March is usually good month due to FY year end pressure on car makers.

My only comment is on sudden spike in Storme numbers - which I presume must be due to the large army order won earlier ( possibly deliveries starting now ) ?

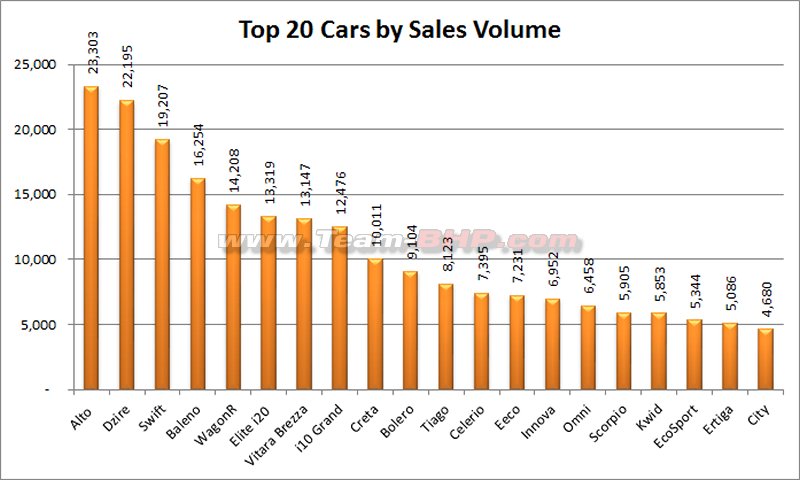

A brilliant financial year end for Maruti. All its top sellers sold well and they have 6 of their cars in the top 10 selling cars of India. Only Ciaz had its run to the top of the segment stopped by the Honda City and Ertiga sold below par as the market is expecting a new one soon.

Hyundai continues its fight with Maruti with its cars taking 3 places out of the top 10. Creta keeps surprising me with its numbers month after month.

It's great to see Tata Tiago doing well and it's difficult to fathom why the Tigor is struggling to get better numbers. Nexon continues its 4000 plus run month after month.

Ecosport as expected is brining in numbers for Ford. Everyone else is struggling.

Honda too is struggling with Brio based cars and it's only the WRV and City that are bringing in respectable numbers. The all new Amaze is a much needed car for Honda.

Looks like nothing can stop the Innova Crysta Juggernaut. The Yaris should get a good start when ever it gets launched.

A great month for Mahindra as well with the Bolero and Scorpio getting good numbers

Nissan may start selling only Datsun cars in the near future if they can't get in some new products soon.

The Captur is a DOA product and Renault must get the new Duster sooner than later.

Looks like the fight for Compact SUV is settled. Brezza is the undoubted leader followed by EcoSport at a distant second. Close tussle between Nexon and WRV for the 3rd and 4th place followed by TUV.

Out of all the manufacturers, Tata has shown a total transformation, where their bulk of sales is coming from the new age products. This shows Indian junta is ready to give a second chance provided the products are good. Tata should give better engines and touch screen to Tigor, for better sales.

Rest it is the same story.

Maruti - Eat My Dust

Hyundai - We have three aces (i10, i20, Creta)

Mahindra - UV King

Honda - Don't worry People will Pay

Toyota - Milk the cows (Innova, Fortuner)

Ford - One Trick Pony

Rest - Whatever is left get it and be happy.

Thanks Aditya for the March sales data.

Here is the perceptive of the FY 18 Fiscal and March -18 data.

The Indian automobile industry at an all-time high, be it is the passenger vehicle (PV), the commercial vehicle (CV) or the two-wheeler segments, they all have reported robust sales for the fiscal year just ended March 31, 2018.( FY18)

- Cumulative domestic vehicle sales growth in the past year was ~ 13-15%, achieving double-digit mark for the first time since fiscal 2012.

- Sales of passenger vehicles (PV) rose by about 11% in the fiscal, with sales of about 3.3 million units

- The launch of various new models, especially in the fast growing SUV space, along with a recovering rural economy, helped automobile sales in financial year 2018

- The Auto leader Maruti Suzuki hits best-ever domestic sales of 16,43,467 units, a 13.8 per cent year-on-year growth on year-ago sales, crossing the 1.5 million mark for the first time since it started operations over three decades ago.

- Maruti Suzuki takes 50% market share in the passenger vehicles segment for the first time ever in 2017-18 as its utility vehicle sales outpaced that of rivals.

- Also establishes itself as the leader in the UV segment beating Mahindra’s by a margin of 19,844 units.

- Hyundai Motors was at its best-ever domestic sales in the fiscal and sold a total of 536,241 units between April-March 2018, registering a growth of 5.2 per cent .

- Mahindra’s cumulatively sold 248,862 PV units in the fiscal, registering a growth of 5.39 per cent.

- Honda’s cumulatively, for the fiscal it sold 170,026 units between April-March 2018, growing 8.08 per cent.

