (translation: around Rs. 1,500 cr revenues). So it makes lot of sense for the manufacturer to attach a tiny boot to every hatchback they make. Small R&D amount spent on this exercise increases the platform sales by 100% to 200%. Lage Raho! SUB-SEGMENT 2:  1) This sub-segment of sedans is slightly different from sub-4m variety. Specifications - * Between 4 and 4.3 m length. * Usually has larger petrol engine, when compared to hatchback variant. * Higher entry and 'exit' price points 2) Currently clocking just 3,400 units per month. Very odd, but cars in this segment is popular among cab drivers. The low sales is probably because none of the cars look desirable. Also, big players like Suzuki/Hyundai/Tata/Honda are conspicuous by their absence. Likely customers of this sub-segment, if new exciting models are introduced - * those interested in buying a more proportional/natural looking sedan, but don't want to stretch their budget to get a Ciaz or City. * those who prefer more powerful petrol engines, rather than puny 1.2 litre ones in sub-4m sedans. * those who want more legroom/larger boot. 3) Renault Pulse (hatchback) starts at Rs. 5.3 Lakhs (1.2L petrol engine) while Renault Scala (sedan) starts at Rs. 8.6 Lakhs (1.5L petrol engine). And wow, Nissan Sunny is aiming for Honda City/VW Vento with a starting price of Rs. 10 Lakhs. Unlikely to help - but Nissan/Renault could bring in lower priced versions of these sedans. No need to pull out expensive variants though. SUB-SEGMENT 3  1) Clocks an average of 13,500 units a month. Gives an impression of being a 'hot' sub-segment because of Ciaz sales growth, but is actually growing at a pace slower than the industry (<8 percent per annum). What has happened is that Verna sales (4,000 units per month) has been transferred to Ciaz. It would be interesting to see if new Verna expands the market or takes away share from others. 2) Compact SUVs like Brezza at lower end and Creta at higher end of the price band are the biggest competitors of cars in this sub-segment. 3) With very little demand for cars like Corolla, the opportunity lies in bringing in more expensive variants with "big car" features. Success of City ZX variant gives some clues. Going by the price range of Ciaz, it looks like Suzuki has the biggest opportunity to grow sales. VW too could bring Octavia/Jetta features into this segment. More airbags and more gadgets!  SUB-SEGMENT 4:  1) The sub-segment that has shrunk a lot since its heydays, it now manages to clock 800 units per month. Even new launches like Elantra with low entry prices (Rs. 16 Lacs) doesn't seem to excite the markets. 2) However, it looks like the manufacturers find this segment worthwhile even at these volumes (200 units per month equals roughly Rs. 350 to 500 cr per annum revenues) - otherwise Hyundai, Toyota and Skoda wouldn't have bothered to regularly bring the latest models. Possibly because this is a simple CKD assembly operation, with no supplier or inventory build-up issues. 3) One of the reasons for customers not picking up cars from this sub-segment is city traffic and parking woes. Hence, European hatchback versions (Golf/ Focus/ i30/ Corolla etc) of these cars could be introduced because that solves the "size" problem. This is a risk-free strategy because infrastructure for assembly, sales & service of these models already exists, and minimal investment is required to introduce the hatchback variants. 4) If the above idea sounds daft, remember that customers are ready to pick up Rs. 12 Lakhs i20 and Rs. 17 Lakhs Creta. Also, in markets where both hatch/sedan variants are sold, hatch variants are 5 - 8% cheaper too. Entry point can further be reduced by introduction of base variants of Golf/Focus/i30/Corolla hatch powered by a smaller petrol engine. Hatchback starting price of Rs. 13 to 16 Lakhs (sedans: Rs. 16 Lakhs to Rs. 19 Lakhs) could double or triple the platform sales, with very little risk and investment. SUB-SEGMENT 5  1) Together, the sub-segment clocks around 210 units per month. The Japs have taken the petrol + hybrid route while Skoda has a more conventional lineup. Surprisingly, both Toyota and Skoda has gone to the trouble of setting up an assembly line in India for these cars. Localization is likely to be close to nil though. 2) 90% of Camry's customers opt for the hybrid variant. Superb's petrol:diesel sales mix is roughly 65:35. Going by the low price point and the number of variants offered, it looks like only Skoda is serious about this segment. Toyota has the biggest opportunity in increasing sales - more variants, Rs. 30 Lakh starting price and a diesel engine option. SUMMING IT UP  1) The sedan segment clocks 52,200 units per month on an average, with majority of sales coming from sub-4m cars. Suzuki has an outsized share of the pie, thanks to blockbuster DZire sales. 2) Hyundai carpet bombing strategy at work here - they have 3 sedan models and 31 variants! 3) This segment is Honda's "bread" - sedan sales constitute a big chunk of their Rs. 12,000 cr per annum topline. 4) Quite surprising that "serious manufacturers" like Ford, Mahindra and Renault Group are ignoring this segment. Last edited by SmartCat : 17th April 2017 at 15:35. |

| |  (39)

