Team-BHP

(

https://www.team-bhp.com/forum/)

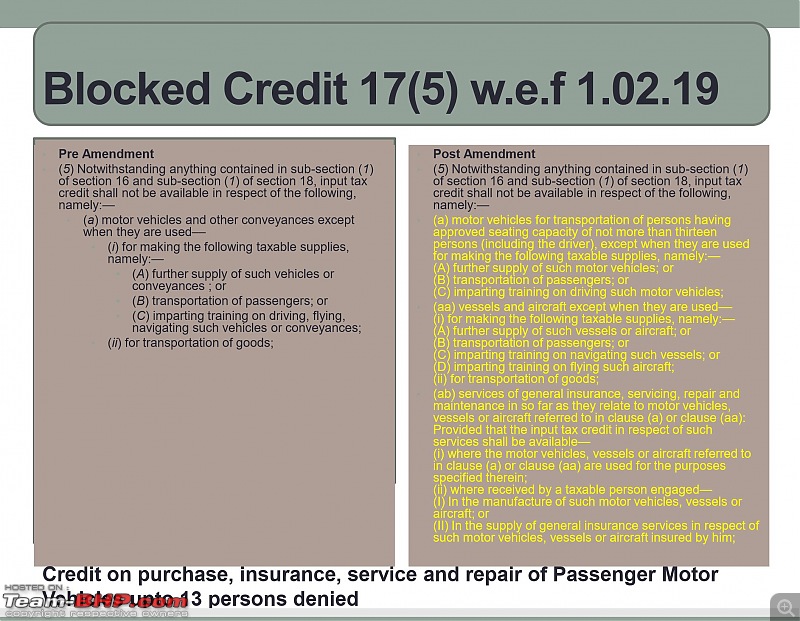

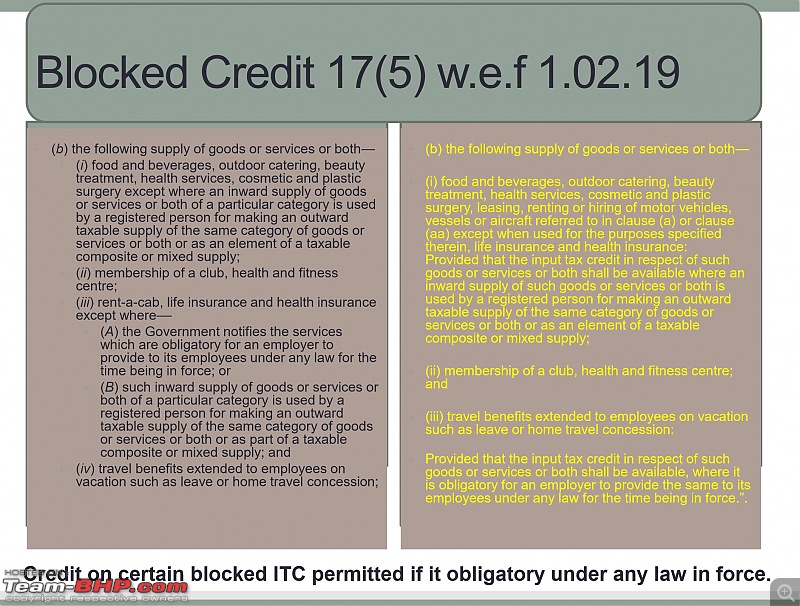

Credit on purchase, insurance, service and repair of Passenger Motor Vehicles upto 13 persons denied Effective 1st Feb 2019

As per a new Notification, one cannot claim GST on repairs/ Service on passenger vehicles any longer :deadhorse

And as per another Notification,

Input credit on Lease/ Rental will also be not available, though I am not sure on this given the high repercussions.

Quote:

Originally Posted by Turbanator

(Post 4542603)

Credit on purchase, insurance, service and repair of Passenger Motor Vehicles upto 13 persons denied Effective 1st Feb 2019

As per a new Notification, one cannot claim GST on repairs/ Service on passenger vehicles any longer :deadhorse

|

There is nothing disappointing or incorrect in it. As a matter of fact, ITC on purchase of spare parts was not available in VAT too, and I, as a tax professional, have never allowed the ITC of all these to my clients, in the GST regime too.

