Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by dailydriver

(Post 5489327)

Here and elsewhere, I see a lot of motives ascribed to the intent and timing of the Hindenburg report. Also, there have been suggestions to the effect that country X or country Y has sponsored or backed the report and its release; just as they say was done in case of the BBC documentary.

|

I don't see any geopolitical conspiracy against India or our ruling party. And I say this as somebody whose political views lean to the right (on many issues).

So what's the secret behind Hindenburg targeting Adani? Well, there is no secret as such. It's just that Adani became too big too fast, and that drew the attention of this particular short seller. From being a frog in a well, Adani became a whale on the beach. If somebody shows up as the 3rd richest person in the world and gets lots of media attention in international publications, obviously their businesses will come under scrutiny - especially since Adani bonds are listed in Western stock exchanges.

Quote:

Though not a direct shareholder, I have some of my money invested in Adanis through LIC and SBI, both of whom, if I were to believe my esteemed minister of finance, are still holding profitable positions vis a vis the fallen angel.

|

I think both LIC and SBI will be fine, even when we consider worst case scenarios.

- LIC claims they have invested Rs. 30,000 cr in Adani Group. That is apparently 1% of their total AUM. So even if Adani stocks go to zero, it will barely make a dent on LIC's portfolio.

- Regarding SBI loans or bond holders, these are all asset backed. Bond holders and lenders have the first right over assets. That's why the interest rates offered by lenders to infrastructure projects is as low as a housing loan (8 percent-ish). And it does not look like the Adanis are inflating their networth or cash flows a lot. Because if they did, the group stocks would not be trading at PE ratio of 200+ or Price to book value of 50+.

Quote:

Originally Posted by SmartCat

(Post 5489403)

- LIC claims they have invested Rs. 30,000 cr in Adani Group. That is apparently 1% of their total AUM. So even if Adani stocks go to zero, it will barely make a dent on LIC's portfolio.

- Regarding SBI loans or bond holders, these are all asset backed. Bond holders and lenders have the first right over assets. That's why the interest rates offered by lenders to infrastructure projects is as low as a housing loan (8 percent-ish). And it does not look like the Adanis are inflating their networth or cash flows a lot. Because if they did, the group stocks would not be trading at PE ratio of 200+ or Price to book value of 50+.

|

The issue is not monetary but of perception, how can professional agencies skip due diligence?

An incredible number of conspiracy theories have been expounded in some of the posts above - including by raking in political issues like views on the BBC Documentary.

But at least in this case, I would abide by Occam’s Razor - which says, “The simplest explanation is usually the best one”. And the simplest explanation is that there are several unanswered questions about the Adani Group, which have been talked about for years, and which attracted international attention following the incredible run in group stocks and the rise of Gautam Adani up the Forbes / Bloomberg billionaires rankings in 2022. Hindenburg dug into this, and put several questions people had talked of, and a few that were not widely known together in one place. As they said, even if they were wrong and everything Adani reported was accurate, the stocks were massively overvalued when compared to peers (Of course, that does not necessarily mean the valuations of the Adani stocks were incorrect or unjustifiable - differences in views is why we have markets). The report seems to have resonated with both equity and bond investors - which triggered the recent crash. Depending on how Hindenburg shorted the Adani bonds and what the international reference securities they shorted are (no one knows, and no one has the right to know), they may be laughing their way to the bank.

If Hindenburg’s views are incorrect and the Adani stocks were fairly valued before this, it represents an incredible buying opportunity - if you have conviction in this hypothesis, put your money where your mouth is and buy the Adani stocks and bonds. If they were incorrect on the fraud allegations, but the stocks were overvalued, this is a long over due correction - which is good for markets. If they were correct on the fraud hypothesis, hopefully this triggers investigation, prosecution and conviction (think Ramalinga Raju - who built a fantastic real business, but committed fraud because he did not want to let his valuations drop). This does not hurt India in any long term way - if there is a fraud or overvaluation, uncovering it is good. If there was no fraud or overvaluation, this is a blip. Ultimately water finds its level.

The Indian markets trade at higher levels than all other Emerging Market peers because our regulators such as SEBI and RBI have done a fantastic job over the years in dealing with frauds when they have emerged, and in investigating matters in a transparent way. The only thing about this matter which can hurt India is if our regulators fail to investigate this transparently - I am confident that will not happen.

https://youtu.be/4WSAeT_XDaI

Credits: Youtube

This report is quite good and explained in layman terms. I'm a rookie myself with no idea of stock market and this research with it's implications. This gentleman in the video deserves applause for explaining it in simple terms.

