Team-BHP

(

https://www.team-bhp.com/forum/)

I have been thinking of purchasing commercial real estate for many years but never could gather the courage to do so, especially looking at the cost of good properties in Pune and Mumbai. So while thinking about it, the following idea struck me.

Since shifting gears has been my regular haunt for so much of my browsing time, I am putting up this idea here for discussion.

Advantages of commercial real estate:

High rental yield on total investment

Rents increase annually leading to appreciation of investment

Easy to sell

Easy to rent out

Disadvantages:

High ticket size. Decent properties in good locations are more than 1 crore.

If the entire location / building flops, impossible to find good tenants

Why crowd funding?

Diversify your money.

Rather than buying one property in one location

Purchase a 10% share in 10 different properties in 10 different locations at 10 different times.

No chance of all 10 tenants vacating at the same time. So continuous rental income (full or partial)

Low ticket size, easy to start with one share in one property

Easy to do SIP, buy one share in one LLP every year

How can this be achieved?

Create an LLP of 10 owners

Each owner gets 10% ownership share and 10% of the rental income monthly

Appoint a property manager to rent out the property, collect and distribute the rent

When you want to sell, you sell your 10% share in LLP rather than selling the property

The buyer can see the actual revenue stream of the property since it is well documented and do his own yield calculations based on actual rent received.

Does the above make sense? The indian commercial real estate market is notorious for black money, benami transactions, and being only available for deep pocketed investors. Can this idea help upper middle class professionals like us?

Quote:

Originally Posted by abeerbagul

(Post 4436389)

Each owner gets 10% ownership share and 10% of the rental income monthly. Appoint a property manager to rent out the property, collect and distribute the rent. When you want to sell, you sell your 10% share in LLP rather than selling the property. The buyer can see the actual revenue stream of the property since it is well documented and do his own yield calculations based on actual rent received.

|

Your model will work but only among a close circle of friends or relatives. Then there is an issue with valuations at which one investor sells his share to others. There is also the liquidity issue (what if nobody wants to buy somebody else's share?). The website

www.propertyshare.in works on the same model but on a larger scale.

But enter REIT or Real Estate Investment Trust.

It is a $1 trillion industry. REITs are listed on stock exchanges just like stocks. First there is an IPO through which the property management firm collects funds from investors. Those investors can either hold on to REIT units (and collect rental income via dividends) or sell them to other investors on the stock exchange.

In India, Blackstone and Embassy plan to launch India's first REIT IPO and raise up to $1 billion

http://timesofindia.indiatimes.com/a...w/64593988.cms

I have been tracking REITs for quite a while as they operate in US.

This model may not work in India, because there is a major lack of transparency and there is no market discovery for valuations.

In an Indian REIT, I will have to purchase units just like a mutual fund, but I have no idea how the manager is purchasing property and at what valuation.

There is no developed secondary market for property like there is for shares, so there is a huge scope for corruption.

What if the fund manager purchases a property worth only 2 crore for 2.5 crore? In the stock market, an equity fund manager cannot purchase an Infosys share worth 2000 for 2500 because the prices are transparent.

Quote:

Originally Posted by smartcat

(Post 4436417)

|

I did not know about this website. Thanks for the link!

Quote:

Originally Posted by abeerbagul

(Post 4436419)

In an Indian REIT, I will have to purchase units just like a mutual fund, but I have no idea how the manager is purchasing property and at what valuation. There is no developed secondary market for property like there is for shares, so there is a huge scope for corruption. What if the fund manager purchases a property worth only 2 crore for 2.5 crore?

|

Well, its not your job to know the valuation of each commercial property in a REIT. That's why you have "hired" professionals (Blackstone, in this case) to manage your investment.

What you can do is look at rental yield of a REIT. If the yield is above average (8% for example), you invest. If the rental yield is just 4%, then you know that it is overpriced. When REIT IPOs are launched, it will have a mix of already functioning commercial property (major portion) + upcoming launches (minor portion). REITs pay out 90% of the rental income (after accounting for expenses in managing the properties).

