| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  467,704 views |

| | #1441 |

| BHPian Join Date: Apr 2010 Location: India

Posts: 477

Thanked: 995 Times

| Re: Understanding Economics I have a quick question for all of you. I agree that it's unlikely that another currency will overtake dollar any time soon. It's also a fact that Dollar's prominence is coming down big time. My understanding is that most of the sovereign dollar reserves are in the form of treasury bonds. Since interest rates have just risen by around 400 basis points in the last 9 months or so, the value of those treasury bonds in the market would have reduced by atleast 30-40 percent in the open market. When you talk about dollar reserves for say India, should we mark to market the value of these dollar bonds? Wouldn't that decrease the dollar reserve value significantly? |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks vishnurp99 for this useful post: | Herschey |

| |

| | #1442 | |

| Team-BHP Support  | Re: Understanding Economics Quote:

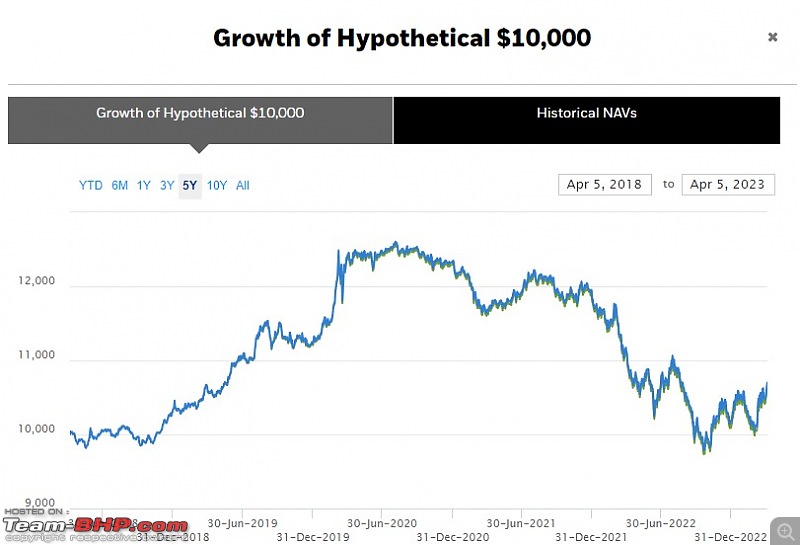

Because of the rise in US interest rates, the value of long duration treasury bonds would have fallen, yes:  But the value of shorter duration (0 to 1 yr) treasury bonds would have gone up in value.  We can expect RBI to hold their dollar reserves in a mix of US currency & US treasury bonds (ultra short term/short term/medium term/long term) Last edited by SmartCat : 6th April 2023 at 10:49. | |

| |  (6)

Thanks (6)

Thanks

|

| The following 6 BHPians Thank SmartCat for this useful post: | am1m, digitalnirvana, Jeroen, rajvardhanraje, V.Narayan, vishnurp99 |

