Team-BHP

(

https://www.team-bhp.com/forum/)

It is interesting that this topic has come for conversation now, because 2021 might be the year when the Indian automobile industry finally breaks out of the 250k/month that it has been doing for the last 7-8 years.

That said it would be wrong to say that the market has been stagnant.

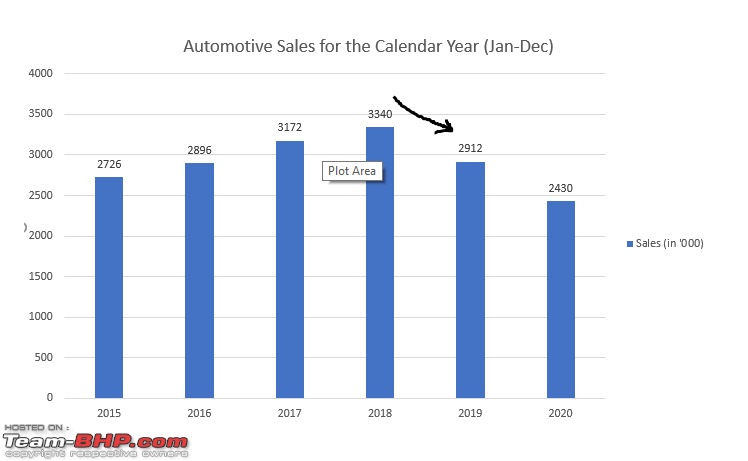

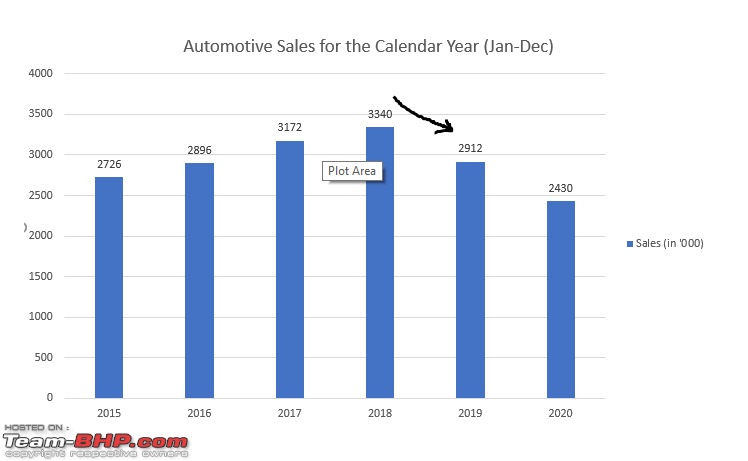

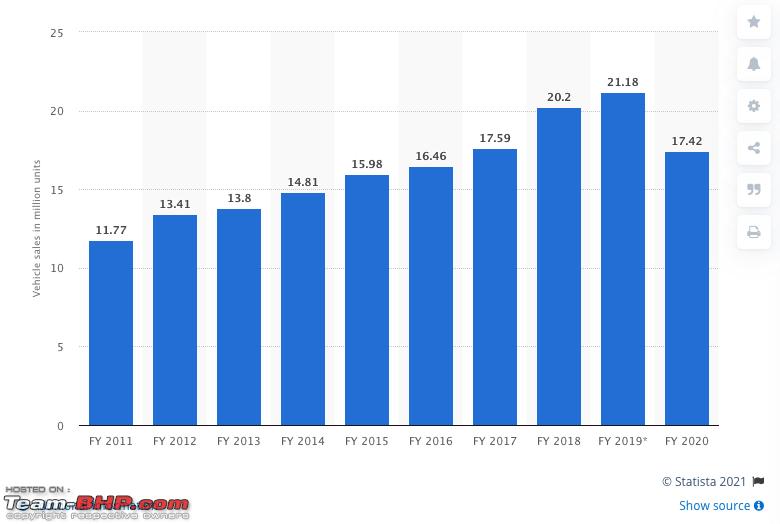

Using team-bhp's monthly sales graphs, we can see that the peak (in terms of volumes) was in the year 2018. Post that, the general slowdown in the Indian economy which started from 2018 and continued all the way until COVID hit in Q4 FY20, dragged down sales.

