Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by V.Narayan

(Post 4859564)

Serious question for those who know>

Where can one sell gold bars. By gold bars I mean those 999 purity 10 or 25 or 100 gms bars that come in a Swiss sealed packet which the banks used to sell in earlier years. Should one go to a traditional jeweller? Will he pay by cheque? .

|

You may reach out to your jeweller to sell your Gold. They pay by cheque, and some of them also do RTGS. However, some jewellers have reservations and they only buy Gold which has been purchased from them.

Since you stay in Delhi NCR, you may even consider 24karat to sell your Gold. They have many branches and their price is competitive.

https://www.24karat.co.in/cash-against-gold.php#

If I may take the liberty of sharing my thoughts on Gold, the bull run has just commenced and by the end of 2020, you may expect it to cross 75k.

https://m.economictimes.com/markets/...w/75338955.cms

Quote:

Originally Posted by DCEite

(Post 4858247)

And for the first time ever i would advise against investing in SGB.

|

Agreed. I sold off all the SGBs I ever owned today at 5290 and bought niftybees and lots of yes bank.:D

Quote:

Originally Posted by DigitalOne

(Post 4859701)

Though this is generally accepted belief that Gold will serve as an insurance against currency collapse, I have never read that it did serve as an insurance. In all the countries, you have mentioned, did grocers start accepting gold instead of cash?

The biggest disadvantage of physical gold is its non-divisibility beyond certain limit. Imagine buying a packet of noodles with gold.

|

Even If Grocers did not directly accept Gold or Silver, they still ended up increasing the prices. What would a common man do who earns 40K a month and one fine day he learns that one loaf of bread costs 5k. I cannot evisage Gold for buying Noodles, but I surely can imagine Silver to buy the same. Human civilization has been doing this for last 5000 years.

Here is a video of Venezuelan people selling their jewllery to buy groceries. Because Jewellery is a store of wealth.

https://youtu.be/gEEgJK0kk7Q

Here's a historical chart of gold prices (downloaded from one of the Indian bank website). Notable thing is that it has steadily grown higher than official inflation figures. Also compare your asset prices or your salaries with the price of gold and you will see that salaries and property prices rose only briefly between 1990s and early 2000s and have plummeted after the oncoming of the latest government. Gold represents actual prosperity of a society, away from the political and economic jargon floating around in ever increasing quantity.

Guys, if you do buy physical gold, any Tanishq (Tata Group) outlet will check its karat rating for free. Their karatmeters are free for the public to use, no matter where you bought the gold from. It was actually a brilliant marketing strategy to get customers into showrooms when the brand was new.

https://www.youtube.com/watch?v=u_9QYQGuY08

Is the party over?

Quote:

Gold prices today collapse, down ₹4,500 in 2 days; silver rates crash

|

Link

here

Today is the third consecutive day when Gold and Silver prices have maintained a downward trend.

Quote:

Originally Posted by GTO

(Post 4861571)

Guys, if you do buy physical gold, any Tanishq (Tata Group) outlet will check its karat rating for free. Their karatmeters are free for the public to use, no matter where you bought the gold from. It was actually a brilliant marketing strategy to get customers into showrooms when the brand was new.

|

Bang on!

Yeah this was mentioned in the HBR case study as well on Tanishq which I had read as part of my curriculum in the marketing course last year.

Quote:

Originally Posted by ValarMorghulis

(Post 4862605)

Is the party over?

Link here

Today is the third consecutive day when Gold and Silver prices have maintained a downward trend.

|

Just came here to ask this question and saw this :Frustrati.

Quote:

Originally Posted by SmartCat

(Post 4858333)

