Team-BHP

(

https://www.team-bhp.com/forum/)

Quote:

Originally Posted by fordday

(Post 5199197)

Small cap yield screen has PNB gilts. What exactly are they involved in? Are they distributor of Govt securities or they themselves invest in it? Their Div yield is eye popping 15%, three time the FD rates. Is this sustainable?

|

PNB Gilts is a subsidiary of Punjab National Bank. It has 2 main businesses:

- Primary Dealer of G-secs (gilts). PNB Gilts offers bid/ask quotes (called market making) for these bonds to be bought and traded by banks, insurance companies and mutual funds. However, this income is just 5% or 10% of revenues.

- Trading in govt bonds. Just like how LIC earns profit by trading in stocks, PNB Gilts earns profits by trading in gilts. However, PNB Gilts borrows money from punjab national bank to trade in gilts. That's why debt to equity ratio is 12. In a falling interest rate scenario, profit margins can be huge (1000 cr revenues, 450 cr profit in FY21). Conversely, PNB Gilts can see a lossy year in a rising interest rate scenario.

Dividend yield is not sustainable. PNB Gilts is an extremely volatile stock (because profits are volatile). It can easily fall 50%.

Quote:

Originally Posted by SmartCat

(Post 5199211)

- Trading in govt bonds. Just like how LIC earns profit by trading in stocks, PNB Gilts earns profits by trading in gilts.

Dividend yield is not sustainable. PNB Gilts is an extremely volatile stock (because profits are volatile). It can easily fall 50%.

|

Thank you for the explanation.

Aren't the returns on G-Secs fixed upfront? As in FDs.

Then why do investors trade in it?

Or is my assumption wrong?

Quote:

Originally Posted by fordday

(Post 5199328)

Thank you for the explanation.

Aren't the returns on G-Secs fixed upfront? As in FDs.

Then why do investors trade in it?

Or is my assumption wrong?

|

If I sell you a 5L FD which carries 8.5% interest, how much will you be willing to pay for it? Probably 5.2L or if you expect interest rates on FDs to fall further, then Probably even 5.3L. That's why and how they trade.

Of course there are more inputs to valuation like the credit rating etc., but I hope you got the gist.

Quote:

Originally Posted by fordday

(Post 5199328)

Aren't the returns on G-Secs fixed upfront? As in FDs. Then why do investors trade in it? Or is my assumption wrong?

|

G-secs and other bonds give fixed return if you hold till the end of the tenure. However, unlike FDs, you can sell your bond to a third party.

SLK's explanation of current market price of a bond is perfect:

Quote:

Originally Posted by SLK

(Post 5199336)

If I sell you a 5L FD which carries 8.5% interest, how much will you be willing to pay for it? Probably 5.2L or if you expect interest rates on FDs to fall further, then Probably even 5.3L. That's why and how they trade.

|

Some of these concepts are discussed in this thread:

https://www.team-bhp.com/forum/shift...ebt-funds.html

Quote:

Originally Posted by SLK

(Post 5199336)

If I sell you a 5L FD which carries 8.5% interest, how much will you be willing to pay for it? Probably 5.2L or if you expect interest rates on FDs to fall further, then Probably even 5.3L. That's why and how they trade.

Of course there are more inputs to valuation like the credit rating etc., but I hope you got the gist.

|

Correct me if I am wrong: If the interest rates fall then will not the selling price fall and not increase as per the example shared by you? If I have a conviction that the interest rates would fall below 8.5% then I would rather pay 5.1L than paying 5.2L.

Quote:

Originally Posted by VWAllstar

(Post 5199366)

Correct me if I am wrong: If the interest rates fall then will not the selling price fall and not increase as per the example shared by you? If I have a conviction that the interest rates would fall below 8.5% then I would rather pay 5.1L than paying 5.2L.

|

No, look at it this way. When your bank is offering you 4% interest you will be willing to pay more for an 8.5% interest instrument. When the bank goes down to 3%, you will be willing to pay even more to get same 8.5% interest.

