Team-BHP

(

https://www.team-bhp.com/forum/)

According to a media report, in the third quarter of 2019, Ferrari's revenues increased by 9% and operating profit increased by 12% year-on-year. Ferrari's shares have gained 77% and the company is valued at US$ 31 billion.

The report suggests that Ferrari's customers are willing to pay a premium to personalize cars even during a recession. It is said that the company wants to be seen as a luxury goods company and not as a regular carmaker and that its operating profit margin is 25%, which is much higher than other carmakers.

Ferrari is expected to reduce its clothing and accessories line-up and is looking to move it upmarket with the help of Giorgio Armani. It could also open driving simulation centers and enter e-sports. The company hopes that these services and products account for 10% of the operating profit.

Among the Italian carmaker's upcoming cars is a hybrid supercar called the

SF90 Stradale, while the Purosangue SUV is not expected for another couple of years at least.

Link to Team-BHP News Source

Talk of a recession. The current Ferrari lineup includes around 12 different vehicles including variants of the basic models like 488 Pista, F8 etc. I think this is where Ferrari trumps its rival from Sant'Agata. Lamborghini has only 3 core models whereas Ferrari has around 6-7. Ferrari is also quicker to introduce newer platforms and variants than Lamborghini I think.

With the upcoming Purosangue SUV, Ferrari's profits and valuation is only going to go higher.And people with deep pockets are going to queue up outside Maranello's gates to customize their prancing horses and adding insane amounts of money into Ferrari's account. Recession be damned.

Recessions don't affect Veblen goods like these. In fact, Kering and LVMH have seen a 20% and 50% yoy rise as well, and they're pretty good proxies. I would buy and hold for the next 5 years - the SUV will really make their shares skyrocket.

Millionaires and Billionaires might lose a small percentage of their new wealth because of market fluctuation. Its not a wonder that supercar market is hardly affected.

Hypercar market is getting over crowded with too many options. But I think Ferrari has a good lineup of cars for first time supercar buyers and that eventually shows up in their financial report.

Terms like "Recession", "Downturn", "slowdown" don't apply to super luxury goods & services. Simply because they are immune to market forces which us mortals are subject to. A few percentage or even double digit fall in stock price is chump change & these individuals are well hedged even for major economic crisises. So I think the title of the thread itself is redundant.

I think there is more to this topic than what meets the eye. Ferrari is and has always been very careful about who they allocate cars to. They purposely limit the amount of cars that they manufacture and sell so that there is a demand and desire for their cars. Hence also resulting in their cars holding their value. You can't just walk into HR Owen and order a 488 Pista. You need to create a relationship with the dealer, buy some lower models and then you might be seen worthy by the people at the factory to buy more limited edition models.

On the flip side, Mclarens depreciate a lot, especially because they are willing to provide supply if there is demand. Aston Martins are not selling.

We must applaud Ferrari for playing their cards right.

There might be a slump in the Maruti Alto's sales, but the Mercedes S-Class still has a waiting period! That pretty much sums up how a sluggish economy affects the different strata of society. To the super rich, a bad economy hits their investments & business to a certain extent, but not their lifestyle. There is almost no difference to daily life, vacations or the cars they drive.

Plus, Ferrari has always sold a slightly smaller number of cars than it has demand for. The trend mentioned in the thread title should come as no surprise.

Although they all build high performance/luxury sport cars, the financial situation of Aston Martin and McLaren is totally opposite to Ferrari’s.