|

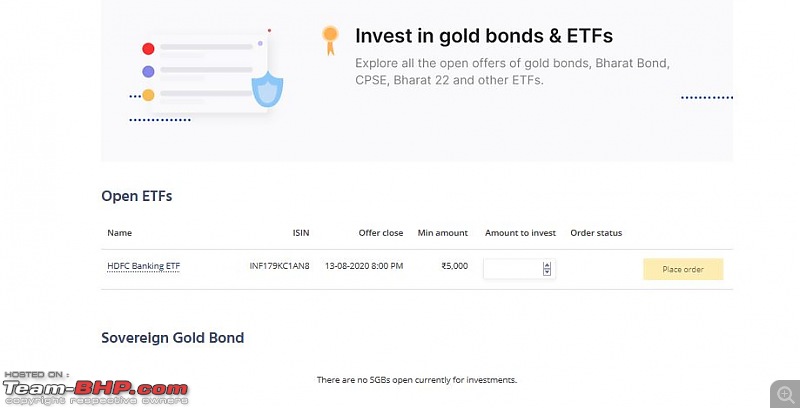

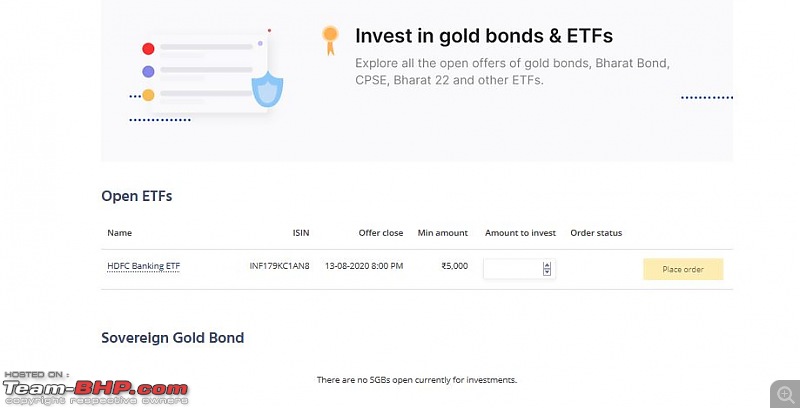

I was planning on exiting an equity MF that hasn't been doing very well (1.09% profit) and reinvesting it in either gold SGBs or ETFs. There aren't any SGBs available on Zerodha but there are quite a few ETFs. The Quantum Gold Savings Fund Direct plan has the lowest expense ratio at 0.06% and no exit load. ICICI Pru Regular Gold Savings has an expense of 0.09% and 1% exit load and seems to be the next best. So my questions are:

- Do I wait for prices to correct a little? If so how do I determine what target price to wait for?

- Am I correct in how I am analysing the two ETFs and then zeroing in on the Quantum Gold Savings Fund.

Could you guys please help?

Quote:

Originally Posted by GTO

(Post 4861571)

Guys, if you do buy physical gold, any Tanishq (Tata Group) outlet will check its karat rating for free. Their karatmeters are free for the public to use, no matter where you bought the gold from. It was actually a brilliant marketing strategy to get customers into showrooms when the brand was new.

|

In Bangalore, all major branded Gold jewelers offers this facility because customers walk-in regularly to "exchange" their Gold jewelry for new designs. The store will check the Gold content and then offer an exchange price.

Incidentally, inherited Gold jewelry (50+ years old) almost always has less Gold content than 91% (22 karat). That's because old jewelry was probably made by a local village Goldsmith and it is likely that they were not totally honest. :)

Quote:

Originally Posted by Iyencar

(Post 4862713)

Do I wait for prices to correct a little? If so how do I determine what target price to wait for?

|

Instead of looking at the price, keep a target of holding 10% of your networth in Gold. That is, [approximate value of Gold Jewelry at home] + [financial Gold value] should be 10% of your total networth (FDs + equity MFs + approx real estate value + Gold). If you are not there yet at 10% levels, invest in Gold across a long period of time in the form of SIPs.

In the short term, Gold price is likely to trend upwards till US interest rates are kept at zero levels. But Gold prices might crash if US FED (an organization like India's RBI) raises interest rates. Whatever you do, NEVER sell your Gold investment at a loss. Because if you hold for a long enough time, eventually it will go back up over your purchase price.

Quote:

Am I correct in how I am analysing the two ETFs and then zeroing in on the Quantum Gold Savings Fund.[/list]Could you guys please help?

|

Good enough. When buying ETFs, use limit orders only. Else, just pick a mutual fund instead.

Quote:

Originally Posted by Iyencar

(Post 4862713)

There aren't any SGBs available on Zerodha but there are quite a few ETFs...

The Quantum Gold Savings Fund Direct plan has the lowest expense ratio at 0.06% and no exit load... [*]Am I correct in how I am analysing the two ETFs and then zeroing in on the Quantum Gold Savings Fund.[/list]Could you guys please help?

|

SGB's are available on Zerodha. Type SGB in the watch list and the various schemes would display. Eg. SGBDEC2512-GB.

IIRC Quantum Gold Savings Fund apparently invests in the underlying Gold ETF of the same MF. So the expense ratio stated would be over and above the ETF charges already levied in the underlying scheme. Similar logic would apply to the other scheme mentioned by you, thus only appearing to be low when viewed in isolation.

Quote:

Originally Posted by SmartCat

(Post 4862741)

If you are not there yet at 10% levels, invest in Gold across a long period of time in the form of SIPs.

|

Thank you SmartCat. It is very helpful to have a clear goal like this to work towards.