Ok, makes sense to look at yield.

I will create a google alert for REIT in India.

This seems to be a good vehicle for passive income. Returns in Liquid mutual funds are dropping every year, and soon it will be only a place to park your funds, not to earn interest for retirement.

The stock market in India is too volatile to practice the 4% withdrawal rule.

If REITs become successful, that can give a good income. US REITs usually give good yield.

Quote:

Originally Posted by abeerbagul

(Post 4436570)

This seems to be a good vehicle for passive income. Returns in Liquid mutual funds are dropping every year, and soon it will be only a place to park your funds, not to earn interest for retirement.

The stock market in India is too volatile to practice the 4% withdrawal rule.

|

If you are looking for yield, there is one more option -> INVIT or Infrastructure Investment Trust. You basically invest in existing infrastructure projects (like toll road) and get a small share of its revenues. Just like REIT, you invest via stock market and receive 12 to 16% per annum tax free dividends.

However, remember that infrastructure projects are like BUILDINGS - they are depreciating assets. All InVITs net asset value will trend slowly towards zero over a period of, say, 20 years. However, since you will be getting 12 to 16% of your money back as tax free dividends, it is expected that you will not only recover the principal and also earn IRR of 12 to 16% pa tax free on your investment.

There are currently 2 listed INVITS:

1) IRBINVIT

2) INDIGRID

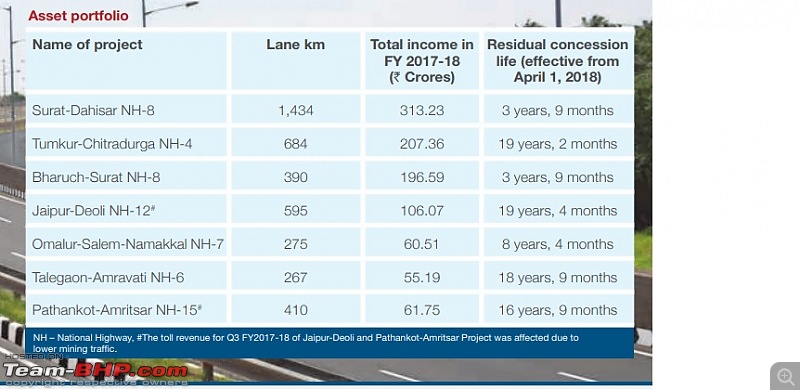

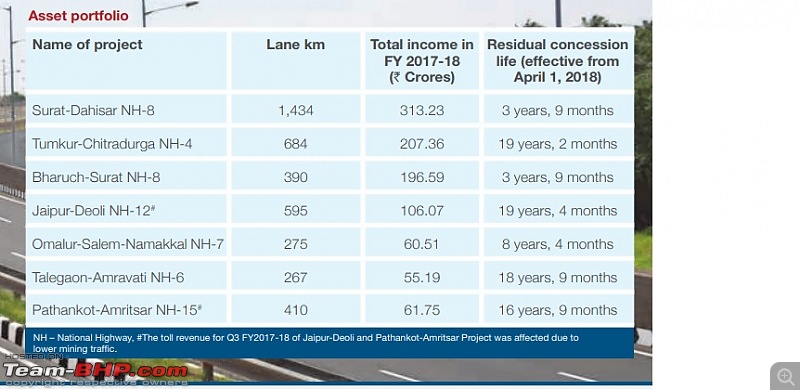

IRBINVIT:

When you invest in IRBINVIT, you get a tiny percentage of revenue generated by the following toll roads:

Minimum investment is 5000 shares of IRBINVIT or approximately Rs. 4 Lakhs. For more details, check

www.irbinvit.co.in INDIGRID

When you invest in INDIGRID, you get a tiny percentage of revenues generated by these power transmission lines

Minimum investment is again 5000 shares or approximately Rs. 5 Lakhs. For details, check

www.indigrid.co.in Risk Factors:

1) Remember that the price will tend to trend lower over a period of time, because these are depreciating assets. You earn money via dividends.

