Team-BHP

(

https://www.team-bhp.com/forum/)

- -

Startup shenanigans

(

https://www.team-bhp.com/forum/shifting-gears/169994-startup-shenanigans-15.html)

Quote:

Originally Posted by shankar.balan

(Post 5412173)

Indians are generally prudent with their hard earned money. They cant be duped that easily because they will always view these high flying setups with some level of suspicion. So all these excel sheet based over valued companies and their ilk will come to a natural end, while leaving only good companies with a viable and sustainable value proposition to survive. It is simply the process of natural selection at work.

|

Are Indians prudent though? I'm not so sure.

In a pre-IPO situation, retail investors are not in the game. The valuation is being driven by Venture Capital (Professional and Family owned). Most common folks will never be exposed to valuation risk unless they buy pre-IPO stocks in some way and only a minuscule fraction do that. They come into play at the IPO.

It's well known that most IPOs (not just tech IPOs) don't make the retail investor money in the short term. There is usually a valuation pop, followed by a correction. The stock price then correlates with performance and market sentiment over the medium to long term. IPOs are for the founders, investors and underwriters to make money at the expense of retail investors. So an IPO carries the hoopla of a new car launch: many rush in fearing FOMO whereas it is prudent to wait for things to settle down.

In an IPO process, the company puts out Draft Red Herring Prospectus (DHRP). You can look at the balance sheet. The valuation is known. It's rare for critical information to be hidden. If you choose to buy, you are doing it with your eyes open. There might be an element of duplicity in the marketing (as with every product out there) but the process is quite regimented.

Contrast that with real estate buys where most Indians park their entire life savings. Look at their prospectus and rendered images. Opacity at many levels leading to a higher possibility of fraudulent activity that wipes entire families out.

Quote:

Originally Posted by ranjitnair77

(Post 5412370)

Are Indians prudent though? I'm not so sure.

Contrast that with real estate buys where most Indians park their entire life savings. Look at their prospectus and rendered images. Opacity at many levels leading to a higher possibility of fraudulent activity that wipes entire families out.

|

Perhaps I should have said ‘stock market shy’.

Yes I agree about the Monster of Real Estate.

But equally Indian families buy lots of gold and silver and similar. Its mostly the new age Indians that buy Mutual Funds.

But then, as per the common disclaimer - Mutual funds are subject to market risks, as indeed, all investments are!

And as far as real estate in Bangalore goes, well, we can also add, high risk of floods!:)

Quote:

Originally Posted by turbospooler

(Post 5412198)

As for the shenanigans experienced by me, I have realized the start-ups will go to any length to acquire and retain customer when they have secured funding.

|

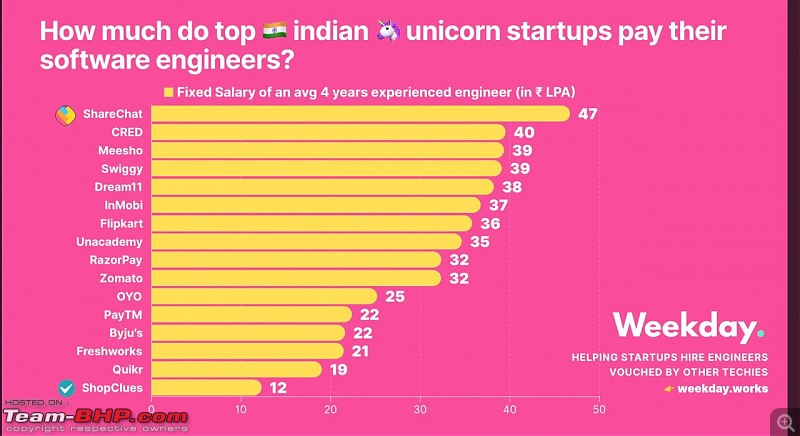

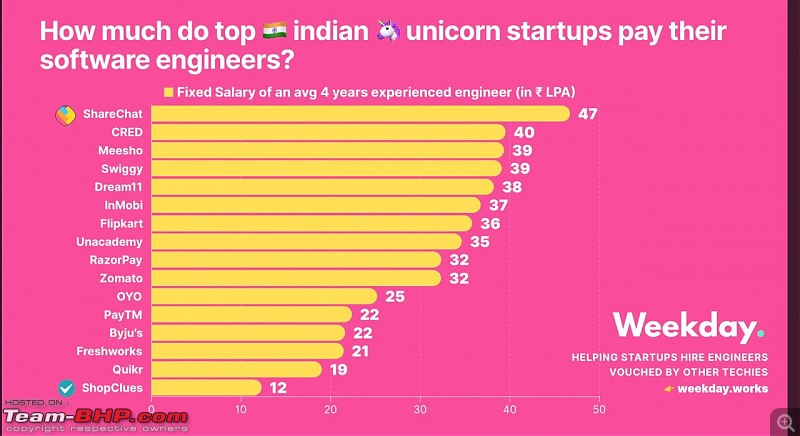

Not only that, they go to any lengths to hire engineers, there by completely messing up the finances of companies that actually operate on revenue and care about ROI.

