Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by smartcat

(Post 4222309)

Investing....

|

Hi, Thanks for this thread - there are many wonderful tips you have given.

Can i ask you to pen a list of check points to validate stocks ?

Also, i have starting reading about candlesticks trends & how they are good indicators for stock value - can you pen your thoughts on these & some good resources to use these.

Thanks in advance !

Brilliant thread. It makes me think that perhaps team-bhp needs a separate section on "Investing in Auto Companies" with a thread for each company. What say?

Quote:

Originally Posted by 100BHP

(Post 4228964)

Also, i have starting reading about candlesticks trends & how they are good indicators for stock value - can you pen your thoughts on these & some good resources to use these.

|

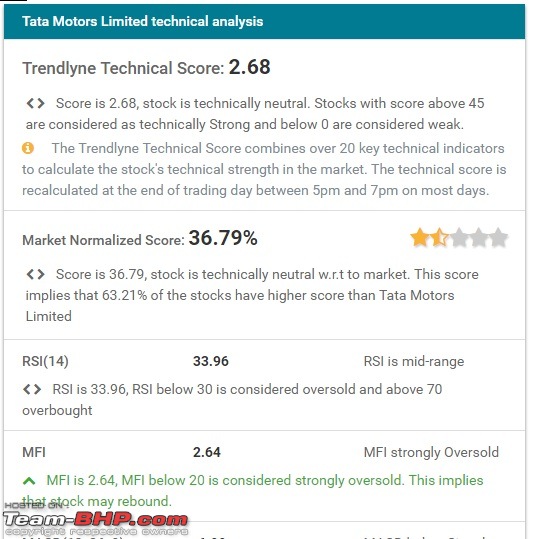

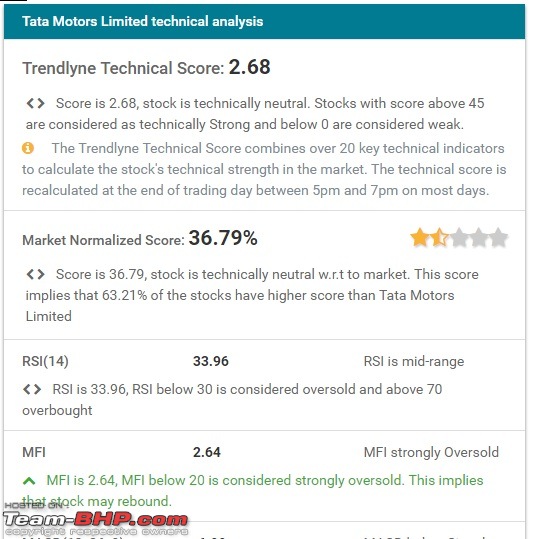

I don't have much knowledge about technical analysis. But there are some long term investors who check the technicals before buying. Both marketmojo.com and trendlyne.com gives you technicals data.

Quote:

Originally Posted by indusboy

(Post 4228976)

Brilliant thread. It makes me think that perhaps team-bhp needs a separate section on "Investing in Auto Companies" with a thread for each company. What say?

|

Good idea, but a separate thread makes sense only for large companies like Maruti, Bajaj Auto etc. :)

Quote:

Originally Posted by smartcat

(Post 4229146)

Good idea, but a separate thread makes sense only for large companies like Maruti, Bajaj Auto etc. :)

|

To begin with yes, but we can have a template driven approach for starting new threads in this section - like an investment thesis, so that anyone who has an auto stock idea can post it. Think of this as valuepickr for Auto related stocks...

An excellent thread to begin with and amazing guidance to novices.

I would like to take this opportunity to clarify some queries here ( may be save some folks from spirited investments and losses there by)

a) Market does not keep rising & rising & rising : It consolidates, falls, moves side ways but slowly and steadily it keep rises.

People tend to be speculative punters in BULL market but the fact is every other stock is rising and pretty much one can invest any where and get benefit. People get carried away about "Targets" and become greedy and keep investing only to realise that greater sentiments changed and the money goes down the drain

b) Do not TIME THE MARKET - Keep an Investment horizon based on GOALS and not SPECULATED trades : Most of the investors I know have been patiently sitting on Eicher Motors and Maruti stock from decades. They have made a KILLING out of it but many others got their targets achieved and took the money out and god knows where they again speculatively invested. The said folks are buying more but not selling these stocks.

Buy good stocks at good valuations and keep holding them for long - market will always give you opportunities just like it is giving right now.

Moreover, we know the charts and sales number month on month.

c) Markets at ALL TIME HIGH - This does not mean new scales will not be achieved. Had it been the case, we would not have been sitting on all time high today. No one can predict what will happen tomorrow and what events will occur but if you keep your investments based on your goals - events will not matter.

Last but not the least

Price of a stock is 50% determined by World Economy | 25% by Indian economy & the sector | 25% by its performance.

You can only as much do with a performance :)

Stay Invested... Stay Happy :)

@smartcat: As you have mentioned I have found screener to be a very nice tool to get the ratios.

Is there any website in which I could access the historical data(say for last 10 years) and also specify the conditions?

For instance, I would need to get a list of stocks which have

Return on equity >= 40% AND Dividend Yield >= 3% AND Debt to equity <= 0.3 for last 5 years?

