Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by ventoman

(Post 4399333)

How about consortium like mfuonline or camsonline? Do they have any hidden charges or commission from investors?

|

Unfortunately, I do not know about revenue generation model of these companies.

But always remember, If You're Not Paying for It; You're the Product.

In my opinion, directly buying from the mutual fund companiesís website is the best option. It might get little tedious as you will have to remember multiple logins and passwords, but you will be sure that you will not be paying any additional charges.

Always make sure when you are buying a mutual fund that its name has ĎDirectí word, else its a regular fund.

You can use simple tools like on value research online to track your portfolio at a single place. Review your mutual funds not more than once in 1-2 yrs. Try to stay invested in them for a long term. When I say long term, it means at least 10-12 yrs.

Quote:

Originally Posted by ventoman

(Post 4399333)

How about consortium like mfuonline or camsonline? Do they have any hidden charges or commission from investors?

|

Hi ventoman,

I have been using both for couple of years. Both have zero charges. Only JM Financial funds is not available on the platforms. MFU has the maximum fund houses and better than Camsonline.

Quote:

Originally Posted by The Rationalist

(Post 4399347)

Hi ventoman,

I have been using both for couple of years. Both have zero charges. Only JM Financial funds is not available on the platforms. MFU has the maximum fund houses and better than Camsonline.

|

I've recently started using mfuonline and it's been a single click, hassle free experience for buying from multiple fund houses using CART and CAST orders. But wasn't sure of their charges, if any. Thanks for clarifying.

Quote:

Originally Posted by Who_are_you

(Post 4399337)

Unfortunately, I do not know about revenue generation model of these companies.

But always remember, If You're Not Paying for It; You're the Product.

|

MFU is a consortium of Mutual fund houses in India. You are paying them already as fund management charges. Using their portal doesnít incur any charges whatsoever. Its just that instead of making separate login id for each fund house you make one for all fund houses using a centralized platform. MFU is a hidden gem and hardly promoted as there is no incentive for anyone o do so. No Mutual fund advisor will do that. There is nothing to beat MFU at present and nothing will ever come also. And itís a breeze to use. You will be surprised that such a brilliant thing is available at no extra cost.

Quote:

Originally Posted by The Rationalist

(Post 4399380)

MFU is a consortium of Mutual fund houses in India. You are paying them already as fund management charges. Using their portal doesn’t incur any charges whatsoever. Its just that instead of making separate login id for each fund house you make one for all fund houses using a centralized platform. MFU is a hidden gem and hardly promoted as there is no incentive for anyone o do so. No Mutual fund advisor will do that. There is nothing to beat MFU at present and nothing will ever come also. And it’s a breeze to use. You will be surprised that such a brilliant thing is available at no extra cost.

|

I agree.

I use zerodha and recently opened a login with mfutilities. Both are equally good although I have not compared the funds available etc.

Login creation process

-- zerodha was super fast and its obvious as it's a paid product. Cost 300 (trading account) + 50per month (for MFs). Comes to 900 a year.

-- mfutilities - could do most online but needed to go to karvy once so the experience was a little harder, but who cares. Its a one time experience.

If your intent is just MFs, mfutilities is as good as any other.

If you also need trading benefits, then zerodha is a good idea.

Quote:

Originally Posted by The Rationalist

(Post 4399380)

There is nothing to beat MFU at present and nothing will ever come also. And itís a breeze to use. You will be surprised that such a brilliant thing is available at no extra cost.

|

Absolutely. MFUonline is a gem. And since it is promoted by most of theMF houses, there is a certain element of trust and security that one gets using it. i have been using it from the past 1.5 years and find it very easy. In fact once i transferred money to the wrong account and when i rang them up, they promptly corrected it.

Quote:

Originally Posted by earthian

(Post 4399449)

Absolutely. MFUonline is a gem.

|

But for Auto-SIP deduction they ask us to get 'PayEezz mandate' done. I thought opening the account would suffice for SIP, but you need this PayEezz mandate setup for SIP deduction from the bank. I was NEVER told about it when i went to open MFU account at Karvy.