Just yesterday I came across this WA forward.

The moment I saw that, I checked how many of them are profit making companies. Just one, RazorPay. Rest of them are simply burning VC money and totally spoiling up the employment market. Engineers keep hopping jobs every few months for a higher pay. Companies are having a very hard time to deliver anything since they can't establish a stable team. This will also impact the employees in the long term because they won't have useful skills, because they never stuck around long enough to learn anything.

Quote:

Originally Posted by Samurai

(Post 5412409)

Not only that, they go to any lengths to hire engineers, there by completely messing up the finances of companies that actually operate on revenue and care about ROI.

Just yesterday I came across this WA forward.

|

I used to work as an Engineering Manager in one of the FANGMA companies a few years back. 4 years experience would mean that the person is at a Software Development Engineer-II level. These salaries (40L or so) is comfortably within range for that level at FANGMA. Plus stock options. Enterprise Product Companies and Cloud companies like Adobe, Salesforce, SAP and others are at this level too. And each of these employ engineers in their thousands. They drive salary levels, far more than startups.

Salaries should find their own level due to market dynamics but clearly there is a supply-demand mismatch for skilled software engineers, due to which salaries are soaring.

The Ken had done a great article on this. It's paywalled though.

https://the-ken.com/the-nutgraf/the-...engineer-rule/

Quote:

Originally Posted by ranjitnair77

(Post 5412495)

I used to work as an Engineering Manager in one of the FANGMA companies a few years back. 4 years experience would mean that the person is at a Software Development Engineer-II level. These salaries (40L or so) is comfortably within range for that level at FANGMA. Plus stock options. Enterprise Product Companies and Cloud companies like Adobe, Salesforce, SAP and others are at this level too. And each of these employ engineers in their thousands. They drive salary levels, far more than startups.

|

I am sorry, this doesn't compute. FANGMA hires only the top 1% of the talent pool, and their salaries are never a threat to most recruiters.

But startups are so desperate, they hire whomever they can find meeting the minimum requirements. That means anyone above average (top 50%), for whom such salaries are not impossible to attain if they keep looking. They have funding, and very hard deadlines set by VCs looking for an exit.

Quote:

Originally Posted by Samurai

(Post 5412515)

I am sorry, this doesn't compute. FANGMA hires only the top 1% of the talent pool, and their salaries are never a threat to most recruiters.

But startups are so desperate, they hire whomever they can find meeting the minimum requirements. That means anyone above average (top 50%), for whom such salaries are not impossible to attain if they keep looking. They have funding, and very hard deadlines set by VCs looking for an exit.

|

The Ken has analyzed the data. For instance, the total engineering strength of Byju's, (the most notorious one :D) is estimated to be in the 700 range, and they have laid off folks since then. Amazon adds 2000 engineers (conservatively) on a yearly basis. That's just one example, there are more.

Most of India's most valuable startups don't hire that many engineers. They are burning most of their cash in customer acquisition. It's the tech giants that move the salary market.

Quote:

Originally Posted by shankar.balan

(Post 5412173)

Indians are generally prudent with their hard earned money.

|

Before the Crypto tax laws came in, that space was on fire. I think prudency has made way for following global trends.

Speaking of hiring, many businesses fell into the trap of setting shops in India without realising that we are known for "quantity" and not "quality" - thanks to all the heroic accomplishments of our NRIs that shaped the "brand India". All the companies who need to hire top talent are fighting over a very small talent pool. Some of the folks in this "small pool" will not join companies outside of FAANG brands rendering the pool even smaller.

Even though startup hiring numbers are small (because they are less into product/engineering and more into sales/marketing), they can pay disruptive levels of salaries to fill up the critical roles. Due to the small size of talent pool to start with, the impact is felt by all companies targeting such top talent.

Quote:

Originally Posted by androdev

(Post 5412584)

shops in India without realising that we are known for "quantity" and not "quality" - thanks to all the heroic accomplishments of our NRIs that shaped the "brand India". All the companies who need to hire top talent are fighting over a very small talent pool.

|

This statement you have made is very true. Our IT Industry is very much built on the tenets of ‘less-expensive-outsourcing-of-bodies’. Services companies are rife, they just throw more people at a problem. This applies even to the big and famous IT companies with ‘Holy and Saintly Founders and Senior Management’ - naming these companies is completely superfluous.

Many of the new age startups don't really have much of a business plan and all. Its just a lot of hype. And today, people have zero patience. They want to get to the top and exit with zillions without having really worked for the reward.

This is overall a very unhealthy state of affairs.

Quote:

Originally Posted by ranjitnair77

(Post 5412543)

The Ken has analyzed the data.

|

That sent alarm bells for me. I used to be a subscriber for an year and I used to be quite impressed by their hard-hitting long reporting. However, whenever they addressed an issue I was very familiar with, I found them quite inaccurate. Then I wondered if that was the case with other articles, where I am not familiar with the issues. Eventually I didn't renew the subscription, I preferred to be uninformed rather than misinformed.