Quote:

Originally Posted by VWAllstar

(Post 5199366)

Correct me if I am wrong: If the interest rates fall then will not the selling price fall and not increase as per the example shared by you? If I have a conviction that the interest rates would fall below 8.5% then I would rather pay 5.1L than paying 5.2L.

|

The value of existing bonds go up if interest rates fall and vice versa. These two are inversely proportional. This matters when you are trading in the bond market or buying mutual funds which are based on them.

Does not make any difference to retail holders of individual bonds or fixed deposits with a definite maturity date and a fixed rate of interest

Quote:

Originally Posted by SmartCat

(Post 5205669)

...

|

I have a few questions for you, hope you don't mind.

1. What's your take on Taleb's anti-fragility? Have you implemented or tried to implement it in your portfolio? If so, I would like some details on how you did it.

2. Recommend a book that works in the Indian context.

3. Technical analysis, for whatever it is worth, seems to have become an important factor determining short term market movements, mostly because of social media and greater retail participation. Do you use technical analysis and does it work well for you?

Thanks.

Quote:

Originally Posted by Electromotive

(Post 5205675)

1. What's your take on Taleb's anti-fragility? Have you implemented or tried to implement it in your portfolio? If so, I would like some details on how you did it.

|

Since I'm totally dependent on financial markets for income, I have to incorporate a few fail-safe systems.

1) I never have more than 50% of networth in stocks.

2) Significant % is deployed in Gilt funds and Gold ETFs. Whenever there is a crisis, capital flees stocks and gets into Gilts and/or Gold

3) I use options to hedge my equity portfolio against black swan events.

However, because of the above, my portfolio typically chugs along slowly when compared to investors who are 100% in stocks. In a way, I'm giving up "high" returns for "smooth" returns.

Quote:

3. Technical analysis, for whatever it is worth, seems to have become an important factor determining short term market movements, mostly because of social media and greater retail participation. Do you use technical analysis and does it work well for you?

|

Technical analysis works, but not in the way most people imagine. What works is ->

Technical Analysis + Money Management + Trading Psychology. The other 2 aspects are equally important. A technical analysis based strategy might have a "win rate" of just 40%. But it will still work out well if the absolute profit on a win is > 2x that of a loss. Trading psychology is about having trust in the trading system. Even if a strategy has a win rate of 40% in 3 year backtests, when you actually deploy a strategy, it can have a win rate of just 20% during the first month. If you give up after the first month and go looking for another strategy, you will slowly burn cash.

You should be good at programming/scripting or MS Excel to succeed with technical analysis. That's because you have to backtest your trading system to gain confidence. If the strategy is not too complex, you can use Zerodha's STREAK platform to backtest:

https://www.streak.tech/home

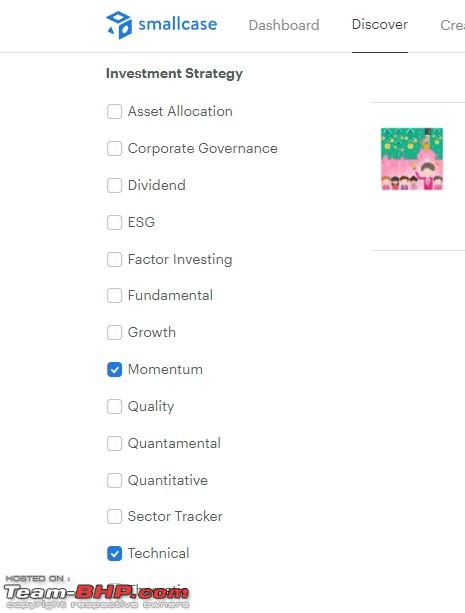

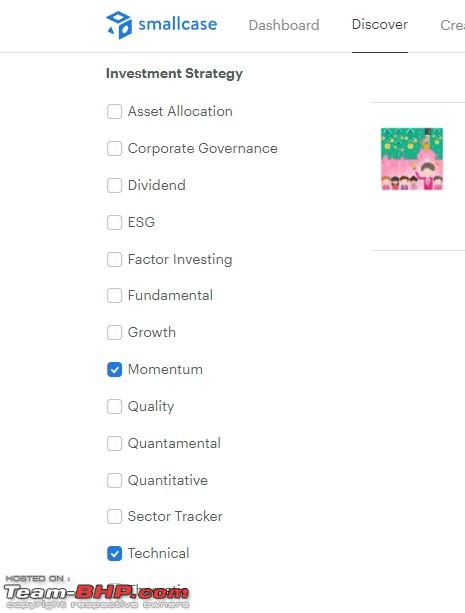

Smallcase.com too has a few strategies based on technical analysis (select 'momentum' and 'technicals') under 'Discover':

https://smallcase.zerodha.com/discov...gies=technical

You can give this a try and see how it goes.

