Thanks Aditya for the December sales data:

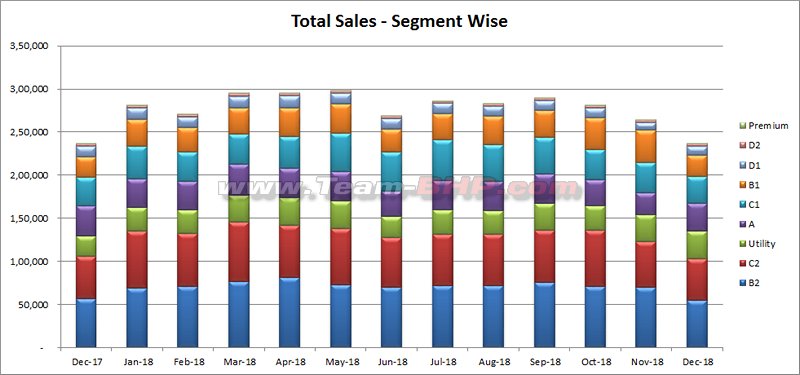

Here are some observations including the 2018 overall round-up.

Slump in the auto industry continues even as discounts seemed to be the highest.

The condition for the dealerships are also at a critical stage as they are carrying an average of 45 days stock with wafer thin profits as well due to additional discounts being offered from their margins to liquidate stock.

The situation is even worse pronounced for the challenging brands (bottom 6 OEMS) where dip in volumes is hitting their bottom line really hard and justifying the investment is an uphill task.

New Launches/Facelifts- Effect: With the impending New WagonR launch, it loses its position in the top 10. Baleno too loses its position due to the face-lift expected soon. Discounts bring Hyundai’s Grandi10 in the top 5. Maruti Suzuki rejigs its production and smartly brings Celerio volumes up to take it in the top 10.

Seven Maruti Suzuki cars and 3 Hyundai cars that cover the top 10 cars. Also Maruti Suzuki still holds on to a Market share > 50%, in fact its market share has grown 0.5% (YOY).

Hyundai too has gained 0.8% market share and in the other side of the spectrum FCA has lost the highest Market Share in Dec’18 due to the dwindling volumes of its flagship Compass.

Maruti Suzuki: Leading in most segments, sees its mass market product Alto back to its Nr. 1 position. Dzire the car responsible for revival of the compact segment seem to be growing stronger leaving the second in that segment far behind. Ertiga with its strong demand is now the leader in the MPV segment, Ciaz leading the sedan segment, Vitara Brezza in the Compact UV and utility vehicles (Eeco +Omni) helps to consolidate the dominance of Maruti Suzuki in December dispatches. New 2019 launches like WagonR, face-lifts like Baleno and Power train changes to its line-up looks promising enough for Maruti to defend is commanding position. But 2020 is the period to watch for exciting launches.

Hyundai: Despite the hype of the new launch Santro, Hyundai is having just 5% growth. The highlight of the month is i20 reaching the 3rd best seller beating Maruti’s Baleno and Grand i10 ahead of WagonR. Santro falls to ~7k units even with a strong booking seems priority in production could have been changed in the product mix. Expectation from Hyundai is the promising Compact SUV slated for an early 2019 launch.

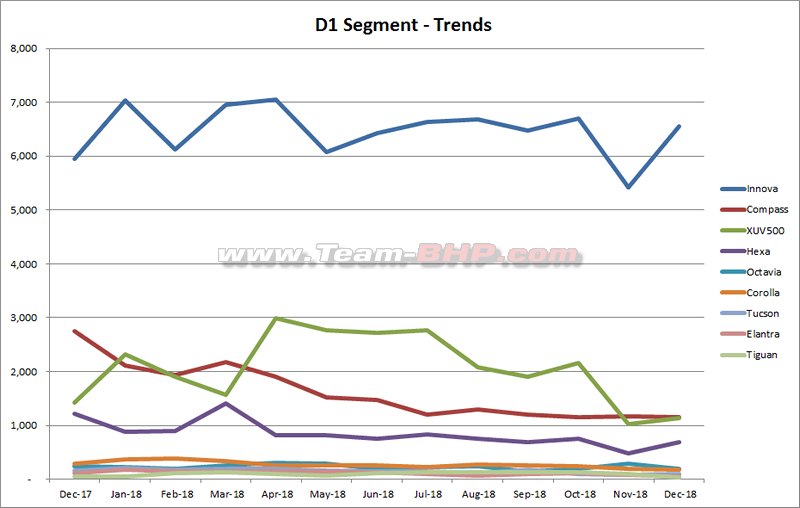

Tata Motors: Holds on to the top 3, with the help of its newer launches. New launches like Nexon helps but fail to understand the drop in Tiago volumes (M-OM). Discounts have helped Hexa to show marginal increase as compared to November dispatch figures. Harrier and its Premium hatch will be Tata’s promising offers for 2019.

Mahindra: Not so good for Mahindra as it de-grows 1 % when most top auto manufactures see a positive growth (YO-Y). Almost all products shows de-growth with abysmal numbers coming from KUV. Too early to pass a verdict the flagship Altura . TUV and XUV show a flat growth. 2019 growth depends on the pricing of XUV3OO,

Honda: Shows a healthy growth of 4 %. Amaze stabilizes at ~ 5.5K, City establishes as second to Ciaz in the sedan segment, WR-V is now a 3rd in the CUV segment. CR-V shows respectable numbers while Jazz de-grows further and Brio seems to have ended production? Honda Civic is the much awaited launch, but with Honda’s expected pricing might not fetch the desired volumes.

Toyota: Grows at 10 % mainly with volumes from Innova and Fortunerer. Yaris further decreases, what is next with Yaris? For 2019, Toyota has Corolla and Suzuki badged products for launch. Camry too is due shortly but not expected to garner any substantial volumes.

Ford: Grows at 15% due to a low 2017 base number. EcoSport overtaken by Tata Nexon. Aspire and Freestyle volumes drop. No clue on how Ford is going to sustain with no new models are being speculated for a 2019 launch.

The rest of the Auto Manufacturers: Have all registered double-digit de-growth! The bottom 6 is finding it extremely tough to maintain their Market Share and is losing their ground rapidly.

Overall 2018:

Maruti posts highest sales while Tata Motors post highest growth.

- Tata find themselves at an enviable position at the top of the list at 26.3 percent sales growth.

-Hyundai Motor India has reported its highest sales volume in a calendar year

- Despite strong sales volumes from Honda Amaze for a few consecutive months, Honda Cars India reports 2.3 percent sales decline for 2018.

- Datsun India reports sales volume drop of 12 percent despite launching 2018 Datsun Go, and Go Plus in Q4 2018.

-Volkswagen at 22.9 percent sales decline. Renault India reported 28.3 percent decline complete the bottom end of the chart.

Sales:  Growth:

Growth:  Source

Source +Auto Punditz

(19)

Thanks

(19)

Thanks

(12)

Thanks

(12)

Thanks

(11)

Thanks

(11)

Thanks

(13)

Thanks

(13)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks

(3)

Thanks

(3)

Thanks

(4)

Thanks

(4)

Thanks

(1)

Thanks

(1)

Thanks

(8)

Thanks

(8)

Thanks

(13)

Thanks

(13)

Thanks

(2)

Thanks

(2)

Thanks

(1)

Thanks

(1)

Thanks