Now the encouraging bit is, post the lockdown the four-wheeler sales recovery has been quite good. There are certainly some factors at play like deffered purchases during lockdown etc, but the recovery has extended beyond the festive seasons and the buying sentiment is strong even after the price hikes at the start of the year.

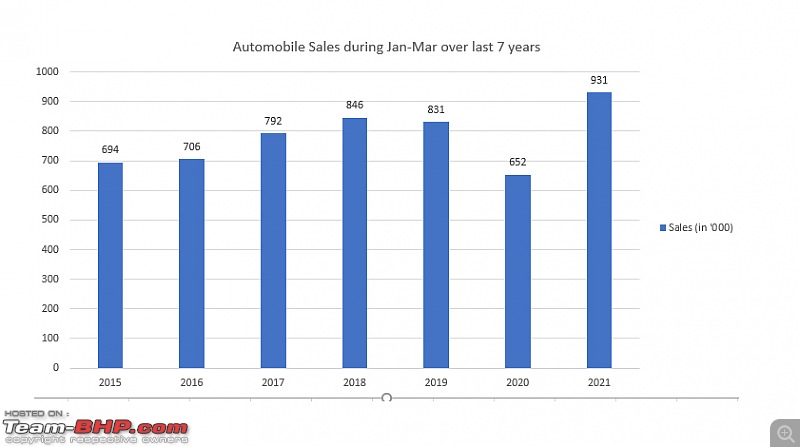

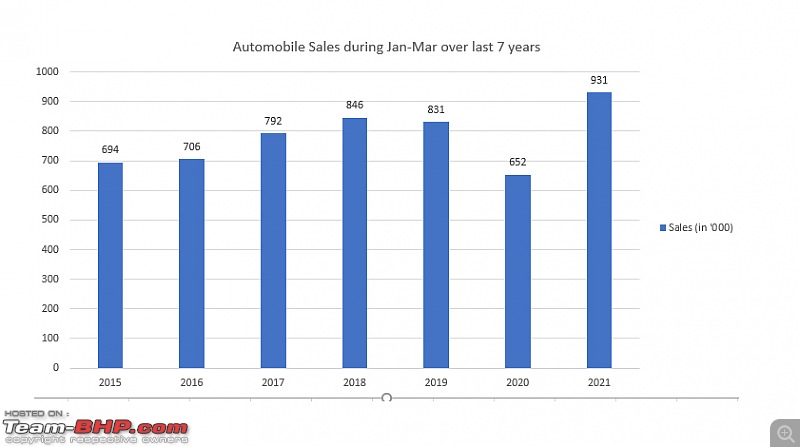

This is clearly reflected in the sales charts. I took the number of sales in Q4 (Jan-March) of every year from 2015 to 2021, and we can see that the last 3 months has been the best ever (production-wise atleast) for the auto industry.

If the industry can sustain this momentum, 2021 will be the new "highest".

Ofcourse, there are already a couple headwinds which can spoil this party,

1. Lockdowns have started again disrupting the auto retail business in some states.

2. A general economic slowdown.

3. Semiconductor shortage.

But at the same time, I believe these factors will not prove to be a hindrance because the slowdown in sales over the last 30 months has kind of created a pool of cars which are past its replacement date (for their owners).

By this I mean that car buyers have held onto their cars for an extra 1-2 or even 3 years, since 2018 waiting to ride out BS4-BS6 transition, increasing costs, taxation changes, economic slowdown, model lifecycles etc. A general sense of "lets just see what new cars come/I dont feel excited about new cars" has been the sentiment among the buying community for a while. Which is why it is crucial for manufacturers today to increase their launch tempo bring out fresh models, fast. Also bank loans have become cheaper, which might be nudging many into buying a brand new car instead of a second-hand one.