Quote:

Originally Posted by Swapnil4585

(Post 4542648)

There is nothing disappointing or incorrect in it. As a matter of fact, ITC on purchase of spare parts was not available in VAT too, and I, as a tax professional, have never allowed the ITC of all these to my clients, in the GST regime too.

|

Why Not? We have many company cars and bikes that our staff uses for company work, so why should we not get the benefit? If you do not allow your clients to claim GST on repairs previously it was your own decision, I don't see any merits in non-claiming. Comparing it with VAT regime wont be fair, as an example, if we had to furnish our office before, we would have never claimed VAT, same goes for numerous other things like Air Conditioners, Stationary but now in GST we claim ITC on everything that's not disallowed specifically.

Quote:

Originally Posted by Swapnil4585

(Post 4542648)

There is nothing disappointing or incorrect in it.

|

It is indeed disappointing. What was the point of bringing in the GST reform if everything is going to continue as it was in the VAT regime??

True GST is when input credit if given on all input costs incurred in running a business. I can understand if they can't allow ITC on motor vehicles, but servicing and insurance costs are regular revenue expenditure which an entity has to incur. I don't see any rationale as why these specific expenses have to be excluded from eligible ITC. Remember how GST was touted to be a major reform which was supposed to help businesses bring down costs by allowing ITC on inputs. They even forced businesses to reduce prices of their products and services citing the same and brought in an anti-profiteering clause.

Quote:

Originally Posted by Swapnil4585

(Post 4542648)

As a matter of fact, ITC on purchase of spare parts was not available in VAT too, and I, as a tax professional, have never allowed the ITC of all these to my clients, in the GST regime too.

|

In that case your clients missed out on the available ITC on these expenses for the past 18 months given that the notification comes into effect from 1.2.19. If they specifically mention that it is not available from 1.2.19, then they are silently implying that it was available till 31.1.19 :).

Quote:

Originally Posted by Turbanator

(Post 4542658)

but now in GST we claim ITC on everything that's not disallowed specifically.

|

+1. That is why there is a negative list. Other than items in the negative list, ITC is available on every other business related expense.

Thanks for sharing, Turbanator! Moving your post to a new thread.

I don't agree with this change. Company-registered cars anyway undergo higher registration charges in almost all states. Now, if it is company registered and / or being used for business purposes, why should input tax credit not be allowed?

Quote:

Originally Posted by GTO

(Post 4543089)

Thanks for sharing, Turbanator! Moving your post to a new thread.

I don't agree with this change. Company-registered cars anyway undergo higher registration charges in almost all states. Now, if it is company registered and / or being used for business purposes, why should input tax credit not be allowed?

|

The moot point being that these (vehicles with less than 13 passengers) are used for 'non-business'/ personal purposes on a large scale. This is either done by the proprietors themselves or used as perks for employees. Till such an approach of most businesses continues (especially SMEs & professionals), it is fair that ITC be blocked.

Quote:

Originally Posted by srh

(Post 4543140)

The moot point being that these (vehicles with less than 13 passengers) are used for 'non-business'/ personal purposes on a large scale.

|

So why allow Depreciation or even allow booking of Purchase of such vehicles at first place on the balance sheet? I am sure more than 90 % of the Luxury cars will be in the company books, all the exotics that we see cannot be normally bought by an Individual.

Quote:

Originally Posted by srh

(Post 4543140)

The moot point being that these (vehicles with less than 13 passengers) are used for 'non-business'/ personal purposes on a large scale. This is either done by the proprietors themselves or used as perks for employees. Till such an approach of most businesses continues (especially SMEs & professionals), it is fair that ITC be blocked.

|

Will this impact the monthly EMIs of existing car leases or upcoming ones taken by an employee through the company's vehicle lease plan? Please shed some light on what this actual change means.

Quote:

Originally Posted by GTO

(Post 4543089)

I don't agree with this change. Company-registered cars anyway undergo higher registration charges in almost all states. Now, if it is company registered and / or being used for business purposes, why should input tax credit not be allowed?

|

The questions that come up at the assessment stage are: -

1. What business is the company engaged into.

2. What proportion of the usage of the vehicle is used for business & what for personal.

Answer to question 2 is difficult to classify. And for question 1, GST says that ITC can be availed on goods used for furtherance of business & which are capitalised in the books of account. So now though the asset is capitalised in your / company's books, you would still be required to classify its usage. Now if you have taken credit while filing your return, and at assessment stage it is denied, the same need to be reversed and interest at a higher rate is charged.