Quote:

Originally Posted by SmartCat

(Post 4862741)

Because if you hold for a long enough time, eventually it will go back up over your purchase price.

|

Will keep this in mind.

Quote:

Originally Posted by SmartCat

(Post 4862741)

Good enough. When buying ETFs, use limit orders only. Else, just pick a mutual fund instead.

|

Why is it good practice to set a limit order in case of ETFs and not in case of MFs? Is there a logical approach to setting a limit order, especially in this case where there seems to be some wild fluctuations?

Quote:

Originally Posted by Fx14

(Post 4862760)

SGB's are available on Zerodha. Type SGB in the watch list and the various schemes would display. Eg. SGBDEC2512-GB.

|

Thank you! I was looking in Coin instead of Kite.

Quote:

Originally Posted by Fx14

(Post 4862760)

IIRC Quantum Gold Savings Fund apparently invests in the underlying Gold ETF of the same MF. So the expense ratio stated would be over and above the ETF charges already levied in the underlying scheme. Similar logic would apply to the other scheme mentioned by you, thus only appearing to be low when viewed in isolation.

|

Good catch. You're right, but every fund listed in the valueresearch link is a Fund of Funds type. So better to go for a gold MF instead of an ETF?

Quote:

Originally Posted by Iyencar

(Post 4862838)

Why is it good practice to set a limit order in case of ETFs and not in case of MFs? Is there a logical approach to setting a limit order, especially in this case where there seems to be some wild fluctuations?

|

Limit order price should be placed half-way between "bid price" and "ask price". This is to be done not because of wild fluctuations, but because there is usually not much "depth" (liquidity) in these ETFs. Ideally, place the trade after lunch time so that there is enough volumes to take your order. Do not invest in ETFs at market open.

For more info, check this article:

Why bid-ask spread costs are so important to ETF investors https://finance.yahoo.com/news/why-b...130014865.html

With mutual funds, this issue does not arise because the fund house executes your order at a particular time (Eg: 11:30 AM) without any "slippage" between bid prices and ask prices. So that way, mutual funds are much simpler instruments when compared to ETFs.

Quote:

Originally Posted by Iyencar

(Post 4862838)

Good catch. You're right, but every fund listed in the valueresearch link is a Fund of Funds type. So better to go for a gold MF instead of an ETF?

|

Depends on what you are comfortable with. Note that :

1. ETF would require a Demat account whereas Gold MF does not necessarily require one.

2. ETF units offer intra - day variations in price whereas MF units would be only @ NAV for the day.

3. Expense ratios of the MF schemes listed in your earlier post would be higher than the underlying ETF. For ETF, there would be Demat and brokerage costs additionally.

Quote:

Originally Posted by sunnsood

(Post 4859377)

I follow a very simple process. Buy say X amount of sovereign gold bonds (SGB's) every year. Hold them for 8 years. Pocket 2.5% half yearly. Reinvest X amount in the same SGB's at the end of 8 year (at maturity).

I use gold for hedging as it's price always move with inflation (sooner or later). Gold for investment is useless product as it rarely beats inflation.

|

This is what I have started to do as well. Invest a portion in SGB and keep rolling it. One more thing is I will increase/decrease the allocation based on the requirement and gold price at that time of redemption.

RBI website has the historical SGB price from 2015 and when I checked it apart from some slight decrease in 2017-18 compared to previous year, there has been no major drop Year-on-Year and it has only been consistently increasing. It was at 2600 in 2016 compared to 5200 now in 2020 :eek:

Quote:

Originally Posted by Iyencar

(Post 4862713)

There aren't any SGBs available on Zerodha but there are quite a few ETFs.

|

To Answer this specifically, the SGBs are open only on specific dates as announced by RBI. The place you checked it is the correct one in coin and for 2020 the last tranche is in the last week of August-first week of September and it will be then open in Zerodha. I am buying SGB for sometime now in Zerodha and once you get the allotment, in a week or so it shows up tradeable in your holdings.

Quote:

Originally Posted by praveen_v

(Post 4863019)

To Answer this specifically, the SGBs are open only on specific dates as announced by RBI. The place you checked it is the correct one in coin and for 2020 the last tranche is in the last week of August-first week of September and it will be then open in Zerodha. I am buying SGB for sometime now in Zerodha and once you get the allotment, in a week or so it shows up tradeable in your holdings.

|

Yes but you can buy from the secondary market just like you buy shares. Just search for SGBs like you search for shares. Today was a good day to buy SGBs since the price dropped to almost June levels ~ INR 47xx per gm. Anyway, I am holding on for as long as I can.

| All times are GMT +5.5. The time now is 11:18. | |