Source: Autopunditz

With Indian economic growth in tailspin, 2019 saw one of the worse decline in passenger vehicles sales.

Will 2020 overshadow this, as a Global recession is looming at large?

Almost every major PV manufacturer suffered from 2019 consumption demand slowdown.

Luxury market too saw a decline in demand by 13%.

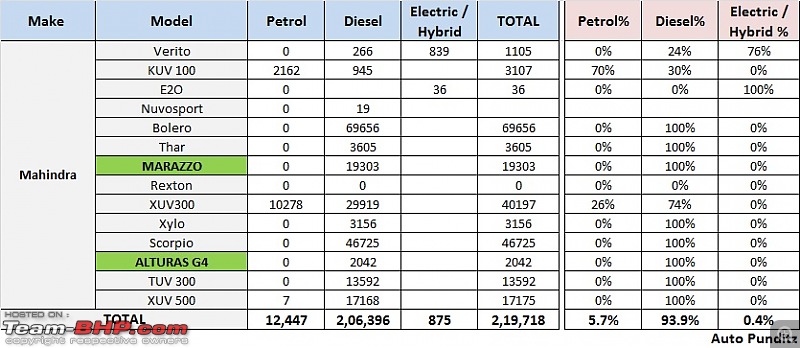

New product launch which helped respective manufacturer to fair better than industry decline : Hyundai Venue, Mahindra XUV300, Mahindra Marazzo, Nissan Kicks and Renault Triber.

BODY STYLE:

BODY STYLE:

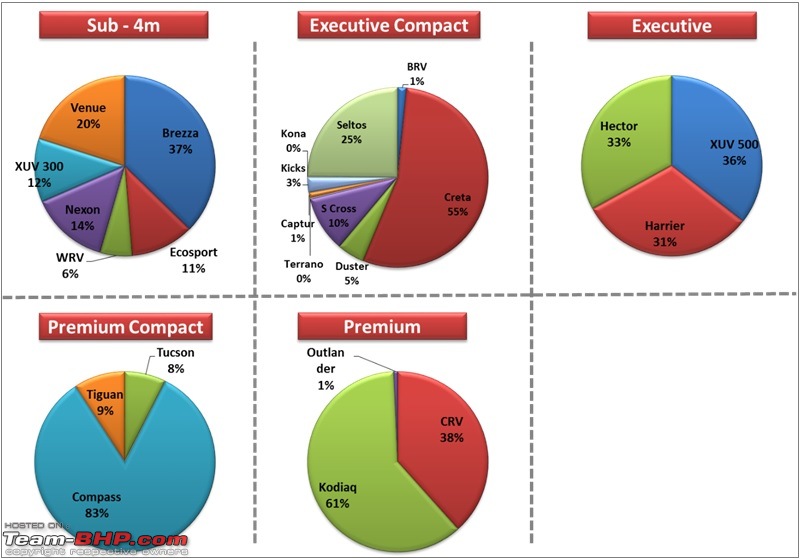

Almost all segment witnessed de-growth and slight growth in UV segment is due to new or upgraded product launch.