As original owners have held onto their cars, the second-hand market has become more expensive because of the diminishing pool of first-hand cars heading into the second-hand market. The second-hand market itself is hot because there is a big enough demand for owning a personal four-wheeler, but prices of cars has risen much faster than possibly earnings.

That gap between the ability to afford a two-wheeler and a four-wheeler has risen a lot over the last decade, which is one of the reasons why the second-hand market became so hot. If a family can only afford a Rs 75,000 scooter, they have to wait a while in terms of income growth to be able to afford the Rs 5 - 6 lakh (on road) for a decent hatch!

That is from the demand side, from the supply side things also have not been that stagnant because the product mix of automobiles offered by OEMs has changed. The average realisation from each car retailed has increased.

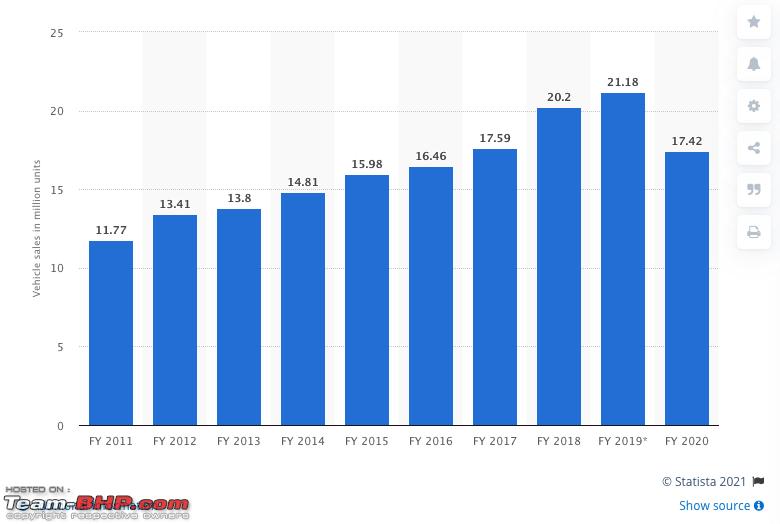

Lastly, there has been a general softening in automobile sales over 2018-2020 all over the world. There is the big daddy China itself which went through a painful slowdown in auto sales from 2017, Indonesia, Thailand, Malaysia, South Korea, Mexico, Brazil...it's the same story everywhere.

EDIT: If you want to see stagnancy in volumes, the two-wheeler industry is even worse off. For companies like Hero MotoCorp their volumes today are just 75% of 2018 volumes.

Yeah India still has the bulk of its sales from the hatchback / compact sedan space so even though average ticket size has increased, it's still those same category vehicles being bought, just more expensive.

It's a vicious circle of high inflation causing expensive cars and expensive cars making it difficult for proper upgrades.