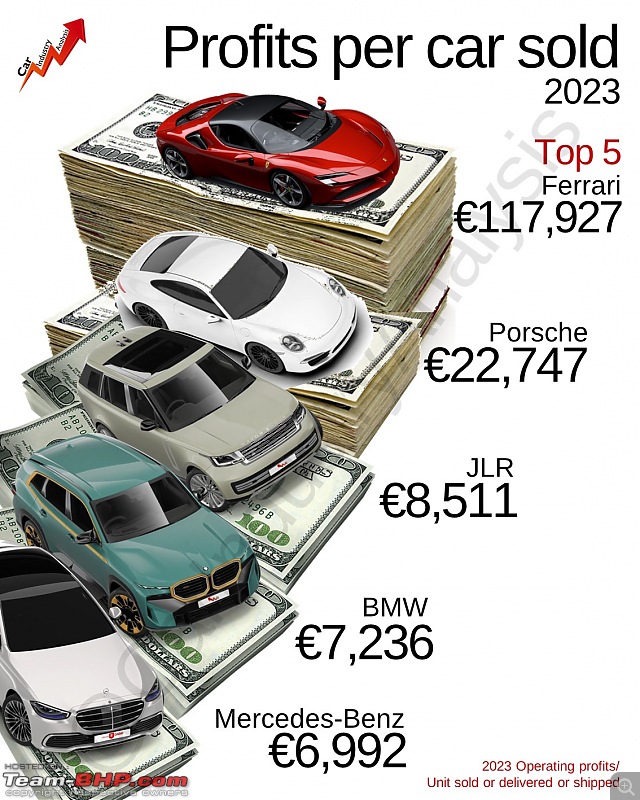

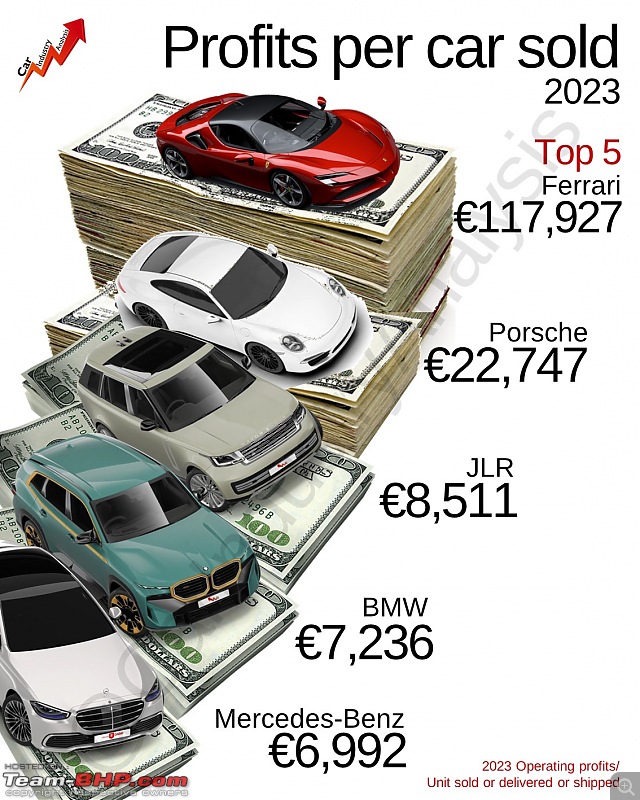

Ferrari and Porsche lead the ranking of the most profitable brands.

Quote:

It's one thing to sell cars and top the volume charts, and it's another to make money selling cars. Being popular doesn't necessarily mean making money and there are two brands in the automotive industry that know this perfectly well. Ferrari and Porsche, two of the most iconic brands, posted the highest profit margins in 2023 despite being at the bottom of the year's volume charts.

|

Quote:

The increase in revenues is not mainly due to the increase in units sold (+9%), but to the increase in car prices. Volkswagen Group, Toyota and Stellantis recorded the highest revenues, with increases of 15%, 11% and 6%, respectively. Basically, all 24 automakers in the sector recorded increases, with the exception of Isuzu, whose revenues remained flat

|

Ferrari gains even more Quote:

The classification changes radically when looking at the profitability of these companies. In 2023, all of them together made €187.8 billion in operating profits (the money earned after paying for necessary expenses). This total increased by 18% compared to 2022, when the same OEMs recorded a total of 159.4 billion euros. The 18% increase is higher than revenue growth, meaning the industry margin increased from 7.8% in 2022 to 8.4% in 2023.