| | #1443 |

| BHPian Join Date: Aug 2007 Location: Bangalore

Posts: 176

Thanked: 293 Times

| Re: Understanding Economics One of the issues we should worry about is a high cost economy. The last twenty years were a period of easy moony, cheap Chinese imports of all kinds. This decade will be expensive money and slow down of economies. I hate to use the word recession, have heard it since 1999 so many times that it has lost its sanctity and not many remember even the technical definition now. Few thoughts: there is race to build capacity domestically, for all kinds of things, will surely make them expensive. Self sufficiency has never worked. From chips to API to critical batteries and so on. Even free trade proponents like US are building capacity domestically for many things. In the name of jobs@home, capacity for emergencies. And of course Chinese capriciousness. In many ways, if China was the bedrock of prosperity for many nations across the globe it will be the bane for the decades to come. Chinese money, enterprise, ability to copy, innovate and come out with inexpensive and equally good or even better replacements drove prosperity for many countries. With Xi s new policies, inward focus of economy, and a muscular foreign policy for real and imagined slights are the keys now. No one is sure what is his long or even medium term vision of the economy is. He surely wants weaker private enterprise, that in turn would hurt the economy, ability to raise and absorb capital and decrease incomes. This may have potential to create unrest. I am sure he and his team understand that. Does he think guided capitalism is the way to go? One that will tell enterprise where to put the money? No one knows. Does he think public sector and local party owned and driven enterprise will replace the private enterprise? Does he think that post covid and bust up of many economies, their poison pill investments will work in poorer economies. All will be forgotten of the covid days when they were the most hated nation in the world? We will never know. But what will surely happen is that down the few years or may be a decade when we will have surplus capacity in many many industries, smarter economies will open up. They will have to open up to reduce inflation and reap advantages, smarter corporations will build up R&D and innovation to face competition post opening. Those countries who dont open up and keep subsidising domestic capacity will face fiscal ruin. When it was the era of cheap money, a sham theory like the modern monetary theory was waved in the face. Fact remains that basic theories of economics have withstood the test of time and come back and prove their importance, time and again. Like the basics of finance in the age of money guzzling start ups. We were all told to forget profitability at that time. All this is still predicated on 2-3 black swan events. No nukes in Ukraine war, then all bets are off. China not attacking Taiwan, and North Korea suddenly not becoming adventurous. Then it will be a freezing winter for very very long. Jingoism, fear of the unknown, mostly Chinese and Covid have changes the trajectory of economies and economic policies, both fiscal and monetary. Will they get the balance soon, tough to say. When we get back to fundamentals of economics and finance; may be it will. Future will always belong to the economies that have low taxes, free trade, free currencies. This will never change. |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank neerajku for this useful post: | am1m, mallumowgli, premsky, Seenz, V.Narayan |

| | #1444 | |||

| Senior - BHPian | Re: Understanding Economics This is by far the most interesting thread on this forum, and that includes the Weird and Whacky Mods one.  I spent some time in China, speaking with many people who were both fiercely Chinese, while being educated across the world - from the US to India. One thing stood out - they don't care. They are not interested in spreading their culture, in colonisation, in global domination. That's why you see nearly no Chinese cultural exports - from pop and movie stars to designer wear. They have a curious habit of looking inward, which has been the case for centuries. If you look at their economy and population to pop culture ratio (yes, I made it up), they are left in the dust by India, let alone Japan or South Korea. Of course, a massive domestic market means that their media icons don't need to export to grow, an added bonus. All of their current 'wolf-warrior' ethos and posturing comes from Xi's megalomania. He has tapped into the vein of resentment that the Chinese have always had - just like the Russians - about being pushed around despite being a great culture and empire (we are also trying it ourselves!). He is also lucky to have inherited an economy and military that is now toe-to-toe with the best, all adding to his heft. Still, most of China's territorial claims are what they perceive to be historic and justified, rightly or otherwise. They are far less interested in colonisation than previous powers, or even power projection in the form of bases like the US. Most of their military focus in other countries is to safeguard their assets, which again are only created to feed their industrial machine for the mid to long term. Quote:

Quote:

Quote:

To make himself the last great Huangdi, he is creating more self-regulating systems - social credit - while ensuring that he is able to bridge the income equality divide in China and make it less reliant on cheap exports. This will make China more obedient internally and more powerful internationally. To this end, he has implemented social credit in a big way over the last decade, with millions of cameras and data points watching every move of the populace. China's high dependence on digital money and record-keeping has made this much easier - it's why GoI pushed so hard for Aadhaar. He has also hobbled industries which seem to promote inequality - afterschool tuitions and learning apps which only the more affluent can afford, and real estate companies gorging on cheap debt and selling second and third homes, themselves being financed by more cheap consumer debt. All leading companies in these fields have lost ~90% of their value, if they haven't completely shut down. What he's done is ensure that the millions who still haven't made it to the middle class, now have a fairer chance using the same public school systems and lending avenues as most others. At the same time, Xi has ensured that investment focus in China has moved from consumer finance and internet, to deeper engineering and tech. While guys like Alibaba and Ant are now pale shadows, the money being poured domestically into defence research, AI, chip manufacturing, and other such fields is off the charts. This is a similar path to what the US took in the 60s, which set off a 30+ year boom of prosperity from the 80s that is only now slowing down. Whether WtP's gamble works out or not is something we'll know over the next 30 years. Of course, as with all Chinese numbers, these are a mixture of guesswork and intuition, often unrelated to what Global Times hawks.  Last edited by v1p3r : 9th April 2023 at 16:03. | |||

| |  (12)