I don't use technical analysis for trading/investing in stocks. But I use something called 'price action trading' for my options trading portfolio

https://www.investopedia.com/terms/p/price-action.asp

Quote:

Originally Posted by SmartCat

(Post 5205797)

...

|

Thanks for that detailed reply. Really appreciate it.

I also use gold as a hedge and liquid funds (or ITC lol:) to park cash when I don't have a play. Of my equity portfolio, only 20% I manage myself - the high risk portion, rest is mutual funds. I have not dipped my toes in F&O, seems very scary and that is what I want to learn.

My biggest issue with the Indian market is that it appears (to me at least) as if the market operators/big players have moles in the offices of the CAs. Somehow the market always knows the results before hand, especially if the results are going to be bad, and the F&O market already realigns before the cash market can respond.

Coal India has approved a decent dividend (Rs 9 per share) with a record date of 7th December. So if one buys it today, that gives 5-6% return as soon as dividend is released considering a market price of Rs 150 at which the share is trading.

Is there a catch here except for the fluctuations in market price that can wipe of the dividend gains?

https://www.livemint.com/companies/n...244894440.html

Quote:

Originally Posted by warrioraks

(Post 5206652)

Coal India has approved a decent dividend (Rs 9 per share) with a record date of 7th December. So if one buys it today, that gives 5-6% return as soon as dividend is released considering a market price of Rs 150 at which the share is trading. Is there a catch here except for the fluctuations in market price that can wipe of the dividend gains?

|

For stocks that pay large dividends, its price will fall to an equivalent level (5 to 6% in this case) on that day. So there is no arbitrage opportunity as such.

Quote:

Originally Posted by warrioraks

(Post 5206652)

Coal India has approved a decent dividend (Rs 9 per share) with a record date of 7th December. So if one buys it today, that gives 5-6% return as soon as dividend is released considering a market price of Rs 150 at which the share is trading.

Is there a catch here except for the fluctuations in market price that can wipe of the dividend gains?

|

Let me try and answer this. There isn't any catch here, but the stock price will most likely adjust after dividend, in proportion. I say most likely because it may not always happen.

Quote:

Originally Posted by warrioraks

(Post 5206652)

Is there a catch here except for the fluctuations in market price that can wipe of the dividend gains?

|

To add to what smartcat mentioned, taxation is a major difference if you are in 30% tax bracket

1) If the equity price appreciate by Rs.9 and you sell - you pay either STCG 15% or LTCG 10% (after 1L)

2) If you get dividend of Rs.9, it get taxed at your slab rates (30%).

With the DDT abolished, Dividend option is not attractive for high tax rate individuals. :Frustrati

Quote:

Originally Posted by SmartCat

(Post 5206673)

For stocks that pay large dividends, its price will fall to an equivalent level (5 to 6% in this case) on that day. So there is no arbitrage opportunity as such.

|

Quote:

Originally Posted by fordday

(Post 5206675)

Let me try and answer this. There isn't any catch here, but the stock price will most likely adjust after dividend, in proportion. I say most likely because it may not always happen.

|

Quote:

Originally Posted by concorde24

(Post 5206684)

To add to what smartcat mentioned, taxation is a major difference if you are in 30% tax bracket

1) If the equity price appreciate by Rs.9 and you sell - you pay either STCG 15% or LTCG 10% (after 1L)

2) If you get dividend of Rs.9, it get taxed at your slab rates (30%).

With the DDT abolished, Dividend option is not attractive for high tax rate individuals. :Frustrati

|

Thank you guys for sharing the knowledge. So if I understand correctly, buying into Coal India now makes sense ONLY IF someone wants to be invested for a longer period of time in the hope of stock price appreciation.

| All times are GMT +5.5. The time now is 08:13. | |