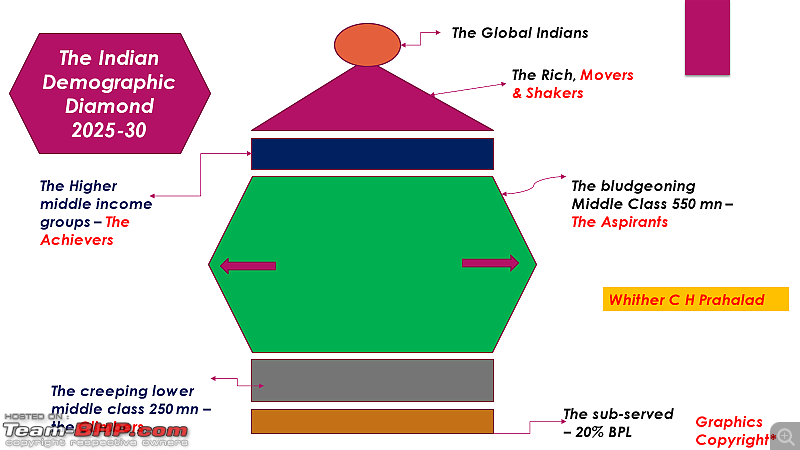

Indian automotive industry (passenger car market in particular) has seen it's

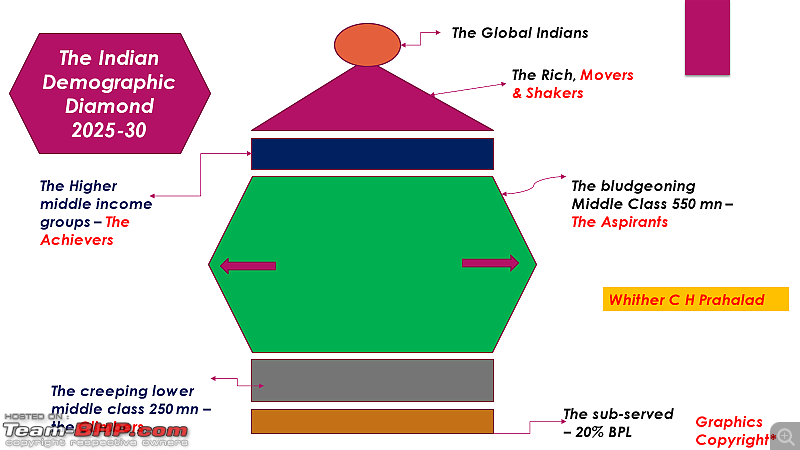

lowest CAGR in the last decade. There are multiple, complex reasons which led to this phenomenon but I still believe Indian auto sector has a massive growth potential as Indian middle class continues to get bigger this decade.

Source :

Sunday Guardian

Great insightful thread and its like research work reading through this thread. Coming to the factor of car sales i would like to add my view here:

1) Policies like GST and demonetization has definitely hit the economy. Covid was a double whammy with no light at the end of the tunnel.

2) Salary growth is in line with inflation. Majority middle class have to deal with the following before they can think of splurging on a new car: Kids education(LKG starts at 1-1.5 lac) + Home Loans (Around 50-1cr) + Build a safety net or emergency funds for eventualities +Saving or invest for the future. We do lack a safety net if things go bad.

3) High fuel price + Higher insurance costs and associated costs of owning a car has not helped new buyers.

4) Higher interest rates for loans and the lack of a lease prevent frequent buying.

5) Income in some segments (especially farming) has remained stagnant for decades while the input costs have risen more than 100%.

6) Uber+Ola plus cities focussing on urban transport and also lack of parking in cities is a negative.

7) Cars are more reliable these days plus a secondary market for second hand does exist and caters to the needs of price consious folks.

8) Govt regulation changes based on who is in power or which side of the bed a judge in the SC wakes up on. 4 meter rule, ban on 15 year old cars, ban on 3000cc cars, ban on tinted windows, ban on modifications, you need to wear a mask and drive etc etc.

We are not a america where the sprawl of suburbia makes owning a car necessary. China has grown like crazy and has more than 15 cities which have a population of more than 5 million.

We are unable to grow at the similar speed. Leave the slogans and bold leadership but creation of jobs at the speed which we want is really not happening. Income inequality could be a big issue in the coming years leading to social unrest making our economy like a basket cases like venezuela or argentina which i fear for.

Maddy

My opinion, I think many think the nos. are not encouraging. I would ask why? Is any car maker not making profits? All of them are making profits with a few exceptions of course, that is part of business. India is a unique market, while looking at car nos., did anyone correlate it with two wheeler sales and stats? I am sure they have grown in huge multiples in the last decade. What was our growth in terms of real estate? Prices have gone up. 85% to 90% prefer two wheelers simply because of the ease of using them on the congested Indian roads. US and European countries need cars just like we need two wheelers. An average Indian thinks he/she is settled in life only when they have bought a house and enough jewelry. These two items take precedence over luxuries (many think so) like cars. Stop Indians from buying gold, India will be the biggest car market in the world! rl:

Apart from many reasons mentioned in this thread for this stagnation, the biggest in my opinion is that people dont have justifiable upgrades in the markets and hence they hold onto their current cars if they are reliable.