Thanks (12)

Thanks

|

| The following 12 BHPians Thank v1p3r for this useful post: | AheadAJ, alpha1, am1m, dragracer567, Everlearner, neerajdan, neerajku, premsky, Samurai, V.Narayan, vamsi.kona, WorkingGuru |

| | #1445 | |

| BHPian Join Date: Aug 2007 Location: Bangalore

Posts: 176

Thanked: 293 Times

| Re: Understanding Economics Quote:

Few others I have a view. No country in the free world tries to export its culture. Honourable exception being , USSR, GDR, Cuba, PRC, all in the 60s onwards. Radio, magazines, inexpensive glossy books, Irodov, calendars and so on. Doubt if they were very effective. USA had those tame VOA broadcasts and one glossy magazine. Probably called Span. India tried in the 80s with festival of India. Yes, brought some awareness but no FDI or tourists. It is not the governments that do so. But done by the best way, popular choice, the wisdom of the masses. Yoga, Korean, Pakistani, Turkish, Indian serials, movies. Boy bands. US pop culture. None were pushed by their governments with some subsidy or any support. Same for Chinese culture. They may or may not be keen, if the world likes it, will find a way to find about it and adapt it. I am not sure I understand the logic of building social capital through surveillance. It is paranoia pure and simple, any which way you look at it. Intent is to limit dissidence and nip in the bud, any resistance. It cant bring in social or economic equity through it. Communists tried that for ages. Had zero success rate. I would see it as attempt to control private enterprise. Drawing parallel with Aadhar is not correct. Aadhar is for controlling leakage, building up a national database of citizens and now more. I also don’t agree that control of Ed-tech and grinding many real estate companies to dust had a social purpose. Wish the regime or any regime, was as altruistic. Real estate troubles pushed millions to extreme difficulty and there were very strong mass protests across China by investors. Very rare, they also did not see any social benefit in it. To my mind intent as to send message to entrepreneurs in difficulty and ensure rest kowtow. Extreme wealth had created many recalcitrant rich ones. This was the message of fear for them. Similarly the Chinese territorial claims , one can say that to be historic from their point of view but others don’t see it that way. We cant claim Afghanistan. Burma, Sri Lanka, or even Malaysia, Thailand or Indonesia now. World has moved ahead. Chinese have always been hungry for territory and started off with Tibet. Now they want more as they are big and powerful. If their claims are so fair and logical then why is it that they have a contest with very possible neighbour. Atavism based territory claims have limited currency in the modern world. Last point, redirecting investment to chosen areas, we tried, Russian did and most of Communist states did. All it did was to drive them penury. Never worked. As state they can only do so much , private enterprise has to supplement with talent and capital, but by a market mechanism and not by coercion. And if it was the size of the domestic market that they were complacent about then they would not raise such a fuss about the export controls off US and Europe. Same arguments are shared by some of our “Bharat Natyam” economists, size of domestic market is good enough. But what they forget that exports bring forex, surpluses, innovation, supplement domestic savings, technology, market savviness, better competitive, products and better quality. Chinese know this well and hence have never been complacent about their domestic purchasing power. Last edited by Samurai : 9th April 2023 at 19:22. Reason: avoid quoting large posts fully... | |

| |  (8)

Thanks (8)

