Team-BHP

(

https://www.team-bhp.com/forum/)

NOTES:

1: Thanks to the team at

Auto Punditz for sharing these sales numbers with us!

2: Only cars that sell 500+ units (and thus, the relevant ones) have been included in the gainers & losers chart.

3. These manufacturer-reported sales numbers are factory dispatches to dealerships. They are NOT retail sales figures to end customers.

The slowdown is evident!

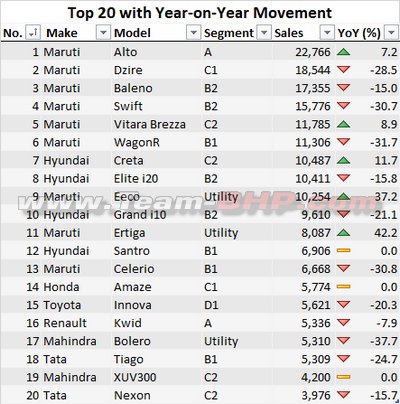

On another note, I am absolutely amazed by Brezza's numbers. Wonder how the Petrol will impact the numbers when launched.

Amaze rescuses Honda to be the only manufacturer to show a YoY growth. Otherwise, each and every Honda car has shown a decline in sales, MoM.

New Launches -

Ford Figo - limping on. Numbers will not make Ford bosses happy, I'd assmue.

Hyundai Santro - Although dropped off by almost 1300 units, its still not bad for a bad performing month.

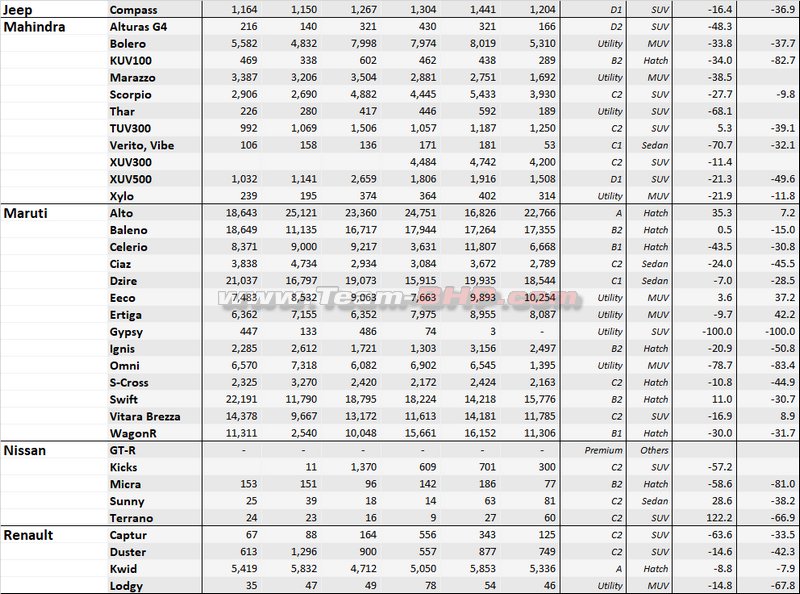

Mahindra Alturas G4 - This car has certainly performed way above my expectations. 166 this month. Wont be surprised if it gets back to 300+ post election results.

Mahindra XUV300 - Impressive to say the least. 4200 even this bad month. Much above EcoSport.

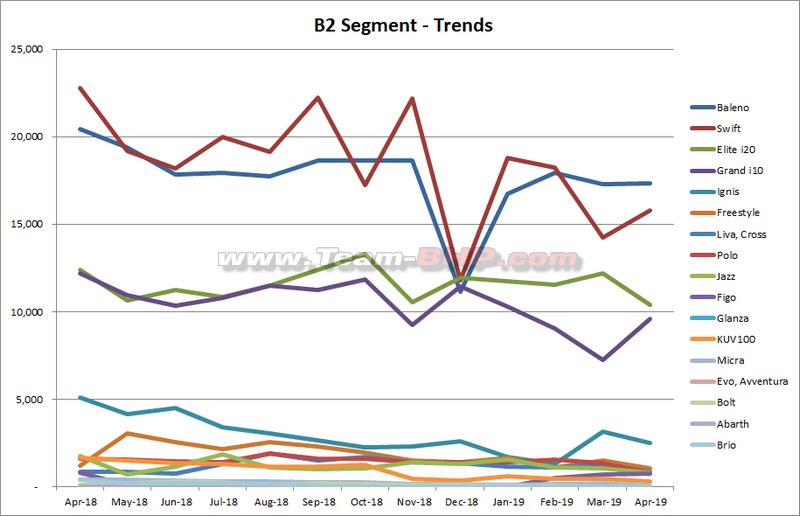

Maruti Baleno - New facelift helps keep sales slightly above last month. 0.53% sales increase MoM puts in the top 10 list! :D

Maruti Ciaz - Even with 1.5L eninge offering, sales have dropped. Will wait for 1.5L engine deliveries to garner pace.

