Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by swiftnfurious

(Post 5734325)

Bhpians - I have been asking in multiple forums the same question repeatedly just so I am moving in the right direction. I know am taking a big step and want to be as accurate in this as possible.

|

Can sense your seriousness from the post. Good to start now than never. I have been doing MFs for few years now and been tracking most all along. Like every influencer (I am far away from being one), it is my personal suggestion and kindly do your own due diligence/research before investing.

1. UTI Nifty 50 Index Fund - 10K

2. Nifty Next 50 Index Fund - 10K

3. HDFC Balanced Advantage Fund - 10K

4. Quant Small Cap Fund - 10K

5. You can either go for Nasdaq / US Blue Chip or a Flexi Fund like Parag Parekh.

MF sahi hai!

Quote:

Originally Posted by vj_torqueaddict

(Post 5733516)

... it was 100 percent equity.

|

I recently consulted a financial planner. I laid out all my assets, FD, PF, insurance, etc. In the end he advised a plethora of purely equity based mutual funds; all aggressive ones, not even conservative funds. I am not even young. His advise was all high risk, high return funds.

Quote:

Originally Posted by swiftnfurious

(Post 5734325)

7 Year Performance (credit to the original source ET Online)

|

I can’t offer much advise other than provide more data to chew one. There are many experts in the forum who can decipher these charts better.

The two charts show ten funds from your list, and represents a theoretical scenario where all ten funds are subscribed. It shows how companies and sectors overlap across those ten funds. Top 25 companies are picked from each fund, tabulated together, and top 25 companies or sectors from combined list are put together for comparison. All %age in the fund columns are percentage of total holdings in the fund. Percentage on the right are for your portfolio combination.

Top 25 companies and sectors, as well percentage on RHS will change if the fund combination is changed, eg if any six out of ten mutual funds are picked.

Chart 1: shows company overlap across funds.

Chart 2: shows sectoral overlap across funds, and top 25 sectors in your proposed portfolio

(Chart source: yours truly, with data from moneycontrol.com. Market cap figures are from ValueResearch)

Your fund choices seem to lean a lot on small cap. In all advise that I have read, the recommendation is always to hold small minority in small cap due to very high volatility. Please refer bottom portion of chart 1, and summation on RHS showing proportion across market capitalisation.

Quote:

Originally Posted by DaptChatterjee

(Post 5734351)

1. Nifty 50 index fund, 40%

2. Nifty next 50 index fund, 15%

3. Nifty midcap 150 index fund, 15%

4. Any active smallcap fund, 15%

5. S&P 500/Nasdaq 100 index fund*, 15%

|

I seem to observe that top performing funds beat market indices by a fair margin. If we can talk about gaining 1% in direct funds over regular funds, I am wondering why there is so much recommendation for index funds when some actively managed funds give a few percent more return.

Quote:

Originally Posted by Guite

(Post 5734461)

I recently consulted a financial planner. I laid out all my assets, FD, PF, insurance, etc. In the end he advised a plethora of purely equity based mutual funds; all aggressive ones, not even conservative funds. I am not even young. His advise was all high risk, high return funds.

|

A big red flag right there. Was he a fee-only Financial Planner, i.e. someone who charges a flat fee for his work? If yes, then you are his boss. If no, then the fund that he peddles is his boss. He will sell funds that give him the biggest commission and has little incentive to work for your benefit.

I have a visceral dislike for people like these. Relationship Managers top this list :D

Quote:

Originally Posted by Guite

(Post 5734461)

I seem to observe that top performing funds beat market indices by a fair margin. If we can talk about gaining 1% in direct funds over regular funds, I am wondering why there is so much recommendation for index funds when some actively managed funds give a few percent more return.

|

The top performing funds change every year. Nippon India large cap had stellar 22 & 23 and has the best 10 year return among large cap funds. But rolling returns say a different story. It was underperforming the benchmark for almost the half of the journey.

Having said that, investment value, time and asset allocation matter far more than choice of funds. The active versus passive debate is futile.

Quote:

https://timesofindia.indiatimes.com/.../108416251.cms

Excerpts:

Sebi ... flagged "froth" in small and mid-cap stocks...

...regulator is willing to review norms that mandate small and mid-cap funds to invest 65% of their assets in these stocks...

... regulator is working to "evidence" the price manipulation of MSME stocks during trading. "We do see the signs...

|

That sounds a bit scary. Can experts comment?

