Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by fash_1

(Post 4683465)

Maruti says 39.4% decline in net profit for FYQ2 '19 and the market reacts by pushing the price up to 7721? What am I missing to read here?

|

That markets are basically irrational in the short term!

It's not about today. Stock market generally anticipates and moves a few quarters ahead and then course corrects as things unfold. So market will set some expectations for the company for future and if those are met, it will reward with a further upmove or a rerating else if the expectations are not met then the stock can come down.

If Maruti is moving now, then it means market expects it to perform well in coming quarters. Now it remains to be seen if that materialises.

Exactly! I think Warren Buffett also mentioned that he will never sell a single share of Coke, because of the brand it carries. I guess this applies to Maruti in India as well.

Tata Motors raises up to Rs 500 cr via issue of securities. Quote:

New Delhi: Tata Motors on Monday said a committee of the company's board will meet later this week to finalise raising of up to Rs 500 crore via issue of securities.

"The company is desirous of offering the rated, listed, unsecured, redeemable, NCDs aggregating to Rs 500 crore comprising three tranches and in this regard is holding a meeting of its duly constituted committee of the board on November 14, 2019," Tata Motors said in a regulatory filing.

The above issuance is pursuant to the approval of the resolution passed by the board at its meeting held on October 25, 2019, it added.

Tata Motors shares on Monday ended 1.68 per cent up at Rs 172 apiece on the BSE.

|

Source:

ET Auto

Guys, what do you guys think of the recent market rally. The market is hovering around an all time high while all the macro economic indicators are near worst performance in last 10 years.

Quote:

Originally Posted by 2000rpm

(Post 4694933)

Guys, what do you guys think of the recent market rally. The market is hovering around an all time high while all the macro economic indicators are near worst performance in last 10 years.

|

This means market is betting that the worst is behind us and there are better times ahead. Most companies have had very poor last few quarters. It is more likely that in near and far future we will see recovery for most of them. Market is already discounting that right now! If it doesnt pan out that way, then there could be deep corrections in future.

No point in investing based on Indian GDP data, unemployment rate or inflation. But it makes sense to keep an eye on global finance, geopolitical and economic news.

www.cnbc.com is the best source for international finance news.

So right now, markets all over the world are buoyant as "bad news" is out of the way:

- USA/China is close to reaching phase one trade deal (apparently)

- There might NOT be a "no-deal" brexit

- Iran/USA tensions seem to have died down (so crude oil price is stable)

- USA interest rates are falling

Such rallies are called "risk-on" rallies. FIIs start investing in all major global markets, including India. It does not matter much to them if there is a small de-growth India's GDP, because GDP growth rates rise and fall all the time. However, they might pick and choose stocks to invest in though. That is, they might decide to exit automobile/financial stocks and buy consumer stocks (for example).

But when there is uncertainty in the financial/geopolitical world, FIIs take the "risk off" from their portfolio. This means selling Indian (and other developing markets) stocks.

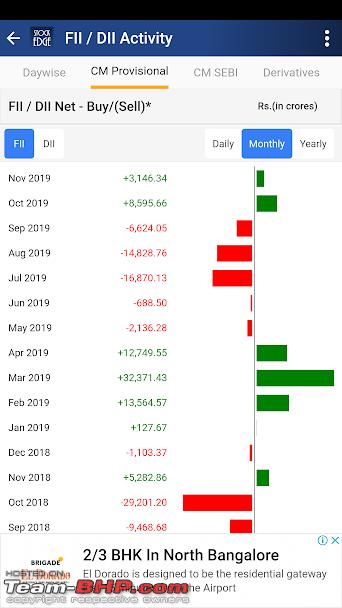

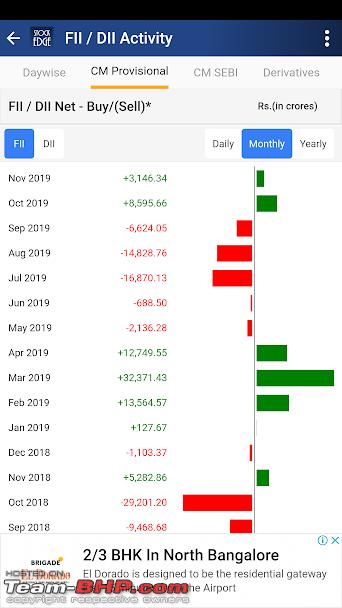

Here is the FII buy/sell data for each month:

Now compare it with NIFTY chart:

Note the amazing correlation between FII buy/sell activity and NIFTY movement. In Sept/Oct 2018, FIIs sold Rs. 40,000 cr worth of stocks and NIFTY crashed big time. Ditto in May 2019 to Sept 2019.