Nate Anderson on his personal twitter account shared the following two articles, depicting that FPO was being rigged as well. Makes me feel like leaving some coins and money in a donation/charity's collection boxes giving normal beings a psychological nudge to give or give more.

https://twitter.com/claritytoast

FORBES's article: (I have highlighted a few key points)

Quote:

Three investment funds that purchased shares in Adani Enterprises’ scuttled $2.5 billion offering have ties to the Adani Group and suspected Adani proxies, according to a Forbes analysis.

Three investment funds with ties to the Adani Group committed to buying up shares as investors in Adani Enterprises follow-on stock offering, which was abruptly canceled Wednesday following a drop in Adani Enterprises’ share price in the wake of U.S. short seller Hindenburg Research’s 100-page report.

Two Mauritius-based funds, Ayushmat Ltd and Elm Park Fund, and India-based Aviator Global Investment Fund, together agreed to buy 9.24% of all shares available to anchor investors, the institutional investors who are allotted shares a day before the public offering. That percentage represented an investment of just $66 million, but is likely more evidence of Adani getting help from affiliated parties.

The three funds’ ties to Adani have not previously been reported, and follow Forbes’ report Wednesday that two of Adani Enterprises’ book-runners, Elara Capital and Monarch Networth Capital, were alleged to be Adani affiliates by Hindenburg.

The Adani Group’s seven publicly listed companies have lost over $100 billion of market value in the ten days since Hindenburg accused it of a decades-long scheme of fraudulent self enrichment. The group issued a lengthy denial and reply to Hindenburg’s report and has threatened legal action against the investment firm. The Adani Group did not respond to Forbes’ request for comment for this article.

Demand for Adani Enterprises’ $2.5 billion stock offering slumped after the short seller’s report. Despite Abu Dhabi’s last-minute injection of $400 million, the Adani Group called off the sale and said it will return funds to investors, with Gautam Adani himself citing in a video the “volatility of the market” and adding that it would not have been “morally correct” to go ahead under the circumstances. (He did not address the Hindenburg allegations.) Adani Enterprises stock has fallen more than 50% since January 24, the day before the Hindenburg report was published.

One of Adani Enterprises’ would-be anchor investors was Ayushmat Ltd, a Mauritius-based fund that had pledged to buy 2.32% of the shares offered early to the institutional investors. Ayushmat is administered by Rogers Capital, a financial services firm in Mauritius. One of Rogers’ directors and key shareholders is Jayechund Jingree, who was formerly a director of the Mauritius-headquartered Adani Global Ltd., a subsidiary of Adani Enterprises.

Jingree also has ties to Vinod Adani, Gautam’s brother and a key player in the Adani Group’s web of offshore companies. As described by Hindenburg, Jingree’s longtime U.K. brokerage, Orbit Investment Securities, was formerly named Jermyn Capital and controlled by Dharmesh Doshi, a former Indian fugitive in connection to a stock rigging scam in 2001, for which his partner, Ketan Parekh, was convicted. Doshi and Jermyn Capital were alleged to have participated in another stock rigging scam involving Indian drugmaker Sun Pharmaceuticals between 2007 and 2009 (Sun’s founder, Dilip Shanghvi, is one of India’s richest, worth $16 billion). That scheme also allegedly involved Jineshwar Holdings, a Mauritius company later revealed by offshore data leaks to be controlled by Vinod Adani.

Vikram Rege, a director at Ayushmat Ltd., said in an emailed statement to Forbes, “Ayushmat Ltd. does not manage any funds on behalf of any Adani Group principals.” Jingree did not respond to a request for comment.

Rege is also a director at Elm Park Fund, which had planned to be the second largest investor (5.67%) in Adani Enterprises’ anchor offering. Elm Park Fund, a Mauritius-based fund, was also alleged to have engaged in the Sun Pharma stock rigging scheme, according to a whistleblower complaint obtained by Moneylife India in 2018. Elm Park Fund was one of a “host of foreign entities involved in questionable transactions in the Indian equity market” as part of the scheme, according to Moneylife India. Forbes could not locate the full complaint; the Securities and Exchange Board of India previously declined to share it.

Rege did not address Forbes’ questions about Elm Park Fund, and the fund did not respond to Forbes’ requests for comment as of press time.

Lastly, Aviator Global Investment Fund subscribed to 1.25% of Adani Enterprises’ anchor shares. The Aviator Global Investment Fund’s senior management official, per 2021 Indian parliamentary records, is Antonino Sardegno. According to Sardegno’s LinkedIn profile (which disappeared within hours after Forbes reached out to him for comment), he led “investment solutions” from 2008 to 2013 for Monterosa Group. In its report, Hindenburg alleged that Monterosa Group and five of its investment funds, holding $4.5 billion of Adani company stock (as of January 24), was Adani’s largest “stock parking entity,” meaning, a third-party fund designed to conceal ownership.

