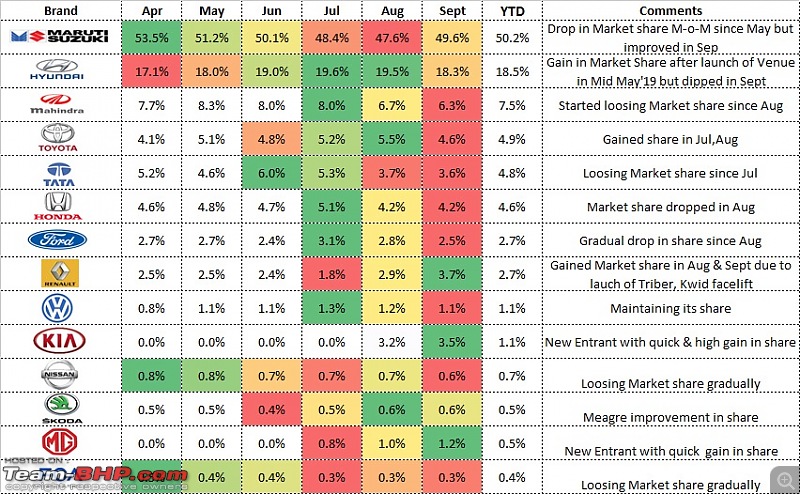

| Market Share H1, FY20 - Indian Auto Industry

With the slowdown of auto industry there is market realignment in terms of market share.

It could be a temporary alignment as it seems dependent on new launches and as seen once the product clicks there an positive movement in market share is visible.

Here is the current scenario in market share H1FY20(April-Sept 2019)

- H1 FY20 (Apr’19-Sep’19) v/s H1 FY19 (Apr’18-Sep’18) is considered in the table for analysis

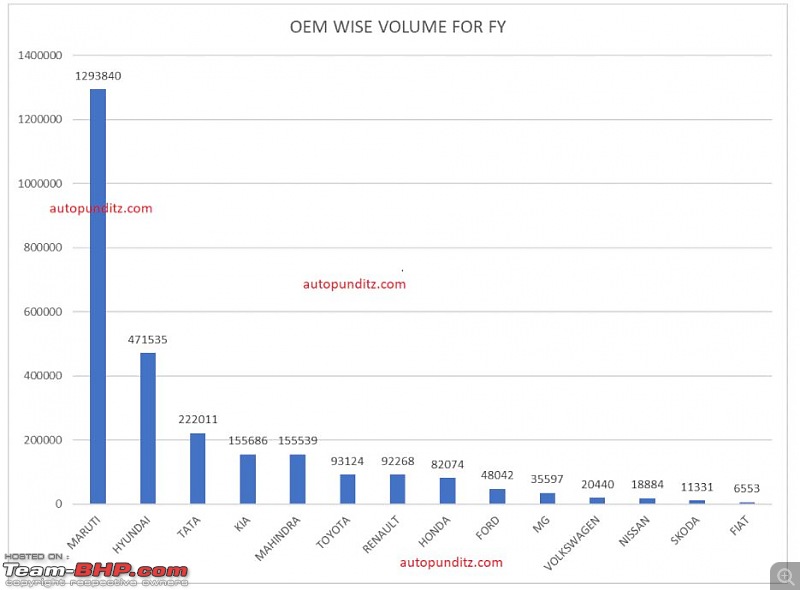

-The Indian Auto Industry degrew by -23% and was led by the fall in sales of the market leader Maruti Suzuki. Maruti’s volumes fell by -27% in H1 FY20 v/s H1 FY19.

-Maruti also registered the highest Market Share drop! Maruti’s Market Share fell by -2.6%!

- Even with the drop in Market Share Maruti Suzuki retains +50% of the market.

-Maruti’s loss was Hyundai’s gain. Clearly the new launch in Venue has contributed to 21% of Hyundai’s volume in past 5 months.

-Hyundai was able to reduce the 'de-growth' and grew its market share by 2.6%.

-Mahindra too took help of the new launch XUV300 to fight the adverse market situation and grew its Market Share by 1% in H1 FY20

- Badge Engineering Success:

Toyota was able to place itself in the fourth spot clearly due to Glanza. Maruti sourced Glanza has sold 11,320 units in past 6 months and has contributed nearly to 18% of Toyota India’s volumes in H1 FY20.

-Tata is now pushed to 5th rank in the OEM ranking table.

- Tata has the second highest fall in Market Share (post Maruti) and almost 1.5% of its market share was eroded in H1Fy20

-Kia has made a strong entry and was able to gain market share of 1.1% with only 2 month volumes taken into consideration (too early though for any conclusion) Link

Last edited by GTO : 7th October 2019 at 07:10.

Reason: As requested

|

(14)

Thanks

(14)

Thanks

(5)

Thanks

(5)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks

(2)

Thanks