Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by deehunk

(Post 4120405)

I got the money to my pocket account after 8 hours by doing a NEFT, so much of time for getting Rs.200. This may be the reason for so much of negative reviews about Pocket.

|

Pockets is useful if one has an ICICI account. I also got the physical pockets card. The main benefit I find is I can load the card with whatever minimum amount required and use it for daily spending. This one unfortunately doesn't have PIN, but this came handy while using for toll payment where there is good time savings as PIN entry is avoided.

Quote:

Originally Posted by GTO

(Post 4120469)

..... If there is a fraudulent transaction online, it's better that it affects my credit card (i.e. bank's money) than my debit card (i.e. my bank balance).

|

+1.

My debit card usage is so low, I end up getting calls from my bank to verify if I still have it. SBI actually disabled mine once due to non-usage for 2 years.

Credit cards are safe, same as postpaid is. I can dispute a fraudulent transaction before I pay up:D

Quote:

Originally Posted by tht'snotME

(Post 4119816)

@aargee ,

with the black money issue(read the new 2000 rupees found from few individuals by IT officials) we have i think we can endure some problems but if we are ready to go with it. i'm sure it will benefit our future generations.

only concern being the uneducated/daily wage earners, who find it difficult with all the banking/other transactions. soon enough there will be solutions for these as well.

|

You believe every news from the mainstream media, don't you lol:

Anyway, I don't dispute that cashless is the way forward & future, it's something to be watched for unless you've a lot of loan; since everything is centralized, its easy to destabilize the system as well. I'm not against this, just that, I'm very much worried about the safety aspect especially when I'm in IT industry for over 2 decade & been using the cashless systems since 1998.

Quote:

Originally Posted by Chetan_Rao

(Post 4120480)

Credit cards are safe, same as postpaid is. I can dispute a fraudulent transaction before I pay up:D

|

It appears to be safe; with so many layers to reach disputes now & will increase going forward, redress mechanisms are going to be even more difficult. Hopefully they won't say, pay up now & dispute later to avoid interest charges & sorry sir, our systems does this & we don't have control :Shockked:

IMHO, this is precisely why the cashless systems are more encouraged, and let's hail cashless systems!!

Quote:

Originally Posted by rajivr1612

(Post 4120067)

Tried to install BHIM. But getting the following error. Anyone else got this too? Attachment 1591185

|

Check the twitter handle NCPI_BHIM for updates. I do remember a tweet saying they are working on that issue.

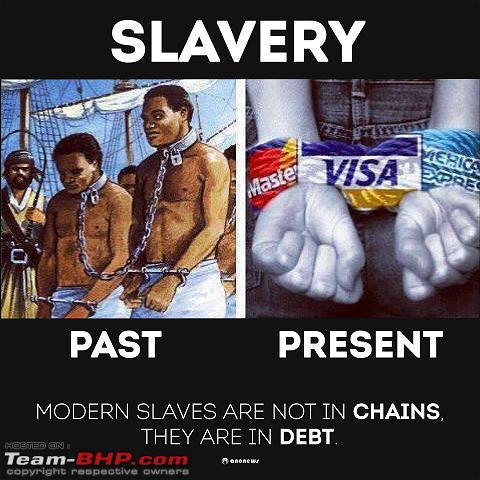

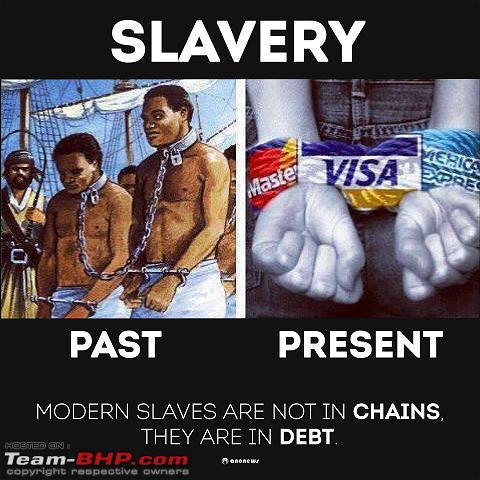

This is exactly the situation I'm say; Indian way of buying things was to work now, save & then buy later, but the West is teaching us to buy now, work, pay later. While these appear good outwardly, these systems are notorious in making people fall into trap of debt sooner or later without them realizing it at early stages. Not just in India, but have seen several cases in US as well. Worst being the "credit score" (CIBIL) & when one falls below the rated score.

