Team-BHP

(

https://www.team-bhp.com/forum/)

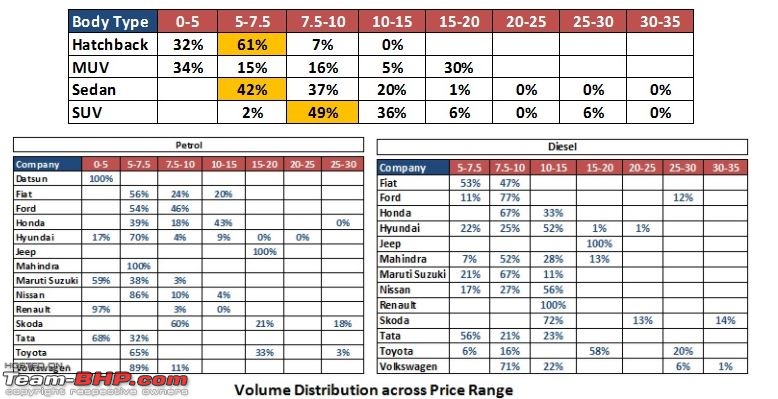

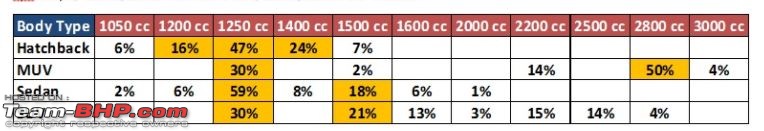

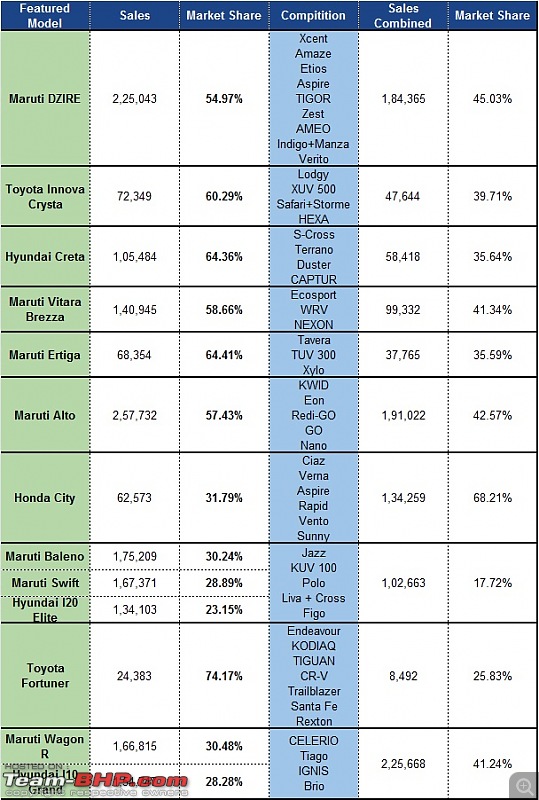

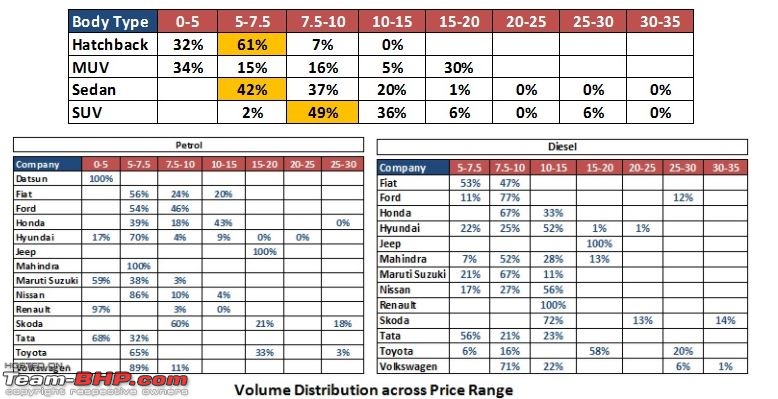

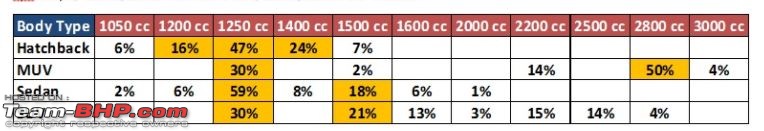

The compact SUV and Sedan, sub 10 lakhs priced product has made a market shift.

