Thanks Aditya for the data and analysis,

More Facts and Figures (FY19 & March-19) FY19:

Overall Passenger Vehicle segment saw reported an increase of 2.7 per cent in domestic sales for FY19 to 3,377,436 units as compared to 3,288,581 units in FY18.

Market Share: Maruti Suzuki’s Market Share increase by 1.2% in FY19 and the Market Leader could capture a Market Share of whopping 51.9% in the Indian market

The slowdown is expected to continue this Financial Year and Apr’19 – May’19 is going to be even more challenging citing the upcoming political conditions.

Top 7 OEMs posted a positive growth in FY19 v/s FY18 and remaining all 5 OEMs registered a YoY de-growth

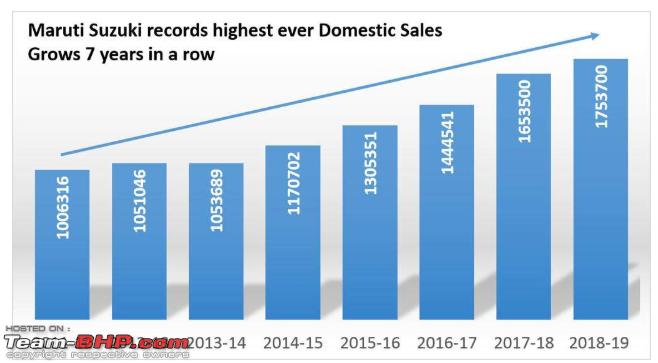

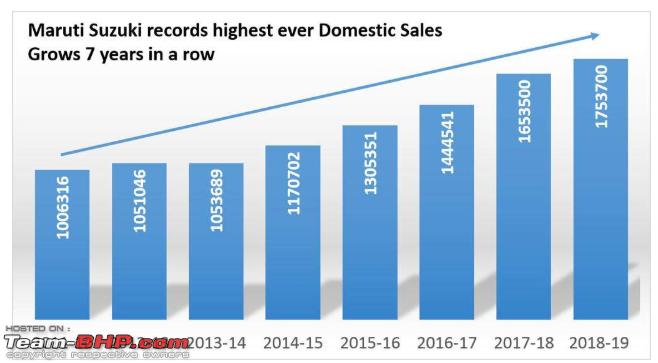

Maruti Suzuki reports highest total sales growth in FY'19 at 1,753,700 units, up 6.1 per cent, The growth for Maruti was supported by the Arena channel (6% YoY).

Hyunda

Hyundai achieves highest ever domestic sales last fiscal at 5.45 lakh units a growth of 1.7%. Hyundai could post a flat growth (2%) and this too was possible with the introduction of the iconic Santro.

Mahindra’s new launches helps in retaining the 3rd spot. Sells 2.5lakh units and up @2%over the previous year.

Tata Motors grows 12%, and falls a spot behind Mahindra’s and sells 2.1lakh units.

Honda grew a healthy 8% in FY19 owing to the tremendous success of New Amaze!

While Tata posted the highest growth amongst all OEMs; It was Nissan+Datsun which seems to lost the track completely.

FY19

FY19 :Market trend shows customers are moving up the segment ( narrowing gap in numbers of the entry level Vs the next segments)

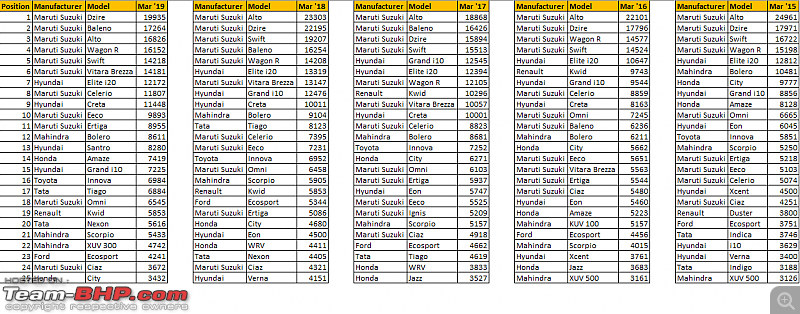

March-19:

The Passenger Car Sales de-grew -2.8% in Mar’19 v/s Mar’18. Due to muted demand and weak consumer sentiment; the Industry is under consistent pressure and last few months have been very challenging. All OEMs are now gearing up to meet the upcoming BS-6 regulations and CAFE (Corporate Average Fuel Economy) norms.

Maruti Suzuki reported a de-growth of 1.5% with its domestic sales at 1,45,031 units in Mar’19 v/s 1,47,170 cars sold in Mar’18.

Hyundai de-grew -8% in Mar’19 v/s the same period last year. Even post Santro launch; Hyundai hasn’t gained significant numbers.

Segment wise:  MPV:

MPV: Grows at 12% (Y-O-Y). The numbers are backed by Maruti Suzuki’s Ertiga and supported by Toyota’s Innova & Mahindra’s Marazzo.

Renault announces TRIBER, a MPV for this segment. Challenging in terms of pricing and packaging as it will take on the established players .