But this time I couldn't possibly argue back without taking a look at the article you cited. So I became a subscriber once again, so that I can understand what you learned from that article.

Frankly, I was horrified. I don't really blame them; this is not a topic some journalist can casually report on. However, it is so misleading, and comes up with such wrong conclusions, I was just bummed. In fact, they have come up with stats that are just plain meaningless. What does

engineers per billion valuation ratio even mean? We already know their valuations are meaningless, and now that is used for measuring other things??? Reminds me of synthetic CDOs from sub-prime era. How about engineers per billions-lost ratio while they are at it?

How do I know better than them? I have played every role in IT in the last 32 years (products and services), have worked in large companies as well as multiple startups, including last two as co-founder. And I still design and write code actively. So, I deeply care about this topic. When I used to run a rural IT product company for 16 years, I used to hire from 4th/5th tier engineer colleges and mentor them for 2-4 years before they flew the coup. Most of them now work for various hi-tech companies including Google. In other words, I have turned plenty of good/excellent engineers out of folks coming out of below average colleges. Many of them have told me how much difference their initial mentoring helped them later in their career. The first few years of mentoring is very important to create good engineers, if they didn't receive good training/mentoring/exposure before that. That is how most of the good engineers are made, since only small percentage can make it to NIT/IIT.

As a technology stack provider to other technology companies, I extensively cater to startups these days, with lots of visibility. Due to NDAs, I can't mention any details. But I can speak in general. Practically every startup is in the race for either revenue or market share, with VCs wielding the whip. They simply have no time for mentoring/training new hires. So, they hire experienced engineers and expect them to be productive from day one. However, they can hardly poach top talent from FANGMA unless they are hiring for top tier. So they end up hiring from regular IT companies which spent years mentoring talent, but don't have the finance to compete with highly funded startups. If regular IT companies try to pay startup salaries or FANGMA salaries, they would all go bankrupt. We should not forget that at least 90% of engineers are working for IT services giants, and other companies (of any size) that are not startups or not even IT companies. Only about 10% might work for FANGMA and all the highly funded startups put together. Yet this 10% category behaves like they are the norm, while they are actually the outliers.

Next let's address the quantity vs quality issue. If you are a technology provider, then you will need much higher quality engineers compared technology enabled company. FANGMA are all primarily technology providing companies, while most startups are technology enabled companies. Most startups do B2C services and are not technology companies. And even within each company you don't need all engineers to be of high quality. There could be 10 times talent difference between the guy who designs an algorithm vs the guy who builds a web page. Therefore, no company really needs all their engineers to be great or good. Most of the work in IT is really very mundane, boring and clerical. Putting very good engineers on mundane work is a waste. However, cash rich companies often do this.

If you need engineers in large numbers, the

68–95–99.7 rule becomes applicable. If you need 1000 engineers, mere 3 need to be geniuses, 50 of them to be very good to good, 267 to be above average and the rest can be average to below average. These number may vary a bit across different companies, but the rule holds good in general.

Therefore, when someone just invents a 10000 engineer rule out of thin air, without any domain knowledge, we don't have to give any importance to it. That's not analysis, and it gives no insight.

Red flags in Byju's financials Quote:

In a letter to ICAI President Debashis Mitra, the Parliamentarian said there are various red flags in the company's financials for 2020-21 period, PTI reported.

On the expenses front, the letter said that 60% of the costs related to employees have been recognised as capital expenses rather than as operational costs.

"If these costs were counted as a direct expense, instead of a capital expense Byju's total loss for FY2021 would have gone over Rs 5,000 crore. Such irregular accounting practices fail to give a clear picture of Byju's income, expenses and losses," said the letter dated October 14.

|

Damn...

So, what did the Byju's investors do 3 days later?

Byju’s raises $250 million in funding from existing investors Quote:

“Byju’s is now at a sweet spot of its growth story where the unit economics and the economies of scale are in its favour,” said Byju Raveendran, founder, and chief executive officer of Byju’s. “This means the capital we now invest will result in profitable growth and create sustainable social impact.”

|

This is really voodoo economics. rl:

Quote:

Originally Posted by Samurai

(Post 5423098)

So, what did the Byju's investors do 3 days later?

|

Not surprised, it's damned if I do, damned if I don't scenario for the existing investors. Why do you think no new investors are putting in money in Byjus.

It's a white elephant, they need to take care of it till the time is ripe to kill it off.

Quote:

Originally Posted by Samurai

(Post 5412409)

Not only that, they go to any lengths to hire engineers, there by completely messing up the finances of companies that actually operate on revenue and care about ROI.

Just yesterday I came across this WA forward.

|

I did the same thing you did, and it's likely the same :Frustrati as I thought of my hiring plans vs my cashflow. Fun times indeed. Sharechat, at the top of the pile, made as much revenue last year as we make this year. Another :Frustrati for the road.

Byju's has roped in Lionel Messi as their "Global Ambassador for equitable education social initiative" while it lays off employees in a few regions.

Mind boggling this startup is :confused:

Link

| All times are GMT +5.5. The time now is 06:52. | |