Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by DigitalOne

(Post 5861341)

Long post :).

One of the most important, if not the most important, tools of retirement/legacy planning are Annuity solutions.

|

In my view, Annuity is in-fact sub-optimal way of deploying your retirement corpus. It gives abysmally low rate of returns on your retirement corpus. Yes it's confirmed and reliable but very inefficient. Combination of Debt + Equity MFs and using methods such as 3-bucket is a far better way of managing post-retirement expenses. Again, my view :)

Quote:

Originally Posted by AMG Power

(Post 5862098)

Well said.

Brilliance they do not teach you in b schools

Folks who budget keenly for say - a car - very seldom budget for a kid

Avoid keeping up with the Joneses. Spend because you want to, not because you want to show your neighbor you can buy a Porsche better than the one he bought today.

|

Common sense is the most

uncommon virtue that one comes across in one’s daily life.

Quote:

Originally Posted by Mystic

(Post 5862095)

2. Are your children as adults look forward to spend time with you whenever possible and participate in resolving your old age issues both emotional and financial?

3. In the event of one of the life partners is gone, how is your planning on surviving alone?

4. Are your finances taken care of with your own retirement savings?

I .

|

In my view, the most important take is that One Simply Has to make one’s self Self-Reliant.

One simply cannot rely on offspring (if any) and so on.

In our futures, the world is going to become far more selfish than it already is. Hence self reliance is the ONLY way forward. This means, financially, emotionally and everything in between.

It therefore makes maximum sense for all folks to actively cultivate hobbies, sports, extraneous interests and activities.

In the words of John Donne; “No man is an island, entire of itself; every man is a piece of the continent, a part of the main.”

Hence it is best to ensure we have some very good friends of the same/ similar age group, around. People of common interests tend to stimulate very healthy conversations and help to hone/ preserve one’s mental sharpness as well as physical fitness, as do pets.

IMHO, considering a kid as an expense would be like considering your parents as an expense. I don’t deny raising a child is mentally, physically and financially challenging but life bears a cost and we end up paying for it in some way or other. Lesser child growth rates is inevitably going to hurt your retirement planning when there aren’t enough working people at the time of our retirement. The taxes will increase and lesser social security if govt isn’t left with income sources.

Again to each his own, I only meant to put my perspective out here, not to hurt anyone. I have 1 child and took a decision not to have more and finances was 1 factor in this decision making although not the top one.

Quote:

Originally Posted by ulhas.ahirrao

(Post 5862135)

In my view, Annuity is in-fact sub-optimal way of deploying your retirement corpus. It gives abysmally low rate of returns on your retirement corpus. Yes it's confirmed and reliable but very inefficient. Combination of Debt + Equity MFs and using methods such as 3-bucket is a far better way of managing post-retirement expenses. Again, my view :)

|

Agree completely.

I decided to take a take break / retire early, a few months ago.

My savings are mostly in balanced MFs. Plan to setup SWPs soon.

Quote:

Originally Posted by shankar.balan

(Post 5862189)

One simply cannot rely on offspring (if any) and so on.

In our futures, the world is going to become far more selfish than it already is. .

|

Agree with you wrt to not relying on offspring. I also have observed in our extended families of incidents of abandoning old parents by their kids. My thinking so far is that it is an exception and not normal as many of our families are still living jointly taking care of elderly.

Filial support laws are there in most of the countries including USA, UK, India.

It is difficult to use law to enforce relationships. Pre independence, back in India when our economy was not so great, we had a lot of joint families and now due to growth in economy, we have all nuclear families. I don't know whether economical growth is a boon or bane. I am still trying to understand the research done for which Nobel prize is given this year for economics based on colonialism and its impact on countries economy etc.

Quote:

Originally Posted by DevendraG

(Post 5862235)

Lesser child growth rates is inevitably going to hurt your retirement planning when there aren’t enough working people at the time of our retirement. The taxes will increase and lesser social security if govt isn’t left with income sources.

.

|

This is a valid point ref ageing population and taxation. Japan for example is struggling in this way, as are Norway and Sweden etc.

