Thanks Aditya for the Dec. data. More inputs as below:

Auto Industry sees a bit of relief from the semiconductor availability, and has impacted to a lesser degree when compared to last month, but some struggled more to provide cars in meeting the demand.

Expected to ease a bit in January though not 100 % normal as the situation is dynamic.

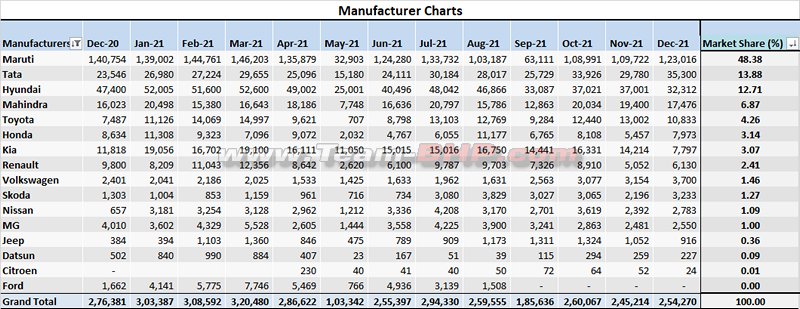

India's biggest automaker Maruti Suzuki recorded a drop in growth to -12.6 percent in Y-O-Y comparison, but an increase in growth of 12.1% on a M-O-M basis.

- The market leader Maruti Suzuki Market Share dropped to 48.4 % from 50.9% (Y-O-Y).

-Hyundaiís was badly hit with the growth being negative at 31.8% percent (YoY) and a market share drop of 4.4 %. The biggest being, Hyundai losing the 2nd position to TATA Motors.

- Tata has the biggest gain in all parameters. It becomes the 2nd largest OEM, registers a positive growth 49.9% and a market share increase of 5.4% (Y-O-Y)

- M&M volumes increased by 8.9 percent in Dec 2021 over Dec 2020 and was placed at the fourth spot in the ranking table. The Indian automaker had a very successful launch of the XUV700 and over 22 percent of Mahindra's volumes came from the new model.

-Toyota maintained its lead over the likes of Renault and Honda to place itself in the fifth spot.

- Honda Cars registered monthly domestic sales of 7,973 units in December 2021. City remained the best-selling Honda for December 2021

- Kia has a downward trend and now is the ranked 7th. With its growth at negative 34%.

-Renault sold 6,130 units of its cars in December 2021 compared to 9,800 units in the same period last year. The majority of sales for Renault come from Kwid, Triber, and Kiger.

Highlights of Dec-21 dispatch figures:

- Maruti's Wagon-R, Swift, and Baleno are the top 3 best sellers in Dec-21.

- 8 of the top 10 best sellers were from Maruti Suzuki while Tata and Hyundai had 1 each.

- In the Top 25, Maruti has 11, an average; the volumes were 10,644 units per car. Hyundai with 3 models in the list averaged 8,040 units per model and Tata had 4 models in the Top 25 (higher than Hyundai!) and averaged 7,398 units per model.

- With 3 models in the top 25, Mahindra's overall volumes is now consistently higher than that of Kia and averaged at 4,518 units/model.

- Ertiga / XL6 duo have been consistently raking in impressive volumes for Maruti Suzuki. Ertiga alone ranked 5th in Dec'21 and was the best-selling MUV for last month. Kia is eyeing the segment with Carens now.

- UVs dominated with 12 models in the Top 25. (8 SUV+4 MUV)

- Hatchback volumes have fallen in terms of models and has 9 models in the top 25.

- Sedans had only 3 offerings in the Top 25 and the best seller was Marutiís Dzire.

Largest segment (volumes) Ė UV

- The top 12 models (n in top 25 list) contributed to 85k units of sales in Dec.

-UV market share has grown from 16 percent in FY2007 to 39 percent in FY2021

-Maruti Suzuki and Hyundai have been the two largest contributors in this segment

-Almost every second PV currently sold in India is an UV

Segment-wise Car Sales

-SUV sales have risen to an all-time high in the Indian market and almost all the OEMs have an offering in this segment.

-Both Compact and Mid SUV segments have grown considerably and are now easily outselling the hatchbacks/sedans.

-Sedans are on a decline -Compact Sedan sales fell -67% & Executive Sedan sales by -27% in Sep'21

-Compact SUV was the largest segment in terms of volumes and also recorded one of the highest YoY growth in Dec'21.1 out of 5 cars sold in Dec'21 was a Compact SUV!

-Compact Hatchback followed to the second position and recorded a YoY fall of 14 percent.

-Mid SUV sales ranked third and grew an impressive 16 percent YOY.

-MUV sales has been increasing steadily and was at a stone throw distance of Mid SUVs.

-Premium Hatchbacks sales fell 29 percent YoY and ranked fifth in the table.

- Compact Sedans placed itself in the sixth position and had cumulative sales of 18,001 units in December 2021.

New Launches and its performance (past One year):

- 8 new models with most being in SUV style

- Tata Punch contributed to 23% of the OEMís dispatches in Oct.

- Mahindraís XUV700 has garnered tremendous interest among the buyers and has already received over 65,000 bookings. With dispatches of 3,980 units; the model contributed to 22% of Mahindra's volumes .

- Nissanís Magnite is single-handedly keeping the OEM afloat. The model contributed to a staggering 88% of the OEM's sales and is slowly emerging as one of the all-time best sellers in Nissan India's portfolio.

- For Renault, Kiger has been faring well too and 2,115 units were shipped to the dealers in December 2021.

- VW Taigun & Skoda Kushaq have made the VW/Skoda brands to jump the SUV bandwagon and are seeing some success. Both are averaging ~ 2300+units/ month.

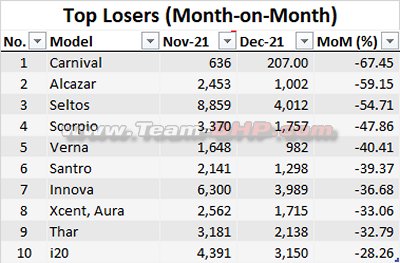

- Both Safari & Alcazar were launched in the 6/7-seater SUV segment and have been doing average volumes for the respective brands.

Source: Auto Punditz

(34)

Thanks

(34)

Thanks

(17)

Thanks

(17)

Thanks

(14)

Thanks

(14)

Thanks

(16)

Thanks

(16)

Thanks

(3)

Thanks

(3)

Thanks

(16)

Thanks

(16)

Thanks

(17)

Thanks

(17)

Thanks

(8)

Thanks

(8)

Thanks

(3)

Thanks

(3)

Thanks

(4)

Thanks

(4)

Thanks

(8)

Thanks

(8)

Thanks

(3)

Thanks

(3)

Thanks

(1)

Thanks

(1)

Thanks

(2)

Thanks

(2)

Thanks

. Things may look better for this segment post the semiconductor shortage. On a related note, overpricing notwithstanding, the Fortuner is now single-handedly keeping the D2 segment alive with over 80% share.

. Things may look better for this segment post the semiconductor shortage. On a related note, overpricing notwithstanding, the Fortuner is now single-handedly keeping the D2 segment alive with over 80% share.