If this is happening in small and mid cap stocks even multi-cap is likely to be affected. I had always felt flexi-cap are better than multi-cap for this reason.

Quote:

Originally Posted by ranjitnair77

(Post 5734521)

A big red flag right there. Was he a fee-only Financial Planner, i.e. someone who charges a flat fee for his work? If yes, then you are his boss. If no, then the fund that he peddles is his boss. He will sell funds that give him the biggest commission and has little incentive to work for your benefit.

I have a visceral dislike for people like these. Relationship Managers top this list :D

|

Unfortunately, my cousin has fallen for this 'relationship manager' recommendations. He has invested in Regular funds(as expected) and most of the funds are from ABSL fund house, some thematic. 8 funds in total. And none of them have a XIRR of >12%. I advised her on this 'loot' but she does not care since she does not understand the numbers and their significance. :Frustrati

Quote:

Originally Posted by swiftnfurious

(Post 5734325)

Bhpians - I have been asking in multiple forums the same question repeatedly just so I am moving in the right direction. I know am taking a big step and want to be as accurate in this as possible.

|

Too many smallcap and too many funds from same fund house are big red flags IMHO. You may want to consider adding some flexi cap or multi cap funds which are also known for giving good returns.

Quote:

Originally Posted by VWAllstar

(Post 5734360)

1. UTI Nifty 50 Index Fund - 10K

2. Nifty Next 50 Index Fund - 10K

3. HDFC Balanced Advantage Fund - 10K

4. Quant Small Cap Fund - 10K

5. You can either go for Nasdaq / US Blue Chip or a Flexi Fund like Parag Parekh.

MF sahi hai!

|

Out of these, I am invested in UTI N50, HDFC Balanced Advantage. For small cap I have Nippon but I have heard Quant has better returns but not sure if it is worth transferring to Quant. I do have PPFAS Flexi cap but we all know its foreign part is reducing each passing day due to the cap in foreign investment.

What was your rationale for investing in HDFC Balanced advantage? I had Back before April 2023, I had heard and read that this one gave almost consistent 12% returns and it was good fund. My wife had 10L invested in ICICI Balanced advantage which was abysmal in performance so I shifted that money to HDFC balanced advantage lumpsum in April 2023 and since then, as some NCD type investments matured, I invested more into this fund and right now it is at approx 32.5L in this single fund (invested) and current value of the same is 40.5L. Basically, with staggered lumpsum (it was not planned and I have no SIP in this fund) since April 2023 (less than one year), this fund alone has adding 8L to my portfolio. I understand bull run is also a factor but then my UTI N50 hasn't been growing at that pace.

This is how my monthly SIP distribution looks now. From all actively managed funds to Large Cap, index funds heavy MF portfolio.

Quote:

Originally Posted by mayuresh

(Post 5735608)

That sounds a bit scary. Can experts comment?

If this is happening in small and mid cap stocks even multi-cap is likely to be affected.

|

Some funds had already stopped the inflows into Small caps long back. After recent Sebi remarks the list seems to be growing.

Routine correction is one thing, but if it is price manipulation, as said in the Sebi remarks (see quoted post), it should be worrying.

What I don't understand (and don't like) is why SEBI has just let out a "whiff of a concern" and then let the stock market play out the reaction. If there is some evidence of manipulation they should investigate thoroughly and do a systemic overhaul.

https://economictimes.indiatimes.com.../108469570.cms

I have some doubts for smallcase users. I was not able to get them clarified from other resources.

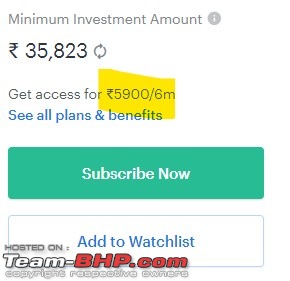

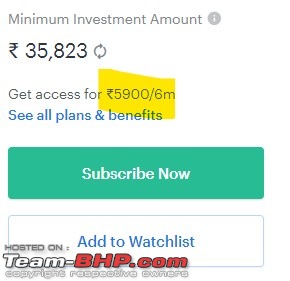

1. Some of the small cases are on subcription basis. It is written as say, 6k for 6 months. Does this mean, we have to 6k every months? Is there a difference in say, if i do lumpsum or SIP? What does it mean, if I do lumpsum, I have to pay 6k every 6 months to stay invested?

