| |||||||

| Search Forums |

| Advanced Search |

| Go to Page... |

|

| Search this Thread |  13,212 views |

| | #16 | |

| Senior - BHPian | Re: The past, present and future of Oil & Oil Companies Quote:

NRL is also laying the 130 km transnational India-Bangladesh Friendship Pipeline (IBFPL) from its marketing terminal in Siliguri to Parbatipur in Bangladesh. Covid 19 would have slowed down the phase but companies like BPCL are heavily investing in upgrading, expansion and de-bottlenecking their current refineries. Simultaneously they are also diversifying into niche petrochemicals. | |

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank SnS_12 for this useful post: | digitalnirvana, FINTAIL, Lobogris, srini1785 |

| |

| | #17 |

| BHPian Join Date: Aug 2011 Location: Pune

Posts: 984

Thanked: 3,872 Times

| Re: The past, present and future of Oil & Oil Companies Here is a quick take on our addiction to Fossil Fuels and how the addiction may be easier to break than we imagine. https://www.bloomberg.com/news/video...ddiction-video Last edited by antz.bin : 10th February 2021 at 16:08. |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks antz.bin for this useful post: | Lobogris |

| | #18 |

| BHPian Join Date: Aug 2019 Location: Bahrain

Posts: 935

Thanked: 4,974 Times

| Re: The past, present and future of Oil & Oil Companies Given that I have lived the better part of my life in the various Persian Gulf countries, I have seen first hand how oil can make and break an economy. Let us Kuwait (where I lived for 7 years) as a case study since it's the most extreme example of Oil dependence in the Gulf (even more so than Saudi Arabia). Oil constitutes about 43% of the country's GDP and a much higher proportion to the state budget. Now to get to the juicy part, the Kuwaiti economy peaked in 2012 with a GDP per capita of $45K per year and has come down to a 16 year low of $22.25 USD in 2020. The drop in GDP during 2020 was so harsh that the economy isn't expected to recover to 2019 levels even by 2025. Effectively, what was amongst the top 5 richest countries in the world is expected to be poorer than Portugal - the poorest economy of Western Europe. This came about because the Kuwaitis flat out refused to shift their economy away from oil unlike their neighbours who are trying. The fact that Kuwaitis are the most racist people in the Gulf (which is saying something) doesn't help either. The only significant consoling factor is their hefty sovereign wealth fund, so they aren't exactly a Venezuela. Now my point, the shift away from oil won't just be because of the existential threat we face called climate change. It's because going forward, it would actually be economical to shift away from oil. We've already seen how solar and wind energy is actually turning out cheaper to produce than coal or natural gas-fired powerplants. Infact, I remember from a CNN article that due to the drop in demand during the lockdown in India, the fossil-fuel-powered plants were the ones shut down to adjust to the low demand, not the renewable-powered ones since the latter was actually much cheaper and more flexible to operate. Offcourse, we can't wait for renewable energy to get economical, so governments need to put their foot down. I used to read columns of Jeremy Clarkson on the Top Gear website (before he was fired offcourse), he used to write about why should we care about climate change when its only some polar bears that would be affected. But, that's not the case anymore. If anything, the glacier incident in Uttarakhand and the Forest fires in California and Australia are just the beginning of a wider trend. We are way past the time for bickering and debating. |

| |  (10)

Thanks (10)

Thanks

|

| The following 10 BHPians Thank dragracer567 for this useful post: | Carpainter, digitalnirvana, DigitalOne, FINTAIL, gauravanekar, maddy42, neerajdan, SnS_12, V.Narayan, Zignor |

