| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  2,709,097 views |

| | #6931 |

| BHPian | Re: The Official Fuel Prices Thread

Well, you were blaming the luxury car owners. The amount the owners pay as taxes while purchasing a luxury car is many times larger than the income tax they suppose to pay. Buying a Luxury car is a public service. Also why should poor people suffer for Governments inability to collect income tax ? Last edited by anb : 8th December 2020 at 10:59. |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank anb for this useful post: | dark.knight, Fuldagap, manim, yogiii |

| |

| | #6932 | |

| BHPian Join Date: Feb 2015 Location: Mumbai

Posts: 218

Thanked: 1,302 Times

| Re: The Official Fuel Prices Thread Quote:

| |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks andafunda for this useful post: | dark.knight |

| | #6933 |

| Senior - BHPian | Re: The Official Fuel Prices Thread Well, the money for the new Parliament building, compensation, TA/DA & retirement benefits for the soon to be expanded MP seats, those two B777s, cost of various blunders.......all these has to come from somewhere!! The stark irony is that if we were to cut down the current number of MPs by 50%, this wouldn't really affect the life of ordinary citizens like us. In fact, the standard of life might just improve as our tax money won't be wasted. Find inner peace and calm by dreaming about that shiny new EV I guess. And also walk to the booth for the local elections happening today?? That way one wouldn't feel the pinch of these high fuel prices and can improve the health & fitness too. |

| |  (13)

Thanks (13)

Thanks

|

| The following 13 BHPians Thank deetjohn for this useful post: | anb, AutoNoob, AZT, Fuldagap, GeneralJazz, GipsyDanger, klgiridhar, longhorn, OrangeCar, Prowler, rbp1988, RSR, yogiii |

| | #6934 | |||||

| BHPian Join Date: Oct 2016 Location: Bengaluru

Posts: 254

Thanked: 1,336 Times

| Re: The Official Fuel Prices Thread I thought this thread was for fuel prices. But, high taxes on fuel and high fuel retail prices even when international crude prices are low is fully justified in varied ways. Oh.. its a push for electric cars.. oh, it has to be raised because fair share of income tax is not paid, etc etc etc..! Taxes on fuel prices are raised because government revenue collected through various means has fallen. Various means = direct + indirect taxes. Indirect tax collection has fallen, or at best has remained flat MoM or YoY because economic growth has been falling mostly (even before Covid struck). But this should be ignored. Quote:

Last I checked, it is not a crime to be earning high incomes (as long as it is through legal means). But, how would one define 'fair share'? They already would be taxed at a minimum rate of 33%. [approximated, 30% tax rate bracket + cess on top of it] That is no way a small tax rate. Especially when some basics like decent roads, clean water, uninterrupted power supply, do not exist in most places in India. On top of the high tax rate, taxes at every level. Dividends from investments - Tax. Buy a luxury car - as already said in above quote - astronomical tax rate of 50%. Basically.. you have high income.. tax tax tax..! That is the solution. Last I checked, it is not a crime to be earning high incomes (as long as it is through legal means). But, how would one define 'fair share'? They already would be taxed at a minimum rate of 33%. [approximated, 30% tax rate bracket + cess on top of it] That is no way a small tax rate. Especially when some basics like decent roads, clean water, uninterrupted power supply, do not exist in most places in India. On top of the high tax rate, taxes at every level. Dividends from investments - Tax. Buy a luxury car - as already said in above quote - astronomical tax rate of 50%. Basically.. you have high income.. tax tax tax..! That is the solution.Quote:

Also, if you have such concrete information that you can show at least 5,000 doctors who make more than 1 crore per year, I'd strongly suggest you to report such incomes and help government authorities. You may find further details here https://www.incometaxindia.gov.in/pa...back-home.aspx and https://www.incometaxindia.gov.in/Do...eme-1-5-18.pdf Quote:

Also, could you please point me towards an information source which shows there was printing of money in excess of what was needed during that period? Quote:

Quote:

No, the government can choose to not tax stuff. It can choose to trust and hire economic experts, take criticism and make changes on the way. Enable growth, such that direct and indirect tax collection increase due to increased economic activity. And salaried class does not have to bear the brunt. Salaried class too can aspire pay less fuel tax. Salaried class too can aspire high incomes, and thus buy luxury cars after paying reasonable taxes (50% indirect tax on cars is not fair share in any world, I would think). More importantly, salaried class can change their opinions too. Especially come to believe that it does not matter which government comes to power, they will be taken for a ride. And thus, choose to vote any which way. In the mean time, let me fuel up petrol and pay fair share taxes of 65% because government has failed in its economic policies. Also, I have only attempted to rebut the points you have made. I do apologize if you find the tone of the message harsh. I no way intend to do that. I only wanted to make my points. Cheers.  | |||||

| |  (15)

Thanks (15)

Thanks

|

| The following 15 BHPians Thank OrangeCar for this useful post: | anb, AZT, doxinboy, drmohitg, Haque, humyum, JithinR, nmenon, RadixLecti, RSR, sid__kaps, spr1ngleo, srikanthmadhava, Torq, yogiii |

| | #6935 | |

| Senior - BHPian Join Date: Feb 2006 Location: Mumbai

Posts: 2,752

Thanked: 5,428 Times

| Re: The Official Fuel Prices Thread Quote:

Are you saying that before Covid there was parity between pump price and international crude price? I have paid for diesel at 65 when crude was 130 plus dollars and I am paying for diesel now when crude is 49.03 dollars In Covid like government has lost revenue, so have people who have lost their jobs, businesses, loved one's, property (Yeah, moratorium for 6 months then what, magically money appears?), why this additional burden of fuel prices which makes everything else expensive too? If money is such an issue, why did the supreme court rap them yesterday about stopping them the 20 thousand crore central vista to be built? Why is bullet train not scrapped? Why such extravaganzas are not being stopped when they are finding it difficult to pay the states their rightful GST share too? About Chacha with a factory in Bhiwandi, my father is one of those Chacha's and since 2016 and there are spiders and macchar's roaming around in that place.That is the case with most of Bhiwandi because that entire industry is destroyed and people have sold their looms with their weight in metal. Please don't justify the unjustifiable Last edited by humyum : 8th December 2020 at 12:03. | |

| |  (11)

Thanks (11)

Thanks

|

| The following 11 BHPians Thank humyum for this useful post: | anb, drmohitg, Fuldagap, JithinR, lurker, Nalin1, nmenon, pmbabu, Prowler, RSR, yogiii |

| | #6936 | |||||||

| BHPian Join Date: Feb 2015 Location: Mumbai

Posts: 218

Thanked: 1,302 Times

| Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

Quote:

Offtopic, but check the source of funding for this project. Getting a free loan from Japan. Only a fool would scrap it. As long as people pay rightful taxes we should be good as a country. Last edited by Eddy : 8th December 2020 at 12:31. Reason: Merged | |||||||

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks andafunda for this useful post: | rbp1988 |

| | #6937 | |

| Distinguished - BHPian  Join Date: Sep 2010 Location: Liverpool/Delhi

Posts: 5,439

Thanked: 7,542 Times

| Re: The Official Fuel Prices Thread Quote:

| |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank drmohitg for this useful post: | humyum, Prowler, rbp1988, RSR |

| | #6938 | |

| Senior - BHPian Join Date: Oct 2008 Location: kolkata/bangalore,india

Posts: 2,901

Thanked: 4,143 Times

| Re: The Official Fuel Prices Thread https://finance.yahoo.com/news/india...081047731.html India's November diesel sales plunge after rising in October Quote:

| |

| |  ()

Thanks ()

Thanks

|

| | #6939 | |||

| Senior - BHPian Join Date: Feb 2006 Location: Mumbai

Posts: 2,752

Thanked: 5,428 Times

| Re: The Official Fuel Prices Thread Quote:

Let me quote my own post from another thread Please look beyond mere numbers, there is an entire socio-economic data behind this. 97 % are tax evaders and 3% run the country is not really the case and far from the truth, let me parse some mota-moti data. Less than 3 percent file income tax return in India Only 3.5 crore people, or 2.89 percent of the country's total population of more than 121 crore, file income tax return in India Out of the 121 crore people might be someone's 1 year old son and a 95 year old grandma who might be earning no income. Neither need to file taxes. In fact, there are only 47 crore people who are actually working, which means only 47 crore have any sort of income. Of these almost half are employed in agriculture. That is pretty much exempt from income tax. Our nation, like many others, have an idealistic attitude towards agriculture - a hangover from the agricultural past. We somehow assume that farmers are doing a more important job than rest of us, which I believe they are and they should not be taxed. Food is a survival item and people who make it need to be provided the best of everything, but anyway that is just my point of view. In any case, that leaves only about 23 crore workers who work in factories and the service sector, IT industries etc etc. To pay income tax you need to be earning Rs. 5 lakhs or more per year now. Because, we don't want to tax the poor. Now, how many of the workers do you see around you make Rs. 41000+ or more per month? How about your maid? Not likely. How about the assistant sitting in the shop? Not likely. Out of these about 15 % I assume must be making more than 5 lakhs per year, that leaves you with a realistic number of the people who are going to file taxes this year. Sure there is tax evasion and lots of businesses and businessmen evade tax but its no where near what is being peddled around. Even people who earn less than 5 lakhs pay indirect taxes in whatever they spend, every rupee that goes out of their pocket, some amount it is tax. Wheels of an economy run when people have money to spend, not when they are taxed to death. Quote:

That free propaganda is just a myth. When you tell a lie a 100 times in full volume with the entire media at your helm, its bound to sound true. http://mybs.in/2UYpe1u Quote:

About the fuel prices, since this thread is about that. --> https://www.pgurus.com/lower-fuel-pr...omic-benefits/ and a little food for thought The price ex-refinery of petrol is Rs. 30/litre. All kinds of taxes and Petrol pump commission add up the remainder Rs.60. 60 rupees as TAX!!!! | |||

| |  (30)

Thanks (30)

Thanks

|

| The following 30 BHPians Thank humyum for this useful post: | ABHI_1512, anb, AutoNoob, AZT, click, dark.knight, doxinboy, drhoneycake, drmohitg, Elito11, Fuldagap, Haque, JithinR, klgiridhar, longhorn, manim, msdivy, nmenon, OrangeCar, pmbabu, Prowler, rbp1988, reignofchaos, Researcher, RSR, spr1ngleo, stanjohn123, Turbohead, Vitalstatistiks, VivekCherian |

| | #6940 |

| BHPian Join Date: Apr 2010 Location: Cochin

Posts: 204

Thanked: 199 Times

| Re: The Official Fuel Prices Thread I think just like black money we will start to see "black-fuel" shortly! With the micro refineries being so cheap, i am not sure why no one is smuggling or importing crude legally into the country! It now makes perfect sense to buy crude and refine it one self than to buy petrol! Heard Californians, Canadians and the Iraqis have micro setups like these. Sad to say, the leadership of country has no vision when it come to economy(or for that matter anything!). It is like flogging a horse and letting it run in the direction it wants. Or if I am to put it - Simply depressing accelerator when the drivers hands are tied behind the seat. Just rethinking whether I want to be a passenger on that car!!!  |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank Sedate for this useful post: | advaydh, AutoNoob, dark.knight, nmenon, Prowler, RSR |

| | #6941 |

| BHPian Join Date: Feb 2015 Location: Mumbai

Posts: 218

Thanked: 1,302 Times

| Re: The Official Fuel Prices Thread Sir, I can appreciate that you may not know my background, but please stop with the funnel analysis that you just did. It does not make sense when you look at it on an overall basis. In developed economies, 30-50% of households pay some sort of income tax. In India, this is lower than 10%. Even ex-agriculture this is less than 20%. During my days as a rookie investment banker we had done an analysis which showed that 50%+ of businesses under-report earnings. This has not changed much. Not sustainable at all. This creates a double jeopardy scenario for the people who pay income taxes - high income tax and high indirect taxes. Hence my tirade against the rest of the medical and lawyer community (part from the 2,000 good souls) who under-report their incomes. Again very offtopic, but with all due respect to Mr. Venu and you, a soft loan over 50 years is just that, free money. I know a little bit about investing and finance (do it for a living) - yes currency depreciation impacts your payout and therefore effective interest rate, but assuming a straight 3% depreciation every year for 50 years is just plain stupid. Plus, you have to take into account the concept of Economic Value Added - a concept alien to Mr. Venu and his kind - which enables the economy to generate activity due to the creation of a public asset. With the same logic, why should we have created any highways or public infrastructure at all? Why do you "invest" in infrastructure, while "spend" on welfare. The concept of EVA comes in. My late professor Sudipto Bhattacharya would have explained this to you better over beer at High Holborn, London. Anways, this is my last reply on the topic. I was merely trying to present a financier's point of view on the prevelance of indirect taxes in our country. I don't have any political affiliations, although would recommend people to stop reading the finance equivalent of Gruhshoba and commenting on fiscal issues. Last edited by andafunda : 8th December 2020 at 15:44. |

| |  (7)