I prefer purchasing funds directly from the company's website. Thankfully most of the companies have made it pretty easy and straightforward to register as an investsor. Buying funds or starting SIP/STP/SWP is a breeze.

I'd advise anyone using these 3rd party MF investment services to compare the NAV's on

moneycontrol or

amfindia before making the purchase. The reason I say so is because some of these services add convenience fee to the NAV. In such cases its always better to opt for company's website.

Quote:

Originally Posted by strawhat

(Post 4399738)

I prefer purchasing funds directly from the company's website. .

|

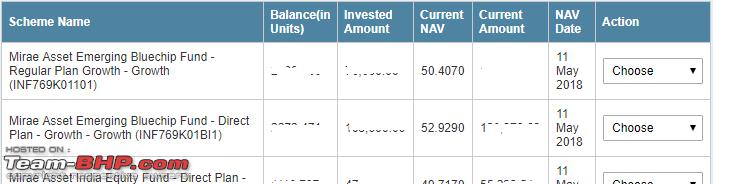

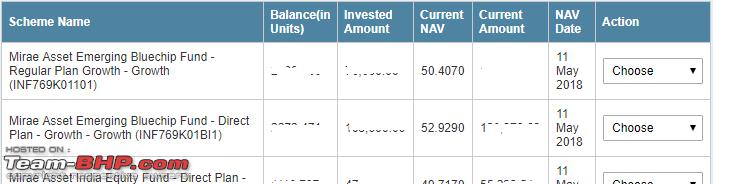

Agree wholeheartedly. I used to buy via agents out of unawareness and see the difference between direct and regular plan. Almost 3 rs for Mirae asset emerging blue chip fund.

Which is the best small cap fund for SIP?

Quote:

Originally Posted by Latheesh

(Post 4400275)

Which is the best small cap fund for SIP?

|

Reliance Smallcap fund is a good fund to consider. Last I know, they closed lumpsum investments and are open only to SIP.

Quote:

Originally Posted by Latheesh

(Post 4400275)

Which is the best small cap fund for SIP?

|

Quote:

Originally Posted by graaja

(Post 4400279)

Reliance Smallcap fund is a good fund to consider. Last I know, they closed lumpsum investments and are open only to SIP.

|

Reliance Smallcap Fund has me given pretty good returns over the last two years. I'll definitely suggest it.

In addition you might also want to look at L&T Emerging Businesses Fund (Direct Plan). The biggest factors for considering this fund is:

1) NAV is low.

2) Historically it has performed very well.

I am planning to split my equity investment between this, Birla Sunlife Small & Midcap and Reliance Smallcap MF.

Quote:

Originally Posted by strawhat

(Post 4400304)

...

In addition you might also want to look at L&T Emerging Businesses Fund (Direct Plan). The biggest factors for considering this fund is:

1) NAV is low.

2) Historically it has performed very well.

...

|

Am invested in this since last 8 months. Selected it seeing the historical growth but as my luck goes annualized returns currently stand at 1.06% lol:

Question to experts: HDFC balanced fund is getting converted to Hybrid fund. Is it advisable to continue with it? As of now there's a window wherein if we want, we can exit without any exit-load. I am invested in it since around 10 months and the returns are okay-ish at 7.xx % currently. Not too much of a market guy so hoping for some suggestions? please:

If I exit, what other balanced funds can I look at? I invest through HDFC fundhouse and ICICI direct account.

Quote:

Originally Posted by strawhat

(Post 4400304)

In addition you might also want to look at L&T Emerging Businesses Fund (Direct Plan). The biggest factors for considering this fund is:

1) NAV is low.

2) Historically it has performed very well.

|

Low NAV and high performance is a contradiction. If two hypothetical funds A and B started at the same time, the better performing fund would have a higher NAV.

So low or high NAV is not a good barometer to judge.

| All times are GMT +5.5. The time now is 11:42. | |