| | #19 |

| Senior - BHPian | Re: The past, present and future of Oil & Oil Companies Very interesting articles and comments here by all bhpians. Oil will be a part of our life for some time to come. Atleast the next 20 years is what i predict before we can see a shift drastically to EVs but another reason it will take longer is a lot of countries either depend on oil sales or taxes on oil revenue to run their country. In other words oil is actually the lubricant keeping the countries economy grinding by either taxes or by peoples movement. Countries which depend on oil sale revenue better start a wealth fund and also look at other means of revenue and also to keep their population employed as a country with no jobs will see internal strife and before you know it, instability. Countries like russia, middle eastern countries and venezuela come to my mind here. Countries which depend on oil imports, would have to strongly diversify their dependence to other sources of energy. You got renewables, but india should even look strongly at nuclear as its a more cheaper means in the long run. India seems to be headed to a gas based economy, but i really hope electric vehicles become the mainstay from where we are today as hydrogen is still at its infancy. Looking at the capex spend of all oil firms in india, it seems like they know something which we do not. The more people move up the ladder, the more they get dependent on oil. Lastly question to all: Is there a reason we are not finding much oil and gas in india or are we not looking properly  Maddy |

| |  ()

Thanks ()

Thanks

|

| | #20 | |

| BHPian Join Date: Dec 2005 Location: bang

Posts: 878

Thanked: 3,117 Times

| Re: The past, present and future of Oil & Oil Companies Contrary to what our petroleum ministry says, our refining capacity has remained stagnant at around 250mmtpa for the last few years.  Source : https://www.statista.com/statistics/...city-addition/ Quote:

| |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks srini1785 for this useful post: | digitalnirvana |

| | #21 |

| BHPian Join Date: Aug 2017 Location: Leeds

Posts: 936

Thanked: 2,259 Times

| Re: The past, present and future of Oil & Oil Companies Right so first off I should probably put a disclaimer out there that I'm a geoscientist with a background in petroleum geology and have spent the last 6 years in a research group with strong ties to the hydrocarbon industry. With that being said, what I can confirm is that predictably change is occurring in hydrocarbon companies. Some doing so belatedly whilst others more wholeheartedly. Though the extent to which a lot of the moves are more in principle than practice has become a topic of great debate (think of it as greenwashing - something done to satisfy investors, many of whom are increasingly climate conscious too on top of simply chasing returns). There's also the small fact that most young geoscientists such as myself are fully aware of the threat of climate change. Now at this point I often get asked why then I remained in this particular stream and to that I have to point out what some have, the sad reality is that for the medium term for sure we can't move beyond hydrocarbons. Even with exponential growth of renewables, the issue that remains in the power grid is the inability of these sources to meet demand fluctuations for example or sometimes you might have inconsistent generation from these sources. Unfortunately with a thermal powerplant you mitigate the odds of being caught with your pants down as a power provider. The key point I personally advocate all the time is that out of the three fossil fuels, the one that needed dumping out of the power mix Yesterday, is coal. The bewildering rate at which China builds coal power plants and to some extent India is catastrophic for emissions but at the same time, it's cheap (though a lot of renewables are either catching up or have already on a per unit power cost). Out of the three the ideal (a relative term I admit) fuel would be natural gas. Again, relatively speaking, it's the cleanest of the fossil fuels so for the medium term we'd definitely need natural gas power plants in our energy mix. Furthermore a point that gets less credence is the emissions tail of having to transport our fuels. For India a large portion of our natural gas comes from the Middle East with supplies from Qatar and prior to a sanctions halt, Iran as well. In an ideal scenario though, you would want to use natural gas available as close as possible, thereby obviating the need for transport costs (fiscal and emission wise) and