More recently, Sardegno was CEO of Andetta Private Services from 2013 until August 2022. Andetta, which Hindenburg identified as a subsidiary of offshore firm Amicorp, is the controlling shareholder of New Leaina Investments, a Cyprus fund that previously owned over 1% of Adani Green Energy, Adani’s renewable energy company, and smaller stakes in other Adani companies, according to Hindenburg’s research and the Adani Group’s financial disclosures of foreign investors. Hindenburg alleges that Amicorp “formed at least 7 Adani promoter entities, at least 17 offshore shells and entities associated with Vinod Adani, and at least 3 Mauritius-based offshore shareholders of Adani stock.” Sardegno, Andetta Private Services and Amicorp have not responded to Forbes’ requests for comment as of press time.

If Adani Group principals are the ultimate beneficial owners of these various funds, that would mean the Adani Group is also a large stakeholder in one of the Adani Group’s rivals: the Hinduja Group, the $70 billion (annual sales) Indian conglomerate controlled by the four Hinduja brothers. The Aviator Global Investment Fund, New Leaina Investments and three other funds with ties to Adani Group – Elara India Opportunities Fund, Connecor Investment Enterprise Ltd and LGOF Global Opportunities Limited – all hold sizeable stakes in Hinduja Global Solutions, Hinduja Leyland Finance and Hinduja’s Gulf Oil Corp Limited. The Hinduja Group had not responded to a request for comment as of press time.

|

At this point, it does not matter when or if Adani's stocks crash, it is clear as day and night that allegations of round-tripping and rigging the share prices are true and shockingly, it is clearly

STILL happening brazenly. I personally always suspected to a degree of confirmation that the FPO will be filled and then cancelled, to save face but more importantly, save money. Had the FPO gone through, all those Shell Companies including the Genuine Investors would have a lost a lot of money. Adani saved his friends but more importantly, saved his retirement funds, so to speak.

There's another article by WSJ but it is pay-walled so I did not read it.

I am glad to see there isn't a contagion but if SEBI doesn't act fast, there will be serious irreparable damages. So far whatever SEBI has done seems to be benefiting Adani Companies more than the general public and investors.

Yesterday one Youtuber Mr Basant Maheshwari mentioned LIC's net worth at about 26k cr whereas it's investments in Adani at about 40k cr at current stock prices.

His video was about whether LIC or SBI could fail and he stressed that GOI couldn't let these institutions fail to save it's own face.

But it is clear that LIC has played with fire and another Hindenburg short seller can be the doom of it.

Sure LIC policy holders and LIC shareholders would not face any losses but Indian public in general and Indian tax payers in particular are going to suffer the misdeeds of Adani & LIC.

https://youtu.be/DBj7k4jU2sM

LIC is not doing it for the first time, neither its the last time for them, so better people prepare themselves to lose a part of their money going into such scams in the future through LIC and other such channels.

Isn't it surprising that such a long thread on a topic where the LIC money is involved but not a single mention about the DHFL scam which is not too old, revealed just couple of years ago. We are yet to see any concrete action against the culprits of the DHFL scam, so I don't expect much in this case as well.

Scamsters are very well aware of the fact that human brain is not capable of remembering the things for too long so they keep repeating the scams in same manners every now n then. And their job becomes much easier when the public turns into the supporter of this or that political party instead of staying as neutral public. Result is they start associating every incident as favorable or non-favorable for their favorite political party and start defending or opposing them as per their political interests.

Due to unusual price movement SEBI puts surveillance methods in place - To save whom?

Quote:

During the past week, unusual price movement in the stocks of a business conglomerate has been observed. As part of its mandate, SEBI seeks to maintain orderly and efficient functioning of the market and has put in place a set of well-defined, publicly available surveillance measures (including the ASM framework) to address excessive volatility in specific stocks

|

Quote:

This mechanism gets automatically triggered under certain conditions of price volatility in any stock

|

Link

Link

Quote:

Originally Posted by volkman10

(Post 5489548)

Due to unusual price movement SEBI puts surveillance methods in place - To save whom?

|

Could be a classic case of

He who pays the piper calls the tune? With the

NSE controversy still making occasional headlines, one is befuddled about the role our market facilitators and regulators are supposed to be playing - in public interest!

Add to this, a top bureaucrat's gall in terming the Adani case a mere

storm in the tea cup, and we are indeed left asking:

All this circus, To save whom?

Quite interesting to see how several people deflect even basic questions into possible malpractices by large corporations involving thousands of crores with:

"shades of grey, all companies need to do things like this to run, key player in national infrastructure, we need to be patriotic and excuse Indian entrepreneurs when they do things like this, side against a foreign entity trying to spread bad news" etc. etc.