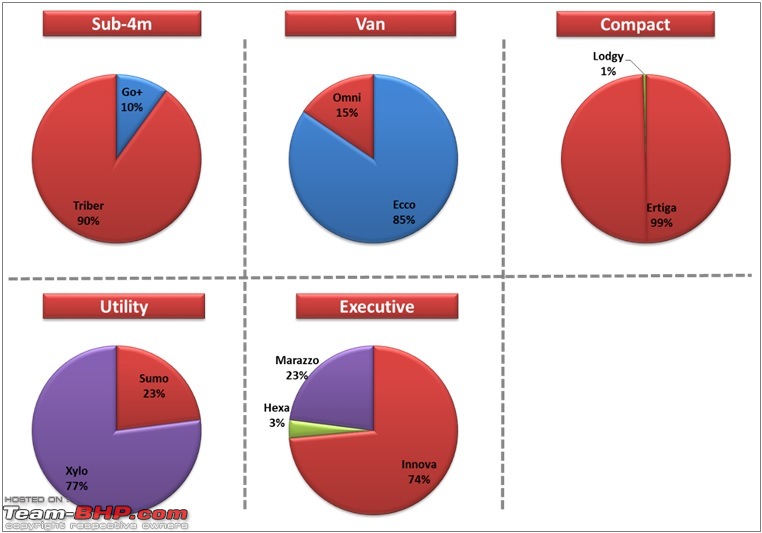

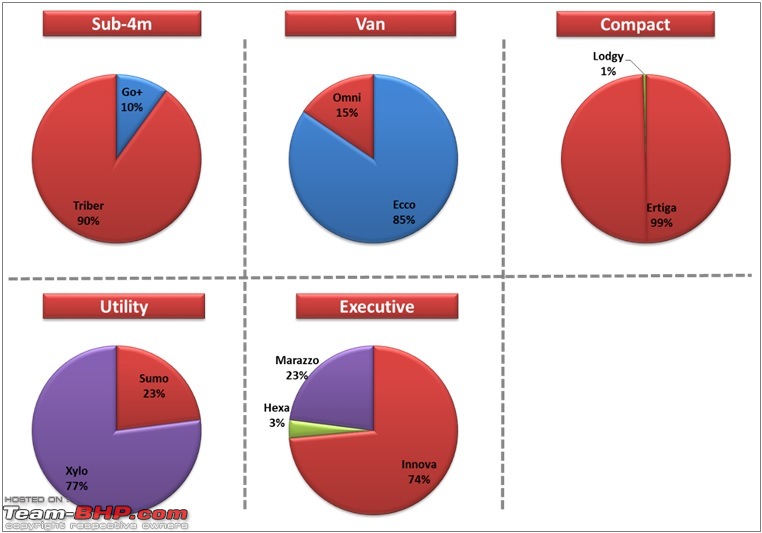

MUV growth was powered largely by new generation Maruti Ertiga and its derivative XL6 and to certain extent by Renault Triber

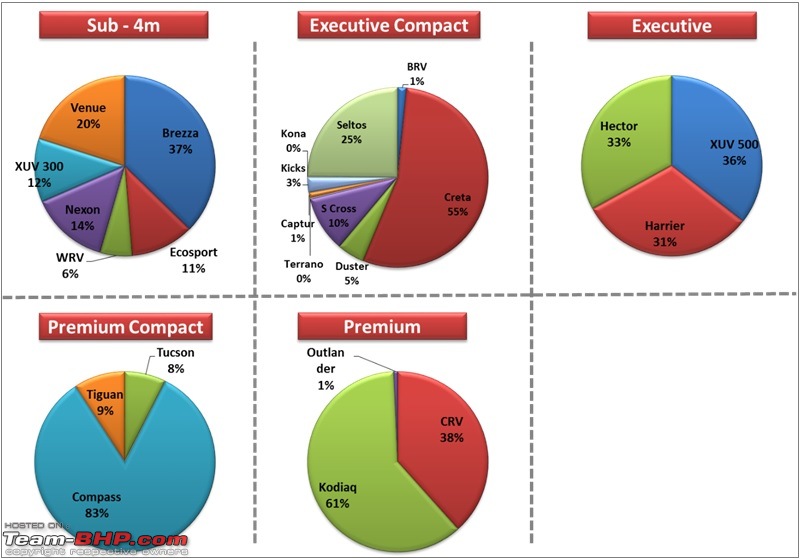

SUV growth can be attributed to Mahindra XUV300 & Hyundai Venue in lower price band and MG Hector & Tata Harrier in middle price band.