Quote:

Originally Posted by ampere

(Post 4120065)

Same feeling here as well. Quite concerned on mobile security.

|

With the booming digital payment through mobile and most famous digital payment applications in India still not using hardware level security, there is a reason to be concerned but going forward companies like Qualcomm is also coming up with new feature in its mobile chipsets from 2017 that verify user with payment gateway using unique features like device id, phone manufacturer signature, Android version in the phone, root kit of operating system, location and time, which will be nearly impossible to duplicate. So i believe there will be hardware security in place starting this year to make us feel safer and move towards digital payment with out a worry .

Quote:

Originally Posted by GTO

(Post 4119815)

Perhaps the only thing I use cash for is paying tolls, parking charges and the like.

|

I drove from Bangalore to Hyderabad in December and paid for everything using my debit cards. Good thing too, I had no cash except for a 50 rupee note and 2 old thousands that I found in my jeans.

All the toll booths accepted my debit cards. A couple of toll booth operators were a teeny bit annoyed because there weren't enough machines to go around, but it got done.

The biggest problem I had was that my State Bank card stopped working for a bit during the trip and had to switch to my HDFC card. It worked at the beginning and at the end of my trip. Server error on State Bank's side perhaps?

Quote:

Originally Posted by GTO

(Post 4120469)

If there is a fraudulent transaction online, it's better that it affects my credit card (i.e. bank's money) than my debit card (i.e. my bank balance).

|

I've heard this many times, but don't understand it. Aren't you liable to pay the entire credit card bill even if there is a fraudulent transaction?

Has anyone experienced this situation?

Quote:

Originally Posted by k36

(Post 4120724)

I've heard this many times, but don't understand it. Aren't you liable to pay the entire credit card bill even if there is a fraudulent transaction?

Has anyone experienced this situation?

|

If you notice and report a fraudulent transaction on your credit card, most banks usually give you an interim charge-back for the amount in question while they investigate (takes upto 3 months with some banks). So yes, you

technically settle the whole bill for the payment cycle but the disputed amount comes from the bank, not your pocket.

If the investigation goes in your favor, the charge-back is permanent and you have nothing more to do. If not, it's reversed and the customer needs to pay up.

Reference point: Personal experience with ICICI bank credit card, family/friend references with Axis and Citi.

Quote:

Originally Posted by Rajeevraj

(Post 4120063)

...worrisome...

|

Quote:

Originally Posted by ampere

(Post 4120065)

... mobile security.

|

Quote:

Originally Posted by a4anurag

(Post 4119700)

|

Thanks a4anurag - I found the link very useful.

And I am still apprehensive about using these apps and share the same concerns as Rajeevraj and ampere. In the case of such apps,

the priority should be security and privacy. Ease of use is secondary to begin with, once the app is absolutely secure (?) we can move on to the nice stuff.

How do the experts rate these apps on

security and privacy?

Quote:

Originally Posted by Chetan_Rao

(Post 4120322)

Long story short, everyone will adapt (evolution is relentless and unstoppable), but let's not be quick to judge the reluctant and unwilling.

|

My example was exactly that. We were guiding them through (this was way back in 2009-12). Tried and gave up. For them, they wouldn't use it themselves, even if stood right in front of them as a preferable option. Instead we delegated the cashless transactions to ourselves. Left to them, they wouldn't go cashless.

Quote:

Originally Posted by GTO

(Post 4120469)

They say, even a millionaire in the USA doesn't carry more than $20 in his pocket.

|

It gets easier once the transaction value is higher and/or vendor is bigger. Card payments were accepted even for sub-10 $ transactions in Walmart or Kroger. Try that with a small time vendor, they are reluctant. This is true even today.

Quote:

Originally Posted by GTO

(Post 4120469)

I'm reasonably tech-friendly and still don't have an ATM card :). Neither do I have a debit card.

|

I have one, and keep it home most of the time. I agree on using credit card, since there is the option to dispute a transactions, if you haven't done it. I have done once and it works. Not the case with debit card/Netbanking where it is not reversible.