the risk of environmental remediation for any accidents mid route. Something I worked on as part of my PhD are gas hydrates. Put simply they're cages of water ice with trapped methane (mostly) found under the seafloor on continental margins offshore. Now estimates vary wildly for the exact amount of trapped methane offshore in this manner but let's just say there's enough to generate enough interest from energy hungry nations like Japan, China and India to explore the possibility of trying to commercially exploit these reserves as an endemic fuel source. It's still in the research stage with India for example having done two extensive surveys of our maritime EEZ alongside the US Geological Survey to get some constraint on the hydrates (see National Gas Hydrate Program). I bring this up to show you how far nations are willing to go to explore endemic energy sources both from an economic and strategic point of view. Big picture then, fossil fuels still have a role to play in the energy mix for electricity grids and for industrial use. Be it the shipping sector or aviation, we're a long way off from solutions where large container ships or passenger aviation could use alternate energy sources unfortunately. So in that sense, definitely in the medium term there is a demand for hydrocarbons here. What has been correctly identified is that for the mobility sector, which is probably the most tangible link we have to oil and gas, there will be considerable decline in the short, medium and long term. Post Diesel-gate, the transition of the auto sector has been put on fast forward and increasingly it's looking like a two pronged solution (BEVs or H2 fuel cells). I should add that the proliferation of BEVs will only increase the complications for our electrical grid planners to adjust to the changing demand cycle, which in turn will impact our generation source. Hence the arguments some make that moving to electric vehicles simply passes the buck down the line, as in you're moving your carbon emissions footprint to source now in the form of how your electricity is generated. Personally though from a carbon credit accounting standpoint, to my mind it's simpler if you have the footprint accountable at one point source rather than the whole chain. You can clearly tell I'm a wishful scientist then because all of us know natural systems rarely work so simply but I digress. Finally returning to hydrocarbon companies, the private players will change. The last ones to change will be the NOCs, the national oil companies (these are rarely the ones that first crop up in our minds yet they are responsible for the bulk of emissions globally) will likely be the last to change. This is likely due to the prevailing inertia of govt institutions as a general fact. As people have correctly noticed, the rest of the oil majors have mostly pivoted in their branding to straight up label themselves as 'energy' majors - an important distinction. Each of them have some internal involvement in alternate energy projects or programmes such as CCS (carbon capture and sequestration/storage) linked to the energy transition. However these efforts might not be happening fast enough for environmental advocates. In closing I'd like to give some anecdotal evidence. When I did my masters, class sizes for petroleum geoscience masters at both my alma mater and present institution were at record levels, as were oil prices. However mid way through that the price crash of 2015 happened and the sector took a hit. Predictably in the years since we've seen headcount for any petroleum related geoscience or engineering courses shrinking over the years to the extent that Imperial this year shuttered their masters programme. By the time I was doing my PhD, most of us in our research group were already pivoting. Sedimentologists who had decades working in industry and supervising projects that greatly enabled hydrocarbon exploration now look at microplastics. My supervisor and I realised at the tail end of my project that beyond the immediate applicability for the seismic and hydrocarbon industries, it could just as easily be repurposed towards CCS. Essentially the principles for hydrocarbon extraction or the geoscience towards it can just as easily be repurposed towards the energy transition. All that was needed was the impetus, and in my case at least it was simply seeing where the funding was. (I've rambled but this is something I'm very passionate about and outreach, as you can tell, is something I did lots of at uni so please feel free to ask more questions and I'll do my best to answer) |