Thanks (39)

Thanks

|

| The following 39 BHPians Thank SmartCat for this useful post: | aargee, Avikbrio, avinash_clt, CarguyNish, Crazy_cars_guy, desiaztec, Divya Sharan, Enobarbus, fuel_addict, GTO, hiren.mistry, IshaanIan, johannskaria, Karthik Chandra, Keynote, KPS, Lij, mayank0782, NPV, procrj, R2D2, RavenAvi, Ravi Parwan, romeomidhun, rsquared, RSR, S.MJet, sahibrain, Sheel, Simhi, sooraj.naik, sri2012, subbu567, swiftnfurious, theexperthand, v12, vb-saan, Vid6639, Vik0728 |

| | #7 |

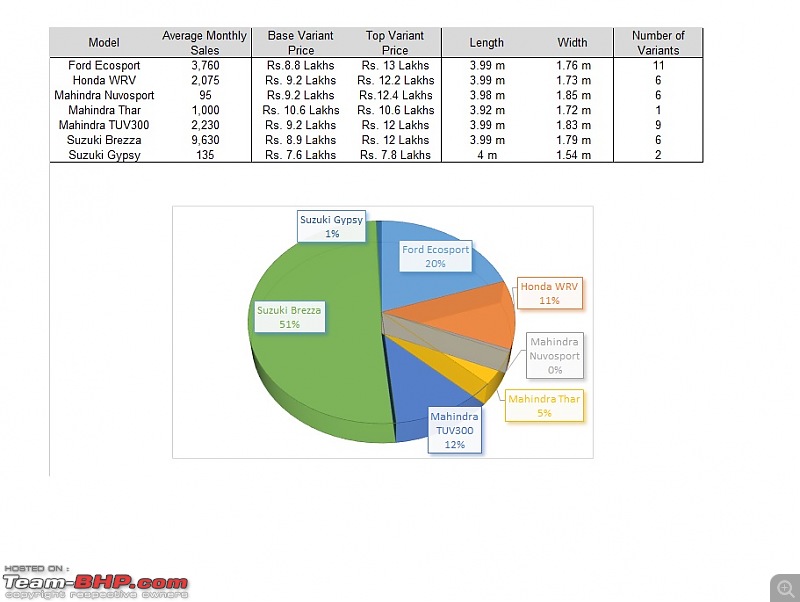

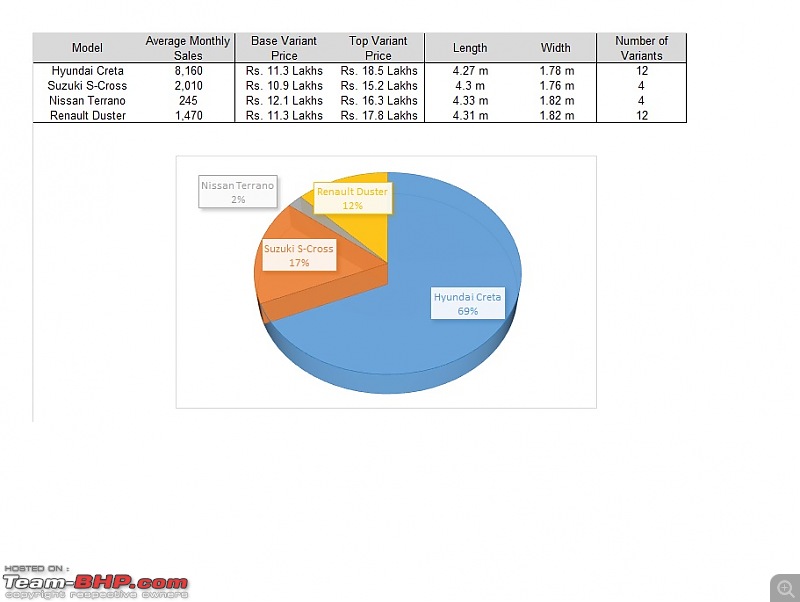

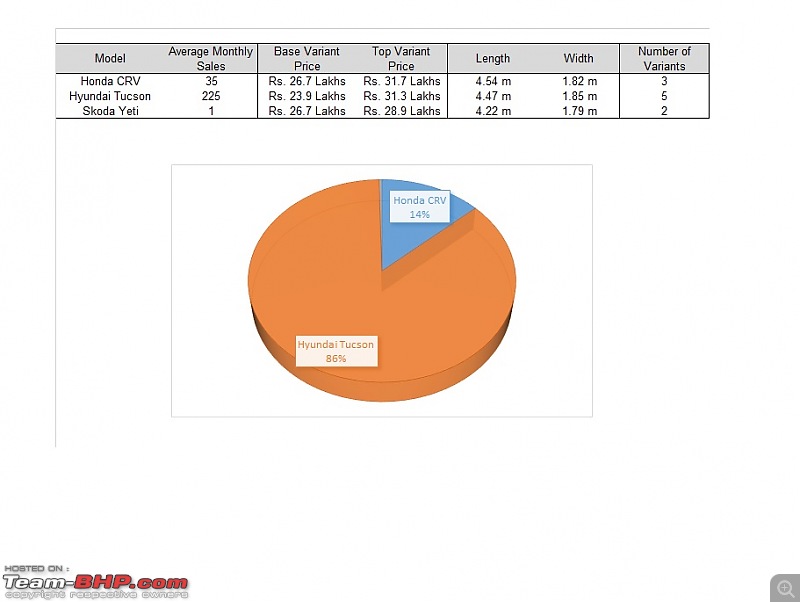

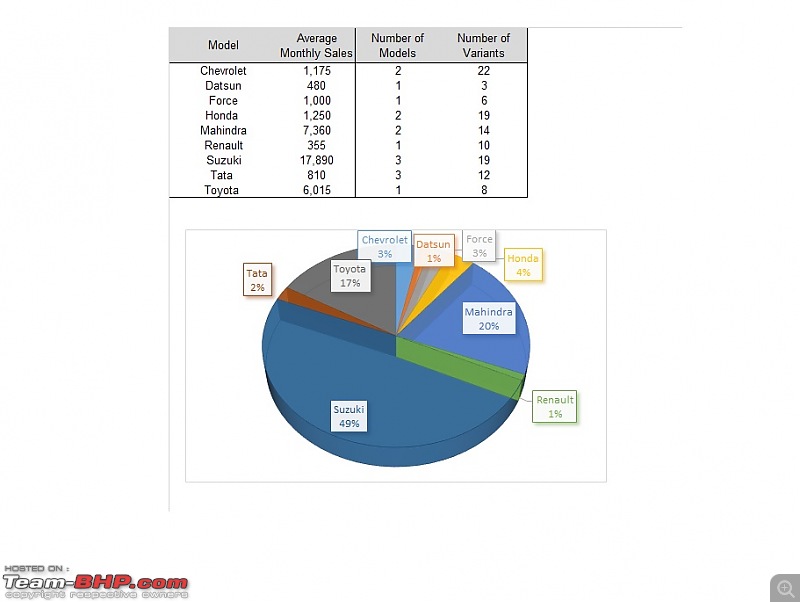

| Team-BHP Support  | re: Dear Manufacturers, this is where opportunities lie SUVs SUB-SEGMENT 1  1) 19,000 units per month and growing! Like the sub-4m sedan segment, the sub-4m SUV segment too has no losers or flop models. 2) Toyota, Fiat & Hyundai have discovered that slapping black cladding to an existing hatchback does not work. What works is a new taller/larger body, new interiors, higher ground clearance and bigger tyres. 3) Suzuki has the biggest opportunity here to increase sales by introduction of petrol variant. Honda could go upmarket with 1.5 litre petrol engine. For a manufacturer with India R&D prowess, this is the sub-segment to be in. Any new model introduced is likely to expand the sub-segment. 4) Amazingly, off-road enthusiasts have two sub-4m SUVs to choose from - Thar & Gypsy. Mahindra Thar average monthly sales are estimates, based on confirmed data from 2016. SUB-SEGMENT 2  12,000 units per month sales, growing rapidly and taking away sales from both sedans and 'Proper SUVs'. And yes, Suzuki S-Cross needs a petrol engine. Contemporary interiors/exteriors, 12 variants, 3 engine options, 2 AT options and a wide price band seems to be key to Creta's success. Like the sub-4m compact SUVs, any new model introduced in this segment is likely to be an instant hit. SUB-SEGMENT 3  1) The 'Proper SUV' segment, averaging around 8,000 units per month. Traditional SUV Looks? Check! 