Team-BHP

(

https://www.team-bhp.com/forum/)

Why can't these guys ever provide an invoice?

The reason I ask is almost never have I got the food bill with proper breakdown of the items, services, and the applicable GSTs.

The only few times I have got the invoice is when I mentioned it clearly on the instructions (but the success rate of even this mode is not 100%) - and that's when I received the restaurant's bill. Not the service provider's bill though.

When Zomato / Swiggy / Foodpanda can send an order summary every time we place an order - what prevents them from sending a complete invoice?

Are these companies pulling a fast one on the Indian tax authorities?

Or are they not liable to pay any kind of tax to India?

I decided to not let go these guys off so easily ... but all I got till now are evasive responses (on twitter, email etc).

What are your comments, observations?

In my opinion, in most cases, you are paying only for the food that you have ordered from the restaurant, and the restaurant provides you with a bill which will have the applicable GST component.

Food delivery outfits generally charge only a flat fee (if at all as the delivery in many cases is free) I am not sure if there is a GST breakup there.

File a grievance at pgportal.gov.in stating couple of examples and assign to correct dept. Then watch the fun.

I once complained against a famous local restaurant and action was taken in 2.5 months with they receiving notices from income tax as well as service tax guys. This was preGST.

Quote:

Originally Posted by hothatchaway

(Post 4436122)

In my opinion, in most cases, you are paying only for the food that you have ordered from the restaurant, and the restaurant provides you with a bill which will have the applicable GST component.

Food delivery outfits generally charge only a flat fee (if at all as the delivery in many cases is free) I am not sure if there is a GST breakup there.

|

Zomato and Swiggy do not hand over even the restaurant food bill unless one makes a prior explicit written demand.

Quote:

Originally Posted by alpha1

(Post 4436118)

When Zomato / Swiggy / Foodpanda can send an order summary every time we place an order - what prevents them from sending a complete invoice?

|

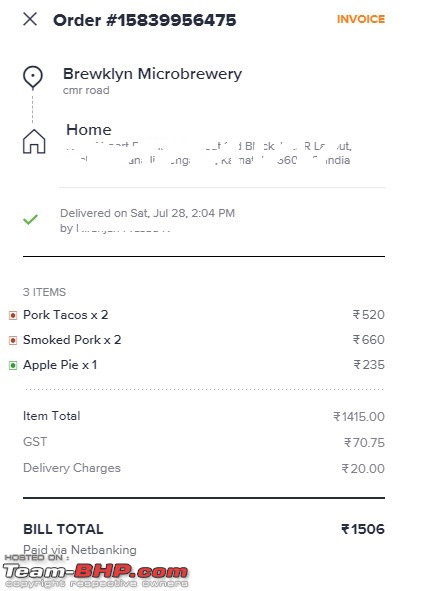

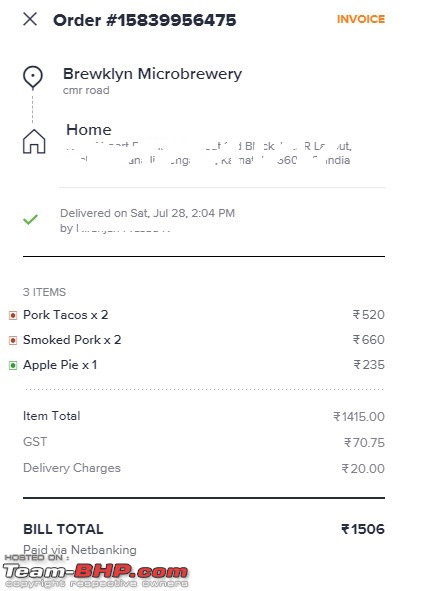

This is the Swiggy invoice I got when ordered this weekend. You can look it up in your swiggy account. Every order should have a GST invoice against it. Why do you need the restaurant invoice too?

Quote:

Originally Posted by Samurai

(Post 4436176)

This is the Swiggy invoice I got when ordered this weekend. Why do you need the restaurant invoice too?

|

But can we be sure that the GST amount added to bill is actually deposited by Swiggy? I don't think this counts as a tax receipt without invoice number, GSTIN etc.

I have never explicitly asked for invoices but I do receive them once in a while. When I do, invoice details match exactly with what is shown in Swiggy app, so I guess all is well there. There are cases when I don't get the invoice. May be restaurant didn't generate invoice thus evading tax or maybe the delivery boy misplaced it.