| |  (18)

Thanks (18)

Thanks

|

| The following 18 BHPians Thank ads11 for this useful post: | alpha1, am1m, arzanali, digitalnirvana, dragracer567, DrANTO, InControl, JayKis, Jeroen, Lobogris, neerajdan, RadixLecti, rajvardhanraje, Seenz, SnS_12, vredesbyrd, yogesh.8984, Zignor |

| | #22 | |

| BHPian Join Date: Aug 2019 Location: Bahrain

Posts: 935

Thanked: 4,974 Times

| Re: The past, present and future of Oil & Oil Companies Quote:

My father had worked as a consultant for some CSR projects for the Saudi ARAMCO where they used microalgae called Dunaliella to absorb flue gases from industry and eventually process the microalgae to produce betacarotene and even biofuels. Offcourse, utilizing a biological system is nowhere near as efficient as CCS though microalgae are more efficient in the sequestration of carbon as compared to vascular plants. | |

| |  ()

Thanks ()

Thanks

|

| | #23 | ||

| BHPian Join Date: Aug 2017 Location: Leeds

Posts: 936

Thanked: 2,259 Times

| Re: The past, present and future of Oil & Oil Companies Quote:

Essentially for a working petroleum system, you need to think of it in terms of its component elements. For that you need a source (an organic matter rich rock such as shale that's been subjected to sufficient temperature and pressure over the requisite amount of time to thermally crack the organic matter into long chain hydrocarbons); a reservoir (a preferably porous rock such as a sandstone or a carbonate to hold the hydrocarbons in. Think of it as a sponge); and your seal/caprock (basically a lid of impermeable rock to prevent the upward seepage of the generated hydrocarbons over time). In order for there to be a hydrocarbon resource you not only need to have all those petroleum systems elements, the timing has to be in the right order. By that I mean, you could have your source generating hydrocarbons long before you have an effective seal which would simply mean over time the hydrocarbons will have long since migrated and escaped. And that's just looking at it simply from a geological perspective. As with most things economics often have a final say - you could find oil/gas offshore India but it's no good to you if its not an economic quantity. Hope that helps! Quote:

At a CCS summit recently a point that struck me was that about the law of diminishing returns. Early decarbonisation efforts will involve low cost, be fairly easy in the grand scheme of things and give high return. An example being the UK cutting coal from the power mix to reduce emissions by 60-70 %. The remaining will have to rely on emerging technology that's often at the pilot stage and to go with the technology it's apparent either a regulatory or fiscal framework needs to be created for the 'carbon economy' if we're to not just reduce our emissions to the ambitious Paris goal but to go the extra mile and make a dent in what's already in the atmospheric sink. Which is why I think it's a bit counter intuitive to argue we should only focus on renewable energy generation - it's more involved than that. It's not easy at all, heck my head hurts once you start connecting the dots but if ever there was a time for the right mixture of luck and the right tech in the right place to make a difference, this is it. Coming back to Aramco, I think I remember being amused to see a bombastic announcement from them regarding their ambition to become the largest hydrogen exporter, be this blue hydrogen or green hydrogen. That the first shipment of blue hydrogen was to Japan is wholly unsurprising given the Japanese (ie Toyota) so far have made the biggest bet on the fuel and the close ties the Saudi's have with Japanese business (through Masayoshi Son and his Vision Fund). | ||

| |  (7)

Thanks (7)

Thanks

|

| The following 7 BHPians Thank ads11 for this useful post: | am1m, digitalnirvana, dragracer567, maddy42, RadixLecti, SnS_12, Zignor |

| | #24 | |

| Senior - BHPian | Re: The past, present and future of Oil & Oil Companies Quote:

Many top insurers and reinsurers especially have adopted coal exit policies which have been in the works for a few years now. A perfect eg would the controversial Adani Carmichael coal project in Queensland, Australia, which was struggling to find insurance after losing major insurers who previously provided coverage for the project. | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank SnS_12 for this useful post: | InControl, maddy42 |

| | #25 | |

| Senior - BHPian | Re: The past, present and future of Oil & Oil Companies Quote:

African continent is starved for electricity, with the increasing presence of China and india in these countries and ease of building coal plants, does the possibility still exists that coal may leave the west but will be there in the Asian and african continents? Maddy | |

| |  (2)

Thanks (2)

Thanks

|

| The following 2 BHPians Thank maddy42 for this useful post: | InControl, Lobogris |

| | #26 | |

| BHPian Join Date: Dec 2005 Location: bang

Posts: 878

Thanked: 3,117 Times

| Re: The past, present and future of Oil & Oil Companies Quote:

Africa and Asia (specific countries) still lack the technology that makes renewable energy sustainable. So yes, coal is also there to stay for sometime. | |

| |  (1)

Thanks (1)

Thanks

|

| The following BHPian Thanks srini1785 for this useful post: | vredesbyrd |

| |

| | #27 | ||||

| BHPian Join Date: Aug 2017 Location: Leeds

Posts: 936

Thanked: 2,259 Times

| Re: The past, present and future of Oil & Oil Companies Quote:

Quote:

Quote:

Quote:

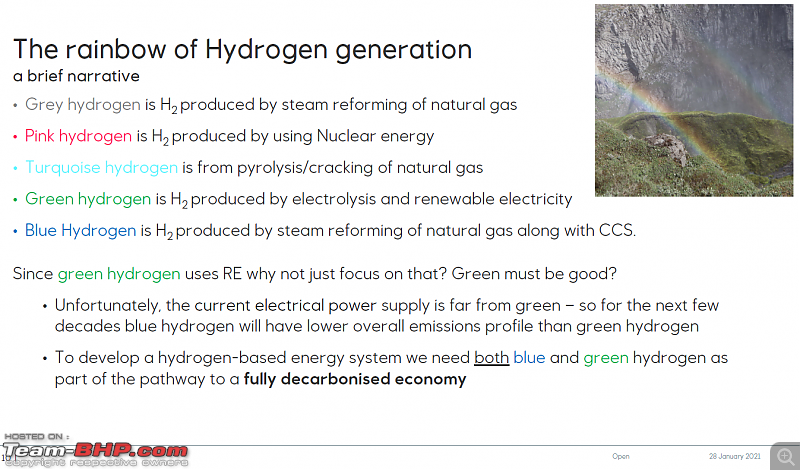

For a lot of these sectors we'll have no option but to continue to rely on the calorific density of fossil fuel power at least for some industrial applications like furnaces etc (this though is a bit beyond my remit and I imagine that I could be wrong about the current state of play). I forgot to mention yesterday that I for one think nuclear absolutely needs to be part of the energy mix if we're being pragmatic here - the big issue with that beyond the optics and public sentiment comes down to the economics. A good explainer can be found below: So if you can find the fiscal capital to justify the expense of a nuclear energy programme, you then run into the objections of Joe Public. Nuclear incidents tend to be raw in the public memory, be it Fukushima, or when HBO produces a show about Chernobyl to dramatic effect - immediately your project planners are going to be on the back foot and then some when it comes to trying to get public approval. And that isn't the only place where decision makers will need to put their political capital on the line because we then come to the tricky topic of what to do with nuclear waste. From what I understand, the currently in development Generation 4 nuclear reactors are purported to considerably assuage a lot of the sustainability and safety concerns that are associated with nuclear reactors. And finally because I mentioned blue and green hydrogen in the context of Saudi Arabia yesterday, here's a handy guide to what the colour coding really means.  Note: Once again, the link for the entire presentation on the role of hydrogen and CCS can be found here Last edited by ads11 : 11th February 2021 at 23:15. | ||||

| |  (4)

Thanks (4)

Thanks

|

| The following 4 BHPians Thank ads11 for this useful post: | digitalnirvana, himanshu_trikha, InControl, V.Narayan |

| | #28 |

| BHPian Join Date: Feb 2021 Location: Mumbai

Posts: 33

Thanked: 119 Times

| Re: The past, present and future of Oil & Oil Companies Some pretty technically accurate points here. Since I work in the oilfield, more specifically on oil rigs, I will be optimistic about the need for oil and gas in the near future being continued. It has already been discussed here at length about the alternate sources of fuel for vehicles and other energy sources for power related equipment. One thing I'd like to add to it is that the oilfield employs a lot of personnel. It is estimated that close to 7 million people worldwide work directly in oil exploration and production whereas close to 10 times that work indirectly in companies dealing with oil related products. A huge quantity of labor is just lost once the world stops relying on oil. Don't get me wrong, I'm all for making the environment a better place. We should be doing that in every small step possible. But the fact is, alternate sources of energy such as lithium or nuclear are yet in a nascent stage of development safety wise. In fact, one of our discussions at work dealt with how it was more hazardous mining lithium as compared to oil. Kindly ignore my bias here but if I could summarize, should we really stop relying on oil for energy? Yes. Will we? I doubt. |

| |  (5)

Thanks (5)

Thanks

|

| The following 5 BHPians Thank Zignor for this useful post: | bj96, digitalnirvana, Lobogris, RJK, vredesbyrd |

| | #29 | |

| BHPian Join Date: Jul 2019 Location: Freeport 7

Posts: 894

Thanked: 3,223 Times

Infractions: 0/2 (9) | Re: The past, present and future of Oil & Oil Companies Quote:

At the end of the day, environmentalists and big corporations will not care if 7 million people lose their jobs. To them, it's just a statistic. | |

| |  ()

Thanks ()