Compact SUV:

Compact SUV: The overall segment grew by 6% YoY. Maruti Suzuki’s Vitara Brezza, with only a diesel offering defies all logic and unbelievable in the volumes churned out every month.

Nexon positions itself as the runner up in this segment. Mahindra’s XUV300 shows impressive numbers in its early months, but comes at an expense of drawing volumes from its own TUV.

EcoSport feels the effect of Mahindra’s release and is now lower in the sales chart. A segment which needs to be watched as Hyundai launches its VENUE in the coming months.

SUV:

SUV: A segment that is crowded and most competitive sees dominance of Hyundai’s Creta from the time of its launch, even though the segment grows by a mere 4%.

Mahindra’s Scorpio continues to churn 5k+ numbers and expected to grow in the coming months due to its rural dominance.

Tata’s latest offering in the form of Harrier shows a lot of promise but need to watch as new launches are poised to enter soon.

FCA juggles its Jeep Compass variants as its position is threatened with new launches.

C Segment

C Segment –Sedan: A segment which is normally skipped by new manufactures and rightly so as the segment de-grows by 12 %.The segment has been slowly shrinking and not a single model in the entire list posted a positive YoY growth in Mar’19!

A closely fought segment between Maruti and Honda, sees CIAZ in lead in March.

Maruti Suzuki’s Ciaz beats its closed rival Honda City in FY 19( Ciaz -total sales 46,169) by 4,485 units, and 5899 cars more than Hyundai’s Verna.

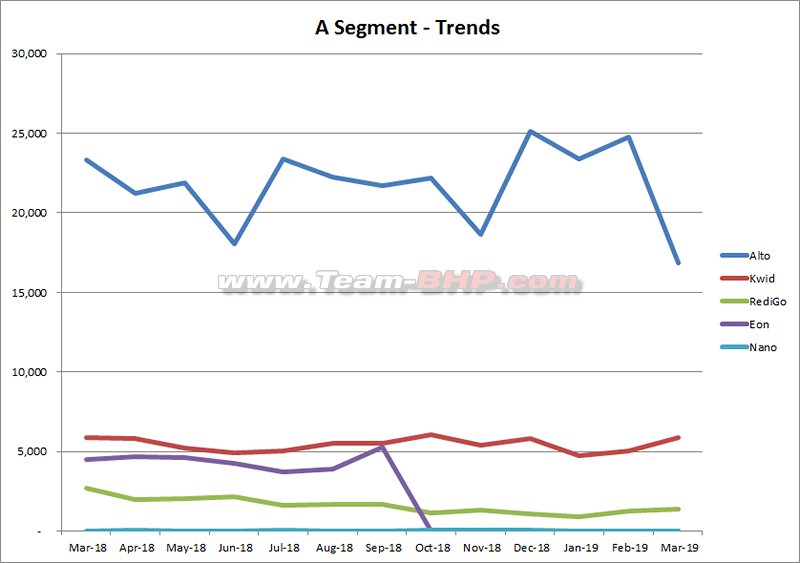

Entry level segment:

Entry level segment: A fast growing segment in the past is now one of the slowest growing showing a de-growth of 34%.

The largest selling of the segment, Maruti Suzuki’s Alto is now pushed to the 3rd position in March-19 sales/dispatches.

The entry-hatch volumes are draining down and 2 models mark their exit in FY19! (Nano & Eon), and most manufacturers will skip bringing/ updating products in this segment.

With EV’s things could change and revive this segment.

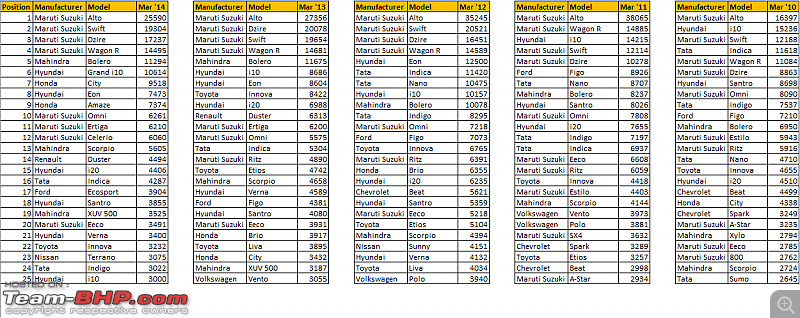

Top 10 cars:

Top 10 cars:

The Top 10 selling cars sold a total of 1,43,896 units in Mar’18 and contributed to >50% of overall car sales in India!

Maruti Suzuki 8/10

Hyundai: 2/10

Source: Auto Punditz/ET +Reports

(21)

Thanks

(21)

Thanks

(10)

Thanks

(10)

Thanks

(9)

Thanks

(9)

Thanks

(12)

Thanks

(12)

Thanks

(1)

Thanks

(1)

Thanks

(24)

Thanks

(24)

Thanks

(1)

Thanks

(1)

Thanks

(17)

Thanks

(17)

Thanks

(3)

Thanks

(3)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(3)

Thanks

(3)

Thanks

(7)

Thanks

(7)

Thanks

(8)

Thanks

(8)

Thanks