Thanks

|

| The following 8 BHPians Thank neerajku for this useful post: | AheadAJ, am1m, comfortablynumb, dragracer567, V.Narayan, v1p3r, vamsi.kona, wheelnpaddock |

| | #1446 |

| BANNED Join Date: Apr 2023 Location: Bangalore

Posts: 17

Thanked: 77 Times

| Re: Understanding Economics https://www.bbc.com/news/world-asia-65229003.amp Well, China has just concluded military drills that included a complete blockade of Taiwan. As the BBC says “China sees Taiwan as a breakaway province that will eventually be brought under Beijing's control - by force, if necessary.” In a blockade scenario the most significant disruption to global economic activity would come from a halt to Taiwan’s trade with the world, particularly in semiconductors. Associated disruptions to global supply chains—especially in major chip-consuming sectors such as electronics, automotive, and computing—would have grave repercussions for the world economy. Global trade with China would also decline due to a contraction in global trade financing, shocking the global economy and potentially triggering debt crises among China’s more fragile trade partners. The economic activity at risk is well over two trillion dollars, even before factoring in international responses or second-order effects. The disruptions would be felt immediately and may even be difficult to reverse. They would impact trade and investment on a global scale, leaving few countries untouched. Hope wiser counsel prevails upon China and the military drill is not an indication of a potentially permanent scenario. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks wheelnpaddock for this useful post: | V.Narayan |

| | #1447 |

| BHPian Join Date: Apr 2010 Location: India

Posts: 477

Thanked: 995 Times

| Re: Understanding Economics Thanks @Smartcat for that clarification on the reserve valuation. Reading through the previous comments that learned members have posted on this thread, this is what i could glean. This could be a simplistic understanding or maybe a misunderstanding. Please feel free to comment if I am missing something major. 1. USA has around 25-30 Trillion dollars of debt currently. They also add up debt yearly at an annual run rate of around 1 Trillion USD. 2. Historically US could afford to do it because USD was the international reserve currency. Also US had manufacturing capacity which resulted in exports which would bring in wealth but this has been going down over the last several years. 3. Going forward, USA will be in a bad situation because the USD reserve status is being constantly eroded. Currently USD is at around 58% of overall soverign reserves. As this percentage drop continues to accelerate, thanks to Russian, Chinese & OPEC action, there will be massive domestic inflation in the US. 4. US runs on credit. This will lead to massive unrest as people & companies won't be able to meet their interest commitments. 5. US won't be able to stop printing money because they have enormous commitments in terms of their military spends, ongoing conflicts in Europe/Ukraine & Asia/Taiwan, Bank Bail offs etc. They also have to pay back the coupon payments for 30 Trillion dollars of debt & the principal amount. 6. This may result in domestic unrest & violence in a country which has the largest per-capita number of guns. All said & done this looks like a disaster for the USA. Have I got this right? What can the US do to get out of this situation? This is also bad news for most of us who have deep professional and/or financial relationships with the USA. The entire IT services sector could be impacted significantly and the product bandwagon led by the FAANG companies could be decimated too. What we are witnessing today in terms of layoffs could just be a beginning. Would like to hear the thoughts of other on this. |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank vishnurp99 for this useful post: | Seenz, SmartCat |