And quite a few of the same voices in the media when it came to the "moonlighting in IT jobs" issue involving lower-level employees:

"unprofessional, unethical, need to be punished, how can they, need to be fired"

:)

When did so many of us become cheerleaders for the big corporations, the governments, the people with all the power and the armies of lawyers? How did the media and those who benefit from the status quo convince us that these are the vulnerable parties? Something worth thinking about.

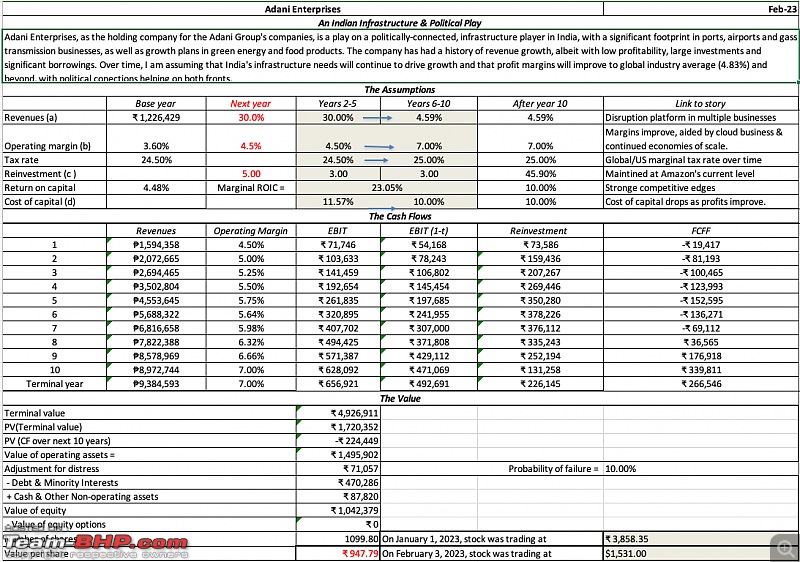

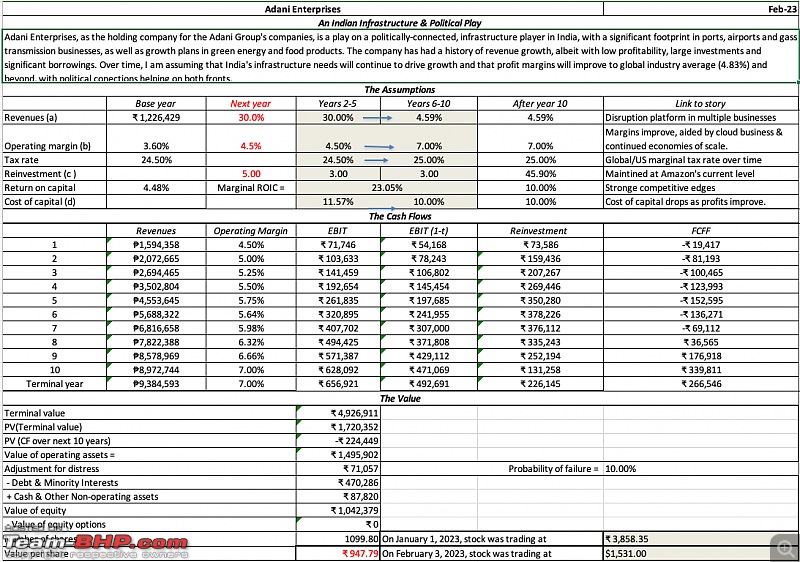

Prof. Aswath Damodaran (Google this name, he is called the DEAN OF VALUATION) says the fair value of Adani Enterprises is Rs. 950 per share

https://aswathdamodaran.blogspot.com...cting.html?m=1

(click on image to open in new window and zoom in to see the numbers clearly)

Quote:

Originally Posted by SmartCat

(Post 5489843)

Prof. Aswath Damodaran (Google this name, he is called the DEAN OF VALUATION) says the fair value of Adani Enterprises is Rs. 950 per share

|

To be clear, he says, “ In fact, a valuation of Adani Enterprises with upbeat assumptions on revenue growth and operating margins, and without factoring any of the Hindenburg accusations of fraud and malfeasance, yields a value of just about ₹ 945 per share, well below the stock price of ₹ 3,858 per share.”

That does not mean ₹ 950 is fair. Of course, he also says he knows very little about the group.

My Dear Bhpians,

After along while, I learnt a lot in a single thread than many websites combined.

This alone is worth its weight in digital gold.:Cheering:

I learnt about shorting, macro economics, geopolitics and regulation or lack of it in Indian markets.

Let us all have sane heads and watch what unfolds.

| All times are GMT +5.5. The time now is 07:17. | |