Automakers to shift focus from low margin sub 5 lakh products to 5-10 Lakh range, as buyers are migrating to higher price range.

Close to 80% of cars sold in India falls under ₹ 10 Lakh price level, ₹ (5-7.5) Lakhs range being most popular. Still 90% of petrol powered car had a price tag of less than ₹ 7.5 Lakhs.

Volume distribution across price range

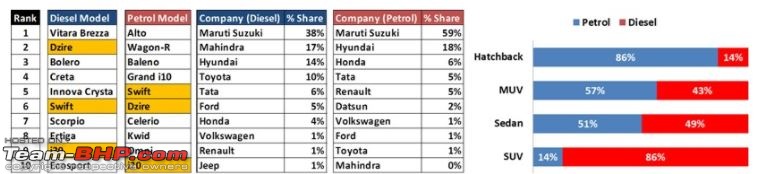

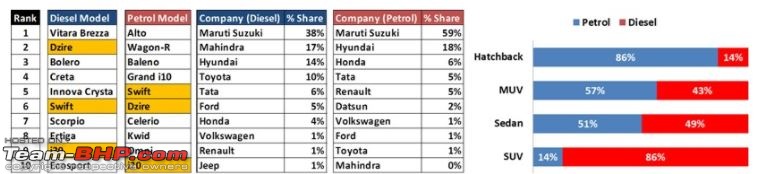

Engine : Petrol vs Diesel

Maruti is most preferred brand across petrol and diesel variants.