| | #1448 |

| Distinguished - BHPian  Join Date: Aug 2014 Location: Delhi-NCR

Posts: 4,071

Thanked: 64,295 Times

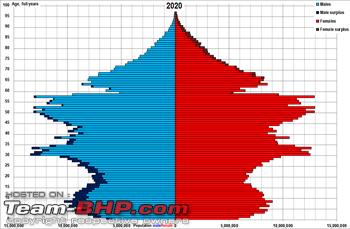

| Re: Understanding Economics Births in Italy Hit Record Low in 2022, Dearth of Babies is 'National Emergency', say Govt. Italy’s dearth of babies is considered a national emergency, and fixing the problem was a prominent policy pledge by Meloni ahead of last year’s election Italy, in 2022, recorded 392, 600 births the lowest since the country was created through a process of reunification in 1861 over 150 years ago. For every 1000 population there have been 7 births and 12 deaths or a negative incline of 0.5% a year or 5% a decade. Their bigger problem as we know is the funding of the burgeoning pension plans and the earners to pensioners ratio. Their modal population group is 45 to 60 years of age implying his ratio is about to get significantly worse in 5 to 15 years. The same problem afflicts Japan, Russia and to a lesser degree France and in the medium term China. I expect in another 5 to 10 years this to be a full blown major economic crises for some countries. A surprising country headed in that direction is Iran! Interestingly UK & USA are not on the hit list. Today Africa as a whole is the same as a China or a India. By the turn of this century Africa will be more than both these giants combined and plus some more. In 15 years this change in demographics will significantly start affecting geo-politics. Right now it is a only problem that needs to be addressed. Soon it will become a problem that can no longer be addressed. A smaller more productive population may not be a bad thing. It is the management of the old that is the elephant in the room. It will be interesting to watch the strategies countries adopt to cope with this front. For the planet earth as whole a reduction in human population by half would be a good thing from point of view of resource use and the environment. It is getting there that is the problem! The Govt's of Italy & Japan want to get couples to produce more babies. I wonder how that would get done  As the chart shows the challenge is with Eastern Europe and Italy and not with the Anglo-Saxon/Benelux/Scadinavian nations. Though France, Portugal & Spain do have a similar crises looming up. Last edited by V.Narayan : 12th April 2023 at 08:22. |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank V.Narayan for this useful post: | alpha1, am1m, ninjatalli, vamsi.kona, wheelnpaddock |

| | #1449 |

| Distinguished - BHPian  Join Date: May 2010 Location: Bangalore

Posts: 1,897

Thanked: 11,976 Times

| Re: Understanding Economics

Is that because they have a working immigration system in place? Not just the system, but the fact that they are more welcoming of migrants than say Japan or Italy? I never understood why a country would opt to get "their" people to "produce more children" instead of going the immigration route to make up the shortfall. I mean I understand, but those attitudes are rooted in the past mindset and ideas of what a citizen of a country should be ideally- what they should look like, which language they should speak, what they should eat. I think eventually there will be no option but to become more open to immigration and rejuvenate the country. Because, I really don't see how you can force or incentivize an educated population to "have more babies". Religion and patriarchy worked for so long. But as a population, especially the women get more educated, it's going to be tough for that to keep going. Last edited by am1m : 12th April 2023 at 09:26. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks am1m for this useful post: | alpha1 |

| | #1450 | |

| Distinguished - BHPian  | Re: Understanding Economics +1 to your post @V.Narayan. Quote:

It's a big issue because China is still a workforce dependent economy and leaving aside the urban areas, the rest of the country is still a developing nation (with regards to economic status) and the state can't provide support to the burgeoning aging population unlike a Japan or European country.  China's population split by age - source Wikipedia Last edited by ninjatalli : 12th April 2023 at 09:55. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks ninjatalli for this useful post: | V.Narayan |

| | #1451 | |

| BHPian Join Date: Dec 2005 Location: bang

Posts: 878

Thanked: 3,117 Times

| Re: Understanding Economics Quote:

1. If Immigration is only meant to top up a decreasing population, then technically anyone from anywhere should be welcome as long as they produce babies. However, many western countries have a point system for immigration whose primary aim is to welcome only the educated, so called skilled labour force while leaving out others. 2. Then there are cultural issues. The first generation who immigrate don't Integrate. Its usually the second or third generation who feels at home in the new lands. So most often you find formation of Ghettos. America is a land formed by Immigration while Europe is not. Europe already had a "native" population long before US was even a country so its Europe which faces the most difficulty due to falling birth rates. So immigration is not the only way forward. Last edited by srini1785 : 12th April 2023 at 10:25. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks srini1785 for this useful post: | am1m |

| |

| | #1452 | |

| BHPian Join Date: Sep 2010 Location: Bangalore

Posts: 183

Thanked: 2,701 Times

| Re: Understanding Economics Quote:

Just a year back when the Russia-Ukraine war started, a few predictions were made none of which turned true: - Natural gas price will increase; it has fallen since the war started - Food shortages especially wheat since Ukraine is a major wheat producer ; 2022 was a record high in global wheat production. Even sunflower oil (another major export from Ukraine) which witnessed a spike in prices after the war has now reduced to pre-war prices. - Europeans will freeze during the winter When one can't predict in the short term, how can one predict what happens decades into the future? Another fact is the so-called de-dollarization has been going on for a long time now. USD share as the reserve currency has fallen from 80% in the 1970s to 70% around the turn of the century to current 59%. So it is not a new phenomenon, and the world or the US is not going to collapse if it falls to 40% in the next 2-3 decades. One may not even notice it. Unlike Russia, China, or Saudi Arabia which are currently led by strong leader/personality based politics, US is institutionally strong with self-correcting mechanisms. No one can predict what happens when Xi, or Putin dies i.e. whether the new leaders will continue on the expansionist mindset of Putin/Xi. Perhaps if there is a new president in the US in 2024, he/she may have a more accommodative stance towards Putin and Russia & US may gang up against China. Who knows?! --------- In my opinion, the biggest impact on global economy/geo-politics would be how Nuclear energy grows. Nuclear energy is already considered as a green energy to combat the climate crisis. When technology evolves for cheaper, modular, quick deployment nuclear plants major economies can turn self-sustainable and inward looking quickly. (See, I can also make a prediction  ). ).Last edited by DigitalOne : 12th April 2023 at 10:30. | |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank DigitalOne for this useful post: | am1m, dragracer567, vishnurp99 |

| | #1453 | |

| Distinguished - BHPian  Join Date: May 2010 Location: Bangalore

Posts: 1,897

Thanked: 11,976 Times

| Re: Understanding Economics Quote:

Again, I don't know enough to say if that is an accurate prediction, or if he's just biased because he works for an EV maker. But it seems that nuclear power is certainly a factor in how things play out, while I thought it was on the decline because of the bad press from accidents like Fukushima and with countries like Germany shutting down their reactors. Last edited by am1m : 12th April 2023 at 10:43. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks am1m for this useful post: | AheadAJ |

| | #1454 | |

| BHPian Join Date: Apr 2010 Location: India

Posts: 477

Thanked: 995 Times

| Re: Understanding Economics Quote:

In case the natural gas prices have dropped now, the reason is that industrial production in countries like Germany has dropped by around 4-5% in comparison to 2019 - pre-pandemic year. This is unlikely to be good for Europe in the longer term. Short term, this may shield the general public from higher gas prices. Europe definitely needs nuclear power to come back now  regardless of all of the other noise around clean energy etc. Of course you can just call it green energy because it makes sense for you economically. regardless of all of the other noise around clean energy etc. Of course you can just call it green energy because it makes sense for you economically. | |

| |  ()

Thanks ()

Thanks

|

| | #1455 | |

| BHPian Join Date: Aug 2019 Location: Bahrain

Posts: 935

Thanked: 4,974 Times

| Re: Understanding Economics Quote:

Anthropologically speaking, there is no such thing as a "native population", humans have been migrating around forever. Infact, an average Italian, Spaniard or Greek actually has more in common in terms of genetics & even cultural elements like cuisine with an average Israeli, Tunisian or Moroccan than with an average Swede or Pole. If you've ever lived in Spain or Greece, except for rules around modesty and gender segregation, the family structure & roles is really similar to North African or Levant cultures (heard of Machismo culture? its still a thing) though this is certainly changing for the better as they get more & better integrated with Northern Europe now. What I am trying to say is, when we talk about culture, its all relative. At the end of the day, even during times of population booms, rich countries always have more jobs for highly skilled workers than the supply & vice-versa for developing ones, so the only real solution for both sides is immigration. For countries like Canada and Australia, most of their economic growth is completely based off pulling highly skilled workers using their points-based system (as you pointed out) who will much much more in taxes than they will ever gain in return, smartly filtering out those who will cost them money in the long-term, taking their geographic isolation for granted (which the US and EU can't afford). Last edited by dragracer567 : 12th April 2023 at 12:14. | |

| |  (3)

Thanks (3)

Thanks

|

| The following 3 BHPians Thank dragracer567 for this useful post: | am1m, carthick1000, V.Narayan |

|