Thanks

|

| | #30 | |

| BHPian Join Date: Aug 2017 Location: Leeds

Posts: 936

Thanked: 2,259 Times

| Re: The past, present and future of Oil & Oil Companies I rambled as usual so I'll use subheaders to break down the two distinct discussions I make below. Alternate fuels: Biofuels |

| Agreed with your points. I may be ill-informed, but I don't understand that why aren't we looking at fuels which work like fossil fuels but are not fossil fuels? Methanol is comparatively less flammable, Ethanol can be considered a renewable source. There seem to be papers and prototypes here and there. Why is there a push only and only for EVs and not other fuel sources? Eventually lithium will run out and the mining scars will remain. Where will EV lobbyist go then? |

To summarise, you need:

- Enough arable land (without encroaching on existing green spaces)

- The right climate

- Food security (you don't want the bulk of agricultural output geared towards biofuel demand rather than feeding people)

Now that doesn't mean we should discount biofuels entirely, and at this point you probably notice I've been careful to use the umbrella term biofuel rather than say bioethanol in particular. I think a really good way of looking at sustainable goals is we should try to resolve an existing issue without withdrawing any net product from the biosphere or earth system for example. A good example of a biofuel say is converting food delivery vans to run on reprocessed used cooking oil perhaps - in this instance you're finding a useful utility for otherwise wasted product. Or find a way to produce your biofuel without using valuable food crops.

Sorry to harp on about the same thing but there isn't a silver bullet solution to these problems and the closer you look at it, the more you realise it really will need lots of incremental to significant changes across a variety of sectors to create the holistic benefits we're after (bravo I now sound like a televangelist for the green party..). But you get what I mean right?

I absolutely think there are probably places where the biofuel model will work at small scale, especially if it means not needing much adaptation to existing ICE infrastructure. Brazil is an interesting one again because they also have significant endemic hydrocarbon resources they can utilise to meet their needs.

India has tremendous agricultural output but food security is a delicate balance. Could a case be made towards part of domestic agriculture being geared say towards making biofuel used in public transportation and how much would that have an impact not just on the pollution issue in cities but India's overall carbon footprint? I think it's definitely something that merits examination. I don't know the numbers off the top of my head but it gives you an idea about the answer to your question hopefully.

Jobs: particularly the state of jobs in the industry

PS: I think it's a bit unkind to state that most environmentalists would naturally want to see folks out of a job. I think the vast majority would much rather they find gainful employment, just not in industries such as the hydrocarbon one. One argument made against the CCS/CCUS industry and the interest that the hydrocarbon sector has shown in it, is that it's simply retooling the existing industrial base towards pumping fluids into subterranean reservoirs (rather than extraction as is the case). At least at the white collar level, those with a geoscience background or engineering background working in the oil and gas industry definitely have skillsets that tally well with the energy transition and a lot of the jobs that are coming up. For those of us looking to make the career switch though, there just quite isn't the same number of jobs in the latter as yet as we'd like, but hopefully this will change over time and the 7 million will shift across.

To add to what Zignor said, a point that might not be immediately apparent to those outside the hydrocarbon sector is that as a consequence of the price low in the 90s, there was a significant gap in hiring during that decade. Thus during the sky high prices of the late 2000s through to the early aughts, the industry was faced with the prospect of a lot of expertise being lost due to retirements and nowhere near enough headcount to replace the gap. What happened after the 2015 price drop is that a lot of those older heads were convinced to soldier on just a bit longer whilst hiring was frozen. From the headcount of masters courses since then, students just switched disciplines mostly and now as those older heads finally retire, the industry is looking at a shrunken workforce in general because there's quite a few mid level experience guys available for free (usually let go during each downturn) and a much diminished pool of younger applicants for traditional jobs. It's probably a trend that's been seen ample times before in other industries that have faced price crunches and enforced evolution, but that's how it is. While I think the premise of peak oil is moot (different argument..), I think peak oil industry size has been reached because I don't think we'll ever go back to the days of 7 million strong. Geoscientists coming in now are either swapping streams within internal grad programs to energy transition focused areas of the business or plain looking at different industries.

(3)

Thanks

(3)

Thanks

| The following 3 BHPians Thank ads11 for this useful post: | digitalnirvana, v1p3r, vredesbyrd |

|