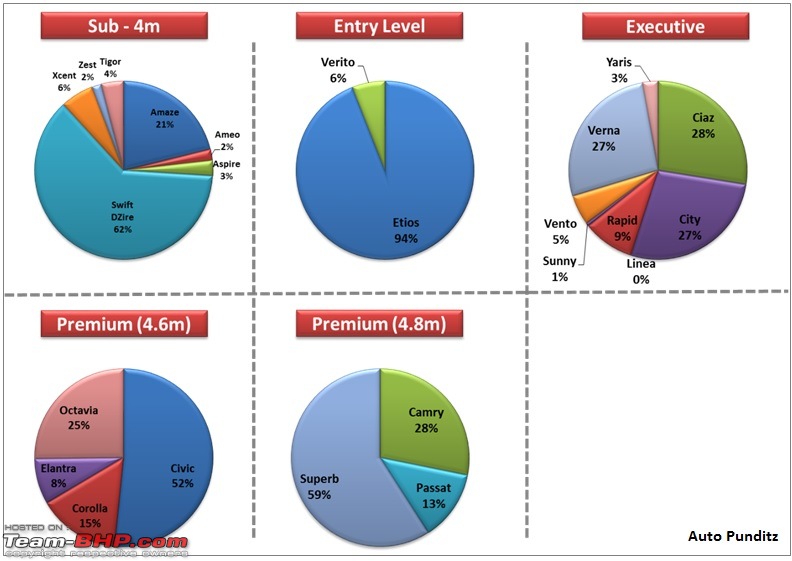

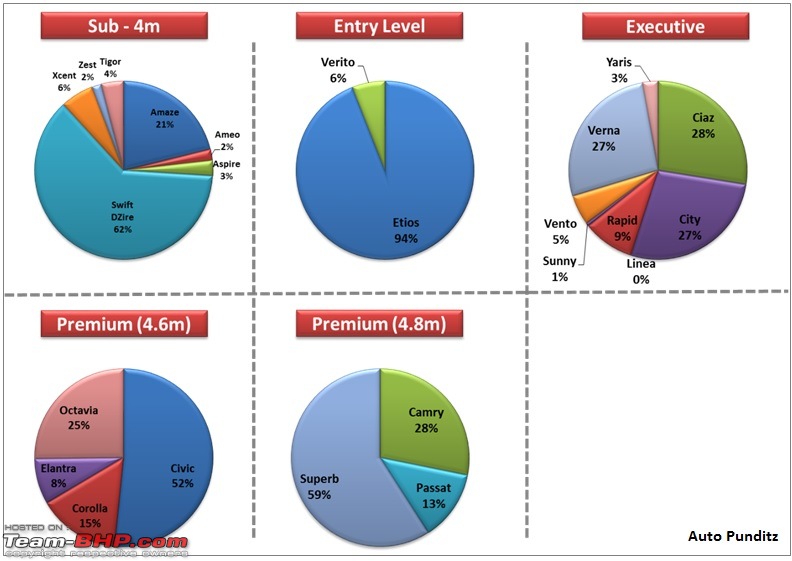

Sedan – sub segments

Sedan – sub segments  Monocoque Chassis SUV – sub segment

Monocoque Chassis SUV – sub segment  Ladder Chassis SUV – sub segment

Ladder Chassis SUV – sub segment  Hatchback

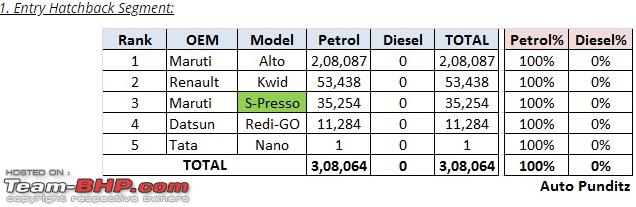

Hatchback

MUV  Fuel & Engine

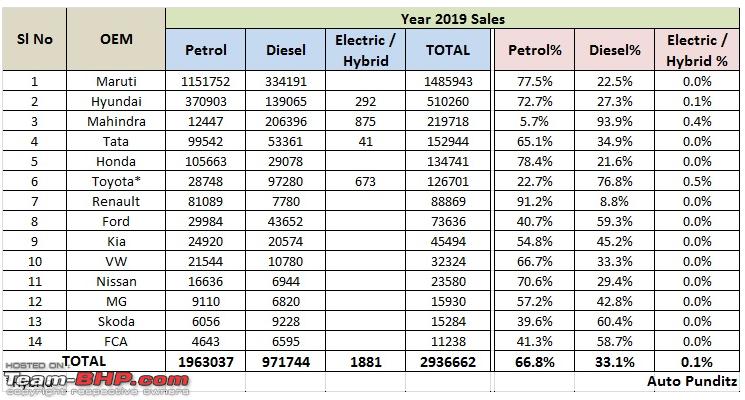

Fuel & Engine

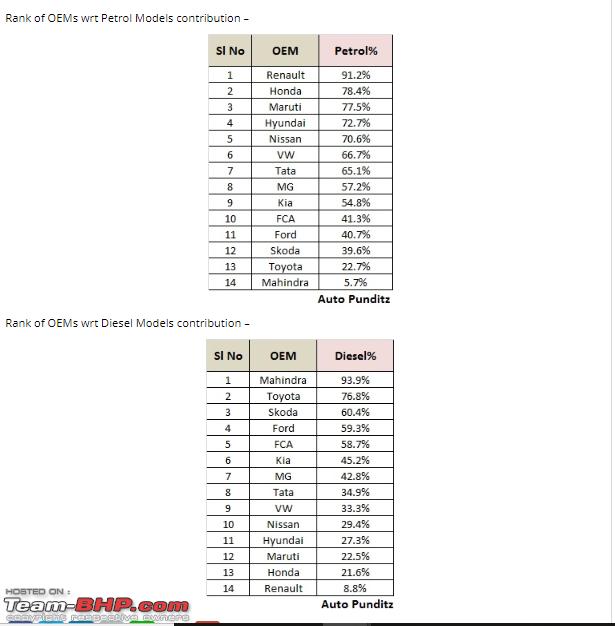

Diesel penetration was at its peak in 2012 when diesel was highly cross subsidized.

With narrow difference in petrol diesel price, low running cost of diesel is not good enough to offset higher purchase cost of diesel cars over petrol ones

Thus higher inclination for petrol cars in recent times

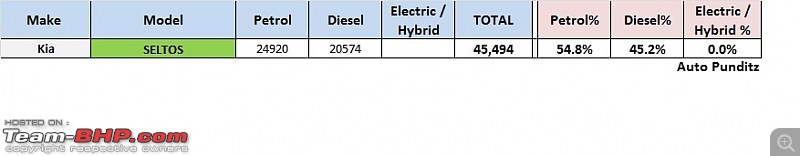

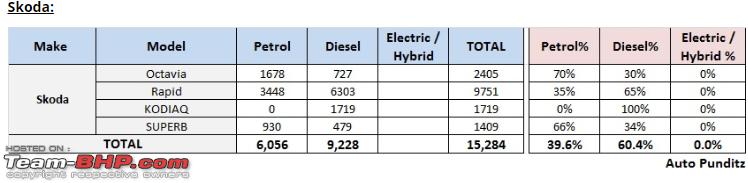

Petrol penetration has improved across the segments -Diesel is still preferred choice for large MUV and SUV

Petrol penetration has improved across the segments -Diesel is still preferred choice for large MUV and SUV

1200cc petrol engine is still dominant due to differential tax structure

Large diesel engine spread is quite uniform due to UV segment

Maruti-Hyundai together dominates 78% of the petrol powered car.

Maruti-Hyundai together dominates 78% of the petrol powered car.

With 1.25L FCA diesel engine gone, Maruti’s lion share in diesel segment is up for grab for other players.