https://www.smallcase.com/smallcase/...nce-OMNNM_0012

2. Some of the small cases have a rebalance option, so let us say, the smallcase is rebalanced every quarter. Can i opt to not to rebalance in this quarter and then again rebalance the quarter after? If i do not rebalance in a quarter, do I have to forgo the rebalance option for remainder of the investment horizon. Why am I asking this? take a free small case, and then invest using custom option, you would notice that it would say, that the custom small cases are not rebalanced. SO i am concerened, that if i opt not to rebalance in a certain quarter, then is the investement considered like a 'custom small case' ? with further rebalance options ruled out?

https://www.smallcase.com/smallcase/...ting-SCAW_0001

Quote:

Originally Posted by govigov

(Post 5737491)

1. Some of the small cases are on subcription basis. It is written as say, 6k for 6 months. Does this mean, we have to 6k every months? Is there a difference in say, if i do lumpsum or SIP? What does it mean, if I do lumpsum, I have to pay 6k every 6 months to stay invested?

|

You have to pay the subscription fee to renew the subscription. Otherwise, you’ll not receive rebalance updates or be able to see the latest portfolio breakdown.

Since shares are held in your demat account, you can stay invested with older portfolio.

Difference between lumpsum and sip is in Smallcase charges, 100+gst for lumpsum, 10+gst for sip.

Unless you are subscribed to an etf based plan, I would suggest that you either continue to pay the fee and do the rebalancing whenever asked or liquidate your holding.

Quote:

2. Some of the small cases have a rebalance option, so let us say, the smallcase is rebalanced every quarter. Can i opt to not to rebalance in this quarter and then again rebalance the quarter after? If i do not rebalance in a quarter, do I have to forgo the rebalance option for remainder of the investment horizon.

|

If you miss any rebalance, you can still go for the next one.

Mod note: Back to back post, please use Multi Quote [Quote +] instead of this. Thanks. Quote:

Originally Posted by govigov

(Post 5737491)

I have some doubts for smallcase users. I was not able to get them clarified from other resources.

1. Some of the small cases are on subcription basis. It is written as say, 6k for 6 months. Does this mean, we have to 6k every months? Is there a difference in say, if i do lumpsum or SIP? What does it mean, if I do lumpsum, I have to pay 6k every 6 months to stay invested?

...

|

(Disclaimer: I am eligible to publish smallcases, but I don't.)

The 'free' small cases are often from the company, or a freemium offering from a publisher. It is likely that the person publishing the small case of your interest is a RA or RIA - the fees are likely to be per quarter or per 6 months.

Any direct equity portfolio requires frequent reviews. (Please note that review does not necessarily mean change.) The subscription basically pays for this effort.

Quote:

Originally Posted by sushantr5

(Post 5728186)

For the purpose for investment education to my son, I am investing his saved money in the mutual funds which are purchased in my PAN.

====

I tried searching for an app but no success, all Apps require PAN linking and automatic fetching of holdings using PAN number.

|

Before coming to the solution, are you sure that this is a good idea? I did have such thoughts earlier, but I am glad that I listened to my wife. My children have confirmed - after they became adults - that they are indeed better off not looking at this portfolio.

Quote:

Originally Posted by Guite

(Post 5714886)

...It is also pertinent to note that ET Money has a very useful rating which they call "Consistency of Returns". If you look at any fund having >4.5 rating under this criteria, the NAV graph have no or negligible dip: it is mostly up. In conclusion, I do understand that NAV can go up and down.

I would rather stick to those funds which go consistently up over three to five years period. It shows that the fund managers are excellent, and the fund is performing well. IMHO an NAV that have many fluctuation similar to some stock price illustrates a badly managed fund.

|

Actually it is possible for a fund to have large fluctuations and still do well over longer periods of time. (HDFC Flexicap is one example.)

However, you are very right in saying that a more consistent fund is better. The main reason - IMHO - is that these funds don't test your patience much, and it is easier to stay invested. An inconsistent fund could have large periods of underperformance, and may pose a lot of dilemma to the investor.

So, in view of this

news, which are the funds where we can continue to invest in US stocks, if at all we want to?

My Navi SIP just got cancelled, though I'm allowed to redeem my units.

| All times are GMT +5.5. The time now is 13:57. | |