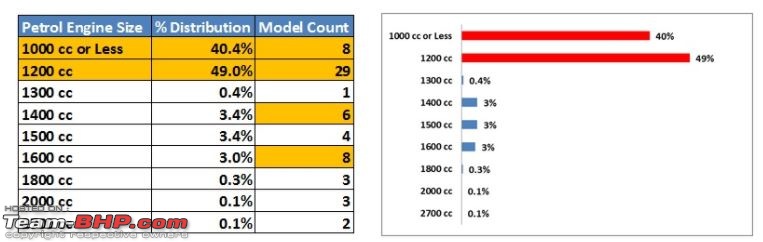

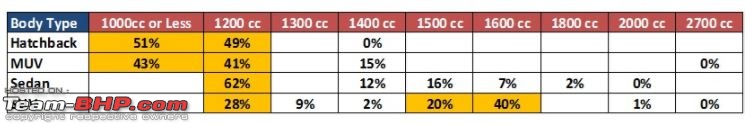

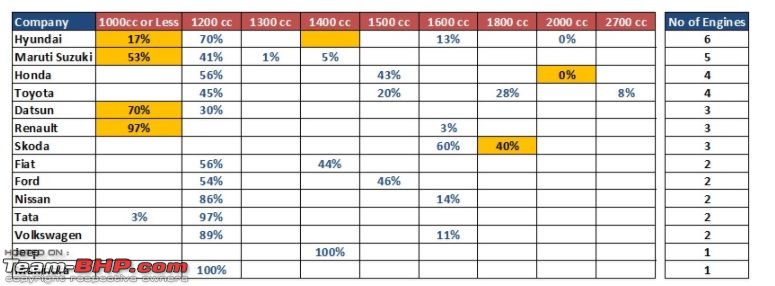

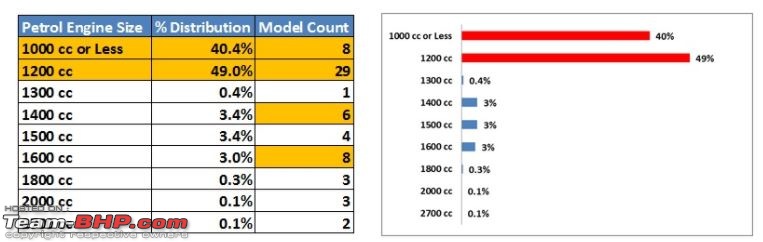

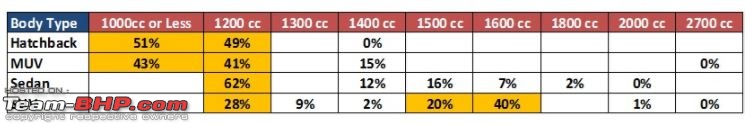

90% of petrol engines sold are 1200cc or smaller in size.

Compact SUVs like Ecosport and Creta has made owning petrol SUV more affordable.

Hyundai has widest range of petrol engines to offer in Indian Market followed by Maruti.

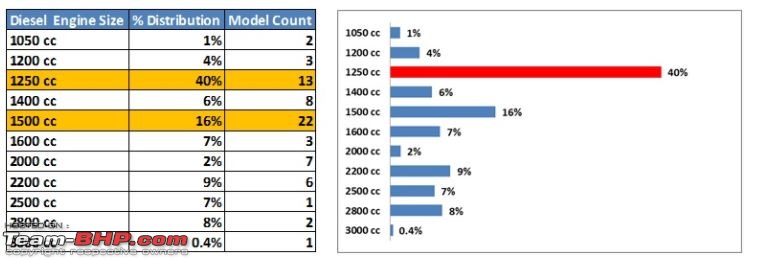

Diesel Engine:

Diesel Engine:

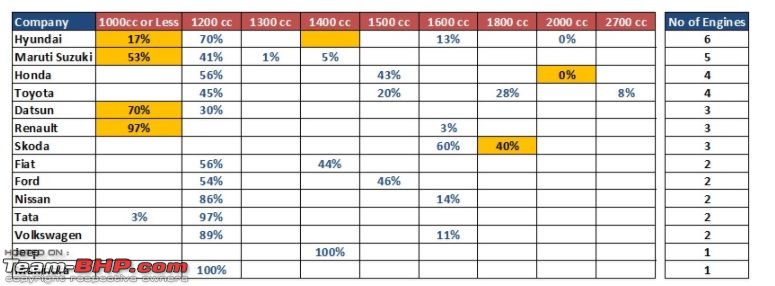

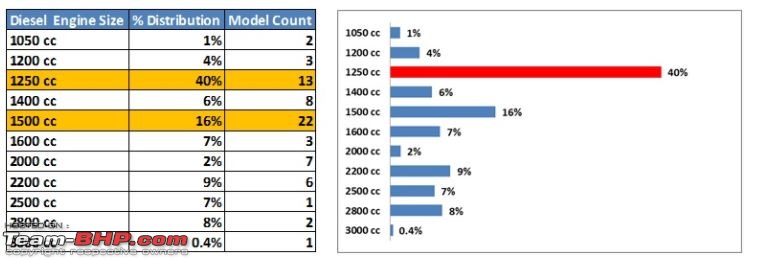

- 40% of diesel cars sold in India are powered by Fiat’s Engine.

- Maruti is the biggest customer.

- 96% of Fiat’s 1248 cc diesel engine is sold through Maruti, rechristened as DDiS and rest by Tata.

1500 cc engine block is quite popular too; Honda and Nissan deploy it across their entire product range.

Tata has widest range of diesel engines to offer in Indian Market followed by Mahindra and Hyundai.