Generally, take no ITC on purchase of cars (and of spare parts), and take depreciation only on the purchase value of car (excluding the indirect tax element) in Income Tax, is a set practice.

Quote:

Originally Posted by Swapnil4585

(Post 4543206)

The questions that come up at the assessment stage are: -

1. What business is the company engaged into.

|

Just for argument sakes, say I am a CA. I buy a Car to go from one meeting to another, from 1 IT zone to another, etc. Wouldn't this be a work related requirement. Due to my usage, the car has to be serviced. Hence the ITC should be available.

Similarly, I give my employee a car, registered in Company name,so that he can go from client to client, Govt. office to another.

So not all 'cars' are for personal use.

Edit: Re-read your answer and understood what you are trying to say. It is prudent not to take credit, rather than argue and get levied with a higher interest rate for returning the credit.

Quote:

Originally Posted by Th!ru

(Post 4543166)

Will this impact the monthly EMIs of existing car leases or upcoming ones taken by an employee through the company's vehicle lease plan? Please shed some light on what this actual change means.

|

I asked similar question in original thread, the response form Turbanator is below

Quote:

Originally Posted by Turbanator

(Post 4543128)

From what I understand, this will affect companies who had got the vehicles on lease and were taking ITC on the GST portion of lease. For an individual there should be no change unless the company had got into some agreement with an employee that they deduct only basic amount and not GST portion on the lease. Or some self employed persons who have GST number in their own name, they will no longer get ITC for this. Since the Government never allowed ITC on the vehicles, I see this more as technical correction.

|

https://www.team-bhp.com/forum/india...ml#post4543128

Quote:

Originally Posted by Turbanator

(Post 4543144)

So why allow Depreciation or even allow booking of Purchase of such vehicles at first place on the balance sheet? I am sure more than 90 % of the Luxury cars will be in the company books, all the exotics that we see cannot be normally bought by an Individual.

|

That is a valid question.......ideally, except for star hotels/ travel & tourism industry fleet owners etc., no one should be allowed profit reducing benefits from luxury cars/ exotics

Quote:

Originally Posted by Th!ru

(Post 4543166)

Will this impact the monthly EMIs of existing car leases or upcoming ones taken by an employee through the company's vehicle lease plan? Please shed some light on what this actual change means.

|

Don't have an idea. But I would assume that even before this change, the employer would not be taking ITC for vehicles leased for employees from a third party.

Quote:

Originally Posted by srh

(Post 4544032)

That is a valid question.......ideally, except for star hotels/ travel & tourism industry fleet owners etc., no one should be allowed profit reducing benefits from luxury cars/ exotics

|

But why?

Especially when an office car is considered a basic perk and given to almost all government officers over a certain rank. And we all know even they flout the norms and use those cars for personal use as well. Then why isn't a business owner allowed the same perk as even he will be using the car mostly for official reasons. If I am going for a meeting with a client, isn't that for 'furthering my business'. If I would take a cab or a flight instead, that is definitely allowed as a business expense.

Quote:

Originally Posted by Turbanator

(Post 4542658)

Why Not? We have many company cars and bikes that our staff uses for company work, so why should we not get the benefit? If you do not allow your clients to claim GST on repairs previously it was your own decision, I don't see any merits in non-claiming.

|

Actually, I discovered this in 2017 during the initial months of GST. At first, as a business owner I was salivating at all the ITC I can get for my company registered cars. Then my auditor dropped a bomb. Unless I am using the car to earn revenue, I can't take ITC on it. Since I am in software business, I can only take ITC on computer hardware and software. If you are consuming something, then there is no ITC for it.

For ITC purposes,

using the car for official reason will fly only if you are being paid for providing transportation service using that car. If you are using it for your convenience to travel places, then ITC doesn't apply.

You are already getting income tax exemption on business expenses, now you want sales tax (GST) exemption too?

Quote:

Originally Posted by Samurai

(Post 4544167)

Since I am in software business, I can only take ITC on computer hardware and software. If you are consuming something, then there is no ITC for it.

|

No, that's not correct. You should claim ITC on anything and everything unless specifically disallowed. What you or your auditor has referred was something being followed under CENVAT rules. Remember how manufacturing companies were claiming Cenvat on the inputs! Under GST, there is no such differentiation of consumption or production.

| All times are GMT +5.5. The time now is 09:16. | |