Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by Pandher

(Post 5648098)

Bitcoin ETF's are coming, your mutual funds and retirement funds will be allocating percentages into it. They will have to market buy BTC 1:1 ratio, only 21 million total BTC in existence, much less available on exchanges to buy.

Do you not understand the gravity of the situation?

|

Could you please quote from where you have this statement highlighted in bold?

As far as I'm aware of, SEBI has banned mutual fund houses in India from investing in any crypto-currency until there's a law enacted on any digital assets. Even the ones like Invesco who have a blockchain fund have declared that they'll wait for such laws.

Could you share further info please?

I'm not trying to disparage you, just genuinely trying to see if there's any news I missed.

Quote:

Originally Posted by Pandher

(Post 5648098)

only 21 million total BTC in existence, much less available on exchanges to buy. Do you not understand the gravity of the situation?

|

Although there are only 21 million Bitcoins, each Bitcoin is further divisible into 100 million

Satoshis.

So that is 21 million x 100 million = 2.1 million billions

There is plenty for everybody!

Quote:

Originally Posted by Small Bot

(Post 5648205)

As far as I'm aware of, SEBI has banned mutual fund houses in India from investing in any crypto-currency until there's a law enacted on any digital assets.

|

Indian mutual funds are not allowed to invest in cryptocurrencies, but American mutual funds are. However, the assets under management of all Bitcoin ETFs combined is just around $1 billion or so (meaning, not very popular).

Quote:

Originally Posted by SmartCat

(Post 5648219)

There is plenty for everybody!

|

Although this is a low effort reply, i'll still answer this question asked by every newbie since 2008. You can settle for a smaller size pizza slice, but the pizza isn't getting any bigger. I think divisibility will come into play more when BTC is well north of a million dollars and your average joe can only afford 0.001 units

As the BTC keeps getting divided into smaller units, you will be controlling a lesser and lesser percentage part of the total supply. Remember the fight is for a share in total supply that is '2.1 million billions'. You can understand this more clearly if you simply think about buying a percentage out of total which is 100% and never going to 101%

The second part of your reply contains falsehood, SEC has not approved any spot ETF, what you have is miners or futures contracts. A spot ETF will mean funds have to keep 1:1 BTC in custody (real BTC not a contract) to every ETF unit purchased by an investor.

More info here -

https://www.investopedia.com/article...-gbtc-arkw.asp Quote:

Originally Posted by Small Bot

(Post 5648205)

Could you please quote from where you have this statement highlighted in bold?

|

My post was oriented towards why and how BTC can appreciate in value, and in Crypto's case you need to have a global perspective. We do not need Indian funds to jump in yet, American money is enough to pump it to stratosphere. I meant these when i talked about etfs -

Remember crypto's mission is to put the monetary system out of government hands into yours. You can purchase and keep BTC in a wallet yourself, you do not need to buy it through an etf. They are for old people/tech illiterate who cannot or won't self custody

Quote:

Originally Posted by Pandher

(Post 5648257)

You can settle for a smaller size pizza slice, but the pizza isn't getting any bigger. As the BTC keeps getting divided into smaller units, you will be controlling a lesser and lesser percentage part of the total supply. Remember the fight is for a share in total supply that is '2.1 million billions'. You can understand this more clearly if you simply think about buying a percentage out of total which is 100% and never going to 101%

|

If you want to explain why Bitcoin will rise, scarcity is not a very good reason for that. If you look around, you might find other "low supply" cryptocurrencies too. It doesn't mean just because supply is low, its price will start reaching stratospheric levels.

Bitcoin price will depend on supply and demand, just like any other asset. So if you expect price of Bitcoin to rise, you need to base your theory on why demand will rise over time. If long term demand (buying interest) for Bitcoin has a negative trend, the limited supply cannot protect its price.

Quote:

A spot ETF will mean funds have to keep 1:1 BTC in custody (real BTC not a contract) to every ETF unit purchased by an investor.

|

This can help, but it will still depend on how much investments these ETFs can garner. In addition to that, there needs to be a continuous buying interest in such ETFs over time, to positively affect BTC price.