P.S: I suggest option of mostly-yes and mostly-no be added to the poll. I would answer mostly-yes.

Quote:

Originally Posted by ksameer1234

(Post 4436179)

But can we be sure that the GST amount added to bill is actually deposited by Swiggy?

|

A company of that size can hardly do hanky-panky on GST on such a grand scale. The auditors representing the investors will instantly raise the red flag on it.

Quote:

Originally Posted by alpha1

(Post 4436132)

Zomato and Swiggy do not hand over even the restaurant food bill unless one makes a prior explicit written demand.

|

I order my lunch almost everyday from Swiggy (occassionally from either Zomato or Freshmenu) and every time I get a proper invoice from the ordering restaurant.

In Bangalore, we have darshinis, which provide self-service facility. If you order from any such darshinis (provided they have tied up with Swiggy) then you do not get any invoice.

From my understanding of the operating model of Swiggy and such, is that all billing is done by the restaurant and Swiggy receives a commission from them. Swiggy does not need to give any GST invoice to the customer as they are just offering a platform but NOT charging anything to the customers.

Quote:

Originally Posted by ksameer1234

(Post 4436179)

But can we be sure that the GST amount added to bill is actually deposited by Swiggy? I don't think this counts as a tax receipt without invoice number, GSTIN etc.

|

Just last month, some of the food delivery chains like Swiggy, etc were under the scanner of the commercial taxes department.

Source:The New Indian Express

http://www.newindianexpress.com/stat...n-1830729.html

Note:the real targets were the 'unregistered' outlets who were evading GST. Swiggy / other delivery chains only provide the platform to order from such outlets. I think pulling up Swiggy in this case is to force those outlets to fall in line.

Fundamentally, they charge for deliveries and if you happen to see the invoice, they have

1. Delivery Fee

2. GST on Delivery Fee

If Restaurant/outlet generates bill for the order, I have received that too.

Quote:

Originally Posted by Samurai

(Post 4436176)

This is the Swiggy invoice I got when ordered this weekend. You can look it up in your swiggy account. Every order should have a GST invoice against it. Why do you need the restaurant invoice too?

|

I actually stopped using Swiggy last year because they never used to give restaurant bills, neither they sent they own invoice over email (what you have attached).

Zomato used to send the restaurant bills atleast, but off late they have stopped giving these. And to further add salt, they do not send any kind of invoice over email also!

Quote:

Originally Posted by BeantownThinker

(Post 4436188)

From my understanding of the operating model of Swiggy and such, is that all billing is done by the restaurant and Swiggy receives a commission from them. Swiggy does not need to give any GST invoice to the customer as they are just offering a platform but NOT charging anything to the customers.

|

Good, but I have never received any restaurant bill from Zomato unless I beg them upfront. Why should they not send it by default?

Also GST = goods and service tax.

Any kind of goods, any kind of service - so Swiggy / Zomato is liable to pay GST for whatever additional they provide.

Swiggy/Zomato do not levy any charges on the customer do they? The delivery charges you see on the invoice is charged by the restaurant I thought. Swiggy/zomato have arrangements with the restaurants and get a cut from the money they make, on which they maybe charging & depositing GST

Caveat: I have never used Zomato, Swiggy etc.

They are liable for GST on their service fee to you or their commission payback from the food maker. What, is a function of their business model. In today's world it would be well nigh impossible for even a small company to operate outside the GST net unless you wish to run a very very high risk operation that only deals with suppliers who themselves are trying to stay below the GST radar. You cant get your company's auditors to sign off if you are fudging GST. You cant get your income tax returns cleared if the assessing officer notices that your GST returns look too small relative to your physical operation. While there has been a lot of criticism of GST on the social media from a long term point of view it will ensure that in the next 6 to 7 years everyone in business will need to be in the GST framework. Zomato has an august Board. I don't see any of them staking their reputation & credibility over cheating on GST of all things.

Quote:

Originally Posted by BeantownThinker

(Post 4436188)

From my understanding of the operating model of Swiggy and such, is that all billing is done by the restaurant and Swiggy receives a commission from them. Swiggy does not need to give any GST invoice to the customer as they are just offering a platform but NOT charging anything to the customers.

|

That seems to be the case. l looked up the menu of the restaurant, and I have been charged the exact amount by Swiggy, plus a ₹20 delivery charge. No GST on the ₹20 though.