7 seater? Check! Four wheel drive as an option? Check! Other than XUV500, all are old school body-on-frame chassis SUVs too. 2) Segment OWNED by Mahindra & Tata, unlikely to see any models from other manufacturers. SAIC perhaps? Maybe. 3) Proper SUVs are slowly losing ground to compact SUVs. I personally know 4 people who have considered SUVs from this segment, before opting for either Duster or Creta. Excuses/reasons for not picking up a car from this segment - * Feels too heavy/cumbersome in traffic * Too big (long) * I don't need 7 seats * Low fuel economy * Not-so-great ergonomics 4) Even XUV500 is losing ground, coming down from 4,500 units per month to 2,000 units per month levels. However, Scorpio continues to post strong sales. 5) Both Tata & Mahindra SUVs in this segment need to lose some drastic weight. The next-gen XUV500 needs to be 200 kilos lighter and have EPS (to be popular with the masses, to feel "light"). Next gen Tatas in this segment is likely to use the flexible AMP platform (Tatas have confirmed that no new body-on-frame chassis is being developed). SUB-SEGMENT 4  1) Europe's idea of a compact SUV, this sub-segment clocks 260 units per month. Newly introduced Hyundai Tucson is contributing to most of the sales. 200 plus units per months on an average seems like decent numbers for Rs. 25 Lakh 5 seater SUV, but the sales trend is declining. After the initial demand has been met, Tucson is likely to settle at 50 to 75 units per month - going by sales of petrol only Honda CRV. Jeep Compass is likely to be introduced at around the same prices. 