However, in India we have a very large youthful population who are in or entering the workforce and will need to pay their share of taxes as they go along. And when you consider the overall population which is after all, the highest in the world (and a large portion of which, is not really productive), I think at this moment it is better for us to behave ‘responsibly’, by not wantonly adding more numbers to it. I think most of India have merrily ‘gone forth and multiplied’ to the point where the country and the planet are groaning under the inordinate pressure.

There will always be contrarian views to this point on ‘procreation’. But when one considers the economics in a calm and slightly arm’s length manner, I think the answers become self-evident.

Tragedy is in India, only the salaried classes pay massive amounts of taxes, perhaps about 65% of which 35% direct tax is straightaway deducted at source and the remaining indirect taxes are paid up instantly every-time one consumes anything at all.

And we get almost nothing back. So all salaried folks have to manage all of their expenses and children's needs and elder’s needs and insurance and medical help and everything else with the remainder left in the hand post all taxes.

However, to merely survive and navigate the world post retirement, they have to save enough too. And the triple whammy is that any capital gains achieved through our own intelligence and work, is also taxed.

It is rather like plodding up a steep mountain whose summit one may never reach, because for every two steps taken in the forward direction, one gets pulled back one step because of the load one is carrying.

Hence, it makes sense to pay heed to controlling all expenditure items both cap-ex and op-ex and being prudent.

Quote:

Originally Posted by DevendraG

(Post 5862235)

IMHO, considering a kid as an expense would be like considering your parents as an expense. I don’t deny raising a child is mentally, physically and financially challenging but life bears a cost and we end up paying for it in some way or other. Lesser child growth rates is inevitably going to hurt your retirement planning when there aren’t enough working people at the time of our retirement. The taxes will increase and lesser social security if govt isn’t left with income sources.

|

+100. When you start considering humans as expenses both born and un-born you are on a slippery slope. Old retired people are actually biggest expense on the society in general.

Quote:

Originally Posted by argho

(Post 5862256)

I decided to take a take break / retire early, a few months ago.

|

Since you have actually done what most of us are aiming for, early retirement, any general tips, what strategy you followed, how you decided the time was right, how you realized you had enough to retire? Any information would be much appreciated. Thanks!

Quote:

Originally Posted by JediKnight

(Post 5862933)

+100. When you start considering humans as expenses both born and un-born you are on a slippery slope.

|

This was what I was afraid of the thread veering off into, when I posted about that. Just to clarify, all I meant to say was that it was one viable option that society generally doesn't approve of, for mainly historical reasons. Maybe that topic deserves a thread of its own. But either way, it would be good to keep this thread to the topic of retirement.

Quote:

Originally Posted by am1m

(Post 5862964)

Since you have actually done what most of us are aiming for, early retirement, any general tips, what strategy you followed, how you decided the time was right, how you realized you had enough to retire? Any information would be much appreciated. Thanks!

|

I would not recommend that others do what I did :-)

I had always planned to retire early. However, the goal posts always kept shifting. Retirement was always a couple of years away / a few more crores in savings away.

I retired when I realised that I was very unhappy and stressed out, and just wanted to take a break. I discussed with my wife before taking the plunge. My unhappiness had been very visible to her the last few years. She was supportive. We agreed that it is more important to be happy and healthy, even if it means we have to economise a bit.

So here I am.

Its been only 4 months now, so very early days. But after 30 years of a very stressful corporate career, I am really enjoying doing nothing. I love the fact that I can sleep peacefully at night, and can wake up in the morning not having to worry about back to back meetings all through the day.

And I am content with the trade-offs I have had to make. For example, I change my vehicles every 5 years, but have opted not do so this time.

My advice :

- Think carefully about your lifestyle and expenses after retirement

- Keep some funds aside for medical emergencies, and for your kids

- If you feel you have enough, go fo it.

Note from Support:

Folks, to have children or not, and related socio-cultural aspects are a deeply personal and often divisive topic. Still, feel free to start a separate thread if anyone's inclined to start that discussion.

Please keep any discussion on this thread limited to factors impacting one's financial and self planning + prep for retirement.

We appreciate your understanding and support.

Thanks!

Major components of a retirement corpus:

1- Medical Cost - get a big fat health insurance cover. The only variable there is the increasing premium amount, but it is still quite insignificant to make a real differenec

2- Inflation - Again, barring the economy going kaput, it is a predictable figure. There are multiple calculators available to get you an idea of the figure required.

