| Re: US Government Shutdown leading to Default

Quote:

Originally Posted by amitoj  Actually, the US economy has been recovering consistently for some time now. It is a slow recovery that is why it is going unnoticed. But unemployment numbers month after month have shown an improvement. Being a lagging indicator of the state of economy, falling numbers means the economy is improving. Earnings reports of many major players have beaten forecasts. And the market is not getting too spooked easily. Yes there are momentary shifts due to global events but things settle down to routine business very quickly. |

Let's pack in the latest numbers: http://www.forbes.com/sites/samantha...-quarter-2014/

0.1% when the government is printing money doesn't sound smashing either.

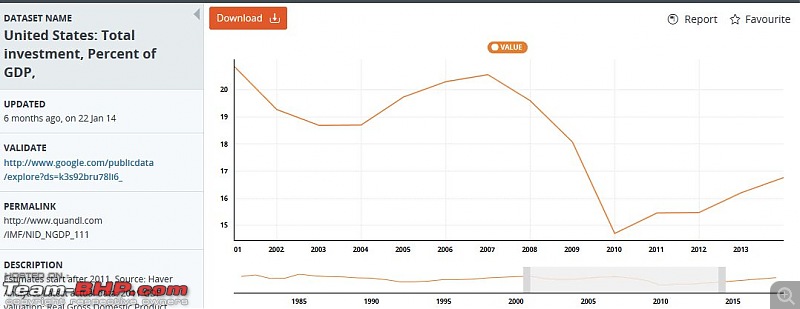

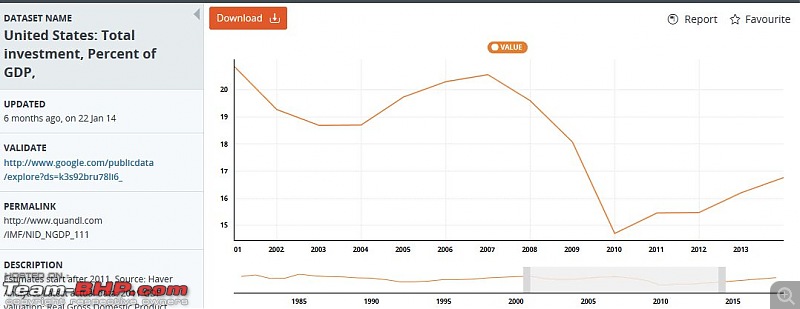

Let's consider investment as a % of GDP - that should tell us whether the businesses want to invest as much as they did earlier? http://www.quandl.com/IMF/NID_NGDP_1...Percent-of-GDP

(curtail chart to 31/12/2013).

Its recovered but not close to 2007 levels yet.

then some interesting stats to munch on, while I have dinner: https://www.creditwritedowns.com/201...-us-banks.html

pasting completely from there:

Amidst record profits ($18 Bn by JPMorgan), banks are NOT lending! Their loan to deposit ratio in 2013 was 57%, down from 88% in 2004!

Legend: Red = loans and leases + bank reserves, Blue = deposits (all commercial banks)  Quote:

As the CNN story suggests, there are a few possible explanations for this trend. Here are four of them.

1. Demand for credit remains weak due to economic uncertainty, large amounts of cash on corporate balance sheets, jittery labor markets, poor wage growth expectations, general unease with taking on debt, etc.

2. Regulatory uncertainty and tighter (and to some extent unknown) capital requirements are preventing banks from extending more credit.

3. Exceptionally low rates make some forms of lending unprofitable.

4. Banks are running unusually large excess reserve positions with the Fed that are “crowding out” lending. These reserves are effectively “loans” to the Fed paying 25bp, funded with bank deposits that pay near zero, creating riskless profits with zero regulatory capital requirement.

There are arguments to be made for all four. The last one however is particularly intriguing because the $2.4 trillion gap between deposits and loans is a familiar number. The excess reserves in the banking system is now … also around $2.4 trillion.

The chart below adds bank reserves held with the Fed to loans and leases – and the gap “disappears” (here we use total reserves vs. just the excess reserves, but the difference is not material to this trend.)

|

Red = loans and leases + bank reserves, Blue = deposits (all commercial banks)

Coincidence? Perhaps. But if there is any validity to the explanation #4 above, it would suggest that QE, which is directly responsible for the $2.4 trillion in excess reserves, was not helpful (and possibly harmful) to credit growth in the US.

Here's another one showing how ginormous and unprecedented this money printing has been - a THIRTY year chart showing how this idle money (reserve balance with federal reserve) has been over the last so many years.

Basically some of that profit is because they are not lending to businesses but putting it with the Fed, which prints more money in a never ending cycle. This level of staggering deposit growth with the Fed is ruinous for the real economy because banks are basically raising cheap finance and investing it for risk free returns. So much for banks powering the economy and all that spiel.

This is a quick perspective - barely researched but its a quick example of my cynicism. More later

Last edited by phamilyman : 24th July 2014 at 19:17.

|

(hat tip, JM Keynes)

(hat tip, JM Keynes)