Nissan Kicks - Blame the brand image. Poor after sales service and other issues have crippled a good product's performance.

Tata Harrier - Not bad at all, for now. Above the 2000 mark (Compass too did 1200 units in a bad month). Couple more months, and with Hector's launch, things will be much more clear.

Toyota Glanza - A start. Most probably dealer display and TD cars. We should develop a MT ratio, or Maruti / Toyota ratio. For now, the Baleno/Glanza product's MT ratio is = 48.2 (Maruti sold 48 times of that of Toyota!)

Toyota Yaris - Rock solid performance with consistent 3XX units every month! Impressive. stupid:

What shocked me was the Top gainers part.

Companies with less than 1% gain also feature shows how badly the car market is hit.

Every CSUV has taken a hit, Every C2 sedan has taken a hit and so has the UV. Troubling time, hope its just the election jitters else we are in a mess for sure

I'll be really interested to see Creta's numbers after a couple of months of Venue's release.

Also, it is crazy the number of Brezzas being sold by Maruti. Brezza above WagonR and Creta above i20 is mind boggling

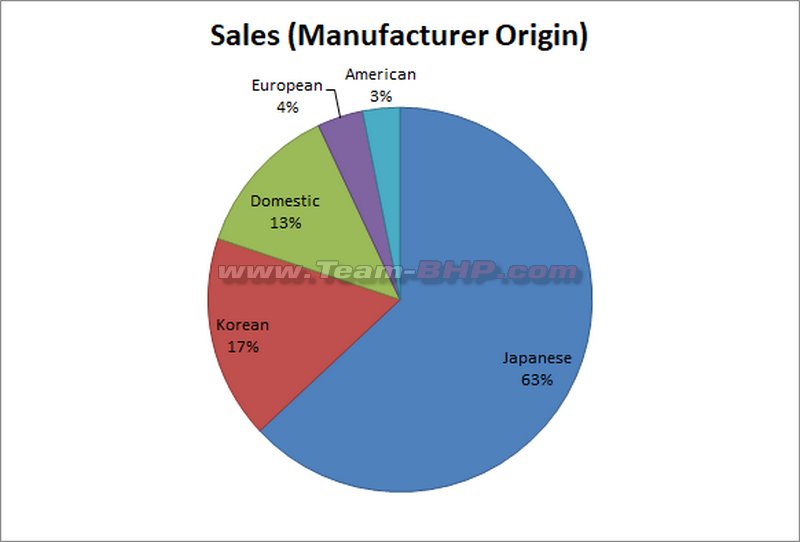

Interesting to see that only change in relative position in marketshare (Apr'18 vs Apr'19) is Toyota-Honda swap in positions 5-6, owing to success of Amaze.

With MG and Kia entering the market soon, will be interesting to see where they slot in.

Thanks Aditya for the data,

Facts and Figures:

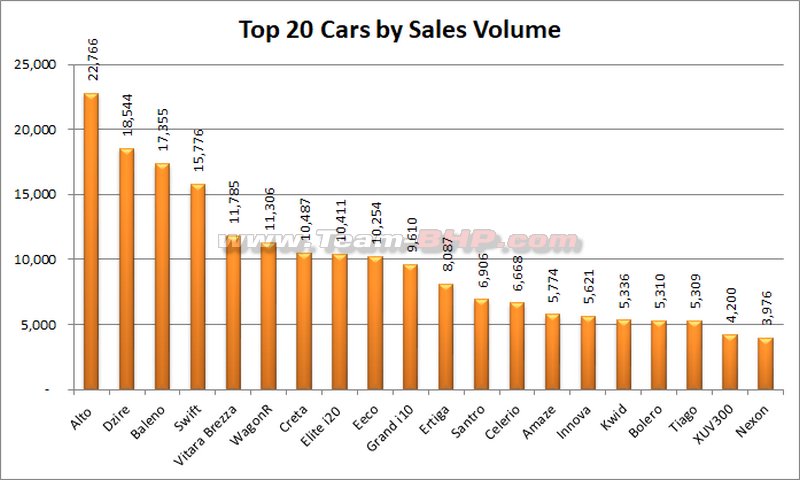

The Passenger Vehicle sales saw a dip of -16.7% in Apr’19 v/s Apr’18, a big fall in numbers not seen in recent times.