Link

Link

Thanks for sharing, Volkman10! Those are fascinating charts - I could spend the entire weekend admiring them.

Moving your post to an independent thread.

I have one query. Why is the hatchback sales between 10-15L price range marked as 0%? Doesn't the Polo GT twins sell well to make a slight mark in that segment?

Quote:

Originally Posted by Turbopetrol

(Post 4349646)

I have one query. Why is the hatchback sales between 10-15L price range marked as 0%? Doesn't the Polo GT twins sell well to make a slight mark in that segment?

|

The prices mentioned are ex-showroom prices. The GT twins are priced under 10 lakhs ex-showroom.

An amazing thread this! Very fascinating numbers... I might revisit this thread many times in the days to come! :thumbs up

Quote:

Originally Posted by volkman10

(Post 4349093)

|

volkman10,

Is it possible to share the actual numbers for the "

Distribution Fuel wise" table? Would be interesting I guess, to know how bulky these %ages are!

Thanks,

C_

Quote:

Originally Posted by Coolman

(Post 4349839)

Is it possible to share the actual numbers for the "Distribution Fuel wise" table?

|

Not sure if you meant Diesel vs petrol trend. If so here is the link.

Link

Quote:

Originally Posted by volkman10

(Post 4349841)

Not sure if you meant Diesel vs petrol trend. If so here is the link. Link

|

Diesel vs Petrol trend - much appreciated. Thanks!

My question though was for the table in the very first image with a bottom heading

"Distribution Fuel wise (Ex-Showroom)"

Thanks,

C_

@Coolman

If you see only in numbers. Petrol shows a increase, but this is only due to the fact that there are no diesels in the below 5 lakh, and very few in the 5 to 7.5 lakh catagory. Above this the trend is clearly towards diesel.

Sincerely,

Rahul

Indians seem to go for products which offer them the most value.

It seems like this definition of value in a product is constantly evolving.

I presume - SUVish vehicles at 5-10L price bracket with higher ground clearance + relatively smaller engines (read value through fuel efficiency) + large interior space + low maintenance is a hit.

No wonder Vitara Breeza is a runaway success, since it fits everything mentioned above [well, almost fits in].

Other cars like EcoSport, Nexon, TUV100, etc are trying to get a strong foothold there.

Thanks for sharing the graphs Volkman10!. Love the way when data is sliced and diced differently, it changes the way you look at regular data.

Hyundai comes out really well in the volume distribution across price range, having presence across 11 columns (including Petrol and Diesel) Maruti in comparison, is present in only 6 columns. Hyundai continues to command the premium which Maruti always dreams off.

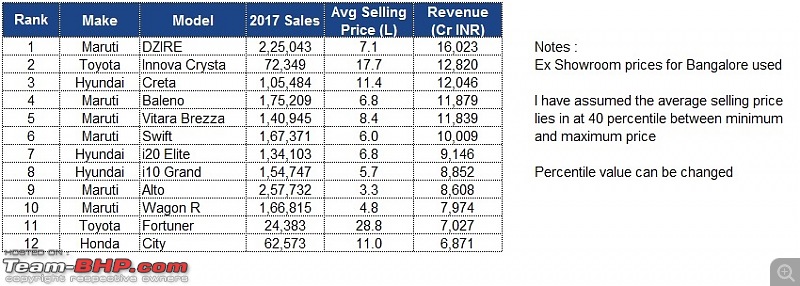

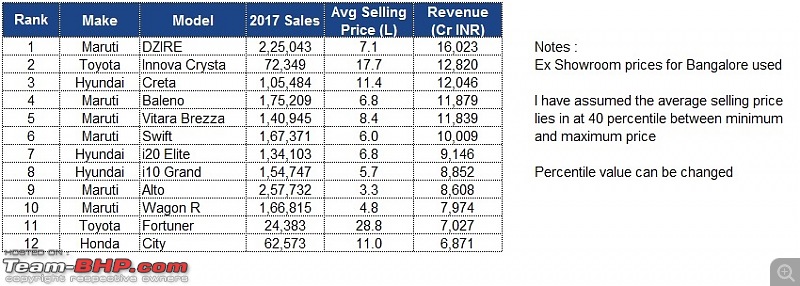

While here are how the models contributed to the respective companies in terms of revenue for calendar year 2017.