That means Swiggy is paid a commission by the restaurant. That means Swiggy collects GST from the restaurant and not from the consumer. Whatever paid by the consumer, is paid to the restaurant after deducting the commission and GST on the commission.

I think the problem you are facing is restaurant specific. In Mumbai, many small restaurants don't give me a proper bill unless I insist on the same.

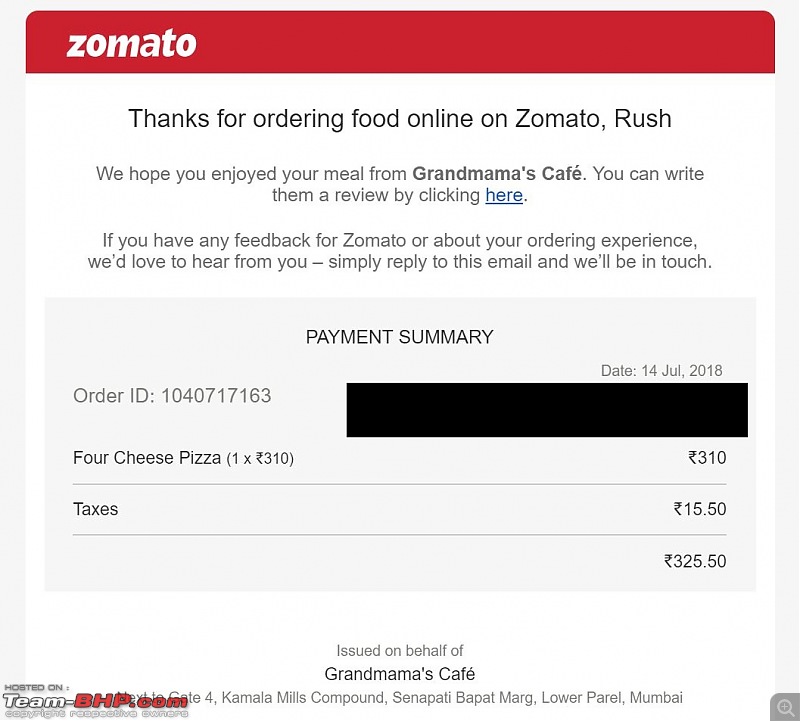

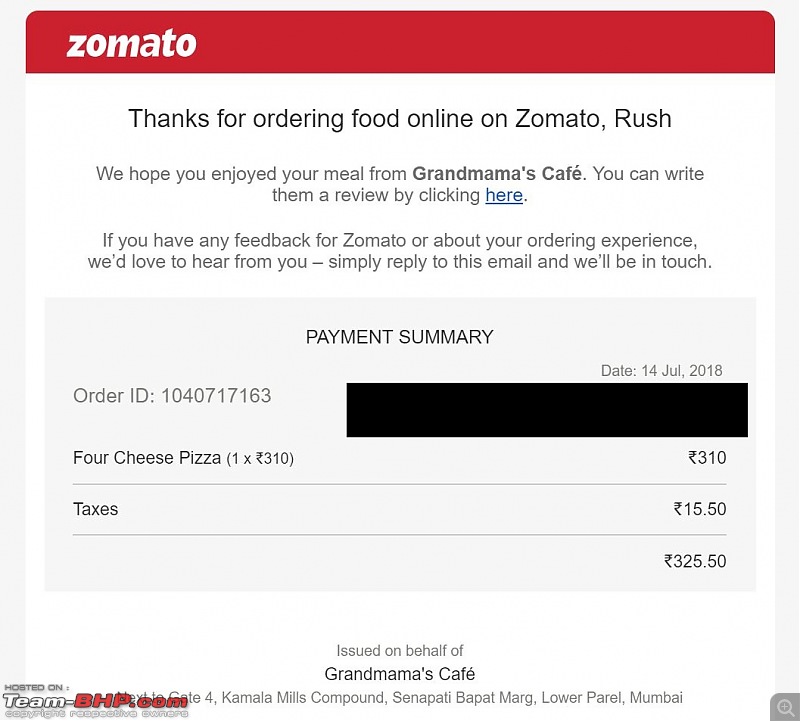

I don't think Zomato, Swiggy etc. are at fault (although they can certainly force the restaurants to provide a bill). Here's my Zomato invoice. See how it clearly mentions "issued on behalf of...." with the proper GST amount. Whenever I order food, I receive a proper paper bill in the bag every time:

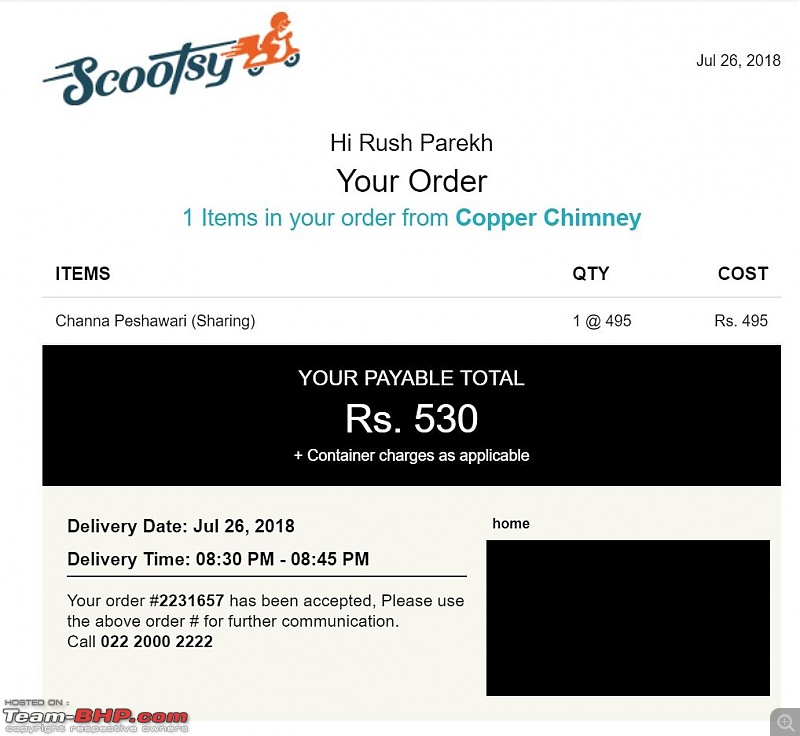

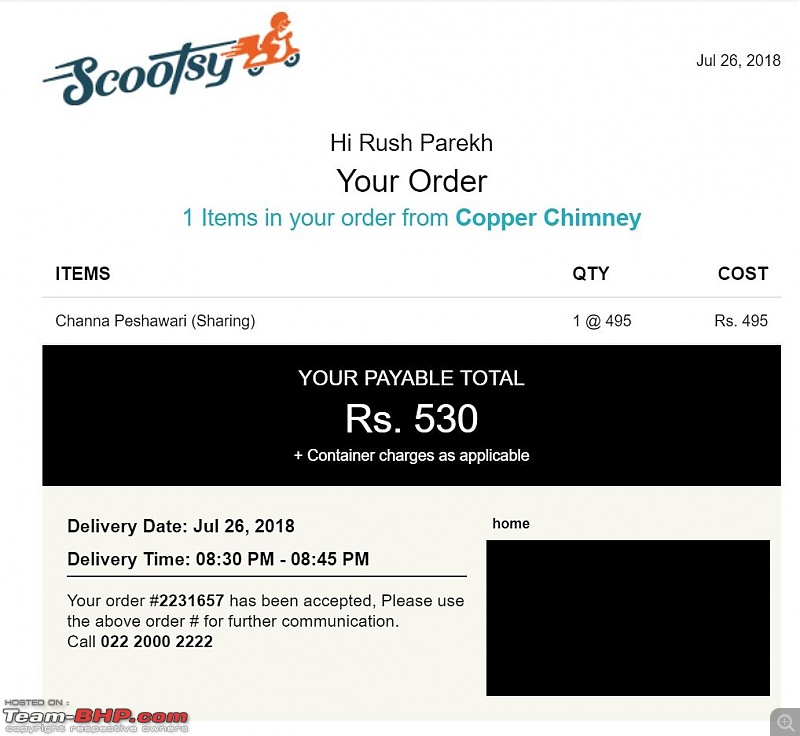

Scootsy hasn't specifically mentioned the taxes like Zomato, but it has included them in the final amount. And yes, I did receive a bill from Copper Chimney in the food bag:

| All times are GMT +5.5. The time now is 13:34. | |