Also marks the beginning of FY20, but not looking good with respect to sales as political uncertainty and lower consumer sentiments, up-coming emission norms, dilemma in diesel scenario, etc. Decrease in OEM discounts for Apr’19 and no new model launches fueled the decline.

- Only 1 OEM (Honda) reported a YoY growth in Apr’19. Honda sees a Y-O-Y growth owing to low base of Apr’18 (and Amaze was also not launched till then).

- Nexa channel de-grew by hefty margin. Nexa’s performance led to the overall degrowth of -19.6% for Maruti Suzuki.

- Hyundai degrew by -10%. However; it was able to gain a Market Share of 1.3% and its Apr’19 MS was 17.1%.

- Mahindra’s backed by XUV300 sales reduced the fall and degrew by -8%. It helped M&M gain a Market share of 0.8% in Apr’19.

- Nissan registered the highest fall of -42.5% in Apr’19. Worrisome situation as its new SUV, Kicks is on a down slide in its sales trend.

April-19

Maruti Suzuki : Reported de-growth in almost all its segments, except its CUV, Entry Level and MUV.

Though it retains its podium positions in almost all its segments, loses the Sedan pole position to Hyundai’s Verna.

Loses Market Share by ~ 1.9%, though the overall it’s a healthy 53.5%

Hyundai: Replicating the trend shown by the market leader, the figures are a bit different. Its only growth coming from its SUV showing a solid performance.

Its newest launch Santro, turns out to be a mediocre product in terms of sales.

Hyundai manages to increases its Market Share (Y-O-Y) by +1.3 %, and going by its upcoming CUV launch, later this month, will be interesting to see how it holds on/increases its market share in FY20.

Mahindra: Shows a de-growth in all its segments but manages to increase its Market Share by 0.8% helped by its CUV –XUV3OO.

Alturas does okay, but see a drastic M-O-M drop. XUV3OO climbs up to the 2nd spot dethroning Tata’s Nexon. With the current sales trend KUV is likely to go the EV way.

TATA: No different from the de-growth trend. Tiago shows sharp down fall, Tigor shows dismal numbers, Nexon loses out to Mahinda’s XUV300, need to watch the CUV chart once Venue start clocking numbers. Hexa drops further. Harrier shows a small drop, is still above XUV and Jeep Compass.

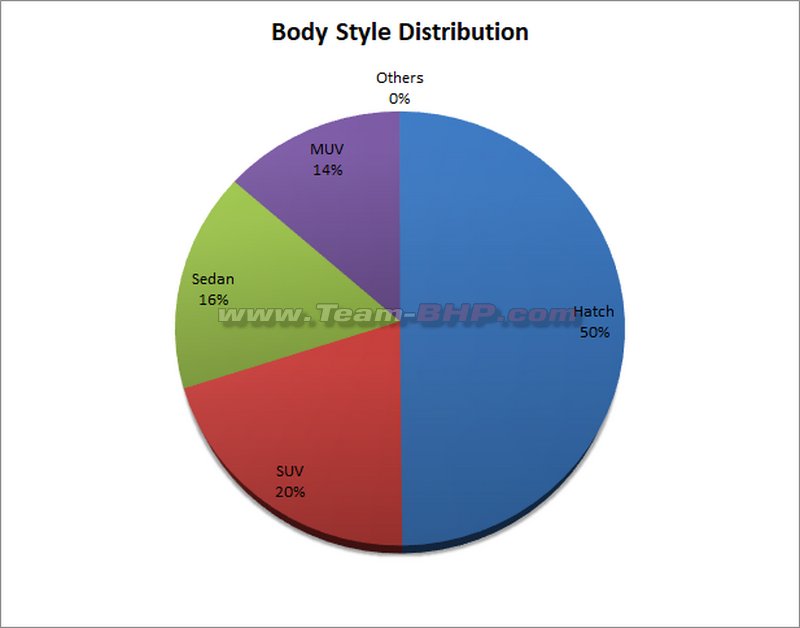

In Top 10 :

Maruti Suzuki : 7/10

Hyundai : 3/10

What a slowdown ! :Frustrati

I can hardly see cars which have shown a MoM% growth. Even though there are a few outliers, the majority industry trend has shown a negative growth. I foresee a further slowdown in sales until the Festive Season.