- Tata’s closes the fiscal with cumulative sales of 207,496 units between April-March 2018, a notable 20.28 per cent growth

- Toyota de-grows in FY18 - The company registered cumulative sales of 140,645 units in the entire fiscal, de-growing at 1.89 per cent .

- Ford has a flat growth - Over the entire 12-month period of the fiscal between April-February 2018, the company sold 90,061 units and maintained flat sales

March 2018

- Only Maruti Suzuki and Tata motors has reported double digit growth during March while other five automakers, Mahindra and Mahindra ,Honda, Toyota, Ford and Hyundai, posted a de-growth to single digit growth during last month.

- The seven companies, which control nearly 95 per cent volumes of the domestic market, posted a growth of 9 per cent.

Maruti Suzuki :

- At 1.65 million, Maruti’s sales were 14% Y-OY, and almost twice the pace of the passenger vehicles industry.

- Riding high on brand loyalty, Maruti Suzuki is the only company having order backlogs with waiting periods of 2- 4 months for its Baleno, Vitara Brezza , Swift and Dzire. Ciaz and Honda City is having a close fight and will be interesting to see how it fares when the facelift is launched.

- The new WagonR, and facelifts of Ciaz and Ertiga are expected to keep the positive momentum for this fiscal year too.

Hyundai :

- Seems to have grown @ 7.26%. With the speculated new Santro launch this fiscal, Hyundai’s sales will mainly depend on its current portfolio with Creta and Elite leading the way.

- Verna though does respectable numbers, is still behind Maruti’s Ciaz and Honda’s City.

Mahindra and Mahindra :

- Registering a growth of 4% in March, Mahindra seems confident of getting back the UV leadership with its strong portfolio for the year( launch new products such as the U321 (codename) MPV, the S201 (codename) Tivoli-based compact SUV and the XUV5OO facelift)

Tata Motors:

- The March figures show a robust growth of 31% complementing its new launches. But the year could remain flat as the future launches seem to elude them this fiscal year. Spurt in volumes of Tata safari is due to the start the execution of the Indian Army order.

- Tata motors drove ahead of Honda to occupy the fourth position among the top-selling carmakers in the 2018 fiscal, but its passenger cars' sales declined marginally by 4 per cent, UVs posted significant growth of 223 percent in the month of March; albeit on a very low base.

Honda :

- Honda is having a tough time and de-grows at 28.36 % in March, primarily being the subdued sales of Amaze as the facelift is ready for launch next month

- With new launches this fiscal year, will Honda be back to the Number 4 slot?

Toyota :

- Another Japanese company recording a negative growth in March @ 9%, its Innova Crysta contributing to 52.44 5 of company’s total sales in Feb.

- Though it sells great numbers of Fortuners, Innova Crysta and Corollas, its mass market cars like the Etios sedan and Etios Liva hatchback have failed to gain momentum

- With Yaris being the only new launch, Toyota will likely to be in the same position as FY18.

- 2019 and beyond it will be interesting to see how the Suzuki – Toyota products pan out and in particular to see the EV that comes out in 2020.

VW/Skoda :

- Skoda’s Octavia and Rapid brings in some numbers (m-o-m), while at VW there is some increased numbers for Polo (new 1.0l MPI?) which overall indicates a growth. But will this sustain in the whole until 2021?

Exports FY18

As Ford prioritizes exports over domestic sales, it leads the FY18 exports replacing Hyundai from the slot. Ford’s export contribution are mainly from its two hatchback-based siblings – the second generation Ford KA+ hatchback and the Ford Aspire compact sedan. From Nov -17 Ford’s contribution in exports led by fresh shipments of the refreshed EcoSport to the North American markets.

Export Shipments: ( ACI -report)

Source: Various sales data

The numbers on Maruti don't need more focus I reckon - it's the same month after month! Find the most interesting facts on:

1. Tata - Hexa has shot up; 1400+ in a month. XUV decline seems most correlated as Jeep is constant; Mahindra could do with the new model I reckon. Will be interesting to see how this moves once that is out. Also, is Tata still refusing to sell to taxi companies? Their refusal to do so will surely have hurt their sales numbers (though they're clearly just focused on the brand right now).

2. Skoda - the Rapid and Octavia with jumps. Small volumes, of course by comparison to segment leaders, but I wonder if VW is missing a trick. The Rapid should be a far more attractive proposition to people who are jumping at the City (I'm a City owner) and the Octavia as a value proposition is unbeatable for what it offers.

3. D1 - is there not a case to delink the SUV / MUV segment here? Price and feature-wise, there's a massive disconnect. Don't see how a Hexa / XUV / Innova Crysta can be classified in the same segment as an Octavia / Elantra / Altis.

4. Crysta - what's the split for private vs cabs? The numbers are obscene for a product that most I know consider overpriced! Variant level data should be interesting along with the buyer profile. My guess is that a vast number aren't private users.

PS: Bears out my firm opinion that the D-segment offers very low value when it comes to sedans. If Skoda were to fix their service rating, the Octavia and Superb would probably be the massive gainers; can't see which other non-SUV/MUV in the 20-40L segment products offer this level of price-performance!