No manufacturers are manufacturing their developed world products here and keep on selling their inferior cars here for inflated prices. Companies launch their good cars either in CKD or CBU format which makes their purchase and upkeep prices unjustifiable and then they cry that indian market isnt mature enough. This statement holds true even with high taxes on cars here.

Indian buyers fit largely into two categories :

1. Well travelled, educated and hence well aware of the global markets - This category of buyers make good research while purchasing and buy the product which is not only fit for their requirements but is also a good VFM and then they stick to it for ownership as long as reliably possible.

2. Buyers who do not much understand cars stick to tried and tested manufacturers and models like Maruti, Hyundai, Toyota, Mahindra, etc. and push for longer ownership periods as well.

Few Examples:

1. Innova: i know so many people who stick to their innovas, marutis and are pushing ownership periods to 10+ years because there is simply no other good choice available at justifiable prices. Kia launched the Carnival but in a CKD route. Had they manufactured it here and sold for 30L OTR price for the top variant, they would have seen sales equivalent to innova.

2. I know so many people who stick to 10-20 Lakh compact SUVs despite easily having budgets for Rs 30 lakh car just because there arent any justifiable choices in market. If cars like RAV4, CRV, Xtrail are manufactured here and sold for Rs 25-30 L OTR, they will see a lot of success.

This step motherly treatment by the manufacturers is the reason for dullness in our market resulting into stagnation. There simply is no motivation for car buyers to spend their hard earned money.

Indeed and infact, quite contrary to the population growth and economic growth the country has seen.

All due to the notorious taxation ~50%(atleast sub 4mtrs space is a bit reliever but it too has ~30%). And Road Tax on top of GST is a crime in day light.

On the flip side, its an advantage to not overcrowd based on density of our population.

IMO, the tier2 and tier3 cities deserve good and safe cars with the new standard of living

Indian car market is definitely not stagnant. More of like it's plateaued before rising again.

If it's on same level since last 10 years then it raises the hope of rising in immediate future since people who hold onto their cars for a longer period of time will change their cars along with new buyers.

And with better infrastructure and parking places which are coming up in numerous places, people will prefer to use personal cars instead of Ola/Uber. I don't remember when was the last time I saw one good clean example.

Also the scrappage policy will also show its effects.

IMHO, car sales will increase in near future and will decline for a year or two during the transition phase of fossil fuel cars to BEVs and then again the sales will increase. 1 million per month is quite achievable before 2030.

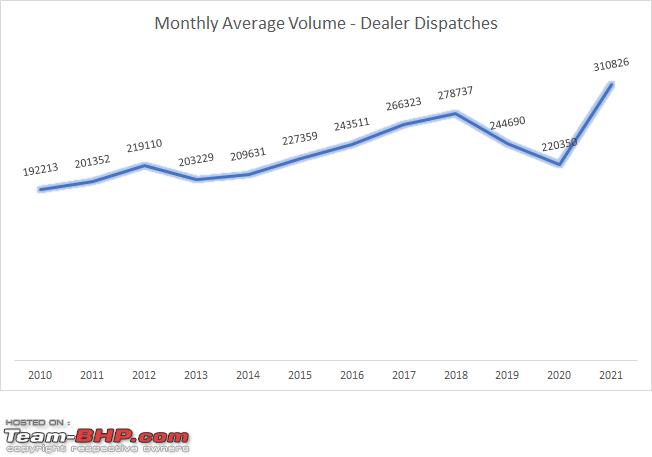

In terms of dealer dispatches, for which we have data available in Team-BHP via Monthly Sales threads,

2018 was the peak with the average monthly volume of

2,78,737 units which followed another impressive year in

2017 (despite introduction of GST during June 2017), which had a average monthly volume of

2,66,323 units.