2) This is a sub-segment with lots of potential growth and decent sales numbers, if priced just above Hyundai Creta. That is, pricing should start from Rs. 18 to Rs. 20 Lakhs (on road) rather than the current Rs. 24 to Rs. 26 Lakhs. I wonder if Rs. 6 Lakhs can be shaved off the on-road price with a smaller engine & heavy localization of parts/components? 3) If Renault Kaptur and Honda HR-V prices start at Rs. 18 Lakhs, they have a pretty decent probability of success. SUB-SEGMENT 5:  The "full-size" SUV (in Indian context) segment clocks 2,300 units per month. Although the sub-segment has doubled in size in past year or so, it's because Fortuner sales have doubled with the introduction of new model. Because of Fortuner's dominance, this is an extremely difficult segment to crack. However, customer acceptance of Ford Endeavour is worth noticing. Also worth noticing is that both Fortuner and Endeavor have 6 variants with different engine, transmission & drive options, available at different price points. SUMMING IT UP (SUVs)  The SUV segment clocks just around 42,000 units per month. Pleasant surprise is that no manufacturer dominates the segment, although Suzuki still has the highest share thanks to Brezza. Tata's share in the SUV segment is truly saddening. On the other end, Mahindra's commitment to SUV segment is obvious when you take a look at the number of models on sale. Monocoque SUVs are 70% of sales -  Note: 4WD/AWD are just options in the models sold. The above graph does not mean 30% of cars sold have four wheel drive. Last edited by SmartCat : 17th April 2017 at 15:32. |

| |  (36)

Thanks (36)

Thanks

|

| The following 36 BHPians Thank SmartCat for this useful post: | Avikbrio, avinash_clt, BlackPearl, CarguyNish, Crazy_cars_guy, Divya Sharan, Enobarbus, fuel_addict, GTO, hiren.mistry, InControl, IshaanIan, ishankpatel, johannskaria, Karthik Chandra, Keynote, KPS, Lij, mayank0782, NPV, procrj, R2D2, RavenAvi, Ravi Parwan, romeomidhun, rsquared, RSR, S.MJet, Sheel, Simhi, snaseer, sooraj.naik, subbu567, swiftnfurious, theexperthand, v12 |