But the biggest unknown (at least for me) is my childs education expense:

- Graduation can be almost free (Delhi University) to Rs 1.5 cr (MBBS Pvt College in India) to Rs 2 cr (studying abroad).

- Post Grad has similar variations.

Assuming one does not want the child to take a hefty student loan - what is the number one should aim for? This is the biggest unknown and will make a huge difference on how to plan for retirement.

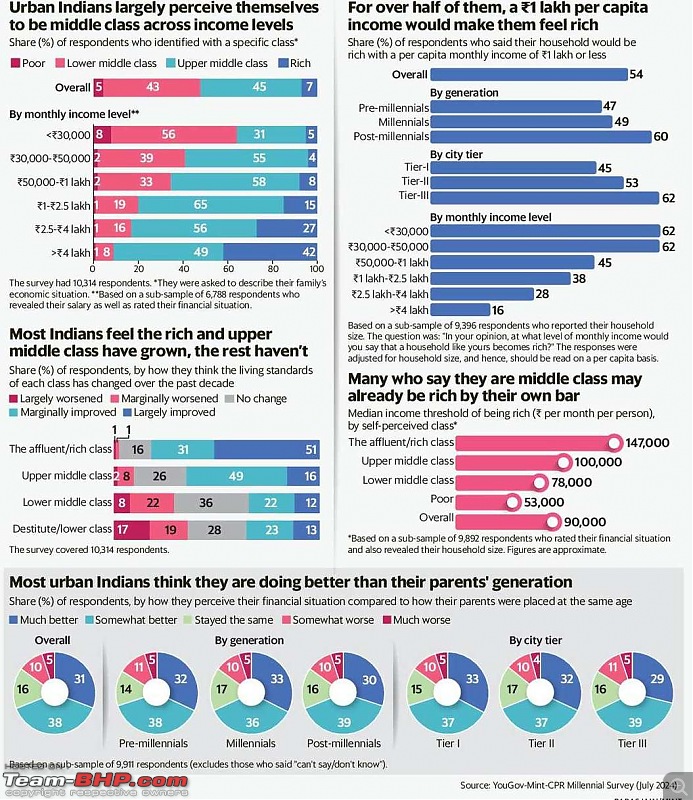

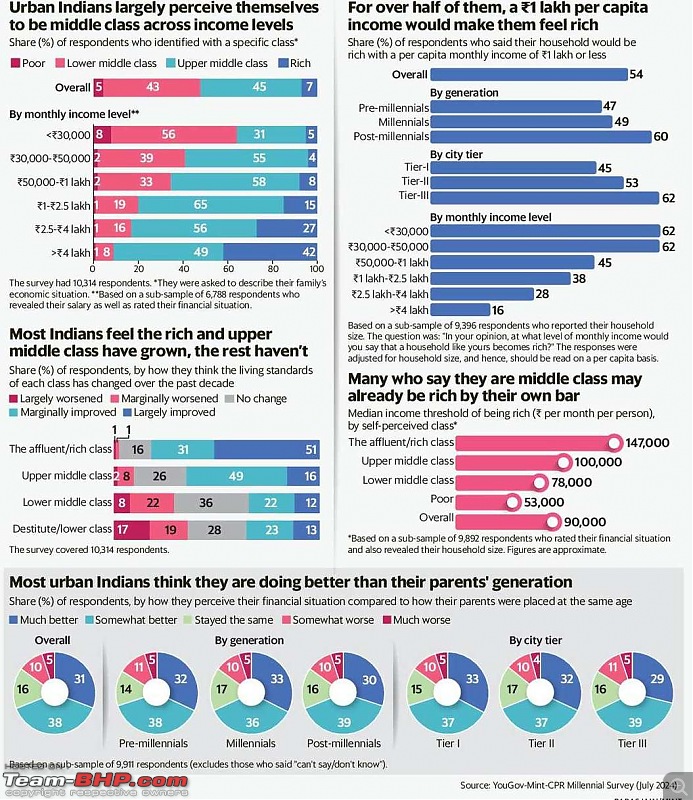

Today’s Mint has a discussion on income vs economic classification based on a periodic survey they undertake. For anyone so inclined to give it a read.