But do other players have the capability to capitalize on Maruti’s loss?

Price Range 81% cars sold in Indian market were having a price tag of under ₹ 10 Lakhs (Ex-showroom)

Price Range 81% cars sold in Indian market were having a price tag of under ₹ 10 Lakhs (Ex-showroom)

High indirect tax rate makes India a low value car market, as major chunk from buyer’s valet goes to Government(s)

Only 6% buyers could afford a car that cost more than ₹ 15 Lakhs (Ex-showroom)

This indicates low level of purchasing power, wealth growth and higher wealth concentration in hands of few

With success of Kwid and Triber, Renault has moved into high volume and low margin segment, major downside of this strategy could be brand image, free cash flow generation, dealer profitability and pricing power in long term.

Starting with Brio in 2011, low cost-mass market driven strategy has costed Honda its premium sheen it use to enjoy a decade back with cars like Jazz, City, Civic, Accord & CRV.

Despite Tata Nano inspired cheap products, like Etios & Liva, Toyota never lost its premium luster, it seems Corolla, Fortuner and Innova have had firmly rooted Toyota’s premium image in India – quite an interesting consumer behaviour.

(26)

Thanks

(26)

Thanks

(1)

Thanks

(1)

Thanks

(7)

Thanks

(7)

Thanks

(3)

Thanks

(3)

Thanks

(3)

Thanks

(3)

Thanks

(4)

Thanks

(4)

Thanks

(3)

Thanks

(3)

Thanks