Quote:

Originally Posted by aargee

(Post 4120576)

Indian way of buying things was to work now, save & then buy later, but the West is teaching us to buy now, work, pay later.

|

Just because the medium of payment allows it, doesn't mean you have to live that way of life. No? The choice is still yours.

The Tamil term 'kandhu vaddi' (private loans charging exorbitant interest) exists since times immemorial, not without a reason.

Quote:

Originally Posted by Chetan_Rao

(Post 4120322)

I'm not sure you read my post right.

the hassle of following-up and resolving issues.

plenty of these options don't even have a proper support and escalation system today), imagine ...

tech-savvy folks l

|

Quote:

Originally Posted by pmbabu

(Post 4120239)

scary :Shockked:

|

This is exactly why I am wary of using all the 'new' methods.

I had a little 'Déjà vu' moment when Uber recently told me without any explanation - "account disabled" and "and there is nothing we can do to have this restriction lifted" - all this after obtaining my

credit card details, phone numbers and email ids - talk about a dictatorship!

Having experienced unfair charges and uncooperative banks with no option to get my complaints redressed, I'll wait until the dust settles and all systems are streamlined. I am happy to be a Luddite in a third world country - I'll go back to gold if I'm allowed, that way I'll not have to 'trust the king'.

Quote:

Originally Posted by narayans80

(Post 4120769)

.....My example was exactly that. We were guiding them through (this was way back in 2009-12). Tried and gave up. For them, they wouldn't use it themselves, even if stood right in front of them as a preferable option. Instead we delegated the cashless transactions to ourselves. Left to them, they wouldn't go cashless.........

|

Similar story everywhere, varying only by degrees.

Dad's been a globe-trotter professionally so fairly well-versed and comfortable with plastic money, but still likes to avoid internet banking if possible (just won't trust computers to completely take over his 'finances'). I recently managed to get him hooked to using Uber and other cabs with PayTM payments, and he finds it swell!

Mom is a late adopter to cards and still struggles sometimes, but nothing unmanageable. There's a strong 'Is my money safe with these things?' mindset at play and it won't go away easily, if ever, with a generation which considers technology an afterthought. Slow and steady, I keep reminding myself!

Quote:

Originally Posted by narayans80

(Post 4120769)

Just because the medium of payment allows it, doesn't mean you have to live that way of life. No? The choice is still yours

|

Just because TASMAC exists doesn't mean one has to go & consume a liquor there. No? The choice is still; you know the reality what goes on with TASMAC, who're the people behind it & the cause & effect of it.

Quote:

Originally Posted by narayans80

(Post 4120769)

The Tamil term 'kandhu vaddi' (private loans charging exorbitant interest) exists since times immemorial, not without a reason.

|

Good that your brought that point :thumbs up

With cash economy it's a benefit to small time players such as "kandhu vatti" to "meter vatti" to "rocket vatti" & what not. With this there're even bigger players going to practice the same. Basically the difference between blue & white collar robbery, that's all. Instead of katta panchayat, there will be court, instead of rowdies, there will be police that's all. Basically, everything going on large scale

Quote:

Originally Posted by mvadg

(Post 4120783)

Having experienced unfair charges...I'll not have to 'trust the king'.

|

Superb example!! These are precisely my points to make here; with numbers gone to systems, we have seldom control over it & the crowd that makes these systems works have better control. For any mistake of theirs we'll have to run from pillar to post (esp in India), while any mistake from our end, they simply put their hands into our pocket & take away with no explanations.

Only when people start experiencing the other side of cashless systems, they'll get to know the reality. Until then, I'll be waiting to see a thread being opened here for that :D

Quote:

Originally Posted by Chetan_Rao

(Post 4120322)

Long story short, everyone will adapt (evolution is relentless and unstoppable), but let's not be quick to judge the reluctant and unwilling. There's two sides to that story, and tech-savvy folks like us probably don't see what's the big deal instead of being empathetic and patient while the oldies catch on.

|

Very well said!! For a generation that has gone through a govt. career of close to 30 years without having to interact with a computer, it is indeed unfair to expect them not to feel a little hassled in the absence of support infrastructure.

| All times are GMT +5.5. The time now is 13:33. | |