Throws up interesting and varied insights into people’s perception of being poor, middle class and rich. Data itself being from a somewhat narrow group set in a certain sense of course. I’ve just attached half the image - best to pick up the paper to read the analysis below it for fuller context.

Quote:

Originally Posted by Eddy

(Post 5863403)

...

Assuming one does not want the child to take a hefty student loan - what is the number one should aim for?

|

It's tricky because there's usually only a handful of years between a child beginning to think seriously of what they might want to pursue academically (usually around when they enter teenage, where we are now with my niece), and actually needing to pay for it.

An approach some people in my circle have taken, is to find out the average cost of the most popular academic choices, adjust for inflation, pick the highest number of the lot and start investing with that number as the end-goal. Even if the target isn't met or the corpus doesn't cover everything, it'll provide a solid financial foundation compared to the child having to bear the whole burden via loans.

There are variables: costs may change unpredictably, the kid may change their mind on area(s) to pursue, ability to save might be impacted for reasons beyond one's control etc.

But in general, aiming for the most expensive target one can realistically afford to save for, is what people around me are doing.

Quote:

Originally Posted by Eddy

(Post 5863403)

Assuming one does not want the child to take a hefty student loan - what is the number one should aim for? This is the biggest unknown and will make a huge difference on how to plan for retirement.

|

Fully agree with you Eddy - it is indeed the biggest unknown. Chetan has summed it up well and this is indeed the basis on which many folks that I know are saving on. Ultimately funds too are fungible and you might take educational funding decisions based on whatever overall corpus you have reached or back yourself to reach until retirement, at the time these decisions come upon you. But for many or most, they'll just assume the highest of the 'best guess range' they've estimated and work accordingly towards saving based on their ability towards that.

The other decision some take is where to spend the big money, if thinking of an education outside India. Some are clear they'll find a way to fund undergrad here and fund an overseas postgrad. Some others are ok with funding undergrad overseas if affordable on the basis that the child should then find a way to fund her own post grad wherever they can.

If you were to pin me to a number, I would say keeping about 1 - 1.5 cr is a respectable number that can make a fairly wide range of options available to you (it can be higher of course if you want to fund a 4 year program in a top US university). If you end up spending a lot less (absolutely possible), it simply goes into your personal retirement kitty - doesn't hurt.

My friend’s son for instance, did a BA from a Tier 2 city in MH and is now pursuing his MBA at IMI, Saket Delhi - a great institute in itself. Higher education costs overall would have been a fraction of that number and if you ask me, he’s well set with this base to make a good career for himself subject to all the variables life can throw hereon of course.

Quote:

Originally Posted by Chetan_Rao

(Post 5863415)

But in general, aiming for the most expensive target one can realistically afford to save for, is what people around me are doing.

|

Quote:

Originally Posted by Eddy

(Post 5863403)

But the biggest unknown (at least for me) is my childs education expense:

- Graduation can be almost free (Delhi University) to Rs 1.5 cr (MBBS Pvt College in India) to Rs 2 cr (studying abroad).

- Post Grad has similar variations.

|

As we age, we also have a finite amount of time to build up that corpus assuming we’re all salaried class folks (ideally you could have started the savings/investment when your child was born or still very young). Look at it realistically and don’t over complicate it or aim for something that’s too expensive or beyond your means, it only increases ambiguity as well as your stress!

For example you could plan for graduation in India and as you mentioned look at 1.5 to 2 cr as your target (I think that’s a very decent amount even for medicine if the child gets a payment seat through NEET).

If you can also plan for post grad, add another 1.5-2 Cr, but here’s where I think we generally overthink and stress ourselves out. Let the child at least start the under grad degree and then plan for post grad. Things could have changed by then (child may decide to do some other course and hence you don’t utilise the corpus much, etc). There could be other options as well like your son/daughter starts working in India, saves some money and takes an educational loan for post grad, etc.

I believe that doing an under grad course abroad is only for the really rich folks who already have the funds in place, not for someone who wants to take a loan (also possible for those who started early towards building a corpus for just that).

| All times are GMT +5.5. The time now is 11:17. | |