2) IRB Invit (toll roads) is a bit risky because of political and court interference

3) IRR of 12 to 16% is not guaranteed. It is based on certain assumptions like increase in revenues at 5% pa (because of price revisions) and interest paid to bank is 10% pa (if interest rates go up, returns will be lower)

I researched a bit about Infrastructure Investment Trusts.

INDIGRID

Current price is 96 per unit, and income distribution is on an average Rs 2.50 per quarter, i.e. Rs 10 annualized.

This looks like a good 10% return.

IRBINVIT

Current price is 79 per unit, while annualized return is approx Rs 8.8

So this too has a good return.

One question regarding liquidity.

In an equity mutual fund, the underlying assets are stocks which are highly liquid.

Here the underlying assets are not liquid. Right now there is a lot of trading happening in both.

What do you think of liquidity concerns in case I want to exit after some time?

Quote:

Originally Posted by smartcat

(Post 4436487)

If the yield is above average (8% for example), you invest. If the rental yield is just 4%, then you know that it is overpriced.

|

At many places in Indian cities property valuations are too high compared to the rental income that is practical. Do you think REITs will be attractive in this scenario?

Quote:

Originally Posted by abeerbagul

(Post 4436710)

One question regarding liquidity.

In an equity mutual fund, the underlying assets are stocks which are highly liquid. Here the underlying assets are not liquid. Right now there is a lot of trading happening in both.

|

Both INVITs and REITs are like ETFs or stocks, not like mutual funds. Liquidity depends on how popular these vehicles are with investors. Right now, there is ample liquidity (1 million shares traded per day).

Quote:

What do you think of liquidity concerns in case I want to exit after some time?

|

Best to treat both REIT and INVIT as long term investments.

Quote:

Originally Posted by sreeramkvs

(Post 4436767)

At many places in Indian cities property valuations are too high compared to the rental income that is practical. Do you think REITs will be attractive in this scenario?

|

Unlikely we will see residential REITs in India because of low rental yield (3 percent?). Initially, there will only be commercial REITs (since commercial real estate offers rental yields in excess of 8%).

Quote:

Originally Posted by smartcat

(Post 4436775)

Unlikely we will see residential REITs in India because of low rental yield (3 percent?). Initially, there will only be commercial REITs (since commercial real estate offers rental yields in excess of 8%).

|

Thanks for the clarification. But with commercial properties giving 8% rental return, capital appreciation will be slow I guess.

Predicting capital appreciation will be tricky.

Since the yield is based on annual rent, and rent will continue to rise year on year, fundamentally the ETF should appreciate.

But since it is publicly traded, the speculation element comes into play. Its the old tussle between value investing and growth investing.

So the NAV might rise fueled by speculation even though the yield has not changed, and the NAV might fall during crashes, even if the yield is growing.

It is rightly said 'Learning is a never ending process'. I did'nt know that such investment options existed in Commercial Real Estate. I always thought of investing in Commercial property in Mumbai / Navi Mumbai but failed to do so as the rates are quite high. Has anyone invested in such collective investment options ? If yes then they can provide a better picture and offer some clarity on this topic.

Our family is planning to invest in a warehouse in Kolkata's upcoming industrial park, which would be given on rent/lease to parties. Warehouse area shall be over 40K sqft.

Any special/upcoming features we should try and incorporate in the design/warehouse so that it is future-proof and more attractive to high-value vendors amongst the competition?

Quote:

Originally Posted by abeerbagul

(Post 4436911)

Predicting capital appreciation will be tricky.

Since the yield is based on annual rent, and rent will continue to rise year on year, fundamentally the ETF should appreciate.

But since it is publicly traded, the speculation element comes into play. Its the old tussle between value investing and growth investing.

So the NAV might rise fueled by speculation even though the yield has not changed, and the NAV might fall during crashes, even if the yield is growing.

|

I also have similar plans like you in terms of diversifying into commercial real-estate. What has been your experience so far, if any?

Thanks in advance

| All times are GMT +5.5. The time now is 06:25. | |