The leader remains Ferrari. The Italian company is not only a benchmark for sports cars around the world, but also a real money-making machine. In 2023, Ferrari delivered 13,663 supercars, with a total turnover of €5.97 billion, an increase of 3.3% and 17%, respectively. This means that the company has been able to sell more expensive cars than before and earn more from other activities, such as Formula 1 or merchandising.

|

Ferrari's operating profits were 1.61 billion euros, or 27 percent of total turnover. That's a huge operating margin that confirms Ferrari's solid position in the industry. In other words, the company retained 27 cents for every euro of sales. Last year, the percentage was 24%. No other car manufacturer comes close to these brilliant results.

Porsche shines too Quote:

The other winner of the year is Porsche, with its profit of 7.28 billion euros on a revenue of 40.53 billion euros. Its operating margin remained stable at 18%, the second highest after Ferrari. Porsche benefited from increased sales of its flagship 911 and Taycan, while its three SUVs accounted for 55 percent of global volumes.

|

Other major players include Jaguar Land Rover, which went from a loss in 2022 to a profit last year. Toyota, Kia and BMW Group also posted strong increases in operating margin. Among the major manufacturers, Stellantis leads with a margin of 11.8%, followed by Toyota, Hyundai and Suzuki.

The only two Chinese manufacturers present, BYD and Great Wall Motors (the other companies have not yet published their results), reported mixed results, confirming that they are in a phase of unit volume growth, while profitability is not yet the priority.

Link:

Link:

More on the 2023

most profitable companies!

The operating profits of Ferrari totaled 1.61 billion euro, representing 27% of total revenue. This is a massive operating margin that confirms the solid position of Ferrari in the industry. In other words, Ferrari kept 27 cents of every euro in sales. Last year, this proportion was 24%. No other car maker gets close to this brilliant results.

PORSCHE SHINES TOO

The other winner of the year is Porsche with its 7.28 billion euros in profits out of 40.53 billion euros in revenue. Its operating margin remained stable at 18%, which is the second highest after Ferrari. A big part of the profitability at Porsche is explained by the good results of its flagship 911, which posted the highest sales growth in 2023. Meanwhile its three SUVs made up 55% of t he global volumes.

TESLA’S PRICE CUTS TAKE THEIR TOLL:

TESLA’S PRICE CUTS TAKE THEIR TOLL: Quote:

Tesla is at the bottom of the operating margin variation between 2022 and 2023. The brand dedicated a big part of the year to cut prices to keep its volume sales growth and its factories in USA, Germany, and China. In fact, these price cuts allowed Tesla to register a new sales record of more than 1.8 million cars delivered, at the expense of fewer profits

|

CHINA: VOLUMES AT THE EXPENSE OF PROFITS

CHINA: VOLUMES AT THE EXPENSE OF PROFITS Quote:

As the majority of these carmakers produce cars for foreign firms (Dongfeng to Nissan, Kia, Peugeot; SAIC to Volkswagen, GM; FAW to Toyota; Beijing to Hyundai) it is hard to split the results by their own brands and their partners. Others like Xpeng, NIO, Geely, have not yet published anything.

Nevertheless, BYD is China’s biggest EV maker and GWM is also expanding fast in overseas markets. Both of them are a good example of what China’s priority is nowadays: volumes. They want to expand their business outside China, meaning that they need to establish themselves around the world through new distribution and service networks, and new factories to localize their production. All of this means higher operating expenses, and lower profits.

BYD sold 62% more cars in 2023 than in 2022, and it actually hit the world’s top 10 by brands. Consequently, its revenues increased by 34% to 76.8 billion euro. However, the company only managed to earn 4.8 billion euro, or 6.3% of the revenue. Although these are positive results, the margin is quite far from some of its Western peers. While BYD made 1,600 euro per unit sold in 2023, a group like Stellantis earned 2,000 euro more per unit. GWM is another example. Its margin fell from 4.8% in 2022 to 1.6% last year.

|

Link:

| All times are GMT +5.5. The time now is 02:36. | |