Not even a single manufacturer has posted a MoM increase in sales. The timing couldn't have been worse for the multiple new products which are expected to hit the market in the next few months. Things might get very challenging for the upcoming new players in India like MG, Peugeot and Kia Motors.

Another sluggish month for the industry.

Going through the charts, there's only one thing I can deduce: India is a tough market to crack. :D

> Anything that looks good will sell as long as you have top-notch after sales network

> A decent looking product loaded with features can sell well with a half-decent after sales network

> Nothing works if you have had poor after sales or reliability record in the past

You've got to have a product that looks good and comes loaded with features at a price that undercuts direct competitors. Depending on the brand image and history, a product can pull off a premium price tag even while compromising on any one aspect except features (such as safety, comfort or design).

While features and design are a priority for customers, aspects such as safety and road manners (handling, performance, etc.) are certainly not as important.

Indian market is becoming very hard to judge, too many variables changing too fast.

I guess below are leading to the slowdown,

1. Indian regulatory scene - AIS 140, AIS 145 (mandatory Airbag, ABS, RPAS, Seatbelt warning, over speed alert), mandatory RFID (=Fast tag), BS6,

2. Economic growth projection slowdown,

3. Mindset of younger generation about owning cars,

4. Increase in availability, ease of utilization and affordability of cabs,

5. Unconventional mobility solutions - yet to start.

Come 2020 and BS6, prices will overshoot budgets for many first time buyers may take a back step.

OEMs need to figure out a lot!

Example:

A. OEMs Joining hands to survive in Indian market -

1. Ford & Mahindra made JV to reduce development costs and Ford had tough time delivering profits in India.

2. Toyota & Maruti Suzuki's partnership,

3. Renault & Nissan JV,

B. OEMs joining hands with cab aggregators and fleet suppliers, like Mahindra and OLA did.

C. The EV push!

D. Using India as manufacturing hub for exports on this side of the world to fully utilize the installed production capacity.

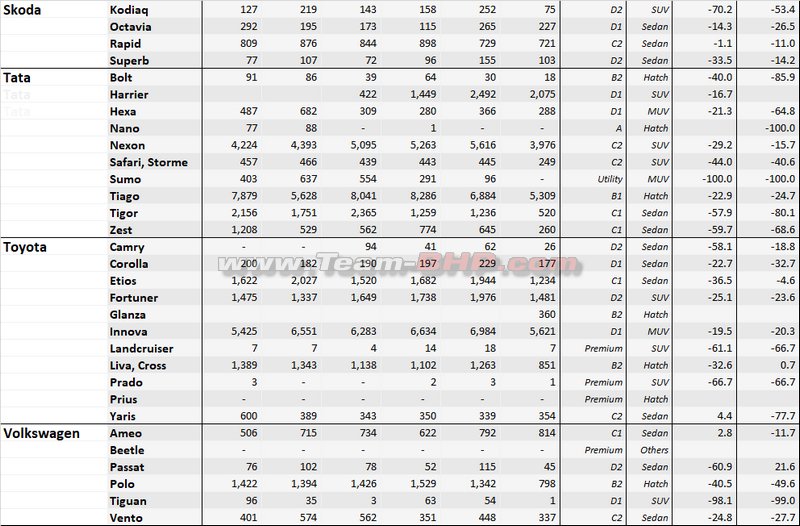

D2 SUVs are not spared in the slowdown.

- Honda CRV 59

- Skoda Kodiaq 75 (+The VAG moved only 1 Tiguan)

- Mahindra Alturas G4 166

- Ford Endeavour 498

- Fortuner 1481

All across the board its a massacre. Only the Fortuner (obviously) and the Endeavour have shown some resilience despite the bloodbath hovering around their respective sweet spots of 1500 and 500 respectively.

Interesting to note that the JV rumours have not dented Ford's market share much, as it continues to maintain the 6k neighbourhood.

| All times are GMT +5.5. The time now is 20:27. | |