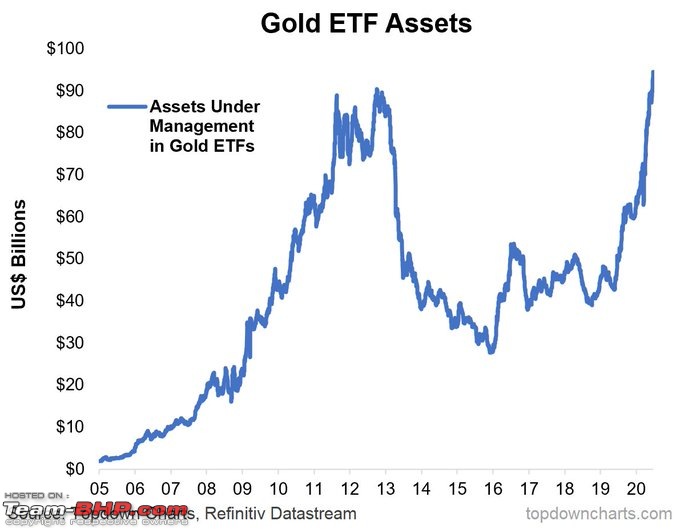

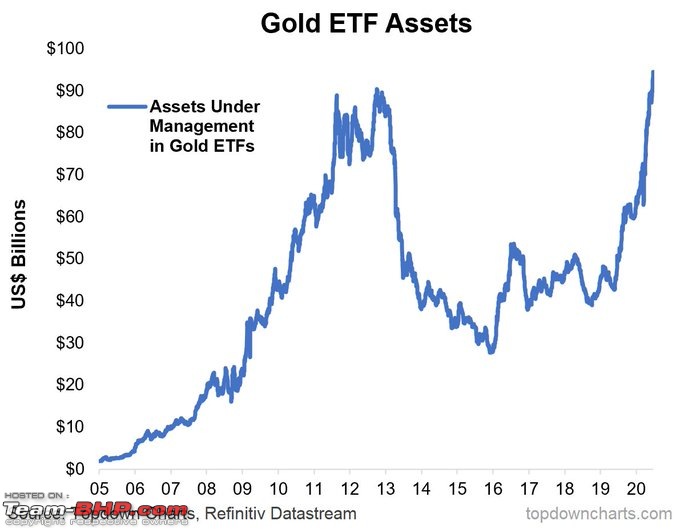

Eg: Gold ETF AUM

Quote:

Originally Posted by Pandher

(Post 5648257)

Remember crypto's mission is to put the monetary system out of government hands into yours.

|

Meanwhile, governments will sit back and let go all their of control of income tax and sales tax.

These ideas have been thoroughly debunked many times in this thread.

The one thing that always fascinates me is the optimism that many people show that people will self govern themselves better than a regulator, which is a utopia in my opinion. Yes people sometimes adhere to rules and even help others as long as it doesn't inconvenience them or doesn't put them at a disadvantage. Selfishness is inherent to every living thing, right from humans to dogs as it is how they survived through ages.

A simple example. Without traffic police our entire cities turn chaotic with everyone trying to get ahead without a thought for others. Even if majority had good sense, acts of few would throw the entire traffic to come to a stand still. Everyone here would have faced this situation. The presence of a traffic cop who regulates the traffic reduces the chances of such jams. If we as a society cannot take care of a simple thing like this I don't know what is the chance of running a complex thing such as monetary system. Whatever scams and frauds in financial space is not because of regulators, but in spite of regulators. Absence of such regulators will lead to anarchy. What many don't seem to think is that if we take away control of monetary system from government, that void will be filled by a few private individuals who lord over us. And no, there will never be a truly utopian system where everyone has equal voice and say.