However, since then, the economy has taken a downturn and it has reflected in the monthly Car sales as well -

2019 registering a average monthly volume of

2,44,690 units and the COVID-19 hit

2020 registered a average monthly volume of just

2,20,350 units (similar to 2015 levels).

But

2021 has begun on a positive note and we already have the monthly volumes of all the 3 months crossing 3L units with an average of

3,10,826 units till now. To put this in perspective, only twice before 2021 have the monthly total dispatches has crossed 3L units in the history of Indian Automotive sales. So, 2021 could be a breakout year from which we may pull away from an Average Monthly Volume of 2.5L units to 3L units.

As you can see from the graph, the monthly average volume was steadily increasing till 2018, and after a dip of 2 years, 2021 has seen a steady increase again and hope the market can sustain the momentum.

One interesting correlation will be to see the growth of the 2 Wheeler number per month. I suspect if that will also show a stagnant number for the decade.

There are many posts that talk of ‘Taxes’ being one of the reasons for people finding the prices prohibitive to buy. I quite agree. On the same breath, in our Country, we just have 3% of the population who pay Income Tax. This equals to just about 1.3 Cr Indians earning more than 5L per annum. I wish we had some data points around the correlation between people who buy new cars and people who pay income tax.

Technically then, if you look at the Income Tax paying population, the market suddenly shrinks.

Now, I’m sure there are many many in our country who don’t pay income tax and still own fancy cars. But that % may be very small I think.

The head is now searching for many many data points at this stage. This is such a treasure trove ‘Research’ thread.

Time will tell how the ‘scrappage’ policy may impact the growth %. Moreover, people have started the mode of ‘spend’ vs ‘save’, though largely applicable for white goods, it’ll be interesting to see how much of the money gets into automobiles.

There is one thing that has changed though, the average price and segment of a car sales. A decade back, most cars sold in India were small hatchbacks but now we have cars like the Hyundai creta in the top 5. Now I’m going to make some potentially triggering assumptions here:

1) In the past decade, much fewer people have truly entered the middle class as compared to the decade before.

2) Most of the economic growth in the past decade was seen with those who are already in the upper middle class who can afford a car or the upper class.

These two assumptions tell us why we have climbed up the car food chain but overall sales haven’t increased - those who bought small cars in the last decade can afford a more premium car now but those who couldn’t afford a car in the last decade still can’t afford one now. This assumption is offcourse based on the country itself and independent of the car market. Maybe I’m wrong and there’s other factors at play as other indicated (infact I hope I’m wrong).

Quote:

Originally Posted by dragracer567

(Post 5040157)

There is one thing that has changed though, the average price and segment of a car sales. A decade back, most cars sold in India were small hatchbacks but now we have cars like the Hyundai creta in the top 5. Now Iím going to make some potentially triggering assumptions here:

1) In the past decade, much fewer people have truly entered the middle class as compared to the decade before.

2) Most of the economic growth in the past decade was seen with those who are already in the upper middle class who can afford a car or the upper class.

These two assumptions tell us why we have climbed up the car food chain but overall sales havenít increased - those who bought small cars in the last decade can afford a more premium car now but those who couldnít afford a car in the last decade still canít afford one now. This assumption is offcourse based on the country itself and independent of the car market. Maybe Iím wrong and thereís other factors at play as other indicated (infact I hope Iím wrong).

|

IMO, this is a very obvious ( and correct) angle nobody brought up; I was typing along when it came up.

Just need to look at the winners of the last decade -- Duster, Creta etc. There are very few winners lower down who are new entrants.

There is also a severe issue in the term middle class being used fast and loose, especially in infographics.

Middle class is not really the population that falls in the middle.

In India, if one earns about 50k per month, they are in top 10%.

A household that makes 6L per annum is among the top 10 households.