But FIIs bought stocks between Feb 2019 to Apr 2019 and in the past 2 months. That explains the current rise in Indian markets.

Quote:

Originally Posted by SmartCat

(Post 4695241)

Note the amazing correlation between FII buy/sell activity and NIFTY movement. In Sept/Oct 2018, FIIs sold Rs. 40,000 cr worth of stocks and NIFTY crashed big time. Ditto in May 2019 to Sept 2019.

But FIIs bought stocks between Feb 2019 to Apr 2019 and in the past 2 months. That explains the current rise in Indian markets.

|

I would NOT know when Indian markets break-out of this correlation between FII buy/sell into Indian Markets and the Nifty movement. I keep hearing for the past 10+ years from several analysts that 'Now Indian domestic investors/MFs have taken over from FIIs on fund inflows into markets' and then this happens! :)

Quote:

Originally Posted by JMaruru

(Post 4695372)

I would NOT know when Indian markets break-out of this correlation between FII buy/sell into Indian Markets and the Nifty movement. I keep hearing for the past 10+ years from several analysts that 'Now Indian domestic investors/MFs have taken over from FIIs on fund inflows into markets' and then this happens!

|

It is unlikely to ever happen, primarily because of investing style - not because of volume of fund flows.

See, Indian retail investors and mutual fund managers are not "tactical" investors. So MFs getting Rs. 5,000 crores per month will not break the correlation. Because they steadily invest whatever flows into their funds, irrespective of global macros.

But FIIs as a group are tactical investors. They pump in huge amount of cash into Indian markets for 6 months and then might decide to pull out the same over the next 3 months.

Quote:

Originally Posted by SmartCat

(Post 4695387)

But FIIs as a group are tactical investors. They pump in huge amount of cash into Indian markets for 6 months and then might decide to pull out the same over the next 3 months.

|

Thanks SMARTCAT!

This just reminds me of the myth which everyone of would have heard about. That the world is controlled by a few families!

We are technically at the mercy of the FII for our returns.

SMARTCAT, where do you get the FII Data from? If someone wants to check this regularly.

Quote:

Originally Posted by 2000rpm

(Post 4695453)

We are technically at the mercy of the FII for our returns.

|

hehe.. not really. FIIs affect volatility (up and down movement) of stocks/index. They do not affect the returns much. Stock returns will always be dependent on the company you pick, your purchase price and the company's earnings growth.

Quote:

where do you get the FII Data from? If someone wants to check this regularly.

|

I use STOCKSEDGE app:

https://play.google.com/store/apps/d....stockedge.app

Guys can anyone please enlighten what is happening with the adani green energy stock.

Any sign of promoters off-loading their holding to unsuspecting retail investors?

I don't think we have discussed about Tesla in this thread. With the latest earnings report, the stock has performed very well with a 4x or more surge. The possibility of bankruptcy risk has reduced and hence valuation has seen a re-rating.

TATA Motors is royally battered. Don't think their share values have fallen so much since the recession of 2008 - 2009!

Heading to double digits? With the Chinese economy not showing any signs of recovery, and taking JLR down with it - I guess so!

Quote:

Originally Posted by CrAzY dRiVeR

(Post 4767181)

TATA Motors is royally battered. Don't think their share values have fallen so much since the recession of 2008 - 2009! Heading to double digits? With the Chinese economy not showing any signs of recovery, and taking JLR down with it - I guess so!

|

The two global facing automobile stocks - Tata Motors & Motherson Sumi have taken a big hit. Tata Motors has taken a bigger hit because of its poor financials. Tata Motors has two problems:

- Debt of Rs. 70,000 crores on which interest outgo is Rs. 7,000 cr per year.

- Depreciation charges of Rs. 20,000 crores per year.

On the bright side -

- Tata Motors is still clocking an operating profit of around Rs. 25,000 cr per year. Margins are not too bad at 10%.

- Depreciation is a non-cash expense, and is expected to fall over the next few years. That's because Tata Motors is mostly done with investing in new technologies (emission tech, EVs) and new platforms/models. The fall in depreciation will directly add to profits.

However, as long as Coronavirus is taking up space on mainstream and business news, the stock price is unlikely to recover.

Tata Motors stock in double digits after 11 years

More than 11 crore shares of Tata Motors were traded on the NSE and 57.43 lakh on the BSE.

Quote:

The scrip fell 6.43 per cent to close at Rs 99 on BSE. It hit 52-week low intra-day and closed on a weak note for the fifth consecutive session. The stock has been ending in the red since March 4. It has lost more than 24 per cent since then on the BSE.

|

Link

| All times are GMT +5.5. The time now is 20:14. | |