Thanks in advance.:)

Quote:

Originally Posted by shetty_rohan

(Post 4231225)

Is there any website in which I could access the historical data(say for last 10 years) and also specify the conditions? For instance, I would need to get a list of stocks which have Return on equity >= 40% AND Dividend Yield >= 3% AND Debt to equity <= 0.3 for last 5 years?

|

Here you go -

You can specify last year's debt to equity ratio only though, not for 5 years. Check this link for more input options -

http://blog.screener.in/2012/07/creating-stock-screens/

@smartcat - What is your view on Sona Koyo? Thanks in advance.

Quote:

Originally Posted by Latheesh

(Post 4231718)

@smartcat - What is your view on Sona Koyo? Thanks in advance.

|

Investment in Sona Koyo stock comes under 'special situations' investing.

http://www.investopedia.com/terms/s/..._situation.asp

The company has average fundamentals and average growth numbers. But the stock is trading at insane valuations. It has gone up 12x in 4 years. The reason being that the Japanese promoter wants to fully own the company

http://economictimes.indiatimes.com/...w/56768428.cms

The markets expect the Japanese promoter to possibly de-list the stock. That is, they expect the Japs to offer an even higher price for shares owned by minority shareholders.

@smartcat - Thanks. SONA KOYO - I am sitting on ~ 250% profit now. What do you suggest? To hold or book profit?

Pricol board has “approved the acquisition of PMP Auto Components,” the auto components maker said in a regulatory filing today.

The PRICOL stock has started trading high. Is it a good auto stock for investment?

Quote:

Originally Posted by 100BHP

(Post 4228964)

Hi, Thanks for this thread - there are many wonderful tips you have given.

Can i ask you to pen a list of check points to validate stocks ?

Also, i have starting reading about candlesticks trends & how they are good indicators for stock value - can you pen your thoughts on these & some good resources to use these.

Thanks in advance !

|

Adding my 2 paisa here,

A day/swing (or even long term) trader might find candle sticks to be better among other indicators but these are lagging indicators and for slightly confident speculation of future I find chart patterns (shoulders/inverted shoulder/Doji etc.) on the chart itself with 'volume' helpful. Traders get success with OHLC charts coupled with patterns.

Here's a free literature by John Murhpy

pdf " on technical analysis of financial market"

Once you get a good understanding of this, I would recommend understanding value based trading approach and then make your own approach, followed by paper trading. A brief & introduction:

Value based trading

Note that you may be tempted to deploy almost every indicator on the screen but that will stop you in your tracks and won't let you even do paper trading. So keep it as simple as possible on the charts with eye on macro factors as well.

IMO it will be as clear as muck before it gets better. cheers!

Quote:

Originally Posted by smartcat

(Post 4229146)

Bajaj Auto etc. :)

|

Hi Smartcat,

I am not sure if I missed your views on Bajaj Auto, Hero and TVS shares.

TVS with p/e ratio of 200 looks high in terms of valuations. While Bajaj / Hero still looks within reasonable p/e of 21 and 37 respectively.

What will be your top pick among these stocks?

Also considering the expensive nature of these shares like 4000 per share for Hero and around 7500 per share for Maruti, what you suggest - will it be wise to accumulate these shares in small amount. Like buying 2-3 shares of Maruti each month over a period of time say 12 months?

Quote:

Originally Posted by bluevolt

(Post 4252065)

I am not sure if I missed your views on Bajaj Auto, Hero and TVS shares. TVS with p/e ratio of 200 looks high in terms of valuations. While Bajaj / Hero still looks within reasonable p/e of 21 and 37 respectively. What will be your top pick among these stocks?

|

TVS is trading at 45 times earnings while Bajaj/Hero is trading at 22 times. Bajaj and Hero valuations seem to be OK and you can buy at these prices.

You could also consider buying a company called BAJAJ HOLDINGS. This company owns 30% of Bajaj Auto and 30% of Bajaj Finserv. It is trading at just 10 times earnings. That's because Bajaj Holdings has no operating business as such - they earn interest income and dividend income (from holding shares of the above 2 companies)

Quote:

Also considering the expensive nature of these shares like 4000 per share for Hero and around 7500 per share for Maruti, what you suggest - will it be wise to accumulate these shares in small amount. Like buying 2-3 shares of Maruti each month over a period of time say 12 months?

|

Looks like you want to buy shares worth Rs. 1.5 Lakhs in Maruti or Hero Motocorp. Spreading investment over 12 months is one strategy. But I would recommend this instead -

1) Invest Rs. 1 Lakh right away

2) If the stock falls 10%, invest Rs. 10,000

3) If the stock goes up again after your Rs.10,000 investment, leave it alone.

4) But if the stock falls a further 10% from your last purchase price, invest Rs. 10,000 more.

and so on, till you have your fill.

Quote:

Originally Posted by smartcat

(Post 4252071)

You could also consider buying a company called BAJAJ HOLDINGS. This company owns 30% of Bajaj Auto and 30% of Bajaj Finserv. It is trading at just 10 times earnings. That's because Bajaj Holdings has no operating business as such - they earn interest income and dividend income (from holding shares of the above 2 companies)

|

Hey I tried checking moneycontrol but their the P/E shows to be 51. Consolidated it's PE is 11 which might be due to lower valuation of associated business units?

| All times are GMT +5.5. The time now is 20:40. | |