Thanks (7)

Thanks

|

| The following 7 BHPians Thank andafunda for this useful post: | .Albatross., doxinboy, rbp1988, shashant, srvshaun, Torq, yogiii |

| |

| | #6942 | |

| Senior - BHPian Join Date: Nov 2009 Location: Bangalore

Posts: 1,434

Thanked: 2,046 Times

| Re: The Official Fuel Prices Thread Quote:

Most doctors I know struggle to make ends meet. seeing 10-15 patients per day charging 200-300 per patient, paying staff, paying rent, water and electricity bills at commercial rates. Most barely scrape through to the 10% bracket. Many doctors I personally know fudge their income tax returns by quoting non-existent income to be eligible to avail loans to buy instruments. Sure there are certain hotshot doctors who earn a lot, but they are more businessmen than doctors. I don't know much about lawyers, but the few I know are running around courts in the hot sun trying to rustle up cases. | |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank wildsdi5530 for this useful post: | drhoneycake, RSR, yogiii |

| | #6943 | |

| Senior - BHPian Join Date: Nov 2009 Location: Bangalore

Posts: 1,434

Thanked: 2,046 Times

| Re: The Official Fuel Prices Thread Sorry, Time crossed to edit the previous thread. Cross posting from the credit card thread. Quote:

| |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks wildsdi5530 for this useful post: | mvadg |

| | #6944 | |

| BHPian Join Date: Jul 2015 Location: BLR, CCU

Posts: 35

Thanked: 113 Times

| Re: The Official Fuel Prices Thread Quote:

| |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank dgogold for this useful post: | Nalin1, spr1ngleo |

| | #6945 |

| BHPian Join Date: Oct 2016 Location: Bengaluru

Posts: 254

Thanked: 1,336 Times

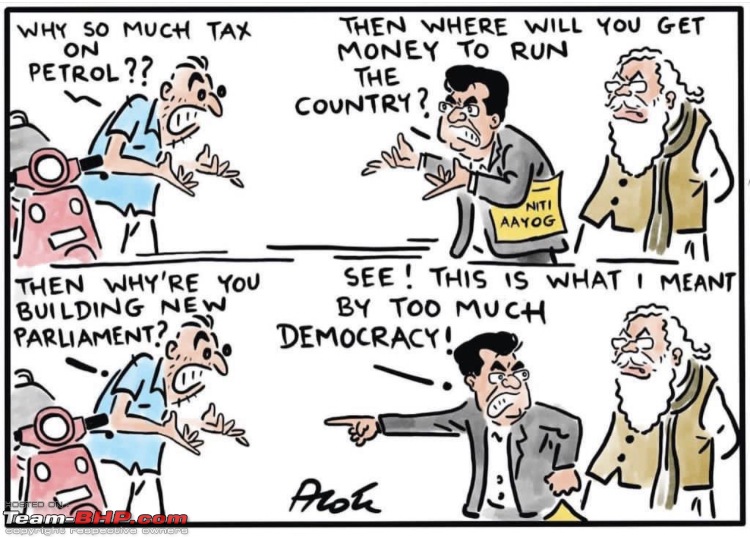

| Re: The Official Fuel Prices Thread BJP Rajya Sabha MP, also a trained economist, Dr. Subramanyam Swamy tweeted the below image. Well.. at least somebody has a sense of humor and a spine. Rare qualities these days!  |

| |  (10)

Thanks (10)

Thanks

|

| The following 10 BHPians Thank OrangeCar for this useful post: | AutoNoob, humyum, longhorn, rbp1988, RSR, Sandeep500, sumeethaldankar, Turbohead, vharihar, yogiii |

|