Sam Bankman-Fried

convicted of financial fraud

Quote:

Sam Bankman-Fried, who once ran one of the world's biggest cryptocurrency exchanges, has been found guilty of fraud and money laundering at the end of a month-long trial in New York.

|

Incidentally, he was one of the biggest donors to the US Democratic party.

Bumping the thread, cryptocurrency newbie here.

Thinking of investing a small amount every month (maybe 4-5 k) accumulating a small amount of BTC to my portfolio. I’m looking to diversify, not make a quick buck. Plus over a 10-15 year horizon, the value is bound to increase given the limited supply.

What’s the general consensus? Also I see wazirx and coin switch as the two big platforms. Any recommendations or feedback?

Quote:

Originally Posted by three10

(Post 5667804)

I see wazirx and coin switch as the two big platforms. Any recommendations or feedback?

|

Don't leave your crypto on an exchange, unless it's a small amount that you're happy to lose. Once you have a larger amount, move it to a wallet that you control.

A surprisingly large amount of people who got burned in the bitcoin space lost money because of an exchange going bust.

This is a huge step towards the mainstreaming of Bitcoin.

US SEC approves bitcoin ETFs in watershed for crypto market Quote:

The U.S. securities regulator on Wednesday approved the first U.S.-listed exchange traded funds (ETFs) to track bitcoin, its Chair Gary Gensler said, in a watershed for the world's largest cryptocurrency and the broader crypto industry.

|

Quote:

The products - a decade in the making - are a game-changer for bitcoin, offering institutional and retail investors exposure to the world's largest cryptocurrency without directly holding it, and a major boost for a crypto industry beset by a string of scandals.

|

Source:

Moneycontrol

Quote:

Originally Posted by DigitalOne

(Post 5697250)

US SEC approves bitcoin ETFs in watershed for crypto market

Source: Moneycontrol

|

All the big bulls holding thousands of Bitcoin can finally offload them to Blackrock, who in turn can package them in an ETF and sell them to unsuspecting pension funds.

And when the asset comes crashing sometime in the future, all the small investors would suffer.

My friend wants to buy an Antminer X5. This X5 variant works only on RandomX algorithm, not very popular & hard to find. Any idea where we can get this in Mumbai? Please share offline dealer contacts as it is risky to buy it online. Also let us know if there is any authorized Bitmain dealer in or near Mumbai.

Looks like we missed this news:

WazirX halts withdrawals after losing $230 million, nearly half its reserves https://techcrunch.com/2024/07/18/in...ious-transfer/ Quote:

Lookchain, a third-party blockchain explorer, reported that more than 200 cryptocurrencies, including 5.43 billion SHIB tokens, over 15,200 Ethereum tokens, 20.5 million Matic tokens, 640 billion Pepe tokens, 5.79 million USDT and 135 million Gala tokens were “stolen” from the platform. Risk-management platform Elliptic reported that the hackers have affiliation with North Korea.

|

WazirX to ‘socialize’ $230 million security breach loss among customers https://techcrunch.com/2024/07/27/wa...ong-customers/ Quote:

WazirX will “rebalance” customer portfolios on its platform, returning only 55% of their holdings while locking the remaining 45% in USDT-equivalent tokens. This will also impact customers whose tokens were not directly affected by the breach, with the company stating that “users with 100% of their tokens in the ‘not stolen’ category will receive 55% of those tokens back.”

|

Wazirx has even launched a bounty program to recover the cryptos.

https://wazirx.com/blog/wazirx-bounty-program/

Any idea why some folks compare crypto world with the Wild West?

Quote:

Originally Posted by SmartCat

(Post 5811745)

WazirX to ‘socialize’ $230 million security breach loss among customers

|

Im one of those who lost considerable savings in crypto and will never touch it with a barge pole. Learnt the lesson "Do not invest in something that you don't understand".

Any seasoned investor in crypto will never leave their assets on an exchange. They will always transfer the coins to their personal wallet. Hacking crypto exchanges are very common and I wonder why the hackers took so long to bring down wazirx lol:

| All times are GMT +5.5. The time now is 05:54. | |