Also, if we count absolute numbers, counting cars that cost above say 10L for "growth" is wrong.

Most probably a person who buys a 10L+ car is from a household that had a car. There may be exceptions, but a miniscule percentage.

Also, taxes are an issue for shifting between segments. I dont think anybody is putting off buying an Alto because it is costlier by Rs. 10k. Its costlier by Rs 1L compared to the income of the person that wants a car.

Just an observation, no data behind this.

Quote:

Originally Posted by GTO

(Post 5039452)

Amazing thread :thumbs up. Our market has great volumes, but it has been largely stagnant, yes. There are many contributing factors such as the masses preferring 2-wheelers (this is a big one), people holding onto cars for longer, app-based cabs like Uber & Ola bringing chauffeur-driven Dzires & Xcents to the masses, work from home (especially in Covid), traffic & parking woes, rising car prices and what not.

That said, the average transaction price has surely gone up due to the pricier crossovers. Not just 12-lakh ones like the Vitara Brezza & EcoSport, but also 20-lakh ones like the Creta & Seltos. In terms of GMV, we are way ahead of where we were in 2012.

|

Spot on, I looked up the Jun 2012 stats (on BHP) for a comparo and it was interesting to say the least.

Top 10 had 2 A segments @ 27,000 cars total, 1 B1 + 4 B2's @ 38,000, 1 C1 at 13,741, 1 Utility (Bolero) @ 9,500 and a D2 Innova with around 7,000 units. In Mar 21 though the market dynamics have changed entirely.

Only 1 A segment in the 4th place, 4 C1's+C2's and 3 B1's+B2's.

The top seller in 2012 was the humble Alto which is now in the 4th place.

That being said I think the numbers will rise exponentially and hit maybe 400,000 to 500,000 registrations by 2024-25.

Why?

1- Despite the rise of mass transport in our cities, a car is still a deeply aspirational purchase and public transport is still yet to even be planned for our tier 2 cities and down.

2 - The economy is stated to have a secular growth (and not just the top down trickledown type we are used to) over the coming decade and this will create greater disposable income.

2a- By 2028 an estimated 60 million households could enter the "consuming class"- a family with an income of Rs 7,00,000 + PA is the benchmark here.

2b- India is expected to see a huge bump in urbanisation as well, and a large chunk of this is expected to move towards tier 2 towns - 500 Mn is the expected number here.

3- The mass adoption of EV''s (still 5-6 years away) would lead to greater competition and prices will rapidly drop in this segment.

The GoI should also realise that taxing this segment so heavily (it contributes 7% to the GDP) is counterproductive and rationalising taxes could add another boost.

In my opinion, our roads and parking infrastructure are not in a shape to allow further growth of cars. Most of the new car buyers are in Metro and tier 1 cities and we know how choked the parking is in these cities. With most of the people parking cars on the roads and creating a nuisance, do we need to think or worry about the stagnating car growth? I do not think so.

Interesting Thread. But, I also believe,

- Skewness in income ranges across the population

- Larger two wheeler base

are also points to consider while evaluating the car market.

There are also inherent behaviours while families climb-up the income ladder:

- First buy a two wheeler

- Then a car

- Then a house..

Statista shows ~2X rise in two wheeler sales in last 10 years.

A percentage of these may buy a car each year. Even if we keep that percentage fixed every year, it should result in an increase in car sales. That not happening is counter-intuitive. Couple of reasons:

ex: you buy a car X years after buying a two wheeler and you upgrade to a used or a new car Y years after buying your first car.

If majority of the sales are from people pushing their boundaries and taking loans, it makes it hard (behaviourally and economically) to buy a car resulting in a stagnation - atleast from the area of first time buyers who are upgrading from bike, although I don't believe car > bike :D

Just some thoughts. We are a tough market with too many dynamics to be explained with data, even when it is said

Quote:

”In God we trust. All others must bring data.”

- W. Edwards Deming

|

| All times are GMT +5.5. The time now is 05:43. | |