Quote:

Toyota Fortuner, its total dominance in a low volume premium SUV segment ensured its position.

|

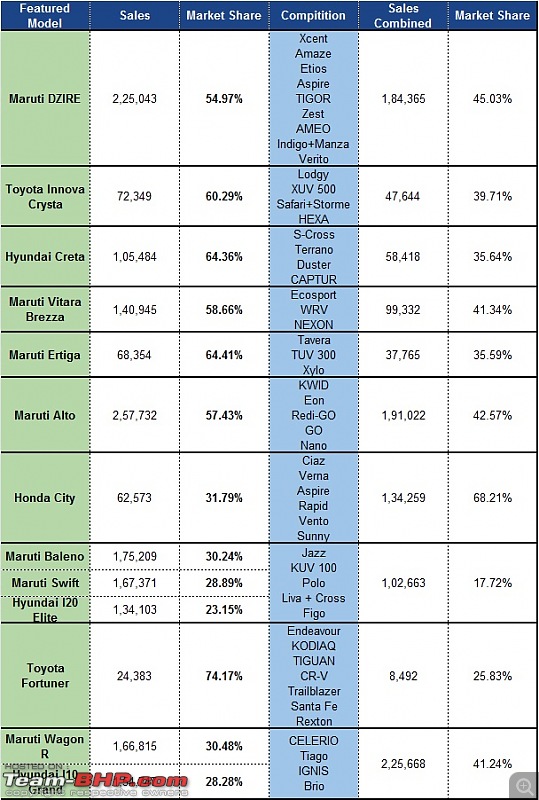

Each model featured in the above list with market share numbers and the complete dominance in respective segment .

Source:

Source:

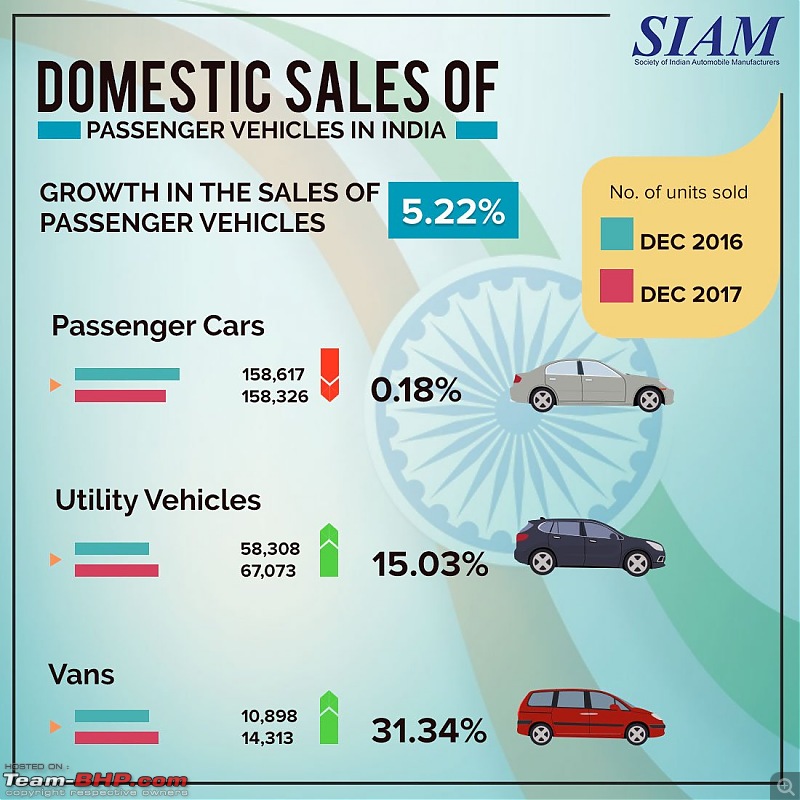

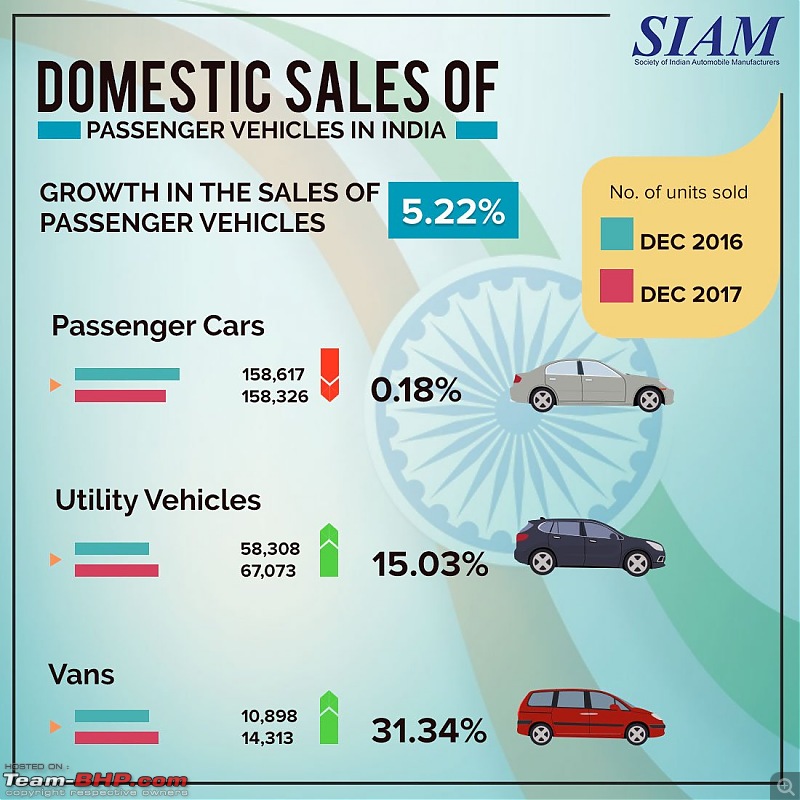

Full Year 2017 SIAM's data indicate the zooming preference to the M/S(UV)style of vehicles.

Expect entry level cars to now have the S/CUV styling as led by KWID.

Excellent compilation, volkman10. I appreciate.

I would like to bring a few observations I made in your post.

1. Maruti has 6 petrol engines, you mentioned it as 5. (800C on Alto, 1L on K10, ubiquitous 1.2L, 1.4L on Ciaz, 1.3L on Gypsy & 1L Boosterjet)

2. You missed the 2.4L Diesel engine of Toyota.

Quote:

Originally Posted by volkman10

(Post 4349093)

- 40% of diesel cars sold in India are powered by Fiatís Engine.

|

I guess the rest of it must be coming from Tata and Mahindra.

It is hard to believe that a engine developed 15 years ago is pretty much what 40% of cars have today. Heck; it could meet Euro 4 norms too.

Very insightful charts.

Quote:

Originally Posted by rahulrajeev

(Post 4350649)

Excellent compilation, volkman10. I appreciate.

I would like to bring a few observations I made in your post.

1. Maruti has 6 petrol engines, you mentioned it as 5. (800C on Alto, 1L on K10, ubiquitous 1.2L, 1.4L on Ciaz, 1.3L on Gypsy & 1L Boosterjet)

2. You missed the 2.4L Diesel engine of Toyota.

|

The fantastic data is from Auto Punditz. There seem to be some misses in the chart though. :)

| All times are GMT +5.5. The time now is 02:10. | |