| | #8 |

| Team-BHP Support  | re: Dear Manufacturers, this is where opportunities lie MPVs/MUVs SUB-SEGMENT 1  1) Analyzing this sub-segment of MUVs is as exciting as watching money grow in a 15 year PPF account! The entry level people mover sub-segment clocks around 13,000 units per month, via Eeco and Omni sales. Eeco pricing especially is incredible. 2) Datsun GO+ can do a Versa to Eeco transformation, and go a couple of steps down the ladder. There needs to be variants with smaller 0.8 litre engine, no power steering and inexpensive opposite-facing seats to take on Omni and Eeco. Factory fitted LPG & CNG variants should help too. 3) Tata Venture seems to be very expensive for what you get, compared to Eeco -> 50% higher price for a diesel engine. Tata and Mahindra could give this segment one more shot with a new small-car based monocoque chassis, FWD layout and a small petrol engine (with LPG/CNG options). Going by the success of Omni/Eeco, diesel engine is not a necessity - most likely because these are not long distance people movers. SUB-SEGMENT 2:  The MUV sub-segment primarily counts rural/semi-urban private users & highway passenger transport operators as their main customers, and clocks >9,000 units per month. All the MUVs in this segment are based on 20 year old RWD/body-on-frame chassis. With Tavera out of the picture, looks like there is an opportunity for Tata & Mahindra to introduce newer models (same chassis/new body or a SUV-shaped vehicle based on CVs perhaps) to keep things fresh. Tata seems to have handed over the passenger UV segment to Mahindra though - they are simply not interested in this sub-segment. SUB-SEGMENT 3:  1) The MPV sub-segment aimed at large families in urban areas, equipped with car-like features and safety aids (airbags/ABS). Clocks 9,000 plus units per month, but shrinking in size over time. Only Ertiga has managed to hold sales at 6,000 per month levels. 2) Like the 'station wagon' segment, MPVs are just not popular among urban buyers, despite their huge practicality. Honda attempted a SUV'ed variant of Mobilio, and that didn't work well either. Also, it seems that demand for 7 seat private vehicle is not as much as originally envisaged. These MPVs regularly figure in "What Car?" threads on Team-BHP, but most members eventually pick compact SUVs. 3) Looking at the falling popularity of the sub-segment, Hyundai dropped their plans of introducing MPV in India. However, Mahindra has not given up on this sub-segment yet! SUB-SEGMENT 4:  The "premium" MUV segment clocks 6,000 units per month thanks to Innova Crysta. Tata Aria takes a respectable second place in the sub-segment. Tatas had the right concept, but they messed it up with a weird marketing strategy (Sedan + SUV = Crossover). Poor reliability didn't help either. With prices of some Innova variants touching Rs. 25 Lakhs and going by the immense popularity of AT variants, Ssangyong/VW/Hyundai/Honda/Renault could consider taking on Innova with a premium MPV. Obviously, it would be very tough to eat into Innova's share of the pie and the sub-segment is unlikely to grow much from here either. SUMMING IT UP (MUVs)  The passenger UV segment clocks around 36,000 units per month, with Suzuki (surprise!) leading the segment with close to 50% share. For manufacturers, biggest opportunities (and risks) are in entry level and premium UV space. Last edited by SmartCat : 17th April 2017 at 15:27. |

| |  (66)

Thanks (66)

Thanks

|

| The following 66 BHPians Thank SmartCat for this useful post: | 9thsphinx, amitjha086, amitpunjani, amrisharm, aravindkumarp, aviat18, Avikbrio, avinash_clt, basubhatta, BlackPearl, CarguyNish, Crazy_cars_guy, desiaztec, Enobarbus, Eyas337, fuel_addict, Geo_Ipe, gkveda, gr8guyme, GrammarNazi, GTO, Hayek, hiren.mistry, InControl, INJAXN, IshaanIan, johannskaria, Karthik Chandra, Keynote, Lij, mayank0782, MinivanDriver, NPV, ObsessedByFIAT, Omkar, pachchu77, procrj, quadmaniac, R2D2, RAHS, Rajeevraj, rambo1o1, RavenAvi, Ravi Parwan, rejeen, romeomidhun, rsquared, RSR, S.MJet, sahibrain, samabhi, samaspire, sathya.bhat, Sheel, Simhi, sknglobal, sooraj.naik, sups, theexperthand, Transporter, v12, vamsi.kona, vb-saan, Vik0728, vivtho, volkman10 |

| | #9 |

| Team-BHP Support  | re: Dear Manufacturers, this is where opportunities lie Thread moved from the Assembly Line to The Indian Car Scene. Thanks for sharing! |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank Aditya for this useful post: | GTO, IshaanIan, SmartCat |

| | #10 |

| Senior - BHPian Join Date: Jan 2010 Location: TSTN

Posts: 6,236

Thanked: 9,641 Times

| re: Dear Manufacturers, this is where opportunities lie

Brilliant thread, but could not rate more than 5 stars from my end. Just a correction, SCross has 5 variants at the moment - 1.3 Alpha, Zeta, Delta, Sigma & 1.6 Alpha |

| |  (7)

Thanks (7)

Thanks

|

| The following 7 BHPians Thank aargee for this useful post: | Avikbrio, gr8guyme, romeomidhun, sidzz, SmartCat, The Great, TorqueTwist |

| | #11 |

| BHPian Join Date: Dec 2015 Location: KA19/KA01

Posts: 143

Thanked: 570 Times

| re: Dear Manufacturers, this is where opportunities lie Wow.! Superb thread. Rated 5 starts. smartcat, you can charge the OEM's for these kind of detailed information. I think this must be better than their internal reports. |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank sathya.bhat for this useful post: | mayank0782, SmartCat |

| |

| | #12 |

| Distinguished - BHPian  Join Date: Aug 2011 Location: Bangalore

Posts: 4,607

Thanked: 17,684 Times

| re: Dear Manufacturers, this is where opportunities lie Excellent and innovative thread smartcat. You should request the mods to change your handle to supersmartcat.  The first thought that came up after reading this is that-rather than going behind new models, manufacturers should rework some of their variants, features and combinations. This itself will cause a spurt in sales relative to their current numbers. Some quick things that come to mind are

Disclaimer: No science or number behind these. Just of the top of my head. Last edited by Rajeevraj : 18th April 2017 at 09:58. |

| |  (21)

Thanks (21)

Thanks

|

| The following 21 BHPians Thank Rajeevraj for this useful post: | 400notout, AkMar, asaraf, Avikbrio, Crazy_cars_guy, daretodream, fuel_addict, gkveda, Keynote, Latheesh, mayank0782, NPV, RavenAvi, rejeen, S.MJet, sahibrain, samaspire, Simhi, SmartCat, Vik0728, vsrivatsa |

| | #13 |

| BHPian Join Date: Jan 2009 Location: -

Posts: 956

Thanked: 1,105 Times

| re: Dear Manufacturers, this is where opportunities lie Simply outstanding @Smartcat!! What a deep dive analysis!! Rated a well deserved 5 Stars!! One thought : Should the under 4m SUV segment also include the New Bolero (Bolero Power+ I believe) with shortened length and smaller capacity engine? OR are the sales numbers combined along with the regular 4m+ Bolero? Force motors could have done well with the Force One. It was actually the closest match to a Ford Endeavor (purely look-wise and nothing more!!) and could have clocked decent numbers only if Force could make it more desirable by adding ABS, Airbags and other goodies as standard. Not to mention the After Sales experience. Wish FIAT India reads this thread and start planning to get more cars from their international line-up! |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank ObsessedByFIAT for this useful post: | mayank0782, RavenAvi, SmartCat |

| | #14 |

| BHPian Join Date: Aug 2007 Location: Coimbatore

Posts: 35

Thanked: 29 Times

| re: Dear Manufacturers, this is where opportunities lie Awesome analysis and an in-depth and detailed view on the current scenario and what needs to be done by the car manufacturers in India!!!! Maruti Suzuki seems to be taking a chunk of the pie in most of the bread and butter segments. Considering their after sales service, I guess this is bound to happen. Sad to see that Fiat is in pathetic state in India. They should shut shop on Punto and Linea and concentrate on Jeep with renewed vigor. I guess if they do that there will be at least something to take home for them in that segment. Last edited by gr8guyme : 18th April 2017 at 10:25. Reason: Correction in spelling. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks gr8guyme for this useful post: | SmartCat |

| | #15 |

| BHPian Join Date: Sep 2015 Location: Madras

Posts: 857

Thanked: 3,198 Times

| re: Dear Manufacturers, this is where opportunities lie Fantastic thread smartcat, you are smart indeed  You have given free consultation for manufacturers. Now all they need to do is access this thread and chalk down their product planning. Because going by the recent products, their features and pricing, it seems that a few manufacturers aren't analyzing the pulse of the Indian Automobile market, this would be an eye opener for them. Oh wait!!! GM might want to analyse this thread before they exit, for if they do, they might change plans. Would be of additional help for Peugeot and Kia for their entry plans  |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks Karthik Chandra for this useful post: | SmartCat |

|